Inflation in the Euro Area is high and erodes the purchasing power of many (but not all) incomes. Bad. But it will be transitory. And there is no indication of endogenous macro-economic instability. Why do I think this? I’ll first discuss the (largely) transitory nature of the present price increases, macro (in)stability comes next. Graph 1 shows two metrics of inflation. The first is based on the ‘normal’ consumer price index, but this time without energy and without increases of indirect taxes (read: Value Added Tax, VAT). As we can see this inflation metric was quite low during a large part of 2021 and still is way below the 2,0% ECB inflation target. Crisis? What crisis! The data show that the recent (and large) increase in inflation is largely caused by energy

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Inflation in the Euro Area is high and erodes the purchasing power of many (but not all) incomes. Bad. But it will be transitory. And there is no indication of endogenous macro-economic instability. Why do I think this?

I’ll first discuss the (largely) transitory nature of the present price increases, macro (in)stability comes next.

Graph 1 shows two metrics of inflation. The first is based on the ‘normal’ consumer price index, but this time without energy and without increases of indirect taxes (read: Value Added Tax, VAT). As we can see this inflation metric was quite low during a large part of 2021 and still is way below the 2,0% ECB inflation target. Crisis? What crisis! The data show that the recent (and large) increase in inflation is largely caused by energy prices and governments (which increased VAT). The second inflation metric is (hold your breath) ‘Frequent Out Of Pocket Purchases (FROOPP) inflation’. Behavioral economist have noted that perceptions of inflation are largely based on non-automated payments connected to groceries, coffee, beer and gasoline. What you pay is what you see. Which led statisticians to develop an inflation metric based on such purchases: FROOPP inflation. Which (including VAT increases) is quite high and explains the feeling that prices are rapidly increasing. But gasoline prices are actually coming down, again, which will lead to a decline of FROOPP and possibly to less inflation anxiety.

The influence of VAT changes is shown in graph 2. The orange line shows and increase of inflation without VAT increases of around 3%-point since the autumn of 2020 while the blue line (which includes VAT changes) shows an increase of 4%-point. Meaning that one quarter of the increase of inflation is caused by one player only: the government… For inflationistas: raising taxes is one of the classical ways to cool an economy – deflationary policies are pursued already, rightly or wrongly.

But as I do not expect more VAT increases while I also do not expect the same kind of energy price increases in 2022 as in 2021 we can safely state that inflation in 2022 will be quite a bit lower than in 2021.

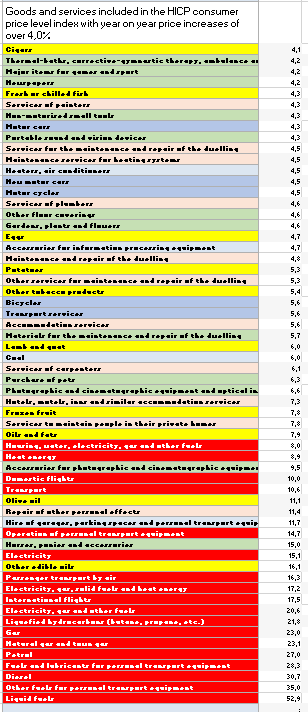

A comparable story is told by the table below. The table shows al items included in the basket used to calculate the consumer price level with year on year price increases of above 4,0% (november 2021). As we can see, the top 15 is dominated by oil, energy (and ponies and accessories…). These energy price increases will no doubt subside, leading to lower inflation. To me, the most surprising aspect of this table was however the rather high level of increase of a whole number of services related to repair and maintenance as well as accommodation. It is tempting to speculate which these prices surge, comments are welcome. These prices might continue to rise as increases in these rates will only lead to a slow increase of supply, if any! The stock of skilled plumbers and carpenters is limited. Inflation will subside, but it might not be as low as during the last years.

We should of course not just look at consumer items. The national accounts teach us that there are different kinds of expenditure. Graph 3, based on Eurostat national accounts data for the Euro Area, shows price increases not just for consumer spending but also for investments and government spending on education, streetlights, the army and other items considered public consumption’. As we can see, Covid led to a stark increase in volatility – which is the reason to be skeptical about the enduring nature of the present rates of inflation.

The national accounts also teach us that, when we look at nominal data: ‘expenditure = income = production’ . Which means that even looking at more categories of expenditure, as in graph 3, is not enough. We should also look at income prices (the wage level, the level of rents and profit margins) as well as production prices (including administered prices of stocks in, for instance, ships waiting in the waters outside the harbor of Los Angeles). When nominal expenditure increases, nominal income by necessity increases too, either because of higher wages or more wages or higher rents or more rents or more profit because of higher sales or higher profit margins.

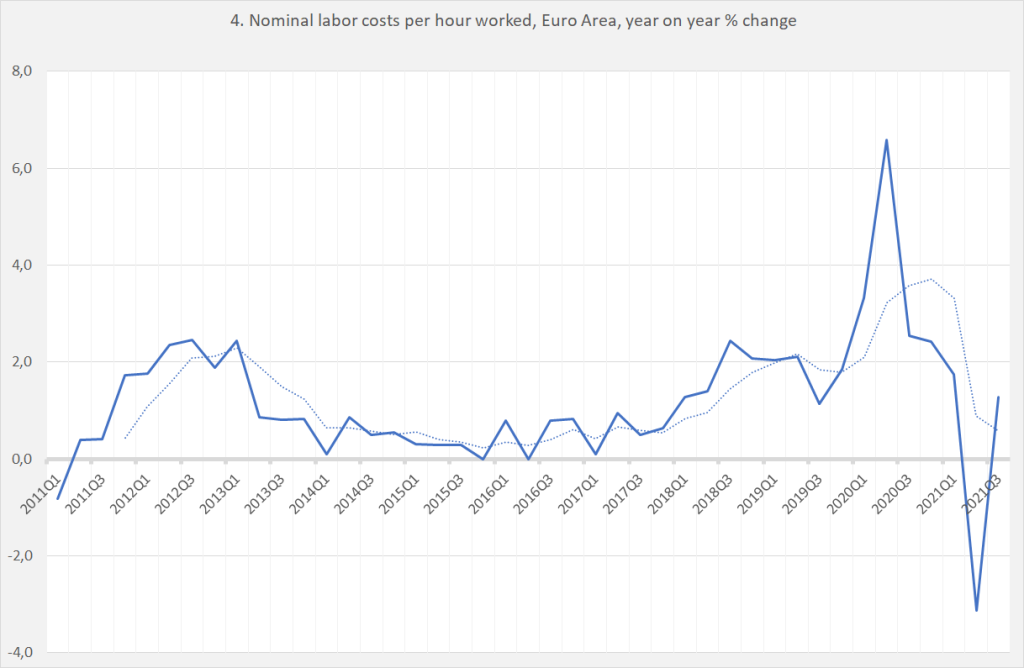

Keynes was actually the first one to use this idea in an analytical sense, in ‘How to pay for the war‘. In a truly inflationary environment, we should see increases in wages and/or rents and/or profit margins, too. Mind the and/or. The gains of inflation are not always equally divided between labor and capital (or, for that matter, the government when it increases VAT rates…). Read Keynes. At this moment, to my knowledge, rents as well as profit margins are increasing, while rates charged by the self employed might be increasing, too (see the table above). Wages, however, are on average not increasing, or at least not as fast as consumer prices (graph 4). The interpretation of graph 4 is complicated by compositional changes. In 2020, many low wage workers became unemployed, which led to an increase of average wages (the spike in the graph). In the second quarter of 2022 the opposite happened. For the macro accounting identity this however does not matter. There is simply no way that inflation can be explained by a wage-push environment. To the contrary: the spike in demand which was met by an increase in employment, not by an increase in wages! Also, the volatility of the data are a warning. In the Covid economy, spikes as well as dips are bound to be transitory… And at this moment, it will be clear that people with rent incomes (Putin, oil) are the real winners. It’s all about ‘land’, or ownership of non-produced inputs. Lower VAT rates. Increase land taxes.