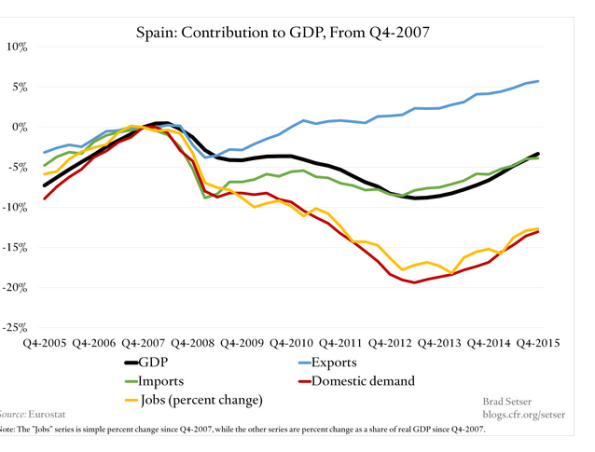

On the CFR blog Brad Setser has an interesting post about Spain, based upon the Spanish national accounts.. Summary: it is going better but (the volumes of) domestic demand and jobs are still 10% below the 2007 level. And despite a relatively favorable development of (net) exports domestic demand seems to explain about everything, when it comes to employment. I have three points to add. The difference between the development of GDP and the development of domestic demand is, when it comes to incomes, explained by the increase of the rate of profit in this period. And from the demand side from the shift of a 10 to 15% of GDP deficit on the current account to a situation with a small surplus. The increase in profits did not lead to an increase of the rate of investment; a return to the 2007 ‘building boom’ rate of investment is by the way not in the cards anyway. Also, the tight correlation between domestic demand and employment implies an almost stable level of ‘domestic demand’ productivity. Productivity in the entire Spanish economy however increased, due to the building bust and the decline of (low productivity) construction.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

On the CFR blog Brad Setser has an interesting post about Spain, based upon the Spanish national accounts.. Summary: it is going better but (the volumes of) domestic demand and jobs are still 10% below the 2007 level. And despite a relatively favorable development of (net) exports domestic demand seems to explain about everything, when it comes to employment.

I have three points to add. The difference between the development of GDP and the development of domestic demand is, when it comes to incomes, explained by the increase of the rate of profit in this period. And from the demand side from the shift of a 10 to 15% of GDP deficit on the current account to a situation with a small surplus. The increase in profits did not lead to an increase of the rate of investment; a return to the 2007 ‘building boom’ rate of investment is by the way not in the cards anyway. Also, the tight correlation between domestic demand and employment implies an almost stable level of ‘domestic demand’ productivity. Productivity in the entire Spanish economy however increased, due to the building bust and the decline of (low productivity) construction. As construction is part of domestic demand this suggests that the rise of low productivity sectors (hospitality, health care) must have compensated for the decline of construction and all of the (net) productivity increase (as Setser also states) must have been located in the export sector. The last point: Setser mentions that people still think that the Spanish labor market is rigid. But the facts are that rates of ‘job churning’ in Spain are extremely high. Still, jobs do not seem to be created by this dynamism but by demand (duhhh…). The labor market clearly has a musical chairs aspect to it: it is about the net number of chairs. Not about the speed of the music.