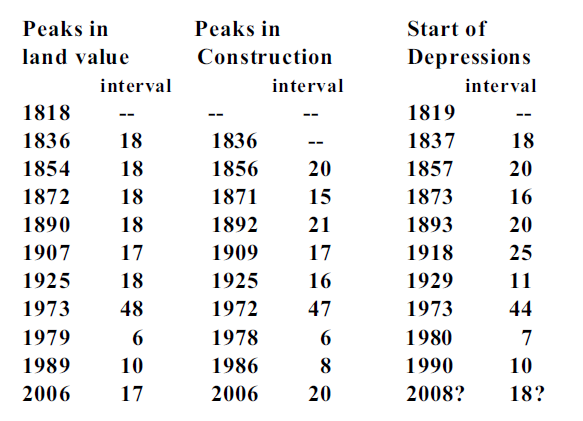

In the latest Research Bulletin of the ECB Gerhard Rünstler rightly states that ‘historical evidence suggests that many financial crises have been preceded by credit and housing booms‘ and ‘the emerging stylised facts have by no means been digested by the scientific economics community‘. But his implicit suggestion that these findings about credit, housing booms and economic downturns are new is wrong. According to Fred Foldvary (in 2007), ‘In the United States there has been a real estate cycle with a typical duration of about 18 years. This is shown on the table on the next page. This cycle was discovered by real estate economist Homer Hoyt (1960 [1970], p. 538), who explained, “While there were variations in timing between different cities and different types of property, the urban real estate cycle was approximately 18 years in length.” Hoyt adds, “The urban real estate cycle has been closely associated with the general business cycle.” Hoyt, however, did not fully understand the economics of the real estate cycle, at least the way it is analyzed here. He thus thought that the real estate cycle had been eliminated by 1960, whereas in fact it had already resumed. In real prices, after adjusting for inflation, real estate prices fell in 1973 and in 1990, and then again in 2006 and 2007.‘.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

In the latest Research Bulletin of the ECB Gerhard Rünstler rightly states that ‘historical evidence suggests that many financial crises have been preceded by credit and housing booms‘ and ‘the emerging stylised facts have by no means been digested by the scientific economics community‘. But his implicit suggestion that these findings about credit, housing booms and economic downturns are new is wrong. According to Fred Foldvary (in 2007),

‘In the United States there has been a real estate cycle with a typical duration of about 18 years. This is shown on the table on the next page. This cycle was discovered by real estate economist Homer Hoyt (1960 [1970], p. 538), who explained, “While there were variations in timing between different cities and different types of property, the urban real estate cycle was approximately 18 years in length.” Hoyt adds, “The urban real estate cycle has been closely associated with the general business cycle.” Hoyt, however, did not fully understand the economics of the real estate cycle, at least the way it is analyzed here. He thus thought that the real estate cycle had been eliminated by 1960, whereas in fact it had already resumed. In real prices, after adjusting for inflation, real estate prices fell in 1973 and in 1990, and then again in 2006 and 2007.‘.

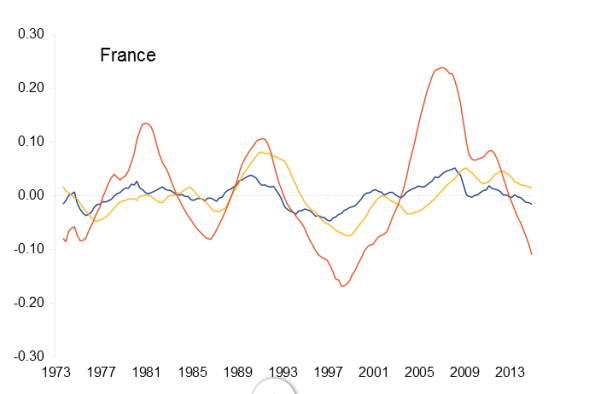

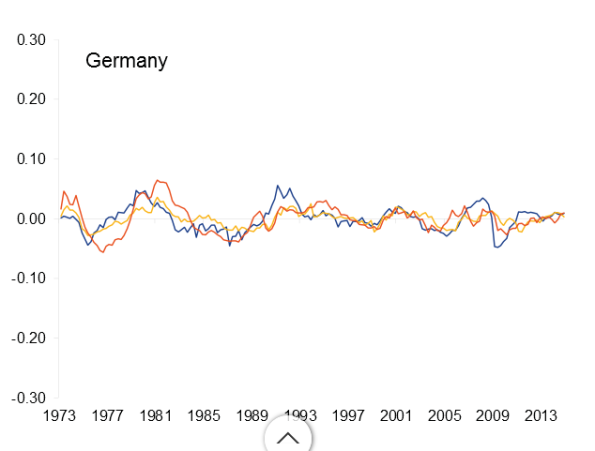

Rünstler shows graphs about credit, GDP and housing cycles in the USA, France (shown below), Germany (below) and the UK and therewith extends this idea to other countries. He also provides more sophisticated econometric analysis. Interestingly, France and the UK show patterns quite comparable to the USA while Germany, which has a tradition of low home ownership, doesn’t! But the existence of a credit-housing cycle is not a new discovery. It is, though, a good thing that Rünstler tries to disseminate this idea. Two graphs from the Rünstler article:

![]()

.

.