RJS @ MarketWatch 666, Construction Spending Rose 0.2% in December after Prior Months Were Revised Higher The Census Bureau’s report on construction spending for December (pdf) estimated that the month’s seasonally adjusted construction spending would work out to ,639.9 billion annually if extrapolated over an entire year, which was 0.2 percent (± 0.8 percent)* above the revised November estimate of a ,636.5 billion rate annually, and 9.0 percent (±1.0 percent) above the estimated annualized level of construction spending in December of last year . . . the annualized November construction spending estimate was revised almost 0.7% higher, from ,625.9 billion to ,636.5 billion, and the annual rate of construction spending for October was

Topics:

run75441 considers the following as important: Hot Topics, MarketWatch 666, RJS, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

RJS @ MarketWatch 666, Construction Spending Rose 0.2% in December after Prior Months Were Revised Higher

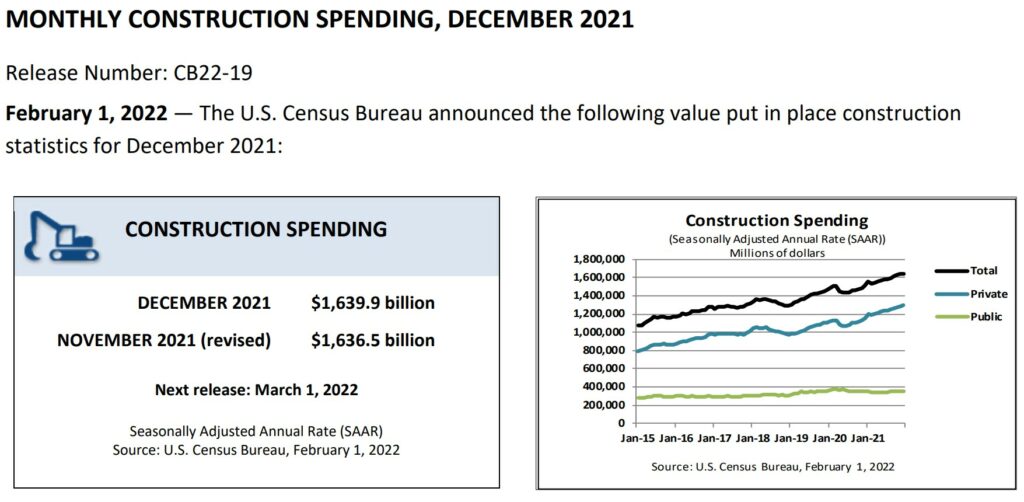

The Census Bureau’s report on construction spending for December (pdf) estimated that the month’s seasonally adjusted construction spending would work out to $1,639.9 billion annually if extrapolated over an entire year, which was 0.2 percent (± 0.8 percent)* above the revised November estimate of a $1,636.5 billion rate annually, and 9.0 percent (±1.0 percent) above the estimated annualized level of construction spending in December of last year . . . the annualized November construction spending estimate was revised almost 0.7% higher, from $1,625.9 billion to $1,636.5 billion, and the annual rate of construction spending for October was revised 0.5% higher, from $1,618.8 billion to $1,626.4 billion…for all of 2021, construction spending totaled $1,589.0 billion, 8.2 percent (±0.8 percent) above the $1,469.2 billion spent in 2020…

A further breakdown of the different subsets of construction spending is provided in a Census summary, which precedes the detailed spreadsheets:

- Private Construction: Spending on private construction was at a seasonally adjusted annual rate of $1,292.9 billion, 0.7 percent (±0.5 percent) above the revised November estimate of $1,283.8 billion. Residential construction was at a seasonally adjusted annual rate of $810.3 billion in December, 1.1 percent (±1.3 percent)* above the revised November estimate of $801.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $482.6 billion in December, virtually unchanged from (±0.5 percent)* the revised November estimate of $482.7 billion. The value of private construction in 2021 was $1,242.8 billion, 12.2 percent (±1.0 percent) above the $1,107.9 billion spent in 2020. Residential construction in 2021 was $774.9 billion, 23.2 percent (±2.1 percent) above the 2020 figure of $628.9 billion and nonresidential construction was $467.9 billion, 2.3 percent (±1.0 percent) below the $479.0 billion in 2020.

- Public Construction: In December, the estimated seasonally adjusted annual rate of public construction spending was $347.0 billion, 1.6 percent (±1.3 percent) below the revised November estimate of $352.7 billion. Educational construction was at a seasonally adjusted annual rate of $81.0 billion, 1.4 percent (±1.5 percent)* below the revised November estimate of $82.2 billion. Highway construction was at a seasonally adjusted annual rate of $103.5 billion, 0.1 percent (±3.5 percent)* above the revised November estimate of $103.4 billion. The value of public construction in 2021 was $346.2 billion, 4.2 percent (±1.5 percent) below the $361.2 billion spent in 2020. Educational construction in 2021 was $82.4 billion, 7.6 percent (±3.0 percent) below the 2020 figure of $89.1 billion and highway construction was $99.7 billion, 0.2 percent (±3.6 percent)* above the $99.5 billion in 2020.

Construction spending in December was higher than was estimated by the BEA in their advance estimate of 4th quarter GDP last week, while October’s and November’s annualized construction spending were revised $10.6 billion and $7.6 billion higher respectively. The BEA’s key source data and assumptions (xls) accompanying last week’s 4th quarter GDP report indicates they had estimated that December’s residential construction would increase by an annualized $1.1 billion from previously published figures, that nonresidential construction would increase by an annualized $1.9 billion from last month’s report, and that December’s public construction would increase by an annualized $0.3 billion from the figures shown in November’s construction spending report . . . hence, by totaling the changes of those BEA estimates, we find the BEA had estimated December construction spending to be $3.4 higher than previously reported November levels, which have now been revised $10.6 billion higher . . . since this report indicated that total construction spending for December was $3.4 billion higher than the revised November figure, that means the net of the annualized construction figures used for December in the GDP report was $10.6 billion too low . . . averaging the differences between the monthly annual rates in this report and those used in the GDP report for the three months of the 4th quarter would mean that this report suggests that construction spending in the 4th quarter GDP report was underestimated by $9.6 billion (at an annual rate), implying an upward revision to the related GDP components at a rate that should result in addition of about 0.17 percentage points to 4th quarter GDP when the 2nd estimate is released at the end of the month, an estimate that should be considered very rough, since we have only allowed for an aggregate deflator for the revisions, and not one addressing the specific components revised…