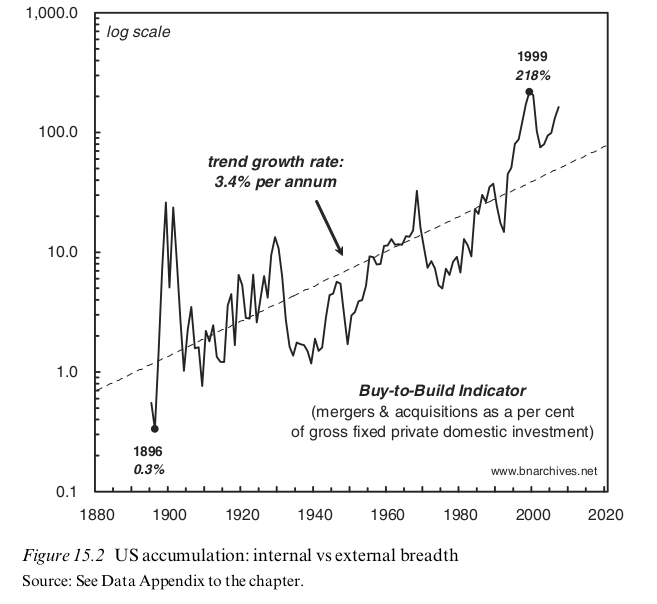

From Blair Fix During the 1990s, corporate mergers became part of the public zeitgeist. But what is the deep history of mergers and acquisitions? Jonathan Nitzan and Shimshon Bichler piece together the puzzle with their ‘buy-to-build’ indicator. This indicator measures the dollar value of mergers and acquisitions expressed as a percentage of gross fixed investments. It tells us how much corporations are spending on buying other companies, relative to how much they are spending on actually building things. Nitzan and Bichler muckrake to put together a century of US data: Nitzan and Bichler’s Buy-to-Build Indicator (Source)More recently, Joe Francis compiled an open source update of the buy-to-build indicator. This is great empirical muckraking.

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Blair Fix

During the 1990s, corporate mergers became part of the public zeitgeist. But what is the deep history of mergers and acquisitions?

Jonathan Nitzan and Shimshon Bichler piece together the puzzle with their ‘buy-to-build’ indicator. This indicator measures the dollar value of mergers and acquisitions expressed as a percentage of gross fixed investments. It tells us how much corporations are spending on buying other companies, relative to how much they are spending on actually building things. Nitzan and Bichler muckrake to put together a century of US data:

More recently, Joe Francis compiled an open source update of the buy-to-build indicator. This is great empirical muckraking.