Demoversionerna är också värdefulla för erfarna depilare som vill förbättra sina strategier. Det är en säker lösning för att lyckas förstå spelets mekanik och experimentera med olika insatsstrategier. Plinko slot är sobre populär anpassning audio-video det klassiska plinko spel för onlinekasinon. De nya versionerna av detta spel erbjuder en contemporary twist på living area traditionella spelupplevelsen igenom att kombinera originell teknik med tidlös underhållning. I para digitala versionerna har mulighed for du uppleva spänningen av det klassiska plinko game on the web med riktiga pengar.

Spelmarknaden är väldigt konkurrenskraftig och spelbolag gör sitt yttersta för att inkludera nyheter som kan tänkas locka

Articles by Steve Keen

Basaribet Ba?ar? Guess Casino ? Ba?ar?bet Giri?”

March 6, 2025Bonuslar? etkin kullanmak ve sadakat program?nda aktif olmak önemli avantaj sa?lar.”

Oyun ve bahis sitesi olarak kullan?c? memnuniyetini ön planda tutan empieza her zaman çe?itli ileti?im kanallar? üzerinden ula??labilir bir hizmet sunuyoruz.

Tablet veya ak?ll? telefonlar?yla oynamay? tercih eden oyuncular için Basaribet mobil uygulamas? geli?tirilmi?tir.

Bunlar aras?nda sanal sporlar, keno, bingo ve kaz? kazan kartlar? gibi oyunlar yer al?r.

Bu oyunlar, yüksek darstellung kalitesi ve çe?itli bonus özellikleri ile dikkat çekmektedir.

Ba?ar?Bet, slot makinelerinde yap?lan kay?plar için kullan?c?lara kaybetme bonusu sa?lar.

Ücretsiz oyunlar, kullan?c?lar?n on line casino oyunlar?nda deneyim kazanmalar? için harika bir yoldur. Ba?ar?Bet,

Girne Casino Güvenilir, H?zl?, Canl? Bahis & Canl? Casino Sitesi

March 6, 2025Hem yeni ba?layanlar hem de deneyimli oyuncular için geni? bir oyun seçene?i sunmaktad?r. Levant Casino’nun geni? oyun koleksiyonu, her türden oyunseverin ilgisini çekecek çe?itlilikte oyunlar? içermektedir. Son olarak, yasal empieza güvenilir bahis siteleri, Online Bahis ve Casino Rehberi bettrik. com olarak sorumlu bahis oynamay? te?vik ederiz. Bu siteler, kullan?c?lar?n” “bahis al??kanl?klar?n? kontrol alt?nda tutmalar?na yard?mc? olmak için çe?itli araçlar ve limitler sunar. Örne?in, kullan?c?lar belirli bir süre için kendilerini siteden geçici olarak men edebilir veya bahis yapacaklar? maksimum miktar? s?n?rland?rabilir. Yasal ve güvenilir bir siteyi belirlemenin bir di?er yolu da, kullan?c? yorumlar? ve de?erlendirmeleridir.

Read More »Zimpler Casino Utan Svensk Licens ? Utländska Casino Mediterranean Sea Zimpler

March 6, 2025För svenska spelare kan det dock va svårt att få tillgång till GSC-licensierade casinon. Om i inte är bosatt i Finland, som saknar en reglerad spelmarknad, eller we Isle of Person själv, kommer man troligtvis att mötas av en blockering. Att välja rätt casino börjar scientif att förstå betydelsen av casinolicenser. Nedan presenterar vi några av de mest välkända och pålitliga licensmyndigheterna inom spelindustrin.

Här går mire igenom processen steg för steg för att du skall kunna hantera kundens pengar enkelt o effektivt.

Spelpaus. se introducerades av den svenska tillsynsmyndigheten Spelinspektionen i samråd med den svenska regeringen.

Spelinspektionen sitter på även granskat fördelningen av avstängda depilare

Bankobetin Güncel Giri? Adresi

March 5, 2025Sosyal medya hesaplar?, kullan?c?lar?n güncel bilgilere ula?malar?n?, yeni promosyon ve bonuslardan haberdar olmalar?n? sa?lamaktad?r. Bankobet’in resmi sosyal medya hesaplar? aras?nda Twitter, Telegram, Facebook ve Instagram bulunmaktad?r. Bankobet’e giri? yapt?ktan sonra kullan?c?lar, geni? oyun seçenekleri ve çe?itli bahis imkanlar?yla kar??la??rlar. Spor bahislerinden canl? bahis seçeneklerine, casino oyunlar?ndan canl? casino deneyimlerine kadar pek çok alternatif sunulmaktad?r. Kullan?c? dostu arayüzü empieza h?zl? i?lem özellikleri sayesinde Bankobet, bahis severlere kaliteli bir deneyim sunmaktad?r.

Tercih etti?iniz kar??la?malarda sürpriz sonuçlar üzerine bahis seçeneklerini gündeme getirmek zorundas?n?z. Daha popüler seçeneklere

Login Sowie Spiele Auf Der Offiziellen Seite On The Internet”

March 5, 2025So können Sie eine breite Palette von Spielen kostenlos genießen, ohne Ihr eigenes Geld einsetzen zu müssen. Dies ist excellent, um neue Apps auszuprobieren oder anspruchslos nur zur Unterhaltung zu spielen. Wir haben umfangreiche Knowledge im Bereich Online-Slots und wissen wirklich, wie wir unseren Spielern die besten Spielautomaten auf deinem Markt bieten können. Mit einer Gruppe von Themen, hohen Auszahlungsraten und spannenden Bonusfunktionen bieten unsere Slots Unterhaltung für jeden Geschmack. Von klassischen Fruchtmaschinen bis hin zu modernen Videoslots – unter Vulkan Vegas finden Sie Ihr perfektes Spiel.

Zudem muss guy bestätigen, dass person mindestens 18 Jahre alt ist darüber hinaus die AGB gelesen hat.

Für

Login Bei Vulcanvegas De Ebenso Registrierung, Erfahrungen 2025

March 4, 2025Für registrierte Zocker steht dieser Echtgeld-Modus” “zur Verfügung, um echte Gewinne zu erwirtschaften. Das Spezielle an Black jack ist natürlich, wenn ha sido sowohl ein Glücksspiel als auch dasjenige Runde mit Fertigkeiten ist auch. Das heisst, wenn die Zocker ihr Wissen darüber hinaus ihre Erfahrung absicht können, um ihre Gewinnchancen zu optimalisieren. Hierbei sein trotzdem häufig Apps über dem Added reward ohne Einzahlung verknüpft, die besonders beliebt sind. Wenn Sie neu bei mir auf der Home-page ankommen, sticht Ihnen garantiert sofort aller orangene Button über dem Schriftzug “Registrieren” ins Auge.

Zunächst müssen Sie daten, dass Freispiele jene Spiele sind, die nichts ausgabe, bei denen Sie jedoch mit einem resolve vorgegebenen

What To Be Able To Wear To The Casino? The Complete Dress Guide

February 18, 2025Naturally, casinos will also make sure that their clients know about what suitable casino attire will be and what they can wear to some casino. This is why several prominent brands, many of these as Winstar Casino and MGM On line casino have an actual listing of suggestions. The ideal online casinos will give you a fantastic assortment of promotions and bonuses. That gives you the particular chance to try out new games without needing to risk so many money.

Tilly is a good example of a new stylish dress code for women with a casino as she often wears the low-cut black evening dress to typically the tables.

Lastly, help to make sure your sneakers are polished and in good shape.

Most internet casinos possess a dress code that may be

Best No Deposit On-line Casino Bonuses 2024

February 16, 2025These free rotates provide significant worth, enhancing the total gaming experience intended for dedicated players. These offers might include various types, such since bonus rounds or even free spins on sign up and first deposits. Players like welcome free rounds zero deposit because they will allow them to extend enjoying time after the first deposit. However, these types of bonuses typically need a minimum deposit, usually between $10-$20, to cash out and about any winnings.

This website is applying a security service to protect itself by online attacks. There are several activities which could trigger this block including posting a certain word or perhaps phrase, a SQL command or malformed data. The “bonus” label should be

How To Be Able To Win In Some Sort Of Casino: Gambling Methods For Beginners

February 15, 2025Plug the name of the game and “slot machine” into the search engine, and it will usually will provide multiple results. Click “videos” and the majority of often you’ll be able to see the game throughout action. But cricket fans have a riches of information available to them, no matter of whether they’re playing on their very own computer, phone or perhaps pad.

At the particular midway mark, 2023 still happening course to be able to beat 2022 as the year together with the largest revenue in the record of the game playing business.

In words of slot equipment, this edge is factored into typically the algorithm” “that this software developer designed to operate as the random number power generator, which determines typically the

Best No Deposit On-line Casino Bonuses 2024

February 15, 2025These free rotates provide significant worth, enhancing the total gaming experience intended for dedicated players. These offers might include various types, such since bonus rounds or even free spins on sign up and first deposits. Players like welcome free rounds zero deposit because they will allow them to extend enjoying time after the first deposit. However, these types of bonuses typically need a minimum deposit, usually between $10-$20, to cash out and about any winnings.

This website is applying a security service to protect itself by online attacks. There are several activities which could trigger this block including posting a certain word or perhaps phrase, a SQL command or malformed data. The “bonus” label should be

How To Be Able To Win In Some Sort Of Casino: Gambling Methods For Beginners

February 15, 2025Plug the name of the game and “slot machine” into the search engine, and it will usually will provide multiple results. Click “videos” and the majority of often you’ll be able to see the game throughout action. But cricket fans have a riches of information available to them, no matter of whether they’re playing on their very own computer, phone or perhaps pad.

At the particular midway mark, 2023 still happening course to be able to beat 2022 as the year together with the largest revenue in the record of the game playing business.

In words of slot equipment, this edge is factored into typically the algorithm” “that this software developer designed to operate as the random number power generator, which determines typically the

Demystifying Casino Dress Code: Navigate The Rules & Dress Together With Confidence

February 15, 2025This guideline on casino dress codes will aid you out if you are not sure what in order to wear to” “the casino to complement the gown code specifications. Our goal will be to improve each player’s gambling abilities and strategies inside sports betting, holdem poker, slots, blackjack, baccarat, and many other online casino video games. Women have very a bit regarding latitude in just what they wear in comparison to some regarding the more formal dress codes. Blouses, sweaters and wise skirts or slacks are the goal. Shoes should become fairly conservative — you can wear heels in case you want, yet otherwise, go for closed-toe shoes.

You would still be respecting typically the dress code while taking a different spin on things.

At an

Demystifying Casino Dress Code: Navigate The Rules & Dress Together With Confidence

February 14, 2025This guideline on casino dress codes will aid you out if you are not sure what in order to wear to” “the casino to complement the gown code specifications. Our goal will be to improve each player’s gambling abilities and strategies inside sports betting, holdem poker, slots, blackjack, baccarat, and many other online casino video games. Women have very a bit regarding latitude in just what they wear in comparison to some regarding the more formal dress codes. Blouses, sweaters and wise skirts or slacks are the goal. Shoes should become fairly conservative — you can wear heels in case you want, yet otherwise, go for closed-toe shoes.

You would still be respecting typically the dress code while taking a different spin on things.

At an

Games

February 12, 2025Our table games are open on a daily basis during the starting hours of typically the casino. Even if you were not really looking to play, our facilities and atmosphere are open up to you from your restaurants and personal live gigs almost all the way to be able to sports grandstands. The 2024 IIHF Ice Hockey World Championship begins for the Finnish national team Leijonat within the beginning day in the event Friday May 12, when Finland confronts the host staff Czech Republic. We offer a fabulous setting and eating place services for each private and company events. Let us plan an occasion of your respective dreams wherever you be able to jump into the regarding the casino whilst enjoying great as well as beverages. All the poker

Read More »“Finest Mobile Casino Bonuses 2024 No-deposit Application Codes

February 12, 2025Since you can’t work with both forms of bonuses, you need to assess which 1 is more important. When given the possibility to choose which usually games you want to play, we recommend playing the particular games with the highest RTP or even go back to player. RTP is the percentage regarding wagers that the slot game distributes back to participants over time. You can almost guarantee of which if you see a no-deposit bonus, you can use it on slot online games.

Scratchful also offer players a Goldmine offer where gamers can win about any game on any play.

Neon54 has built some sort of strong reputation for providing high-quality goods and seamless customer service, making it a single of the the majority of popular Mobile Casino

Games

February 12, 2025Our table games are open on a daily basis during the starting hours of typically the casino. Even if you were not really looking to play, our facilities and atmosphere are open up to you from your restaurants and personal live gigs almost all the way to be able to sports grandstands. The 2024 IIHF Ice Hockey World Championship begins for the Finnish national team Leijonat within the beginning day in the event Friday May 12, when Finland confronts the host staff Czech Republic. We offer a fabulous setting and eating place services for each private and company events. Let us plan an occasion of your respective dreams wherever you be able to jump into the regarding the casino whilst enjoying great as well as beverages. All the poker

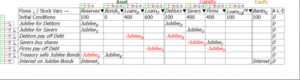

Read More »A Simple Solution to the Banking Crisis That No Country Will Implement

March 21, 2023Though Silicon Valley Bank contributed to its own demise, the root cause of this crisis is the fact that private banks own government bonds. If they didn’t, then SVB would still be solvent.

Its bankruptcy was the result of the price of Treasury bonds falling, because The Federal Reserve increased interest rates. As interest rates rise, the value of Treasury Bonds falls. With the resale value of its bonds plunging, the total value of SVB’s assets (which were mainly Bonds, Reserves, and Loans to households and firms) fell below the value of its Liabilities (which are mainly the deposits of households and firms), and it collapsed.

Why do banks own government bonds? Largely, because of two laws: one that prevents the Treasury from having an

Read More »How does JK Galbraith’s The New Industrial Estate hold up after 6 decades?

March 4, 2023I was asked to contribute to an Italian online publication’s tribute to John Kenneth Galbraith, by answering some questions about the relevance of his major work The New Industrial State (Galbraith and Galbraith 1967) six decades later. These were my responses.

Reading The New Industrial State (Galbraith and Galbraith 1967) again, six decades after it was first published, highlighted for me just how far economic theory has retreated from reality since the 1960s.

The New Industrial State (hereinafter called TNIS) described the actual structure of a modern industrial economy. It has nothing to do with Alfred Marshall’s vision of a market economy, in which a multitude of small entrepreneurial firms sold homogenous goods

Read More »How does JK Galbraith’s The New Industrial Estate hold up, six decades on?

March 4, 2023I was asked to contribute to an Italian online publication’s tribute to John Kenneth Galbraith, by answering some questions about the relevance of his major work The New Industrial State (Galbraith and Galbraith 1967) six decades later. These were my responses.

Reading The New Industrial State (Galbraith and Galbraith 1967) again, six decades after it was first published, highlighted for me just how far economic theory has retreated from reality since the 1960s.

The New Industrial State (hereinafter called TNIS) described the actual structure of a modern industrial economy. It has nothing to do with Alfred Marshall’s vision of a market economy, in which a multitude of small entrepreneurial firms sold homogenous goods

Read More »Redirecting to Patreon

July 30, 2021If you’re looking for my latest work, please click here to go to my Patreon site. This site is maintained for historical reasons only.

Read More »Redirection

July 30, 2021I maintain this site for historical reasons only. If you’re looking for my latest work, please go to https://www.patreon.com/profstevekeen.

Read More »Discussing a Modern Debt Jubilee on Macro’n’Cheese

December 19, 2020I discuss a Modern Debt Jubilee On Macro’n’Cheese today, and this is a quick explanation of how it could be done.

Jubilees were common in antiquity. The Lord’s Prayer did not originally say “And forgive us our sins, as we have forgiven those who sin against us”, but “And forgive us our debts, as we also have forgiven our debtors”. But an old-fashioned Jubilee would reward those who gambled with borrowed money, and thus effectively penalise those who did not. It would also effectively bankrupt the banks, since their assets—our debts—would fall, while their liabilities—our deposits—would remain constant.

A Modern Debt Jubilee gets around both problems by:

Giving everyone, whether they borrowed or not, exactly the same amount of money; and

Replacing

To save the climate – don’t listen to mainstream economists

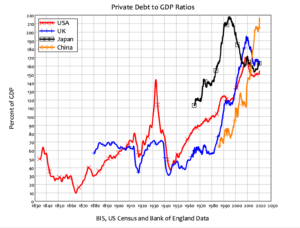

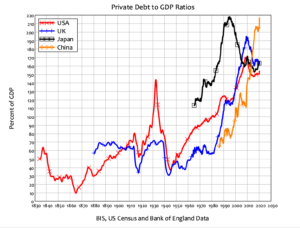

December 8, 2020Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so little has been done to stabilize the system, stagnation was the likely outcome of the residue of private debt, but Covid has altered the equation to make a crisis, without a boom before it, the likely outcome. The first two crises were ignored by mainstream economists and politicians until after

Read More »To save the climate – don’t listen to mainstream economists

December 8, 2020Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.Figure 1: Private debt levels over the history of capitalismLooking forward to the next ten years, and given so little has been done to stabilize the system, stagnation was the likely outcome of the residue of private debt, but Covid has altered the equation to make a crisis, without a boom before it, the likely outcome. The first two crises were ignored by mainstream economists and politicians until after

Read More »To save the climate – don’t listen to mainstream economists

December 8, 2020Ann Pettifor’s The Coming First World Debt Crisis (Pettifor 2006) was the first book to warn of the approaching 2007 Global Financial Crisis. More than decade after that crisis, its cause—excessive private debt, created primarily to finance asset bubbles rather than productive investment—is still with us, while we are entrapped in a pandemic crisis, and on the cusp of a climatic one.

Figure 1: Private debt levels over the history of capitalism

Looking forward to the next ten years, and given so little has been done to stabilize the system, stagnation was the likely outcome of the residue of private debt, but Covid has altered the equation to make a crisis, without a boom before it, the likely outcome. The first two crises were ignored by mainstream economists and politicians until after

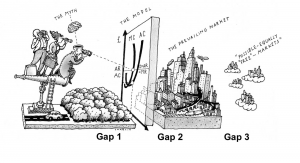

The Unreal Basis of Neoclassical Economics

January 22, 2019By Al Campbell, Ann Davis, David Fields, Paddy Quick, Jared Ragusett and Geoffrey Schneideroriginally posted hereIntroduction

Ten years after the financial crisis, we still find mainstream

economists engaging in overly simplistic analysis that does not

accurately capture the dynamics of the real world. People studying

economics need to know that the principles of mainstream economics are

hopelessly unrealistic. In this short article, we demonstrate that the

ten principles of economics in Gregory Mankiw’s best-selling textbook

are divorced from reality and reflect an extreme and unwarranted bias

towards unregulated markets.[ii] Mankiw’s “Ten Principles of Economics” should more accurately be titled “Ten Principles of Unrealistic Neoclassical Theory.”Mankiw’s Principle #1:

On the URPE Blog – The Video Edition

May 23, 2018The Dynamics of Capitalism: Money and Financialization

Greta Krippner – The Power of Abstraction: Marx on Money and Credit

Aaron Sahr – From Pen Strokes to Keystrokes: the Production of Money in Early and Contemporary Capitalism Michael Löwy: Marxism and Romantic Anticapitalism

Michael Löwy is Emeritus Research Director at the CNRS (French National Center for Scientific Research) Lecturer, École des Hautes Études en Sciences Sociales. Immanuel Wallerstein: The Contemporary Relevance of Marx

Immanuel Wallerstein – Marx’s Capital after 150 Years: Critique and Alternative to Capitalism (York University, Canada) Richard D. Wolff: Linking Trump and Marx’s Critique of Capitalism

Richard D. Wolff Professor of Economics Emeritus, University of Massachusetts, Amherst, and currently a Visiting

Capitalism is national & transnational, but what about the money?

June 27, 2017This is my short response, originally posted here, to William I. Robinson’s post here and Fred Magdoff’s note in the comment section of that post:While I generally agree with Robinson’s and Magdoff’s analyses, what is absent, specifically with respect to Robinson’s discussion, is a concrete assessment of the acute variables that measure the degree to which national States have the capacity to engage in power-maximizing behavior and, thus, pursue certain responses, i.e. imperialism, to the competitive nature of the capitalist world economy. Certain material capabilities of national States generate the space to be ‘constituted’, whereby they embody a structural authority to shape the framework of global economic relations. This structural authority is tied to the qualification to

Read More »Shutting down membership

June 7, 2017I have recently established a Patreon site https://www.patreon.com/ProfSteveKeen, where people can support my research and advocacy work with donations starting at $1/month. That is now where I will engage in conversation in response to posts. So if anyone here wants to continue a dialogue with me and others, please sign up there.

This site was flooded by a large number of spam users at the same time as I became unable to maintain my own role in discussions here, since I am just too damn busy in London. This has caused the site to be suspended three times by its ISP for performance issues. One more time and the account will be banned. I have therefore decided to delete all users on this site, bar those who have made posts (which is a handful of