From Blair Fix I’ve been writing about inflation for the better part of three months. It’s been exhausting. Most of my time has been spent debunking misconceptions promoted by mainstream economists. Fortunately, I’m ready to move on. What’s interesting about inflation is not the fact that prices rise. What matters is that prices rise at different rates. In other words, inflation creates winners and losers — it redistributes income. In this post, I’ll dive into the redistribution dynamics between wage workers and creditors.1 When inflation rears its head, both groups try to bolster their income. But they rarely have equal success. Looking at over two centuries of US price history, I find (perhaps surprisingly) that inflation tended to benefit workers at the expense of creditors. Since

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Blair Fix

I’ve been writing about inflation for the better part of three months. It’s been exhausting. Most of my time has been spent debunking misconceptions promoted by mainstream economists. Fortunately, I’m ready to move on.

What’s interesting about inflation is not the fact that prices rise. What matters is that prices rise at different rates. In other words, inflation creates winners and losers — it redistributes income.

In this post, I’ll dive into the redistribution dynamics between wage workers and creditors.1 When inflation rears its head, both groups try to bolster their income. But they rarely have equal success.

Looking at over two centuries of US price history, I find (perhaps surprisingly) that inflation tended to benefit workers at the expense of creditors. Since the 1970s, however, the reverse has been true; inflation has systematically benefited creditors at the expense of workers.

So what changed?

Two things. First, the US labor movement was crushed. Second (and far less discussed), US policy makers adopted a new way to ‘fight’ rising prices. When inflation reared its head, central banks attempted to quell it by aggressively hiking interest rates. Today, it’s received wisdom that this policy ‘works’.

Of course, the policy does work — but not for its stated goal. Never mind ‘fighting inflation’. When you raise interest rates, you give creditors a raise.

Framed in this light, it’s unsurprising that inflation has recently become a boon for US creditors. Backed by monetarist ideology, the government is now dedicated to preserving the return on credit. When it comes to class struggle, there’s nothing like having the sledgehammer of the state to back you up.

With credit returns in mind, here’s the road ahead. Before diving into the dynamics of class struggle, I’ll take a quick look at the language used to describe rising prices. Next, I’ll quantify the price struggle between creditors and workers. Finally, I’ll measure how this struggle has changed over time, and how it relates to the ideological currents of the period.

Inflation and the English language

To start our journey into income redistribution, let’s talk about terminology. The word inflation … what does it describe?

To many people, ‘inflation’ refers to a decrease in the value of money. While this thinking is not wrong per se, it is needlessly abstract. We cannot measure the ‘value of money’. Instead, we measure price increases.2 Speaking of the phrase ‘price increases’, this language is also indirect. After all, prices don’t raise themselves. If prices go up, it’s because someone raised them. To bolster my profit, I raise prices.

My point here is that there are different ways to talk about the phenomenon of ‘inflation’. And paradoxically, the word ‘inflation’ is itself quite opaque. When ‘inflation’ rears its head, what’s actually going on is that groups of people compete to ‘raise prices’.

Now, if English writers cared about accuracy, you’d think that they would favor terms that are clear. And yet when it comes to price hikes, the opposite is true.

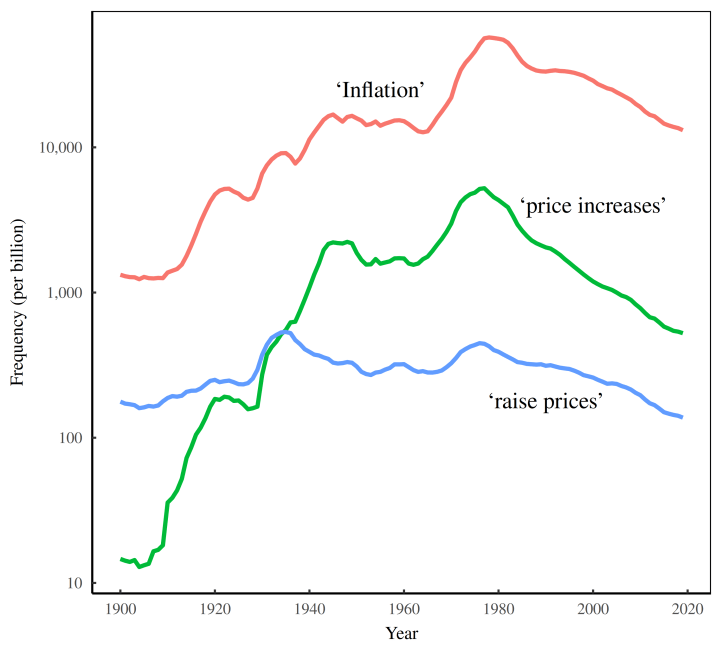

Figure 1 runs the numbers. Here, I’ve plotted the frequency (in the Google English corpus) of three different phrases which describe the same phenomenon: ‘inflation’, ‘price increases’, and ‘raise prices’. The opaque term ‘inflation’ is ubiquitous. The more descriptive term ‘price increases’ is about 10 times more rare. And the action phrase ‘raise prices’ is vanishingly scarce.

Why do English writers avoid plain talk about ‘raising prices’? Well, a feature of plain language is that it’s easy to understand. But as George Orwell observed, sometimes people want to be misunderstood.

Those people tend to be the powerful, and their goal is to distract you from their actions. On that front, talk of ‘raising prices’ highlights the folks doing the raising. Who is raising the price of food? That would be grocery retailers.

If you want to downplay your price-raising culpability, start by removing the subject (you). Talk instead about ‘price increases’, as if prices raise themselves. Or better yet, speak about ‘inflation’. By doing so, you’ll take the focus off of prices and put it onto vague problems with the money supply.

The struggle to raise prices

Now to the science of inflation, which starts with concrete language. I define ‘inflation’ as the general struggle to raise prices.

This inflationary struggle involves everyone. Firms play the price-raising game. But so do landlords, proprietors, wage workers and creditors. Because of this generality, the struggle to raise prices is best thought of as a herd competition. Everybody plays. But not everybody wins.

I SEE YOUR PRICE HIKE, AND I RAISE MY WAGE

Diving into the struggle to raise prices, lets look at how US workers play the game. When firms raise prices, the cost of living goes up. Unsurprisingly, workers respond by seeking higher wages. The result is a tit for tat between commodity prices and wages. When one goes up, so does the other.

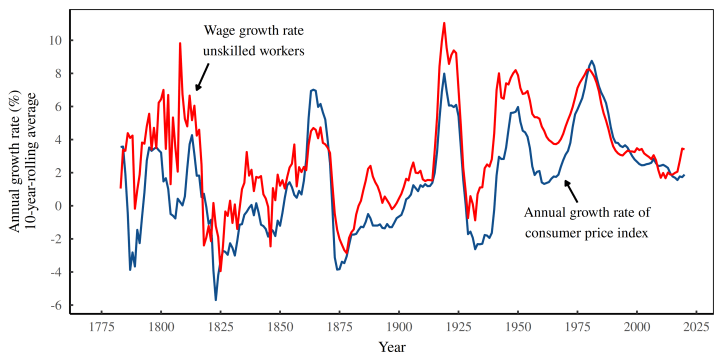

Figure 2 shows the pattern in the United States. The blue curve plots the annual change in the consumer price index. The red curve shows the annual growth rate of wages. Over more than two centuries, the two series are tightly coupled.

Looking Figure 2, what’s interesting is that for most of the last two centuries, wage growth exceeded price growth. (The red curve lies above the blue curve.) In other words, from 1770 to 1970, workers saw their purchasing power grow. But what’s ominous is that after 1970, workers took a beating. For the last fifty years, wages have barely kept up with rising prices.

Sear this stagnation into your memory, as we’ll return to it later. But right now we’ll move on to another tit for tat.

I SEE YOUR PRICE HIKE, AND I RAISE MY RETURN ON CAPITAL

When it comes to raising prices, capitalists play the same game as workers. The main difference is that capitalists don’t receive a ‘wage’; they receive a ‘return on investment’.

Like the various flavors of labor income (wages, salaries, commission, etc.), there are different flavors of capitalist investment. The two most important are equity and debt. Each flavor comes with its own category of income. If I invest in equity, I earn ‘profit’. But if I invest in debt, I earn ‘interest’.3

When faced with inflation, these investment flavors require different strategies for preserving income. Let’s start with equity. When you buy equity, you purchase the legal command of a firm (or at least part of it). So when your competitors raise prices, you tell your firm to do the same. Profits preserved.

If you purchase debt, however, you have no formal say in the debtor’s decisions, and no right to their bolstered profits.4 Instead, your investment return is fixed. It is set at the purchase date by the rate of interest. So if you are a creditor (meaning you own debt), the obvious response to inflation is to raise the rate of interest.

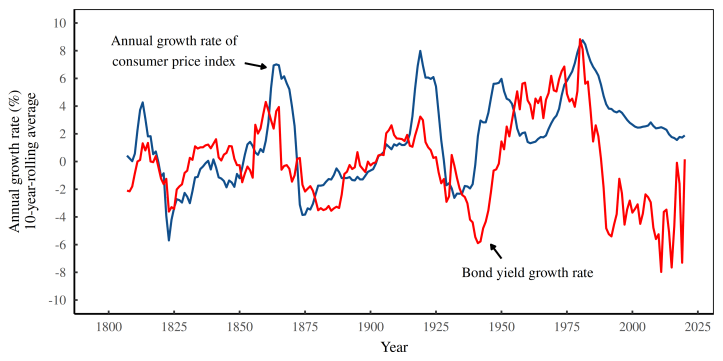

Because of this income-preserving behavior, interest rates tend to rise and fall with other commodity prices. Figure 3 shows the pattern in the United States.

Some things to note about the data in Figure 3. First, I’ve proxied the rate of interest using the yield on long-term bonds.5 Second, the vertical axis shows the growth rate of bond yields, not the percentage point change. So if the bond yield jumps from 5% to 6%, that counts as a growth rate of 20%. The idea is that we’re measuring the growth rate of simple interest earned on a fixed quantity of credit.

Looking at Figure 3, it’s clear that bond yields rise and fall with commodity prices. But then again, it would be astounding if they didn’t. When faced with inflation, creditors bolster their income … just like everyone else.

The struggle between creditors and workers

To summarize the evidence so far, we know that during bouts of inflation, both US workers and US creditors raise their prices. Now we’ll see how these two groups fair against each other.

The way I’ll do that is by measuring the growth gap between bond yields and wages:

The idea here is that the bond-wage growth gap quantifies the price struggle between creditors and workers. When bond yields grow faster than wages, it signals that creditors are winning the struggle. But when bond yields grow slower than wages, it signals that workers are winning the battle.6

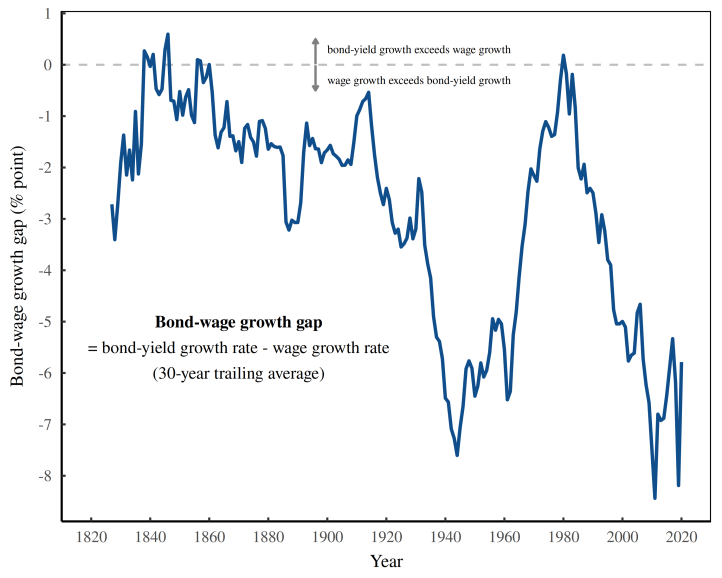

Figure 4 shows the history of the bond-wage growth gap in the United States. Note that the growth gap is quite volatile, so I’ve smoothed it with a 30-year trailing average.

Looking at Figure 4, let’s note some important features. First, the bond-wage growth gap is mostly negative, meaning US bond yields tended to grow more slowly than US wages. That’s expected. Over the last two centuries, US wages grew exponentially; bond yields did not.

Second, the bond-wage growth gap saw some major swings — a stark decline in the early 20th century, followed by a reversal after 1970. These swings — and how they relate to inflation — will be the focus of our story.

Price battles and price wars

To understand how rising prices relate to class struggle, it’s helpful to distinguish between two forms of price competition: price battles and price wars.

Price battles are the incessant skirmishes fought between competing groups. They happen everywhere, all the time, as when a gas station raises prices in response to a competitor. I consider the struggle between workers and creditors a price battle, in the sense that it never stops.

Price wars, in contrast, are less frequent escalations of conflict. They are what happens when everyone joins the price-raising game.

Why does this battle/war distinction matter? Well, because when price wars break out, they affect the outcome of price battles. In other words, when inflation rears its head, class struggle intensifies.

On that front, political economists Jonathan Nitzan and Shimshon Bichler have done pioneering research. Looking at the United States, they’ve found that during bouts of inflation, corporate profits tend to rise relative to wages. Similarly, rising prices tend to benefit the bottom lines of big corporations at the expense of small businesses.7

Taking a cue from Nitzan and Bichler, I’m going to see how inflation affects the battle between US creditors and US workers. To do that, I’ll measure the correlation between the rate of inflation and the bond-wage growth gap. If the correlation is positive, it signals that rising prices benefit creditors. But if the correlation is negative, it indicates that inflation benefits workers.

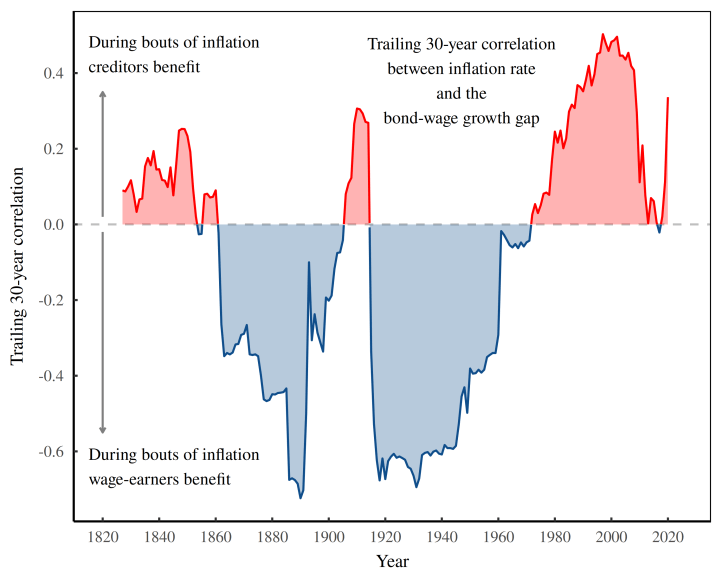

The results; I find that over the last two centuries, the bond-wage growth gap correlates negatively with the rate of inflation (�=−0.11). In other words, price wars have historically benefited US workers at the expense of creditors. That’s surprising. But what’s more interesting is that this correlation has varied wildly over time.

Let’s have a look.

A rolling battle

In Figure 5, I’ve plotted the 30-year rolling correlation between US inflation and the bond-wage growth gap. If you know what that means, skip ahead to the results. But for the uninitiated, here’s a brief tutorial.

A rolling correlation begins by taking a correlation on a subset of the data. Here, I use a window of 30 years. So I start by taking 30 years of inflation data and correlating it with 30 years of data for the bond-wage growth gap. For example, from 1798 to 1827, the correlation between these two series was 0.09. I record this correlation and attach it to the year 1827 (creating a ‘trailing’ correlation). Next, I move the correlation window ahead (to the years 1799–1828) and repeat the analysis. I attach that correlation to the year 1828. Finally, I continue to ‘roll’ the correlation ahead until I run out of data.

Now to the results. If a relation doesn’t change over time, a rolling correlation will return a (roughly) constant value that’s the same as the long-term correlation. But in the case of the price battle between creditors and workers, that’s not what happens. Instead, we find that our rolling correlation has wild fluctuations. Figure 5 shows the pattern.

To help you understand the results in Figure 5, I’ve used color to tell the story. When the rolling correlation is colored red, it indicates that inflation benefited creditors at the expense of workers. But when the rolling correlation is colored blue, it indicates that inflation benefited workers at the expense of creditors.

Looking at the historical trends, we see that US workers typically won the price battle. From about 1860 to 1970, the rolling correlation was overwhelmingly negative, meaning that during bouts of inflation, wages grew faster than bond yields. In fact, prior to the 1970s, there were only a few moments when inflation benefited US creditors. (Creditors came out on top during the run-up to the Civil War, and then briefly during the gilded age of the early 20th century.)

Despite this long-term victory for workers, the price battle has recently shifted. For the last 50 years, inflation has systematically benefited US creditors at the expense of workers. What changed?

The government sledgehammer

To understand the recent tide against workers, let’s talk hammers. If institutions are hammers for getting your way, the government is a fifty-pound sledge. When you wield it effectively, you win.

Workers should know. A big part of the labor movement was getting the government to back the right to organize and strike. (More on that in a moment.)

Of course, creditors also want government on their side. And so they have their eyes on the US Federal Reserve — the arm of government which regulates banking. While the Fed does many things, one of its main tasks is to set the federal funds rate — the interest rate at which banks trade federal funds overnight. By determining this rate, the Fed effectively sets a minimum return on credit.8

On that front, the Fed is basically a capitalist equivalent of the Department of Labor. The DOL sets the minimum wage for workers. The Fed sets the minimum return for creditors. It’s really that simple.

(Sure, the Fed is surrounded by mystique. But so is everything to do with capitalist income. Mystique is part of the toolkit of power.)

Looking at this government structure, the trick for workers is to get the Department of Labor to bolster their income. The trick for creditors is to get the Fed to do the same. The problem for both groups is that success is never guaranteed. (Just ask minimum-wage workers, whose income have stagnated for five decades.)

When it comes to influencing the Fed, creditors have had their work cut out for them. Created in 1913, the Federal Reserve was given a three-pronged mandate that said nothing about preserving creditor’s income. Instead, the Fed was tasked with ensuring ‘maximum employment, stable prices, and moderate long-term interest rates’.

For fifty years after its creation, the Fed seemed to balance these three mandates. However, when Paul Volcker took the helm in 1979, he signaled that the triple mandate would be collapsed to a single order. Going forward, the Fed would focus on stabilizing prices. According to Volcker, the goal was to regulate “the supply of reserves which ultimately controls the money supply”. Or in plain prose, the Fed was about to jack up interest rates in the name of fighting inflation.9

Volcker’s policy didn’t come from nowhere.

For decades prior, the economist Milton Friedman had been claiming that central banks could control inflation by using interest rates to regulate the supply of money. The problem for Friedman was that few economist took him seriously.

That changed in the 1970s for a host of reasons. Perhaps most importantly, the business climate shifted. During the post-war era, the economy boomed, but profit margins steadily dwindled. By the late 70s, business leaders were clamoring for pro-business policies backed by pro-business ‘theory’ (read ‘ideology’).

With Milton Friedman, business had its man. A prolific writer, Friedman churned out ‘theory’ that had the trappings of science, but always recommended policies that were pro-business. And so with capitalists behind him, the stage was set for Friedman’s triumph. By the 1980s, his theory of ‘monetarism’ became wildly popular.

Back to Volcker. By using interest rates to target the money supply, Volcker was channeling monetarist ideology. Of course, the rhetoric was about ‘fighting inflation’. But the direct effect of Volcker’s rate hikes was to bolster the return on credit.

In other words, Volcker was telling creditors that he had their backs. Never mind ‘full employment’ and ‘stable interest rates’. Going forward, the Fed’s goal would be to preserve and protect the income of creditors. Unsurprisingly, the policy worked. Since Volcker’s 1979 declaration, inflation has systematically benefited US creditors at the expense of workers.

A dose of monetarism

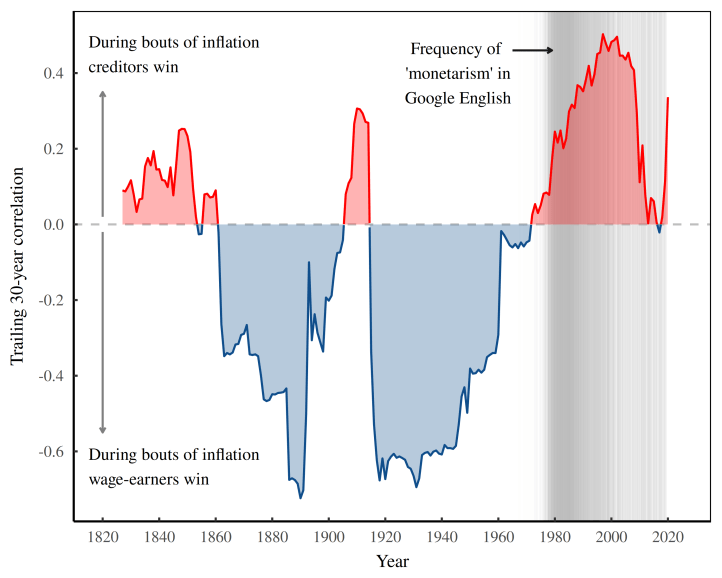

Now the thing about policy is that it can change. So when Volcker left the Fed in 1987, his policies could have been reversed. And yet they were not. Instead, another Friedmanite (Alan Greenspan) became chair.10 Of course, we can blame individuals for these decisions. However, the bigger picture is that the Fed’s policies stayed the course because of a larger shift in ideology. In short, monetarism became the new dogma.

Figure 6 tells the story. Here, I’ve replotted the rolling correlation between the inflation rate and the bond-wage growth gap (first shown in Figure 5). Beneath the curve, I’ve plotted the frequency of the word ‘monetarism’ in written English. (Darker grey indicates that the word is more frequent.) It seems that just as monetarism became popular in the late 1970s, inflation started to benefit US creditors. I doubt it’s a coincidence.

The rise and fall of the labor movement

Perhaps the main legacy of monetarism is that it put the focus on limiting the rate of inflation rather than dealing with the redistributional consequences of the price war.

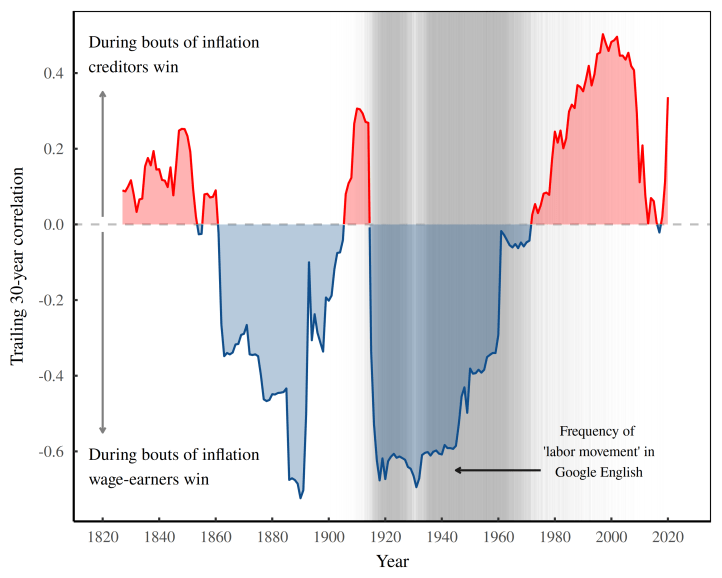

Here’s a case in point. Today, workers assume that inflation is ‘bad’. After all, it erodes their purchasing power. But what many workers don’t realize is that this erosion is not a feature of inflation; it’s a feature of class struggle. Wage erosion signals that today, when firms start raising prices, workers lack the power to bolster their income. Historically, however, this lack of power was not the norm. As the labor movement was heating up in the early 20th century, wage growth far outstripped inflation.

The path to achieving this ‘living wage’ was difficult to implement, but conceptually straightforward. Workers used the sledgehammer of government to raise their income. In the US, the battle came to a head in 1912, after textile workers mounted a tumultuous strike which prompted the first minimum wage legislation (passed in Massachusetts). A decade later, 15 states had minimum wage laws.11

Now, just as the Fed’s monetary policy can change, wage legislation can be bolstered or clawed back, depending on who’s influencing government. So the real story of the labor movement isn’t legislation per se, but the cultural transition that came with it.

On that front, we can see the cultural impact of the labor movement by charting the frequency of the phrase ‘labor movement’. It rose during the early 20th century, and fell from the 1970s onward. Unsurprisingly, that’s the same period during which inflation benefited workers at the expense of creditors. Figure 7 tells the story.

The freedom to invest

Looking at the tight relation between the outcome of the worker-creditor class struggle and changes in the social climate, I can’t help but think of Milton Friedman’s apologetics. When evidence for his monetary policy didn’t turn up, it was no problem. The failure simply indicated that his policies worked with considerable delays:

There is much evidence that monetary changes have their effect only after a considerable lag and over a long period and that the lag is rather variable.

Given Friedman’s equivocation, it’s ironic that his policies did work — and immediately so — but for reasons that he preferred to leave unstated. On that front, Friedman’s ideas were part of the wider rise of neoliberal ideology — a movement that professed a faith in ‘free markets’, yet demanded that the sledgehammer of government be used to crush workers.

And so over the last fifty years, we got a Federal Reserve that, in the face of inflation, acted ‘independently’ to bolster the return on credit. Tellingly, we didn’t get an ‘independent’ Department of Labor that bolstered labor income by hiking the minimum wage. It’s almost as if the Fed’s ‘independence’ was code for ‘regulatory capture’.

In short, when Friedman proselytized ‘freedom’, he had in mind the freedom to invest. And that, Nitzan and Bichler remind us, is code for the “freedom to impose and capitalize power”.

An imaginary blessing

Let’s wrap up our story. Because we (modern humans) are immersed in prices, we tend to forget that these numbers are conventions for quantifying our social relations. In other words, we misunderstand the social system which we have created.

In this regard, we are in good company. A basic feature of all ideologies is that they distract people from what’s right in front of them. Take the example of divine kings. By evoking the will of god, the king distracts people from the hand of power. And so as the tribute flows in, the king’s subjects see a reciprocal flow of divine blessing.

The return on credit operates the same way. When creditors hike the rate of interest, the effect is that their income rises. But to the masses, the move comes in the name of an imaginary blessing — a ‘fight against inflation’.

It’s a testament to our indoctrination that many people believe these claims. And yet it was not always so. Today’s inflation-fighting rhetoric is a recent invention, cooked up at a moment when US workers were winning the price battle and creditors were losing.

On that front, here’s a way to inoculate yourself against monetarist bullshit. Define ‘inflation’ as a general struggle to raise prices. In this light, the ‘medicine’ of higher interest rates is self-evident poison — a price hike that bolsters the income of the powerful at the expense of everyone else. It’s divine kingship in a new form: a real windfall in the name of an imaginary blessing.