From David Ruccio In the first installment of this series on “class before Trumponomics,” I argued that the recovery from the crash of 2007-08 created conditions that were favorable to capital at the expense of labor—and that trend represented a continuation of the class dynamic that had characterized the U.S. economy for decades, going back at least to the early 1980s. There are, of course, many details that were left out of that story, and I want to present a more fine-grained class analysis of the U.S. economy prior to Donald Trump’s election in this post. Let me start with labor. In the first post, my analysis actually understated the capital share and overstated the labor share. That’s because a large share of the surplus was actually included in wages, and thus attributed to labor, when in fact it properly belongs in the share captured by capital. The idea is that high-level executives and others (e.g., CEOs and those working in finance), while much of their income is reported as “wages,” are actually receiving a cut of the surplus from their employers. Therefore, their wages are actually part of the capital share, while the incomes of the rest of workers form the basis of the labor share properly understood. This is clear in the chart below (modified, from a paper by Michael W. L.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

In the first installment of this series on “class before Trumponomics,” I argued that the recovery from the crash of 2007-08 created conditions that were favorable to capital at the expense of labor—and that trend represented a continuation of the class dynamic that had characterized the U.S. economy for decades, going back at least to the early 1980s.

There are, of course, many details that were left out of that story, and I want to present a more fine-grained class analysis of the U.S. economy prior to Donald Trump’s election in this post.

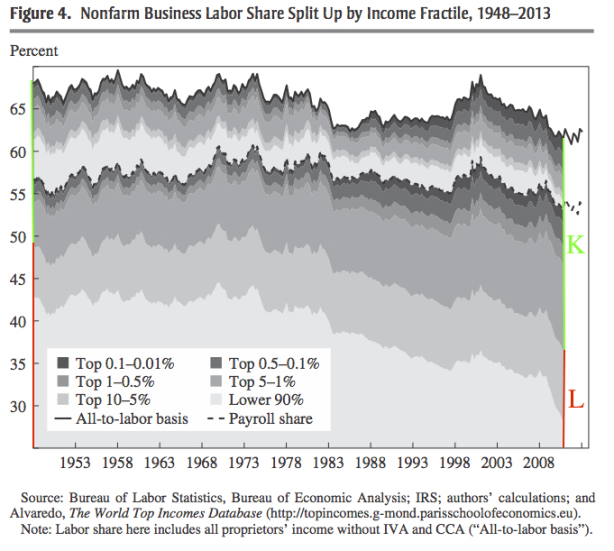

Let me start with labor. In the first post, my analysis actually understated the capital share and overstated the labor share. That’s because a large share of the surplus was actually included in wages, and thus attributed to labor, when in fact it properly belongs in the share captured by capital. The idea is that high-level executives and others (e.g., CEOs and those working in finance), while much of their income is reported as “wages,” are actually receiving a cut of the surplus from their employers. Therefore, their wages are actually part of the capital share, while the incomes of the rest of workers form the basis of the labor share properly understood.

This is clear in the chart below (modified, from a paper by Michael W. L. Elsby, Bart Hobijin, and Aysegül Sahin [pdf]), where the labor share is split up by income fractiles. Based on a rough class analysis of the U.S. labor force, the labor share actually includes the first two components (making up the bottom 95 percent of the labor force), while the other fractiles (those making up the top 5 percent) represent a distribution of the surplus from capital. As is evident from a quick glance at the chart, the share of total wages going to the working-class has been declining since the early 1970s, while the share representing distributions of the surplus has grown.

The consequence of making such a distinction is that the fall in the labor share and the rise in the capital share are actually much more dramatic—both in the decades leading up to the crash and during the so-called recovery—than when we look just at wages and corporate profits.

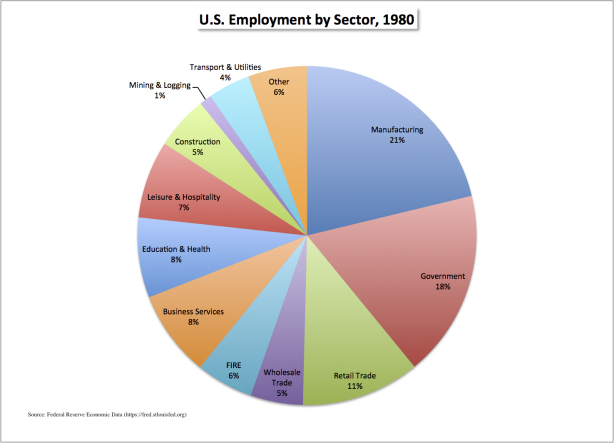

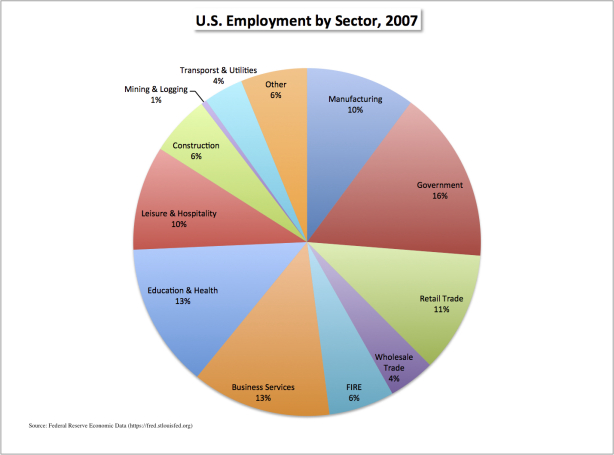

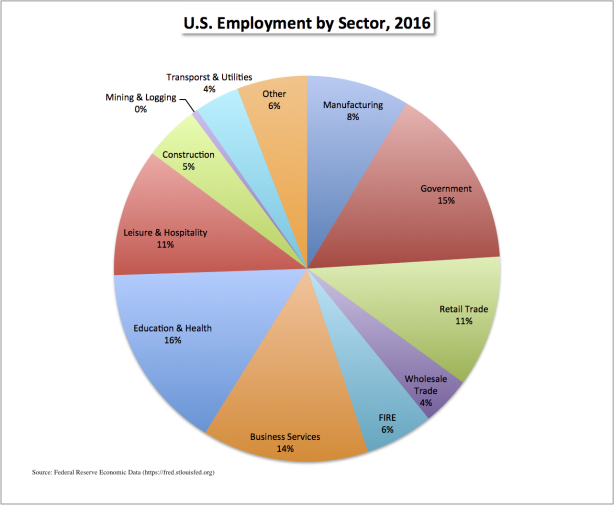

The U.S. working-class has also changed over time, especially in the decades leading up to the crash, as the economy itself was fundamentally transformed by a combination of automation, the offshoring of production, and imports from abroad. In terms of sectors and thus types of jobs, the biggest change that can be seen in the charts above was the decline in Manufacturing, which took place mostly between 1980 and 2007—from 21 percent of total employment to only 10 percent—with a further decrease (to 8 percent) by 2016. The sectors that grew as shares of total employment include Leisure & Hospitality, Education & Health, and Business Services. Mining and Logging, which was never more than a sliver of total employment, began and remained small. And Government jobs, as a share of total employment, actually declined. The result is that, over time, American workers have been forced to sell their ability to work less to employers in the production of goods (who have offshored production and automated many of the manufacturing jobs that remain) and more to those involved in the production of services (who are already engaged in a new round of automation, thus threatening service-sector jobs).

The U.S. working-class has also changed in many other ways over the course of the past few decades.

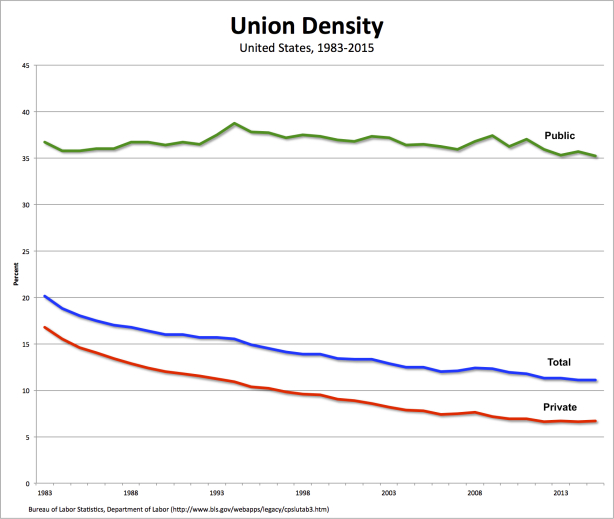

For example, union membership has steadily declined in the United States. In 1983, 20 percent of all workers in the United States belonged to unions, which negotiated wages and benefits on their behalf. By 2015, however, only 11.1 percent of all U.S. workers were union members. The decline has almost entirely been driven by a large decrease in private-sector union membership. In 1983, union members accounted for 16.8 percent of private-sector workers, and in 2015 they only accounted for 6.7 percent. Public-sector unions, meanwhile, remain quite prevalent among government workers. In 2015, 35.2 percent of government workers were union members, which is virtually unchanged from 1983.

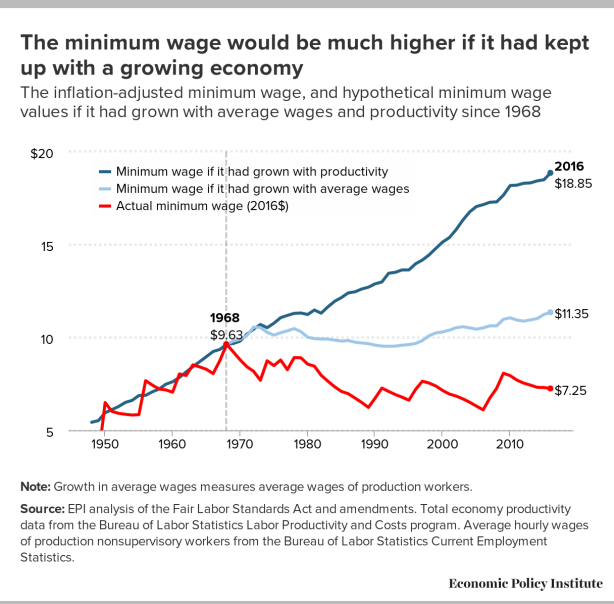

Not only do U.S. workers enjoy less protection as a result of the decline in labor unions; the wage floor, represented by the minimum wage, has also fallen over time. The real value of the federal minimum wage is now less than it was in 1968 (when it was equal to $9.63 in today’s dollars)—and it is now much less than what it would be had it grown at the same rate as average wages and, especially, the growth in productivity.

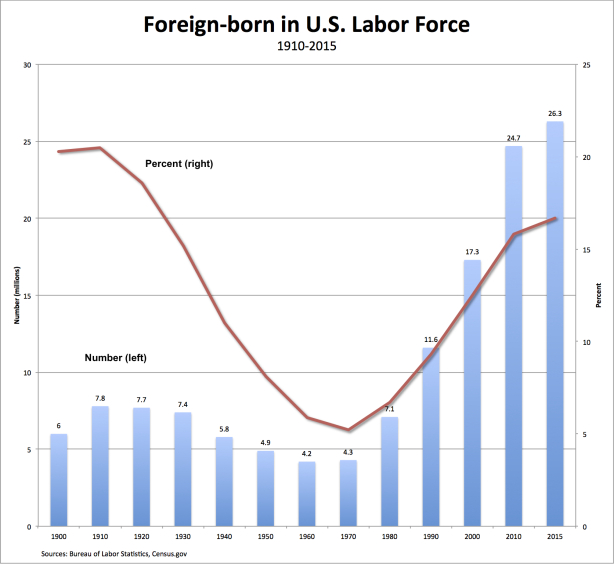

Another change in recent decades has to do with foreign-born workers (both legal and undocumented), which increased dramatically from 1970 through 2010—from 4.3 to 24.7 million workers and, as a percentage of the U.S. labor force, from 5.2 to 15.8 percent. After the crash, however, the growth in both the number and the percentage slowed considerably.

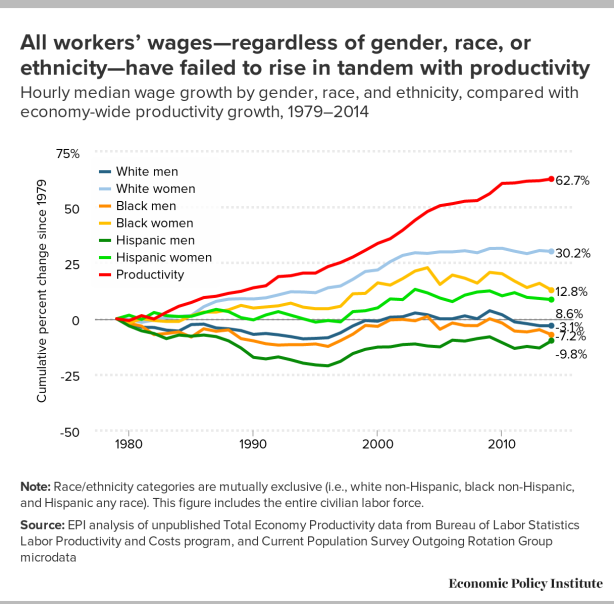

What about other segments of the U.S. working-class? As is clear from the chart above, wages “for all groups of workers (not just those without a bachelor’s degree), regardless of race, ethnicity, or gender,” have (since 1979) have lagged the growth in economy-wide productivity. The gender gap has close somewhat in recent decades—in part because women’s real wages have risen but also because men’s real wages have fallen. Still, white women have narrowed the wage gap with white men to a much greater degree than black and Hispanic women. Black and Hispanic men, for their part, have made no progress in narrowing the wage gap with white men since 1980, in part because the real hourly earnings of white, black or Hispanic men have all fallen over this 35-year period. As a result, black men earned the same 73 percent share of white men’s hourly earnings in 1980 as they did in 2015, and Hispanic men earned 69 percent of white men’s earnings in 2015 compared with 71 percent in 1980. We also need to consider the other side of that relationship—that increased racial and ethnic disparities reinforce the growing gap between productivity and the wages of all workers. Black workers are paid less than their white counterparts (of both genders), and all workers’ wages are as a result less than they otherwise would be. Thus, wealthy individuals and large corporations, who capture the resulting surplus, are the only ones who benefit from racial and ethnic wage disparities.

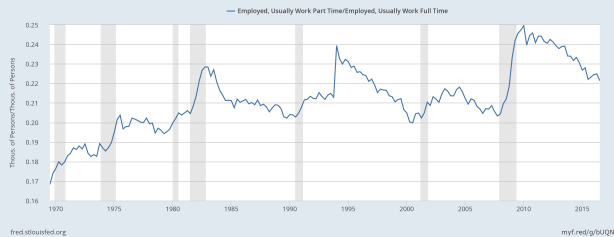

The final major change I want to draw attention to is the increasing precarity of the U.S. working-class. They’re increasingly employed in part-time jobs (as can be seen in the chart above, which tracks the ratio of part-time to full-time workers) and in “alternative” work arrangements. As Lawrence Katz and Alan Krueger (pdf) have shown, just in the past decade, the percentage of American workers engaged in alternative work arrangements— defined as temporary help agency workers, on-call workers, contract workers, and independent contractors or freelancers—rose from 10.1 percent (in February 2005) to 15.8 percent (in late 2015). And, it turns out, the so-called gig economy is characterized by the same unequalizing, capital-labor dynamics as the rest of the capitalist economy.

What is clear from this brief survey of the changes in the condition of the U.S. working-class in recent decades is that, while American workers have created enormous wealth, most of the increase in that wealth has been captured by their employers and a tiny group at the top—as workers have been forced to compete with one another for new kinds of jobs, with fewer protections, at lower wages, and with less security than they once expected. And the period of recovery from the Second Great Depression has done nothing to change that fundamental dynamic.