I am seeing numerous articles on Social Security as of late. How to save it from running a deficit. Is this really, what this is about? Even though, the nation has almost always run a deficit except during Clinton(?). There are different ways in which Social Security can be funded. As one finance expert proclaimed, print more money to fund it or MMT theory. As long as the dollar is in demand globally, we are safe. Another possibility is to open more of the nation’s income to Social Security taxes. I believe the suggested number is 0,000 now. What do we do if a person’s income is not the typical version or salary? We could do a combination of an increased rate and tax higher salaries. Dean Baker pointed this out in his commentary “The

Topics:

Bill Haskell considers the following as important: northwest plan, social security, wall street

This could be interesting, too:

Joel Eissenberg writes Elon didn’t get the memo

Angry Bear writes Social Security, a “pretty good program and we can afford it”

Angry Bear writes Social Security and Its Administration in 2025

Bill Haskell writes “Less than 1 percent of Social Security payments are improper”

I am seeing numerous articles on Social Security as of late. How to save it from running a deficit. Is this really, what this is about? Even though, the nation has almost always run a deficit except during Clinton(?). There are different ways in which Social Security can be funded.

As one finance expert proclaimed, print more money to fund it or MMT theory. As long as the dollar is in demand globally, we are safe. Another possibility is to open more of the nation’s income to Social Security taxes. I believe the suggested number is $400,000 now. What do we do if a person’s income is not the typical version or salary?

We could do a combination of an increased rate and tax higher salaries.

Dean Baker pointed this out in his commentary “The Social Security Scare Story Industry,” cepr.net.

“Government spending on education increased from 1.3 percent in 1946 to a peak of 3.8 percent of GDP in 1970. This 2.5 percentage point increase in spending was to accommodate baby boomers’ needs when they were kids. The 2.5%, is far larger than the 1.8 percentage point projected increase in spending in Social Security from 2000 to 2040. Twenty-forty being the peak pressure of the baby boomers’ retirement.”

As I mentioned above about what do we do if part of earnings are not wages but rather investments, etc. Dean Baker points out the issue of wages. “Part of the program’s problem is that the share of wage income going over the cap, and avoiding taxation, rose from 10.0 percent in 1982 to almost 20 percent today. This is because of the huge upward redistribution of wage income over the last forty years.”

Someone or some-ones made a similar point as Dean Baker. In their plan, the percentage rate would gradually increase for employees and businesses for ten years. The plan was even accepted by the Social Security Administration as feasible. Dale Coberly and Bruce Webb were the champions of Northwest Plan which Dale created. The proposed Northwest plan raised withholding by one tenth of 1% for employees and also for companies. This would be more-than-enough for the next 75 years.

But, but costs keep increasing. Dean Baker: “We went from spending 4.19 percent of GDP on Social Security in 2000 to spending 5.22 percent of GDP this year, an increase of 1.03 percentage points. This cost is projected to increase further to 6.03 percentage points by 2040, a rise of 0.81 percentage points.”

The Northwest Plan would surpass the deficit created. And what if? There is always MMT.

Now I am going to briefly talk about Brett Arends’s plan. The graph looks great. I like the looks of it, except, we have a problem in the US. Banks and Wall Street Investing have proven they can not be trusted. For that matter many of the politicians rolled back parts of Dodd-Frank raising the limit on testing of banks > $250 billion. And here we are again with banks having issues and having to the FDIC support banks. Banks over-extended again.

No, I do not agree with Brett Arends’s Wall Street Plan. Wall Street investment companies and banks investing have not proven they are safe. Read it and see what you think or believe.

Opinion: This solution to save Social Security doesn’t raise taxes or cut benefits, MarketWatch, Brett Arends’s ROI

Rude Europeans used to tell stories, possibly apocryphal, about American tourists who would ask for directions to a famous landmark while actually standing right in front of it.

“Er, EXCUSE ME, SIR! Can you tell us please the way to the Eiffel Tower?”

The Parisian would look at the couple, look at the massive iron structure towering directly above them, and wonder how on earth Americans won the war.

Don’t laugh.

Based on their handling of Social Security, the 535 people in Congress are even worse.

So let us celebrate a momentous event that quietly occurred last week, when suddenly a few overpaid legislators in Washington looked straight up and said, “oh, wow—do you think that’s it?”

The subject under discussion is the financial crisis hurtling toward America’s pension plan. The Social Security trust fund faces an accounting hole of about $20 trillion. It is expected to run out of cash in about a decade—at which point benefits could be cut across the board by 20%. This problem has been looming for years.

People on the “blue” team say the problem is taxes are too low, especially on “millionaires and billionaires.”

Meanwhile people on the “red” team say, no, the real problem is that benefits are too high. (For everybody else, but not for you, naturally.)

It really has resembled nothing so much as a tourist couple in Paris arguing over a map.

So let there be rejoicing in the streets. At last! At last! Some senators and Congressman have suddenly noticed the massive, obvious answer towering right above them.

It’s the investments, stupid!

A bipartisan group of senators is suddenly talking about maybe, just maybe, stopping the most important pension fund in America from blowing all our money on terrible, low-returning Treasury bonds.

Congressman Tim Walberg Is also talking about something similar.

There is no mystery about why Social Security is in trouble. None.

Social Security invests every nickel in U.S. Treasury bonds due to a political maneuver by Franklin Roosevelt in the 1930s, who used the new program to sneak some extra taxes. It may even have seemed a reasonable investment choice back then, just a few years after the terrible stock market crash of 1929-32.

But it is a disaster. A sheer, unmitigated disaster.

No state or local pension plan does this. No private pension plan does this. No university endowment does it. No international “sovereign-wealth fund” does it.

Oh, and none of the millionaires or billionaires in Congress or the Senate does it either. These people blowing your savings on Treasury bonds? The ones saying there is no alternative?

They have their own loot in the stock market.

Of course they do.

Oh, and no financial adviser in America would advise you to keep all or even most of their 401(k) or IRA in Treasury bonds either, unless maybe you needed all of that money within the next few years.

For a longer term investor they’d urge you to keep much or most of your money in stocks. For a very simple reason: Stocks, while more volatile, have been much, much better investments over pretty much any period of about 10 years or more.

Even first year Finance 101 students know that Treasury bonds are a good safe haven but a poor source of long-term returns. This is basic stuff.

Don’t believe me? Try some simple numbers.

Since the Social Security Act was passed in 1935, the U.S. stock market has outperformed U.S. Treasury bonds by a factor of 100.

A dollar invested in Treasury bonds in 1935, with all the interest reinvested (and no taxes), would have grown to $52 today.

A dollar invested in the S&P 500 at the same time? Er…$5,700.

No, really. 100 times as much.

And over any given 35 years (meaning, roughly, the length a typical worker might pay into Social Security) stocks outperformed bonds on average by a factor of 5.

Bonds ended up around 800%. Stocks: 4,000%.

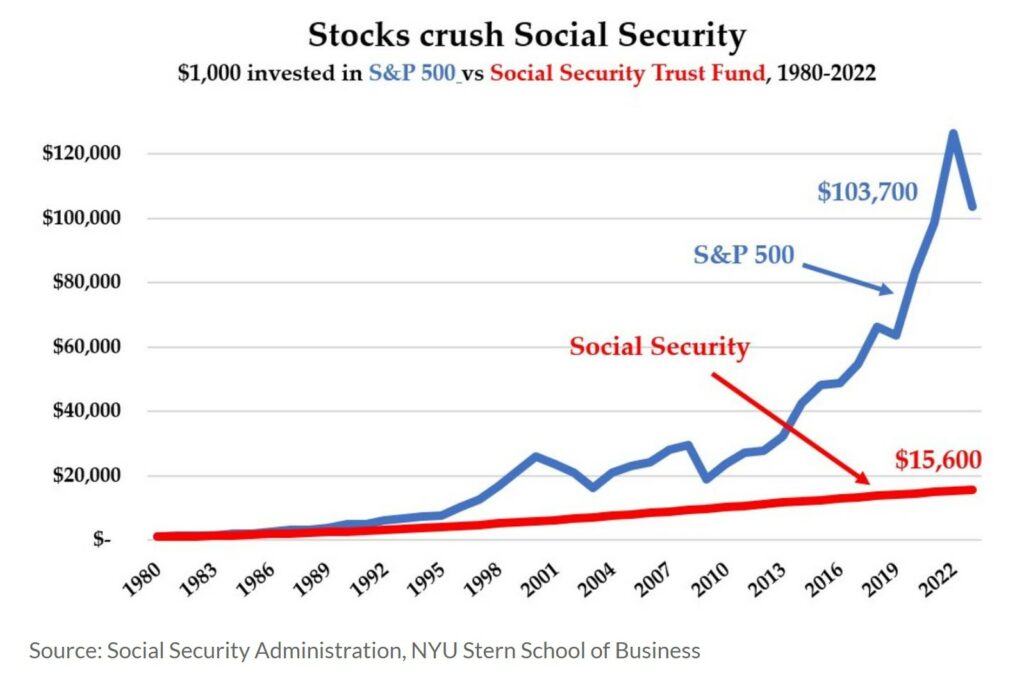

The chart above shows what would have happened since 1980 if you’d invested $1,000 in the Social Security trust fund and another $1,000 in the S&P 500.

It’s not even close. As you can see, we’re looking at outperformance by about a factor of 7. The S&P 500 beat Social Security by roughly 700%.

(These are using the numbers published by the Social Security Administration.)

Or just look at actual pension funds.

In the past 20 years, says the National Conference on Public Employee Retirement Systems, the average U.S. state or local pension fund has produced more than 2-1/2 times the investment returns of Social Security: 320% to 120%.

Social Security doubled your money. America’s other public pension funds quadrupled it.

But yeah, sure, the real problem with Social Security is the taxes. It’s the benefits. It’s all the peasants living too long. That’s the problem.

This is like a drunken driver totaling 10 cars in a row and blaming the transmission. Or maybe the upholstery.

If any private sector pension plan invested in the same way, the people running it would be sued into oblivion for breach of fiduciary duty. A financial adviser who kept all his clients in Treasury bonds throughout their career would be drummed out of the business.

None of the solutions need involve investing the whole thing in the S&P 500 SPX, +0.39% or (much better) a global stock market index fund. It’s not about one extreme or another. Most pension funds are about 70% invested in stocks, 30% in bonds.

But even a 30% allocation to stocks in the Social Security trust fund would have doubled total returns since 1980. No kidding.

If they’d made this change a generation or two ago, there would be no crisis. Nobody would be talking about higher taxes, lower benefits, or working into our 70s.

It really isn’t complicated. At last, only about 80 years too late, some people in Washington may be getting a clue.