From David Ruccio

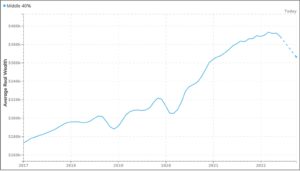

The story currently being peddle by the folks at Bloomberg [ht: ja] is that the American middle-class is currently suffering, as the enormous wealth they managed to accumulate during the past few years is now dwindling. And that crisis—the end of their “once-in-a-generation wealth boom”—is what they will take into the midterm elections.

There is a kernel of truth in that story but it is overshadowed by all that it leaves out.

The small sliver of truth?

Yes, as we can see in this chart, the average real wealth (in July 2022 dollars) of the middle 40 percent of Americans did in fact increase from January 2017 (when Donald Trump first took office) until March of 2022; now it has begun to fall and is projected to continue declining (according to data provided by Realtime

Articles by David F. Ruccio

What’s wealth got to do with it?

October 27, 2022From David Ruccio

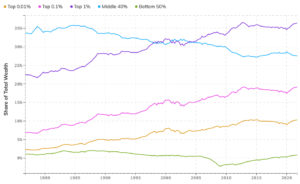

In a recent article in The Intercept, Jon Schwarz [ht: db] arrives at a perfectly reasonable conclusion—but, unfortunately, he makes a real hash of the data concerning changes in wealth ownership in the United States.

Schwarz starts with the fact that the total amount of wealth owned by the bottom 50 percent of the U.S. population has doubled since the first quarter of 2020 (in other words, during the pandemic). He then takes issue with the idea that economic growth needs to be slowed (for example, by the Fed’s raising of interest-rates) in order to help the poorest who presumably have been most hurt by inflation. And his conclusion?

According to the actual numbers, these are good times for many, many Americans in the poorer 50 percent. That doesn’t mean that millions

Reset this!

June 10, 2022From David Ruccio

This was supposed to be the great reset. As the U.S. economy recovered from the Pandemic Depression, millions of jobs were being created, unemployment was falling, and the balance of power between workers and capitalists would shift toward wage-earners and against their employers.

That, at least, was the promise (or, for capitalists, the fear).

But greedflation has delivered exactly the opposite: workers’ real wages are barely rising while corporate profits are soaring. There’s been no reset at all. That’s exactly what was happening before the coronavirus pandemic hit, and that trend has only continued during the recovery. It should come as no surprise then that the already grotesque levels of inequality in the United States continue to worsen.

And who are the

Inflation, wages, and profits

June 7, 2022From David Ruccio

Inflation continues to run hot—and now, finally, the debate about inflation is heating up.

On one side of the debate are mainstream economists and lobbyists for big business, the people Lydia DePillis refers to as having a simple mantra: “Supply and demand, Economics 101.” In their view, inflation is caused by supply and demand in the labor market, which is allowing workers’ wages to increase at an unsustainable rate (a story that, as I showed in April, has no validity), and supply and demand in the economy as a whole, with too much money chasing too few goods.

Simple, straightforward, and. . .wrong.

Fortunately, there’s another side to the debate, with heterodox economists and progressive activists arguing that increasingly dominant corporations are taking advantage

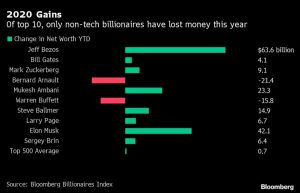

Oligarchs—American style

April 26, 2022From David Ruccio

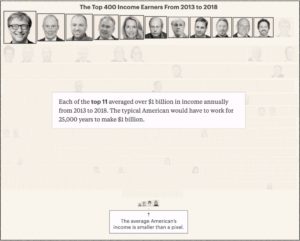

There’s been a lot of talk about oligarchs these past couple of months. Russian oligarchs, that is—the billionaires who have accumulated vast amounts of wealth, including large stakes in Russian industries, mines, and banks, as well as superyachts, private jets, investment accounts, and real estate in the West. We’ve even learned their names: Vladimir Potanin, Leonid Mikhelson, Alexey Mordashov, and so on.*

They’re a pretty easy target, given Russia’s savage war on Ukraine. But what about the other oligarchs out there, why aren’t we talking about them?

They also capture and keep massive amounts of the surplus produced by workers around the globe, and then accumulate even larger amounts of wealth, which they can live off of and utilize as they see fit. Why aren’t

Read More »Inflation and the case of the missing profits

April 15, 2022From David Ruccio

Everyone knows that inflation in the United States is increasing. Anyone who has read the news, or for that matter has gone shopping lately. Prices are rising at the fastest rate in decades. The Consumer Price Index rose 8.6 percent in March, which is the highest rate of increase since December 1981 (when it was 8.9 percent).

Clearly, inflation is hurting lots of people—especially the elderly living on fixed incomes and workers whose wages aren’t keeping up the price increases. No mystery there.

The only real mystery is, what’s causing the current inflation? That’s where things gets interesting.

To listen to or read mainstream economists the answer to the whodunnit is workers’ wages. They’re going up too fast, because the level of unemployment is too low and their

Rebrand this!

April 10, 2022From David Ruccio

It’s not price gouging, corporations tell us—it’s inflation. You know, supply and demand. Not enough supply, because of forces beyond their control, and too much demand, but they’re doing the best they can to meet it.

Not a word about profits, though. Not from the corporations. And not from mainstream economists and pundits (or, for that matter, from the Biden administration, which prefers to point the finger at Putin). When they do go beyond supply and demand, they blame worker shortages and rising wages. They call it the Great Resignation.*

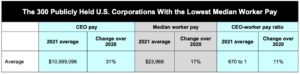

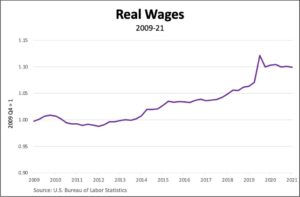

This must be what they’re referring to:

As is clear in this chart, the real wages of production and nonsupervisory workers did in fact increase after the end of the Second Great Depression—by 12 percent (between the end of 2014

Folk economics

February 14, 2022From David Ruccio

James Ensor, “The Intrigue” (1890)Mainstream economists have, it seems, discovered the existence of economic ideas outside the official discipline of economics.

It took them long enough! But, unfortunately, they don’t treat the topic particularly seriously

—certainly not in the way the scholars who pioneered the project of the New Economic Criticism, starting in the mid-1990s, set out to conduct their theoretical and empirical work. No, for mainstream economists it’s just a continuation of their tendency to denigrate and dismiss what the proverbial person in the street thinks about economic issues and to defend at all costs their own citadel of models, theories, and policy directives.

Back in 2017, Robert Shiller discovered what he called “narrative economics,”

How to lie with inequality statistics

February 10, 2022From David Ruccio

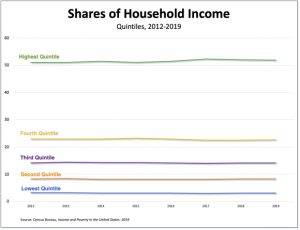

In the world according to Paul Krugman, “most Americans” have gotten considerably richer over the past two years (even if “the gains have been especially big at the top”), “lower-income Americans [have] seen relatively large income gains,” and “the simple story that the pandemic has been great for the wealthy and bad for the working class doesn’t hold up.”

Really?

To support his argument, Krugman trots out a series of charts from Realtime Inequality, which is in fact an eye-opening set of statistics on wealth and income inequality in the United States. But not in the way Krugman uses them. The two biggest problems in Krugman’s treatment are (a) he excludes the bottom 50 percent (so that “most Americans” refers only to the middle 40 percent) and (b) he focuses on

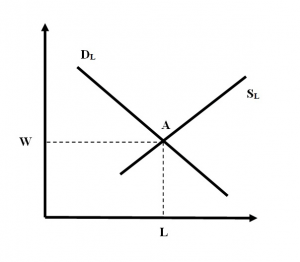

Class conflict and economics

September 17, 2021From David Ruccio

A funny thing happened on the way to the recovery from the Pandemic Depression: class conflict is back at the core of economics.

At least, that’s what Martin Sandau (ht: bn) thinks. I beg to differ. But more on that anon. First, let us give Sandau his due. His argument is that the current labor shortages have shifted the balance of power toward workers (an issue I discussed a couple of weeks ago). As a result, economic analysis is starting to change:

What this looks like is the return of something that was exiled from centrist policy debate and mainstream economic analysis for decades: class conflict and its economic consequences. To be precise, we may be witnessing the manifestation of two outmoded ideas: that the relative power of economic classes alters

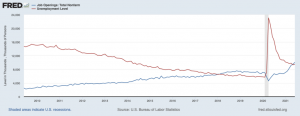

Capitalism and workers’ power

August 29, 2021From David Ricardo

You don’t have to read Marx to understand the lack of power workers have under capitalism. But you do have to read beyond mainstream economists and economic pundits. You might turn, for example, to the business school.

Yes, I know, that’s a strange assertion. But let me explain.

The usual argument these days is that workers have acquired a lot more power because of the scarcity of labor. When labor is scarce (basically, when the quantity supplied of labor is less than the quantity demanded), workers can fetch higher wages and be pickier about the jobs they’re willing to accept. That, of course, drives employers crazy and, as usual, mainstream economists and commentators just echo those concerns.

So, is it true? Well, look at the data they cite:

The blue line

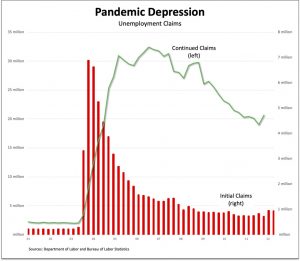

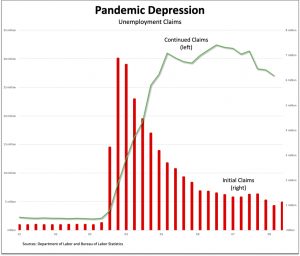

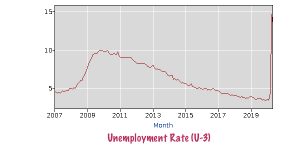

USA Pandemic Depression update

December 18, 2020From David Ruccio

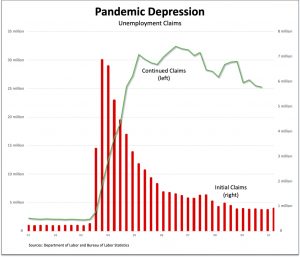

Both the number of initial unemployment claims for unemployment compensation and the number of continued claims for unemployment compensation are once again on the rise, signaling a worsening of the Pandemic Depression.

This morning, the U.S. Department of Labor (pdf) reported that, during the week ending last Saturday, another 935 thousand American workers filed initial claims for unemployment compensation. While initial unemployment claims remain well below the peak of about seven million in March, they are far higher than pre-pandemic levels of about 200 thousand claims a week.

The number of continued claims for unemployment compensation, while also below its peak, rose from the previous week and was more than 20.6 million American workers—a figure that

Pandemic Depression

October 15, 2020From David Ruccio

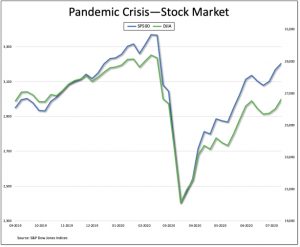

U.S. billionaires have recouped all of their wealth—and more—during the Pandemic Depression. Meanwhile, since May, the number of poor Americans has grown by about 8 million. And the number of American workers applying for and receiving unemployment benefits continues at record levels.

According to Forbes,

Pandemic be damned: America’s 400 richest are worth a record $3.2 trillion, up $240 billion from a year ago, aided by a stock market that has defied the virus.

When the Covid-19 pandemic began to sweep the world earlier this year, the wealth of U.S. billionaires plummeted in lockstep with the stock market. Yet, just six months after the market bottomed out—with hundreds of thousands Americans dead and the coronavirus still to be contained—the wealthiest Americans

Read More »Limits of mainstream economics today

October 12, 2020From David Ruccio

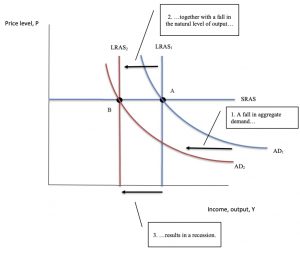

Keynes’s criticisms of neoclassical economics set off a wide-ranging debate that came to define the terms of—and, ultimately, the limits of debate within—mainstream economics.

On one side are neoclassical economists, who celebrate the invisible hand and argue that markets are the best way to efficiently allocate scarce resources. On the other side are Keynesian economists, who argue instead for the visible hand of government intervention to move markets toward full employment.

That tension, between the theories and policies of neoclassical and Keynesian economics, is the reason why in most colleges and universities the principles of economics are taught in two separate courses: microeconomics and macroeconomics. Moreover, the tension between the two schools of thought

Inequality in the United States—pandemic edition

September 24, 2020From David Ruccio

Year 3 of the Trump presidency was absolutely terrific—indeed, record-breaking—for Americans.

At least that’s how things look in terms of the headline numbers from the Census Bureau: median household income was up (by 6.8 percent, a record) over 2018 and the official poverty rate decreased (by 1.3 percentage points, to 10.5 percent, the lowest rate observed since estimates were initially published for 1959).*

And then there’s Kevin Hassett, former chair of Trump’s White House Council of Economic Advisers (who returned to the White House to lead its pandemic-response team, downplaying the danger of coronavirus and pushing the administration to re-open the economy amid lockdowns and social distancing) who seized on the report to make another of his wild claims:

If

Beyond the Mainstream

September 21, 2020From David Ruccio

In this post, I continue the draft of sections of my forthcoming book, “Marxian Economics: An Introduction.” This, like the previous two posts, is for chapter 1, Marxian Economics Today.

This is certainly not the first time people have looked beyond mainstream economics. There is a long history of criticisms of both mainstream economic theory and capitalism from the very beginning. Although students won’t have read about them in traditional economics textbooks.

Those texts are generally written with the presumption there’s only one economic theory and one economic system. The existence of Marxian economics opens up the debate, creating space for both multiple ways of thinking about economics and a variety of different economic systems.

Criticisms of Mainstream

A tale of two capitalisms

September 17, 2020From David Ruccio

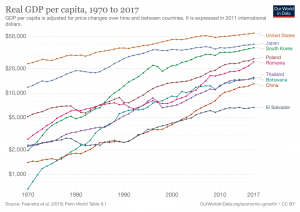

Marxian economists recognize, just like mainstream economists, that capitalism has radically transformed the world in recent decades, continuing and in some cases accelerating long-term trends. For example, the world has seen spectacular growth in the amount and kinds of goods and services available to consumers. Everything, it seems, can be purchased either in retail shops, big-box stores, or online. And, every year, more of those goods and services are being produced and sold in markets.

That means the wealth of nations has expanded. Thus, technically, Gross Domestic Product per capita has risen since 1970 in countries as diverse as the United States (where it has more than doubled), Japan (more than tripled), China (almost ten times), and Botswana (where it has

Mainstream macroeconomics—pandemic edition

August 31, 2020From David Ruccio

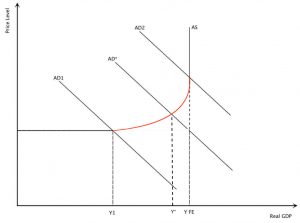

Right now, the United States is mired in an economic depression, the Pandemic Depression, not dissimilar to what happened in the 1930s and again after the crash of 2007-08.

Real (inflation-adjusted) gross domestic product contracted by an annual rate of 31.7 percent in the second quarter of 2020 (according to the Bureau of Economic Analysis) and at least 27 million American workers are currently unemployed (counting workers continuing to receive some kind of unemployment benefits, according to my own calculations).* By all accounts—from both macroeconomic data and anecdotes reported in the media—the current situation is an economic and social disaster equivalent to what the United States went through during the first and second Great Depressions.

The question is, does

Pandemic Depression

August 28, 2020From David Ruccio

The number of initial unemployment claims for unemployment compensation in the United States once again surpassed one million—for the 21st time in the past 22 weeks—signaling a continuation of the Pandemic Depression.

This morning, the U.S. Department of Labor (pdf) reported that, during the week ending last Saturday, another 1 million American workers filed initial claims for unemployment compensation. While initial unemployment claims remain well below the recent peak of about seven million in March, they are far higher than pre-pandemic levels of about 200 thousand claims a week.

The number of continued claims for unemployment compensation has also fallen from its peak but the total from the previous week (the series of continued claims lags initial claims by one

Billionaires—pandemic edition

August 24, 2020From David Ruccio

2019 was a very good year for the world’s wealthiest individuals. The normal workings of global capitalism created both more billionaires and more combined wealth owned by those billionaires.

According to Wealth-X, which claims to “have developed the world’s most extensive collection of records on wealthy individuals and produce unparalleled data analysis to help our clients uncover, understand, and engage their target audience, as well as mitigate risk,” the size of the global billionaire population increased strongly in 2019, rising by 8.5 percent to 2,825 individuals, while their combined wealth increased by 10.3 percent to $9.4 trillion.

To put that into perspective, the world’s real Gross Domestic Product grew by only 2.9 percent (International Monetary Fund)

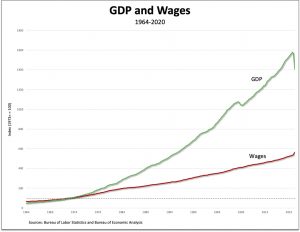

To the victor belong the spoils

August 21, 2020From David Ruccio

The phrase, which was used in the early nineteenth century to describe the the spoils system of appointing government workers, accurately describes the American economy today.* And it’s pretty clear who the victor is, and it’s not the working-class.

Instead, a small group at the top have come out as the victor—and that’s been true for decades now.

How do we know?

Well, all we have to do is look at the growing gap between the amount produced by American workers and what they received in their wages. Gross Domestic Product (the green line in the chart above) grew by a factor of almost 16 from 1973 onward while workers’ wages increased by a bit more than 5 before the COVID Depression.

So, American workers only received back in the form of wages a small percentage

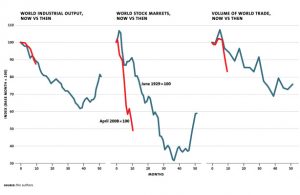

Whither global capitalism?

August 18, 2020From David Ruccio

Mainstream economists and commentators, it seems, are worried that the global economy is going to come crashing down as a result of the COVID crisis. That’s why they’re willing now to consider the possibility that the current crisis is more than a normal recession, more serious even than the so-called Great Recession; in their view, it’s an economic depression.

That, at least, is the argument they present up front. But there’s something else going on, which haunts their analysis—that capitalism itself is now being called into question.

But before we get to that alarming specter, let’s take a look at the logic of their analysis about the current perils to the global economy—starting with the Washington Post columnist Robert J. Samuelson, who is basically taking his

Zombie capitalism

July 30, 2020From David Ruccio

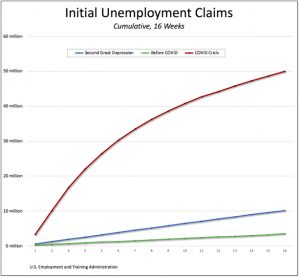

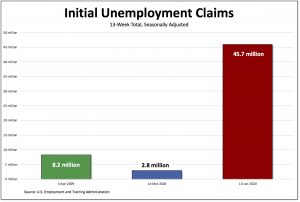

Capitalism’s crises are clearly becoming deeper and more severe. After the crash of 2007-08, the United States (and much of the rest of the world) was subjected to the Second Great Depression, the worst economic downturn since the depression of the 1930s. Now, in the midst of the novel coronavirus pandemic, business activity has ground to a halt and unemployment has soared to levels reminiscent of the first Great Depression.

Not surprisingly, both Main Street and Wall Street firms have once again turned to the U.S. government to be bailed out through a series of programs that dwarf anything the world has seen before.

The Federal Reserve and the Treasury Department have stepped in with a broad array of actions to keep capitalist enterprises afloat, including up to

Read More »Divergent recoveries—pandemic edition

July 21, 2020From David Ruccio

The existing alphabet soup of possible recoveries—V, U, W, and so on (which I discussed back in April)—is clearly inadequate to describe what has been taking place in the United States in recent months.

That’s because there’s no single path of recovery for everyone. For some, the recovery from the pandemic crisis has been just fine, while for many others there has been no recovery at all. Instead, things are going from bad to worse. In other words, there’s a growing gap between the haves and have-nots—or, as Peter Atwater has put it, “there have been two vastly divergent experiences.”

That’s why Atwater invented the idea of a K-shaped recovery.

I think he’s right, although I don’t divide the world up in quite the same way.

The stem of the K illustrates the quick and

178 new cases per million people in the United States compared to 27.6 cases for the world as a whole.

July 12, 2020From David Ruccio

Since the first of June,Lost my job and lost my room.I pretend to try,Even though I tried alone.

— Sufian Stevens, “Flint (For the Unemployed and Underpaid)”

Yesterday morning, the U.S. Department of Labor (pdf) reported that, during the week ending last Saturday, another 1.3 million American workers filed initial claims for unemployment compensation. That’s on top of the 48.7 million workers who were laid off during the preceding fifteen weeks.

Here is a breakdown of each week:

• week ending on 21 March—3.31 million

• week ending on 28 March—6.87 million

• week ending on 4 April—6.62 million

• week ending on 11 April—5.24 million

• week ending on 18 April—4.44 million

• week ending on 25 April—3.87 million

• week ending on 2 May—3.18 million

• week ending on 9

The condition of the black working-class in the United States – 9 charts

June 26, 2020From David Ruccio

Before he was killed, George Floyd worked as a truck, a bouncer, and a security guard. Ahmaud Arbery worked at his father’s car wash and landscaping business, and previously held a job at McDonald’s. Breonna Taylor was a certified Emergency Medical Technician who had two jobs at hospitals in Louisville, Kentucky. Eric Garner worked as a mechanic and then in New York City’s horticulture department for several years before health problems, including asthma, sleep apnea, and complications from diabetes, forced him to quit. Trayvon Martin was the son of a program coordinator for the Miami Dade Housing Authority and a truck driver; he washed cars, babysat, and cut grass to earn his own money.

All of them, and most of the other African Americans who have been killed in

45.7 million USA unemployment claims

June 19, 2020From David Ruccio

They came for him in the morning, before coffee break. — Stewart O’Nan, The Odds

This morning, the U.S. Department of Labor (pdf) reported that, during the week ending last Saturday, another 1.5 million American workers filed initial claims for unemployment compensation. That’s on top of the 44.2 million workers who were laid off during the preceding twelve weeks.

Here is a breakdown of each week:

• week ending on 21 March—3.31 million

• week ending on 28 March—6.87 million

• week ending on 4 April—6.62 million

• week ending on 11 April—5.24 million

• week ending on 18 April—4.44 million

• week ending on 25 April—3.87 million

• week ending on 2 May—3.18 million

• week ending on 9 May—2.69 million

• week ending on 16 May—2.45 million

• week ending on 23 May—2.12

Freedom—pandemic edition

June 18, 2020From David Ruccio

“Formal” freedom is the freedom of choice WITHIN the coordinates of the existing power relations, while “actual” freedom designates the site of an intervention which undermines these very coordinates.

— Slavoj Žižek, On Belief

The novel coronavirus pandemic has demonstrated how shallow and restricted the notion of formal freedom is in the United States.

After years of pretending that private healthcare and health insurance expanded the freedom of individual choice, even with the changes introduced by Obamacare, the existing health system has failed to protect most Americans from the ravages of the disease. Right now, with over 2 million confirmed cases and over 100 thousand deaths, the United States has over one quarter of the world’s cases

Cars and drivers—in the age of inequality

June 11, 2020From David Ruccio

How many of you read Car and Driver magazine?

Not many of you, I presume. But maybe you should. At least the June 2020 issue.

It’s certainly a sign of our obscenely unequal times that a magazine better known for its reviews of foreign supercars and domestic muscle cars and for an editorial policy that courts controversy only when it attacks SUVs (in favor of minivans and cars) highlights the story of Oliver, Jason M. Vaughn’s family’s 260,000-mile Subaru in a piece subtitled “The Fear of Failure.”

Turning the key has become an act of faith. As the engine grumbles to life on this fine southwest Colorado morning, the yellow check-engine light comes on, as it has every day for the past four years, and the same questions swirl in my mind. Is this the day that tiny

Rigged unemployment numbers—pandemic edition

June 8, 2020From David Ruccio

There are lies, there are outrageous lies, and there are statistics.

— Robert Giffen, Economic Journal (1892)

Are U.S. unemployment numbers rigged? Sure, they are!

They’re not rigged in the way Paul Krugman implied last Friday (“This being the Trump era, you can’t completely discount the possibility that they’ve gotten to the BLS”). Or in the way former General Electric CEO Jack Welch suggested back in 2012 (when he asserted that the Obama White House had manipulated the job figures for political gains). Or in the way Donald Trump used to say the unemployment rate was “phony” (“The number is probably 28, 29, as high as 35 [percent]. In fact, I even heard recently 42 percent.”) until, of course, he became president and declared the rising jobs numbers a “blowout” (even