[unable to retrieve full-text content]It is very easy to disrupt a complex system and very hard to get it going again. Trump, Musk, and the Muskateers decided to limit overhead on NIH grants to 15% fearing that some of the overhead might get money to DEI deans. They also limited communication of government health agencies with the public. The […]

The post Throwing a Wrench in the National Cancer Institute appeared first on Angry Bear.

Articles by Robert Waldmann

CAR VII

February 12, 2025[unable to retrieve full-text content]Here I report on research on off the shelf CAR T-cells (which was conducted beyond the reach of Trump, Miust and Vought)

The post CAR VII appeared first on Angry Bear.

Direction of Implication of high probability

December 1, 2024[unable to retrieve full-text content]There are a huge number of anomalies and biases which can be understood as confusing the claims that the probability of p conditional on q is high if the conditional probability of q conditional on p is high. One is diagnostic expectations – the conditional probability that a person has red hair if the person […]

The post Direction of Implication of high probability appeared first on Angry Bear.

Over-reaction to new data. What have you done for me lately ?

November 29, 2024[unable to retrieve full-text content]An explanation of over-reaction to new data starts with a principal agent model. The idea is that the forecasts are made by agents who are trying to impress people who pay for the forecasts. Another, and more important, case is that of professional money managers who are investing other people’s money and trying to convince […]

The post Over-reaction to new data. What have you done for me lately ? appeared first on Angry Bear.

A Complete Set of Subjective Probabilities, Bayes’ Formula, Overconfidence and Over-reaction to new information

November 28, 2024[unable to retrieve full-text content]There is an approach to cognitive psychology and modelling beliefs and forecasts which is natural for economists and very misleading. The assumptions are that we have a complete set of subjective probabilities updated with Bayes’ formula, that for any possible combination of events we have a belief about the probability that they will occur and […]

The post A Complete Set of Subjective Probabilities, Bayes’ Formula, Overconfidence and Over-reaction to new information appeared first on Angry Bear.

The Allais Paradox

November 27, 2024[unable to retrieve full-text content]One of the first observed and best known errors people make when told probabilities is the Allais paradox. People put too much weight on rare extreme outcomes. This means that choices people make different choices when asked to choose between two lotteries with the same probabilities of the same outcomes depending on how they are […]

The post The Allais Paradox appeared first on Angry Bear.

Diagnostic Expectations vs Anchoring

November 27, 2024[unable to retrieve full-text content]For 4 decades I have been trying to deal with, what seems to me to be a contradiction between empirical results. Kahneman and Twersky note two things. One is diagnostic expectations – people over react to useful signals of membership in a group – diagnostic symptoms. One example is that red hair is diagnostic of […]

The post Diagnostic Expectations vs Anchoring appeared first on Angry Bear.

Allais Paradox II : Do Two Wrongs Make a Right?

November 26, 2024[unable to retrieve full-text content]I have begun a possibly long series on people’s heuristics and biases when we try to think about probability. I posted one explanation of the Allais Paradox. Click on the link for definitions as I go on assuming earlier posts have been read (this will create problems but I can’t avoid it). Briefly the Allais […]

The post Allais Paradox II : Do Two Wrongs Make a Right? appeared first on Angry Bear.

Some Thoughts on Psychology of Heuristics and Biases

November 24, 2024[unable to retrieve full-text content]I am going to write a series of posts on Kahneman, Twersky, and their many many followers They will be posted on the principle that something is better than nothing. “Citation needed” would often appear on Wikipedia as I will cite as “I vaguely recall reading somewhere.” Also the reverse chronologicical order will create problems […]

The post Some Thoughts on Psychology of Heuristics and Biases appeared first on Angry Bear.

Alleged Hypocrisy and Virtue Signalling

October 22, 2024[unable to retrieve full-text content]Heads I win tails you lose. There are criticisms of alleged hypocrisy and alleged virtue signalling. I am convinced that most who criticise “virtue signalling” are, in fact, criticizing virtue. My guess is that there the selfishness and altruism of different people is different and the relatively selfish suspect (correctly) that the relatively altruistic disapprove […]

The post Alleged Hypocrisy and Virtue Signalling appeared first on Angry Bear.

About r-g

September 29, 2024If long-term interest rate r is less than the trend growth rate of GDP g

Yesterday (technically very early today) I promised a post on why long-term Treasury interest rates are very important. In particular it is very important if the long-term interest rate r is less than the trend growth rate of GDP g. If rg is a condition for optimality. This has a fancy name — the transversality condition. It also is true for an obvious reason. If all can afford to consume more now without consuming less later, they can benefit by doing so. Therefore, the current consumption/saving plan is not efficient.

To get from the whole economy owned by a mythical representative consumer to the government add the assumption that tax revenues are a constant fraction of

Read More »US 10 Year Interest Rates

September 28, 2024Why have they increased so much. The US Treasury constant maturity 10-year interest rate has increased dramatically since the FED started fighting inflation (after falling dramatically during the Covid 19 epidemic).

The increase is not unusual — Monetary policy effects GDP and employment through medium and long term interest rates, especially including the interest rate on 30 year mortgages. But I think it should be surprising.

Before going on, I have a bit of very useful investment advice: do not take investment advice from Robert Waldmann. WIth that disclaimer posted, I have to say that I have the impression that long term treasuries are a good buy when the Federal Funds rate is high — that is I think the price drops too much so the return

Read More »Housing Shortage, Housing Bubble, Soft Landing, FED Brilliance or Lick?

September 23, 2024I think the title makes it clear that this will be a rambling confused post. I am typing on with the thought that something is better than nothing and no one has to read this.

The first topic – house prices, is in fact one that interests me a lot. I have a regression which suggests that a high ratio of house prices to the general price level is terrible news, because it indicates a housing bubble which will burst and be followed by a prolonged recession.

Currently the ratio of the Case-Shiller housing price index to the CPI is higher than it was in 2006.

I don’t want to jinx the economy (my predictions are almost always wrong) but I am not terrified. I think that this time it’s different. This time there has also been a huge increase in

Read More »The 0.5% Reduction of the Federal Funds Rate

September 19, 2024“The Fed Makes a Large Rate Cut and Forecasts More to Come”

Jeanna Smialak Writes

“The Federal Reserve cut interest rates on Wednesday by half a percentage point, an unusually large move and a clear signal that central bankers think they are winning their war against inflation and are turning their attention to protecting the job market.”

I (and Brad DeLong) wonder why the Fed forecasts more rate cuts to come instead of implementing them now? I wonder why is an 0.5% cut considered large? The answer to my faux naivety is that it was not clear until yesterday if the rate would be cut by 0.25% or 0.5%. The fact that it was not cut by more than 5% was not news and not reported.

The not naive question of why forecast cuts rather than

Read More »The 0.5% Reduction of the Federal Funds Rate

September 19, 2024“The Fed Makes a Large Rate Cut and Forecasts More to Come”

Jeanna Smialak Writes

“The Federal Reserve cut interest rates on Wednesday by half a percentage point, an unusually large move and a clear signal that central bankers think they are winning their war against inflation and are turning their attention to protecting the job market.”

I (and Brad DeLong) wonder why the Fed forecasts more rate cuts to come instead of implementing them now? I wonder why is an 0.5% cut considered large? The answer to my faux naivety is that it was not clear until yesterday if the rate would be cut by 0.25% or 0.5%. The fact that it was not cut by more than 5% was not news and not reported.

The not naive question of why forecast cuts rather than

Read More »Kamiddle Class Tax Cut Harris

September 17, 2024I just heard an advertisement for Kamala Harris in which she said she would raise taxes on the rich and cut taxes for the middle class. I was pleased. I note the empirical fact that, in years when the income tax is constitutional yet the top marginal tax rate is below 69%, nonincumbent Democrats are elected president if and only if they promise to raise taxes on high incomes and cut taxes for the middle class.

I usually do not make predictions (I haven’t since 2004). I merely note the pattern

In 2016 I was convinced there would be an exception to the rule/stylized fact. Clinton proposed increasing taxes on the rich and a large number of tax cuts directed at families for whom they would do the most good. Like many people I expected her to get

Read More »Covid and US Crime

September 14, 2024IN 2020 the US homicide rate increased by 29% the largest percent increase on record. There are different theories of the cause. Some are related to Covid 19 with isolation (not lockdowns there were not lockdowns in the USA) causing increased stress and domestic disputes. The George Floyd associated conflict between police and those they are sworn to protect and serve could have led police to quietly quit (there is evidence of this in the reduced number of citations issued -in particular a huge reduction in San Francisco) or mistrust of the police might have led to less cooperation with the police and more people taking matters into their own hands. The enormous unemployment rate might have lead to murder even though the CARES act prevented a huge

Read More »Why Do We Need Industrial Policy???

September 12, 2024I have thoughts on a typically interesting essay by Brad DeLong. It was sent to project syndicate and also my e-mail inbox. I think I should not quote it at length without paying. His claim is that, whether or not one likes industrial policy, we need it now. Given the 700-word limit, he doesn’t discuss Biden’s industrial policy and how it seems to be working.

I will try to define industrial policy not as anything by laissez faire but specifically as picking winners. A progressive income tax is not industrial policy. A carbon tax is not industrial policy.

“This is industrial policy “

“Today, President Biden will travel to Westby, Wisconsin to announce $7.3 billion for clean, affordable, reliable electricity for rural America, funded by his

Read More »The Expected Inflation Imp

September 12, 2024I think the imp is my most noticed contribution to the economic discussion. Brad DeLong mentioned the fact that I mentioned him, but called him the inflation expectations imp . Then Paul Krugman mentioned him shortening the name to “the expectations imp”. Alot of time has passed since then during the slow recovery from the great recession. The Federal Reserve OPen Market Committe (FOMC) cut the Federal Funds Rate to the lower limit of 0 – 0.25% but demand remained low. They could not reach the 2% target, because inflation was persistently below 2%. Many economists argued that it would have been better to target 4% back when they had traction so they could reduce real interest rates to around mins 4% not around minus 2%.

Also fiscal policy was

Read More »what happened to advocacy of a 4% inflation target ?

September 11, 2024And of a 3% inflation target?

There is some risk of recession in the USA because the FED insists on driving inflation down to 2%. Oddly back in the naughts when inflation was persistently below the 2% target, there was more discussion of raising the target. Then IMF chief economist discussed it.

Paul Krugman advocated it: “The basic point is that a higher baseline for inflation would make liquidity traps, in which conventional monetary policy is up against the zero lower bound, less likely and less costly when they happen.” “What do we want? Four percent! When do we want it? Now!” The Chicago Booth definitive standard for professional consensus polled its panel of experts on it.

This discussion was a bit odd. At the time, inflation was

Read More »What are we To Do With the Phillips Curve ?

September 6, 2024The Phillips curve plays a central role in the policy debate (this is partly due to the fact that debaters have finally learned to ignore very highly theoretical and unrealistic DSGE models). Just to review, the Phillips curve should show a negative relationship between unemployment and actual inflation minus expected inflation (it has been defined this way since 1960) The point where inflation is equal to expected inflation is called the non-accelerating inflation rate of unemployment (NAIRU)

However the performance of the Phillips curve in the 21st century has been horrible. First, in the teens there was high unemployment with no reduction in inflation, then in the 20s there was high unemployment and a large increase of inflation, then a further

Read More »Soft Landing ?

September 5, 2024A soft landing (disinflation without a recession) looks possible. Also the remaining threat is the FED’s sticking with high interest rates, even though inflation is at a very reasonable level. I personally publicly and will almost certainly decline even if unemployment remains low.

The change can be predicted, because the US index includes owner equivalent rent, a price which no one pays which is a calculation of how much homeowners would pay if they rented their houses. Rent in the following year and owner equivalent rent are very predictable, because leases generally have monthly rent in dollars fixed for at least one year. The rent on newly signed leases can be used to predict future average rent — rent is in practice a 12 month moving

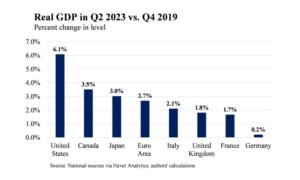

Read More »The US economy is the envy of the first world

September 4, 2024Since the beginning of the Covid epidemic, the US economy has performed better than European economies and the Eurozone average. This comparison is useful, and not just for boasting rights. Fiscal policy in the USA and in the Eurozone has been dramatically different – The US Federal Government implemented Six very large fiscal stimuli:

The CARES act signed into law by Donald

The bipartisan (Manchin) stimulus enacted In December 2024 signed into law by Donald Trump which included $600 per working family.

The American Rescue plan which included $1400 dollars more signed into law by Biden (who actually kept his $2000 campaign promise amazing as that might be)

The bipartisan Infrastructure Bill

the Bipartisan information technology sector

Read More »Opiate Addiction Treatment

September 4, 2024I have long thought that there is a (partially effective) treatment for opiate addiction — suboxone. To review suboxone is a mixture of buprenorphine and naloxone. Buprenorphine is a partial opiate receptor agonist (activator) which also blocks other opiates. At least when taken orally, it relieves opiate craving but does not make people high and prevents them from getting high with other opiates. Naloxone is the well know opiate antagonist used in emergencies. It is not absorbed from the intestine and must be given intravenously or by a nasal spray. In the case of suboxone it is used so that injected suboxone does not cause euphoria, since the buprenorphine is blocked by the naloxone. In contrast if suboxone is taken orally, the naloxone does not

Read More »Policy Proposals, Feelings About Issues, and that Nasty Newly African American Woman who laughs

September 4, 2024I have read many articles quoting (brave) Republicans complaining about Donald Trump’s focus on personal, petty and implausible attacks on Kamala Harris. They often assert that if the election were decided on the basis of policy or issues, then Trump would win. Here is the latest discussion I read about that (just the available link and an excellent blog post).

My immediate reaction is to argue that the Republicans’ claim is false and that voters support Democrats’ policy proposals and vote Republican because of identity politics and effective personal attacks. I found a poll which showed much more support for Biden’s proposals than Trump’s. Before going on, I note that it took an extraordinary amount of Googling to find that page. It was buried

Read More »For Peat’s Sake

August 31, 2024Peat bogs capture much more carbon per acre than forests. Currently, peatlands store twice as much carbon as all the world’s forests . One problem is that they are being drained to free up the land. (also but I think less importantly peat and non-rotten sphagnum moss are harvested for gardening). Various sources (most or all of which seem to be advocacy organisations – yes there are pro-bog advocacy organizations) claim that this causes 10% of global carbon emissions. The more nearly neutral Pew Charitable Trust estimates 5%. Either way, this is a huge amount, but also an opportunity to fight climate change by reflooding the now drained bogs.

I am thinking of more than just ceasing this or even restoring natural peatlands. It seems to me that it

Read More »“Where Do You Get Your News”

August 29, 2024This is a second hand story about my brother in law’s experience in a Giant (TM) Supermarket checkout line (I guess he should guest post this). He saw someone checking out wearing a Trump Shirt and started a conversation (he’s like that) mentioning that he was voting for Harris. The Trump supporter said that BIden and Harris had accomplished nothing. When my brother in law (politely I’m sure) noted that he disagreed. The Trump supporters (plural including Giante employee) were not convinced. One asked if he liked an open border. He said it is now very hard to seek asylum. He was asked “where do you get your news?”

In the USA we know that we have very different opinions about facts. We know they depend on which news sources we trust. It

Read More »Diagnostic Expectations, Anchoring, and Actual Expectations

August 29, 2024This is actually related to my day job. For some decades I have been puzzled by two of Kahneman and Tversky’s discoveries (reported very well in this excellent book).

First, there is the excessive reliance on diagnostic characteristics (called diagnostic expectations by economists). A classic example is the room with 90 lawyers and 10 engineers. Jim is quiet and hardworking and likes model trains. It is human nature to conclude he is an engineer (fits the stereotype perfectly). However, the data do not in fact outweigh the 9 to 1 ratio. Another is a guy has red hair. How likely is it that he is Irish (not very in the actual human population). In each case there is some diagnostic information. In each case we put too much weight on it compared to

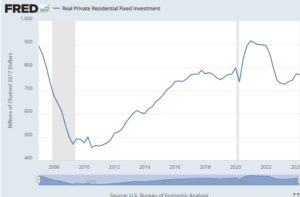

Read More »Soft Landing ? House construction holds up with high interest rates.

August 23, 2024I am late to the discussion of the (possible) US soft landing. I think I better write about the soft landing (so far) in case it is ceasing to be soft (I am not making a forecast).

The remarkable thing is that the dramatic increase in the Federal Funds Rate did not induce a downturn let alone a recession

The way interest rates affect GDP is principally residential investment and exchange rates. Other monetary authorities also raised rates in response to the Covid increase in inflation, so I won’t write about exchange rates. The interest rate relevant to housing demand is the mortgage interest rate. It is very, very different from the Federal funds rate but it also increased dramatically

This odd in itself as all evidence suggests that medium

Read More »Perceived Inflation and the Perceived Effect of Inflation

July 29, 2024I have my usual thoughts about inflation. People confuse levels and changes. I think this is a fundamental cognitive illusion. I think perceived inflation and the perceived effect of inflation on real incomes are based on an impressive pair of errors.

1) people estimate inflation from the price level comparing current prices to prices they remember and consider reasonable. As noted by Krugman and Nate Silver, this is not necessarily an error. It might be that they think of inflation over 24 of 36 months. The choice of 12 months is arbitrary. But it means perceived inflation is very persistent (in your Substack you just argued for monthly and consider the noise by thinking not moving averaging).

2) people think inflation causes lower real

Read More »