Commenter Blogger RJS Summary: Natural gas supplies above average for first time since April. Strategic Petroleum Reserve at a 19-year low. Total oil & products supplies near a 7-year low. Total oil supply falls by most in 25 weeks. Gasoline supplies jump most in 20 months. Distillate’s demand falls by most in 5 years. DUC wells in four basins are lowest on record. DUC backlog at 5.5 months is below pre-pandemic norm. DUC well report for November: DUC wells remaining in four basins are lowest on record; DUC backlog at 5.5 months is below pre-pandemic norm. Monday of last week saw the release of the EIA’s Drilling Productivity Report for December, which includes the EIA’s November data on drilled but uncompleted (DUC) oil and gas wells in

Topics:

run75441 considers the following as important: Hot Topics, oil production, politics, RJS, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Commenter Blogger RJS Summary: Natural gas supplies above average for first time since April. Strategic Petroleum Reserve at a 19-year low. Total oil & products supplies near a 7-year low. Total oil supply falls by most in 25 weeks. Gasoline supplies jump most in 20 months. Distillate’s demand falls by most in 5 years. DUC wells in four basins are lowest on record. DUC backlog at 5.5 months is below pre-pandemic norm.

DUC well report for November: DUC wells remaining in four basins are lowest on record; DUC backlog at 5.5 months is below pre-pandemic norm.

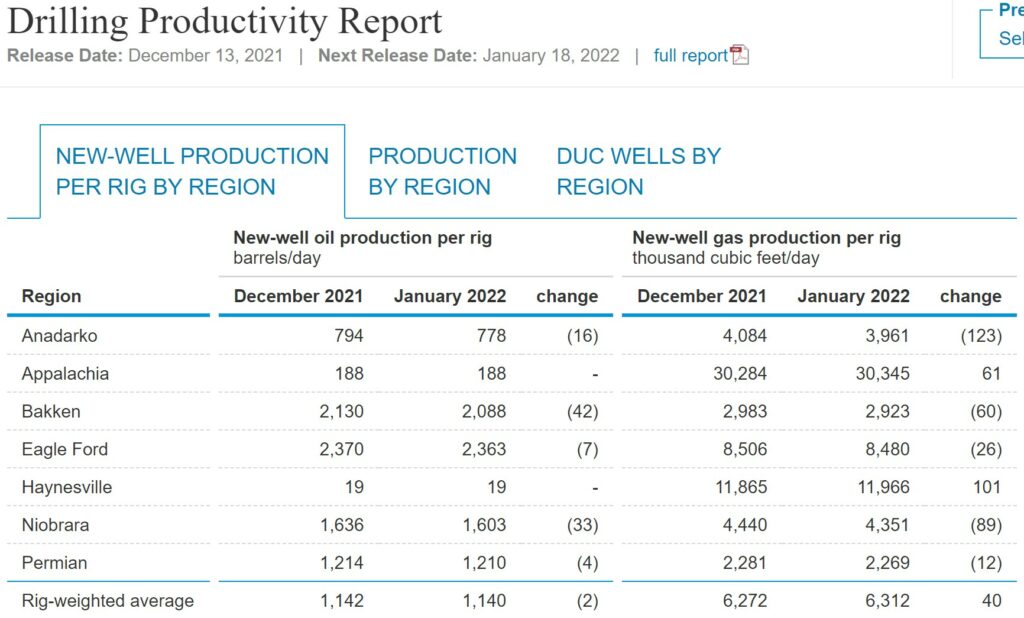

Monday of last week saw the release of the EIA’s Drilling Productivity Report for December, which includes the EIA’s November data on drilled but uncompleted (DUC) oil and gas wells in the 7 most productive shale regions….that data showed a decrease in uncompleted wells nationally for the 18th consecutive month, as both completions of drilled wells and drilling of new wells remained well below the pre-pandemic levels…for the 7 sedimentary regions covered by this report, the total count of DUC wells decreased by 226 wells, falling from 5,081 DUC wells in October to 4,855 DUC wells in November, which was also 39.1% fewer DUCs than the 7,968 wells that had been drilled but remained uncompleted as of the end of November of a year ago…this month’s DUC decrease occurred as 659 wells were drilled in the 7 regions that this report covers (representing 87% of all U.S. onshore drilling operations) during November, up from the 649 wells that were drilled in October, while 885 wells were completed and brought into production by fracking, up from the 876 completions seen in October, and up from the pandemic hit 589 completions seen in November of last year, but still down by 9.4% from the 979 completions of November 2019….at the November completion rate, the 4,885 drilled but uncompleted wells left at the end of the month represents a 5.5 month backlog of wells that have been drilled but are not yet fracked, down from the 5.9 month DUC well backlog of a month ago, a ratio that is now below that of the year prior to the pandemic, despite a completion rate that is still around 20% lower than the pre-pandemic norm…

both oil producing regions and natural gas producing regions saw DUC well decreases in November, while none of the major basins reported a DUC well increase….the number of uncompleted wells remaining in the Permian basin of west Texas and New Mexico decreased by 105, from 1,669 DUC wells at the end of October to 1,564 DUCs at the end of November, as 300 new wells were drilled into the Permian during November, while 405 wells in the region were being fracked…at the same time, DUCs in the Eagle Ford shale of south Texas decreased by 35, from 796 DUC wells at the end of October to a record low of 761 DUCs at the end of November, as 63 wells were drilled in the Eagle Ford during November, while 98 already drilled Eagle Ford wells were completed….in addition, there was also a decrease of 30 DUC wells in the Bakken of North Dakota, where DUC wells fell from 516 at the end of October to a record low of 486 DUCs at the end of November, as 43 wells were drilled into the Bakken during November, while 73 of the drilled wells in the Bakken were being fracked….meanwhile, DUC wells in the Niobrara chalk of the Rockies’ front range decreased by 11, falling from 372 at the end of October to a record low 361 DUC wells at the end of November, as 87 wells were drilled into the Niobrara chalk during November, while 98 Niobrara wells were being fracked…in addition, the number of uncompleted wells remaining in Oklahoma’s Anadarko basin decreased by 10, falling from 799 at the end of October to 789 DUC wells at the end of November, as 47 wells were drilled into the Anadarko basin during November, while 57 Anadarko wells were completed…..

among the natural gas producing regions, the drilled but uncompleted well count in the Appalachian region, which includes the Utica shale, fell by 28 wells, from 537 DUCs at the end of October to a record low of 511 DUCs at the end of November, as 71 wells were drilled into the Marcellus and Utica shales during the month, while 97 of the already drilled wells in the region were fracked….meanwhile, the uncompleted well inventory in the natural gas producing Haynesville shale of the northern Louisiana-Texas border region was down by nine to 383 DUCs, as 48 wells were drilled into the Haynesville during November, while 57 of the already drilled Haynesville wells were fracked during the same period….thus, for the month of November, DUCs in the five major oil-producing basins tracked by this report (ie., the Anadarko, Bakken, Niobrara, Permian, and Eagle Ford) decreased by a total of 191 wells to 3,961 wells, while the uncompleted well count in the natural gas basins (the Marcellus, the Utica, and the Haynesville) decreased by 35 wells to 894 wells, although as this report notes, once into production, more than half the wells drilled nationally will produce both oil and gas…