Yes I am complaining about filing a tax return (I wonder how many people are blogging such complaints today). I am trying to e-file a return for [un-named relative X] who is a full time student with zero income and IRS anxiety. OK so we are silly as X is not required to file a return. So the IRS has an apparently covenient web based e-file system https://www.freefilefillableforms.com/home/continuereturn.php (warning do not click this link if you don’t enjoy the combination of opache software, red tape and buplic sector customer service). I have learned a few things. One I learned last year. when a return is e-files with an elementary error, the web site does not note the error immediately and demand a correction. Rather the return is queued

Topics:

Robert Waldmann considers the following as important: Taxes/regulation

This could be interesting, too:

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Joel Eissenberg writes DOGE goes where the money is

Joel Eissenberg writes SCOTUS and the power of the purse

NewDealdemocrat writes Important changes in trend in the bond and stock markets, and a note on GDP estimates as well

Yes I am complaining about filing a tax return (I wonder how many people are blogging such complaints today). I am trying to e-file a return for [un-named relative X] who is a full time student with zero income and IRS anxiety. OK so we are silly as X is not required to file a return. So the IRS has an apparently covenient web based e-file system https://www.freefilefillableforms.com/home/continuereturn.php (warning do not click this link if you don’t enjoy the combination of opache software, red tape and buplic sector customer service).

I have learned a few things. One I learned last year.

when a return is e-files with an elementary error, the web site does not note the error immediately and demand a correction. Rather the return is queued and then rejected some time later. Below you will see how elementary my errors are and how quickly they could have been detected. Every private sector web form I have ever used (endured, cursed, and screamed at) has instant error reports for errors which can be detected and reported instantly. The IRS reports on obvious errors and delicate reasons a return might be rejected with the same significant delay. It sends an e-mail error report in burucratese allowing one to get a comprehensible explanation by cutting and pasting the entire e-mail into a help window.

The IRS does not accept income tax returns in which 0 income is reported. It is not required to file nor is it allowed. Being an idiot, I decided that $1.00 which I have given to X was to be considered a payment for (many things that X does for me as I do things like attempt to file an un-needed tax return for X).

To file one must provide either last years adjusted gross income (AGI) or a 5 digit PIN selected last year. One is informed of this *after* filling out the tax return with no warning that filing the completed form electronically might be challenging.

It seems my effort last year was also unsuccessful as the PIN I chose is not recognized. Last year’s AGI was not zero but I don’t remember what it was. That’s OK because there is a link to click to look up last year’s return. to read it one must log in to one’s irs.com account.

A freefile account is not necessarily and IRS.gov account — the username which allows me to access the completed but un-fileable 2022 return does not allow me to access an IRS.gov account with a transcript of the 2021 return (which may have been erased because I didn’t know 2020 AGI either and I didn’t notice the rejected because — well it makes no difference as it wasn’t really required to file a 2021 return either). I had no idea that a freefile username was not also an IRS.gov username — actually for a long time while I wondered why the username was sometimes accepted and sometimes rejected.

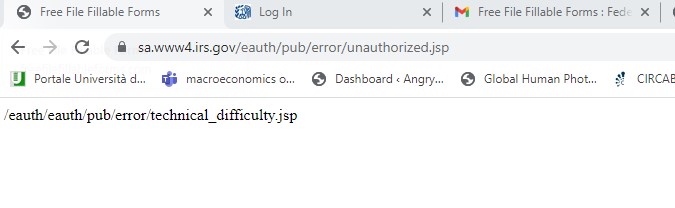

The rejections sometimes where standard username not recognized messages and equally often the following clear explanation of the problem

Aside from that, it seems to me unacceptable to provide me with a link to a site which I can’t use, because the username I use to sign into the page with the link is not the username which I need to type to make use of the linked virtual Kafkaesque nightmare.

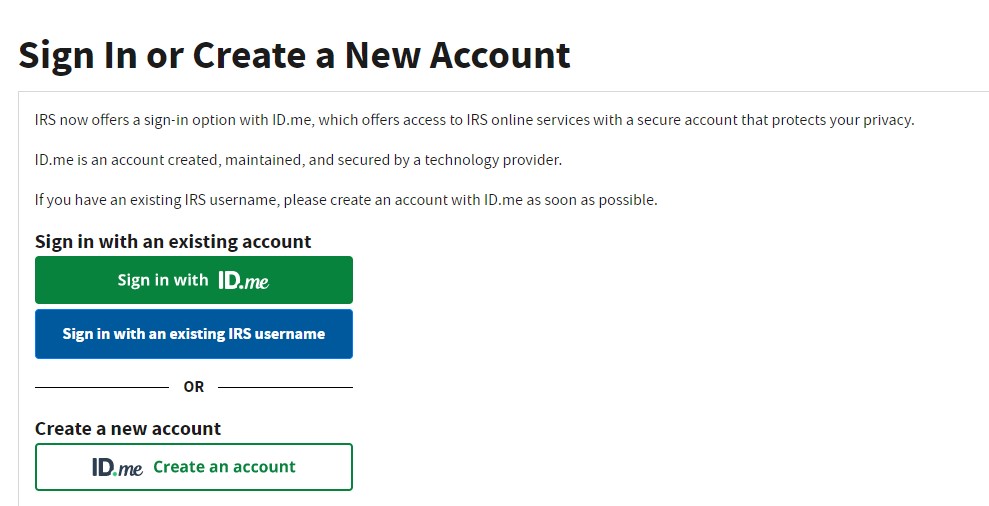

notice that a new account must be an ID.me account. This page does not make clear the fact (reported somewhere in the IRS web labyrinth) that all existing IRS usernames will cease to function some time next month (May 2023 and no way am I going to navigate back to the page where I learned the exact day).

I now have an ID.me account — it was a hassle. also I can access it only using my Italian iPhone (I am not sure I will be able to access it when I am in the USAS). For security it wanted a US phone number to which to send a 6 digit code. I have a T-mobile number which I can’t access as there are no T-mobile antenna’s within 1000 miles. The IRS has decided to create a new digital divide such that only people with smartphones are fully citizens. The problem is worse in Italy. Someone has to tell these people that not everyone has a smartphone. I mean at least warn me that the phone number is for a text message before I give one of my 2 audio only landline numbers and then read that a text message has been sent to it. I got an ID.me account (after many minutes of effort and no warning that smartphones were required) because it accepts I have the right thumbprint on the phone I am using to logon — note I can NOT access the account and see things on a larget than palm sized screen because I can’t get text messages across the Atlantic).

I can check *my* old accounts where the AGI (which I would need to e-file my tax return) is clearly listed in the nth of dozens of lines of plain text (no way I am going to count to n or how many dozens but way more lines than appear in a 1040).

OK so why why why ? Who does the IRS have sepearate acounts for filing tax returns and for IRS.gov ? why is this never explained (really took me a long time to figure out that I could log in to edit the form but not to get transcripts of old returns). Why is ID.me (which is a huge hassle) replacing the old username ? How many IRS.gov accounts have ever been hacked ? What is the relative importance of making surer that privacy is protected compared to the cost of enraging and frustrating people by elmininating their old account and making them go through a large effort to set up a new one.

Why I am trying to bore you with this (notice I have not described the procedure for setting up an ID.me account except to say that it is long, frustrating, and boring) ?

Why wasn’t I warned that last year’s PIN or AGI was needed to file a form before I spent time filling it out (needlessly that’s my fault). WHy am I expected to know last years AGI? Does the IRS *really* think people keep copies of their 1040s for their files (as we are instructed to do by our non-lords and non-masters at the IRS). Why does freefile tell me I can get a transcript and give me a link to IRS.gov which refuses to give me that transcript I need ?

Has the IRS been infiltrated by MAGA moles determined to make people hate the IRS and vote for Republicans and tax cuts for rich people, because we are angry at IRS.gov ? Or are the infiltrators working for TurboTax ? It just can’t be this bad because of mere incompetence.