From Blair Fix Political economist Chris Mouré has a new paper out in the Review of Capital as Power. It’s called ‘Soft-wars’, and it is a fascinating case study of the behavior of big tech. The story starts in 2011, when Microsoft led a .5 billion consortium purchase of Nortel and Novel. Later than year, Google responded by buying Motorola for .9 billion. The funny thing is that Google then proceeded to sell off what it had just bought. By 2014, almost nothing was left of Google-owned Motorola. Nothing except patents. And that, Mouré thinks, was the whole point. Mouré argues that this acquisition war was ultimately a battle over intellectual property. Google and Microsoft were competing to control the mobile market. And the way to do that was not to ‘produce’ anything. It was to

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Blair Fix

Political economist Chris Mouré has a new paper out in the Review of Capital as Power. It’s called ‘Soft-wars’, and it is a fascinating case study of the behavior of big tech.

The story starts in 2011, when Microsoft led a $4.5 billion consortium purchase of Nortel and Novel. Later than year, Google responded by buying Motorola for $12.9 billion. The funny thing is that Google then proceeded to sell off what it had just bought. By 2014, almost nothing was left of Google-owned Motorola. Nothing except patents. And that, Mouré thinks, was the whole point.

Mouré argues that this acquisition war was ultimately a battle over intellectual property. Google and Microsoft were competing to control the mobile market. And the way to do that was not to ‘produce’ anything. It was to command property rights.

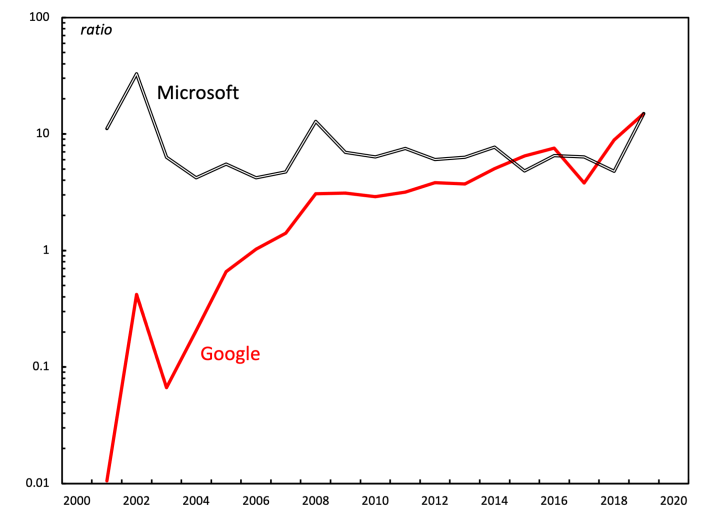

The timing of the 2011 patent war, Mouré notes, was no coincidence. It corresponded with the moment when Google’s profits caught up to Microsoft. Figure 1 shows the trend. This is Mouré’s analysis of ‘differential profit’ — the profit of Microsoft and Google measured relative to the average profit of the S&P 500. You can see that Google entered the 21st century as a bit player. But by the 2010s, Google was a behemoth whose profits matched those of Microsoft.

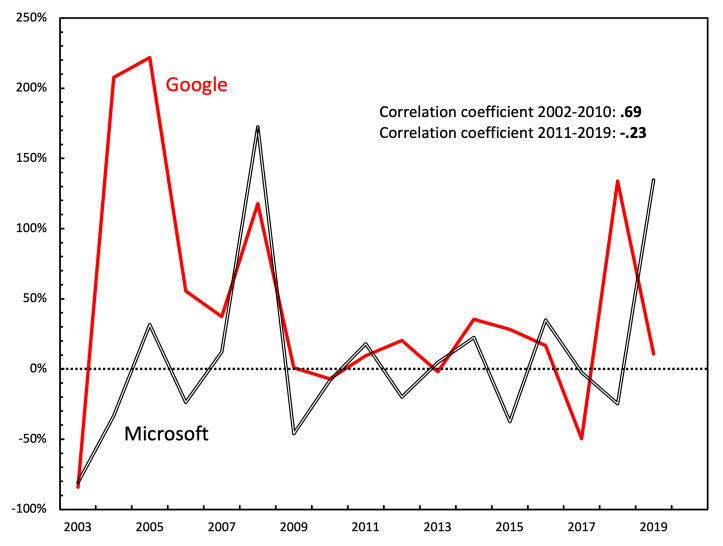

Looking closer at the data, Mouré notices an interesting shift in behavior that happened after 2010. In the decade prior, Google’s profit was positively correlated with Microsoft’s. But after 2010, the correlation turned negative. In other words, when Google did well, Microsoft suffered (and vice versa).

What’s going on here, Mouré argues, is that by 2010, Google and Microsoft had become locked in a heated battle. By then, both firms dominated their core businesses. Microsoft was a monopolist in the OS business. And Google was a monopolist in the online ad business. And so both companies were expanding into new territory. (In this case, mobile computing.) Unsurprisingly, that let to mutual conflict. And so Google’s win became Microsoft’s loss (and vice versa).

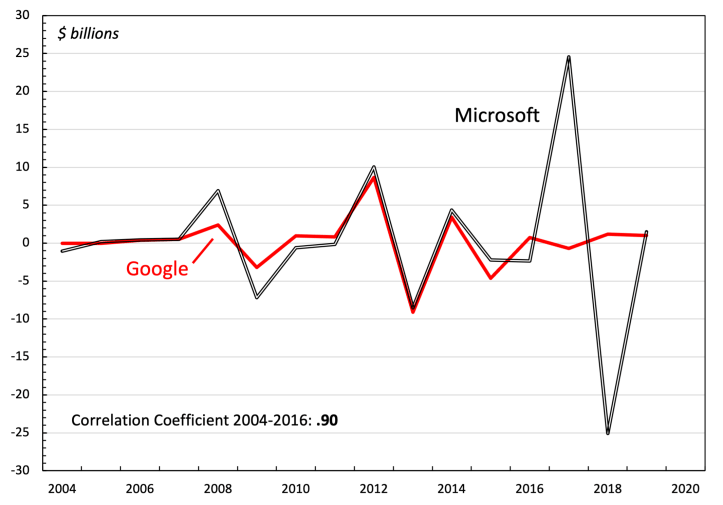

To a large extent, this competition played out in a war for acquisitions. Google and Microsoft both spent billions buying up competitors. What’s impressive, Mouré notes, is that this buying spree was highly coordinated. When Google bought big, so did Microsoft. Figure 3 tells the story.

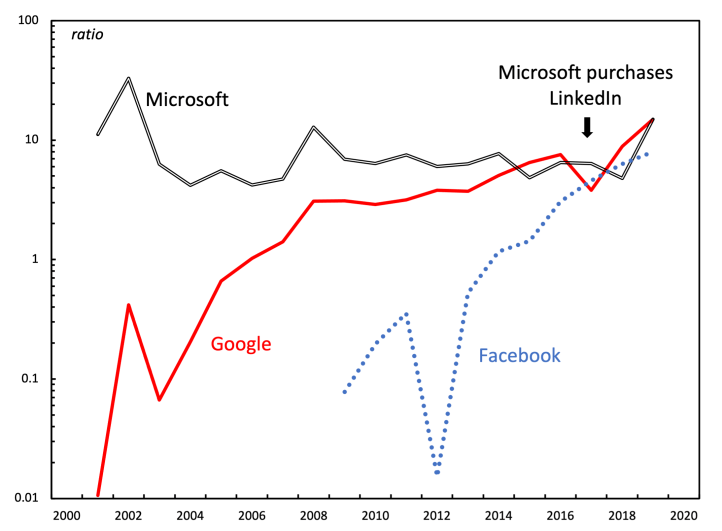

Fast forward to 2018, which saw Microsoft buy LinkedIn for $26 billion. As with the Nortel buyout of 2011, Mouré thinks the timing of the LinkedIn acquisition was no coincidence. It happened when Facebook joined the monopoly game.

As Figure 4 shows, Facebook started the 2010s as a fly on the ‘Goog-soft’ elephant. But by 2018, Facebook’s profits had caught up to both Microsoft and Google. Faced with this new adversary, Microsoft repeated the same strategy: buy your competitor’s main rivals. And so Microsoft bought LinkedIn.

Mouré’s analysis nicely illustrates a truism in economics: big corporations behave nothing like economics textbooks say they should. The textbooks say that profits should stem from productivity. But the reality is that what big companies care about most is restriction. The battle for profits is a battle over property rights — the legal right to restrict.

We all know that big tech is engaged in nefarious activity. The point is that this the norm, not the exception. Econ textbooks say that firms should play nice. In the real world, the big boys make their own rules.

Further Reading

Mouré, Chris. 2021. ‘Soft-wars: A Capital-as-Power Analysis of Google’s Differential Power Trajectory’. Review of Capital as Power, Vol. 2, No. 1, pp. 71–90.