From Dean Baker It seems that Larry Summers is worried that the stimulus proposed by President Biden is too large. I will say at the onset that he could be right. However, at the most fundamental level, we have to ask what the relative risks are of too much relative to too little. If we actually are pushing the economy too hard, the argument would be that we would see serious inflationary pressures, which could result in the sort of wage-price spiral we saw in the 1970s. As someone who lived through the 1970s, it actually wasn’t that horrible. Okay, the fashions and hair styles might have been horrible, and I was never a fan of disco, but the period as whole wasn’t that bad. We didn’t have mass starvation and homelessness, but yes, the inflation of the decade was definitely a problem

Topics:

Dean Baker considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Dean Baker

It seems that Larry Summers is worried that the stimulus proposed by President Biden is too large. I will say at the onset that he could be right. However, at the most fundamental level, we have to ask what the relative risks are of too much relative to too little.

If we actually are pushing the economy too hard, the argument would be that we would see serious inflationary pressures, which could result in the sort of wage-price spiral we saw in the 1970s. As someone who lived through the 1970s, it actually wasn’t that horrible.

Okay, the fashions and hair styles might have been horrible, and I was never a fan of disco, but the period as whole wasn’t that bad. We didn’t have mass starvation and homelessness, but yes, the inflation of the decade was definitely a problem and we would not want to see something similar in this decade.

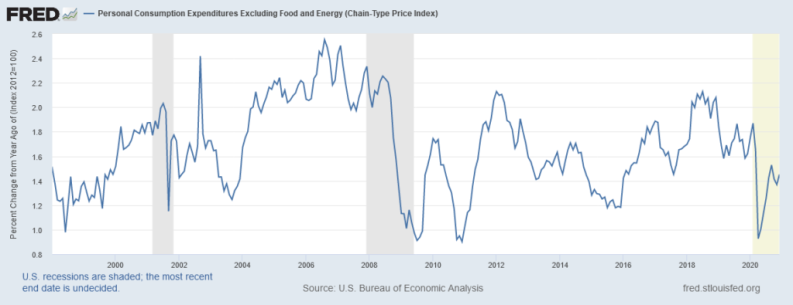

But will the Biden stimulus really cause us to see a 1970s-type wage-price spiral? That seems hard to imagine. We have not seen serious problems with inflation for many decades. Here’s the picture going back to the late 1990s using the personal consumption expenditure deflator, the Fed’s preferred index.

As can be seen, the only period where it is above the Fed’s 2.0 percent target (remember, this target is an average) is 2006 and 2007, and even then it is only modestly above 2.0 percent, with no clear upward trend. There is zero evidence of anything like an inflationary spiral in these data. Again, that doesn’t mean it is impossible, just that we haven’t seen anything like it for a long time.

It is also is worth noting that the Congressional Budget Office has consistently underestimated the economy’s potential level of output. Back in the early days of the recovery from the Great Recession it had put the non-accelerating inflation rate of unemployment (NAIRU) — effectively the floor on sustainable unemployment — at more than 5.0 percent. We had the unemployment rate down to 3.5 percent in 2019, before the pandemic hit, and there was zero evidence of accelerating inflation. In fact, wage growth actually slowed slightly in the months immediately before the pandemic hit.

Next, it is worth asking a few questions about Summers’ calculations. He seems to be treating the $1.9 trillion as spending that will all take place this year. That is clearly not the case. For example, the $120 billion for the expanded child tax credit likely will not be paid out until 2022, when people file their tax returns, unless Congress alters the way these credits are paid. The same is true of the expanded Earned Income Tax Credit. State and local governments surely will not spend the full $350 billion allocated to make up for their recession hit in 2021.

It is also worth noting that a large portion of the pandemic checks are likely to be saved, at least insofar as they go to higher income households. And, much of the spending on expanded unemployment benefits won’t be paid out at all, if the economy recovers quickly as Summers suggests and we all hope. So, there is much less by way of stimulus there than meets the eye.

Another point arguing against excessive stimulus is the story with our trade deficit. Summers oddly points to the “weakness of the dollar.” This is a strange point, since the dollar is actually stronger than it was in 2009, his point of comparison. Furthermore, with our trading partners much less interested in stimulus than President Biden, it is likely that the trade deficit will expand in 2021, dampening growth, as the U.S. economy grows more rapidly than the economies of our trading partners.

Finally, Summers is rightly concerned about long-term prospects and complains that this package lacks money for investment. While Biden has pledged a rebuilding package that will be focused on investment, in fact much of this spending can rightly be thought of as investment. The $350 billion for state and local governments is not designated as investment, but surely much of this money will go for infrastructure and education, spending that should be counted as investment. Also, we have enough evidence about poverty and children’s educational outcomes and subsequent labor market experience that we should think of the child tax credit, at least for lower-income families, as investment.

In short, Summer’s does raise a very reasonable concern, but there is so much upside to this package, with a comparatively small downside risk, that it definitely seems worth the gamble.