Summary:

Lina Kahn wrote an excellent totally Veblenian analysis of Amazone and anti-trust policies. Or: why Chicago style price based anti-trust analysis does not work and we have to look at the nature and structure of the brave new internet markets. “Journal of Economic Issues: 50th Anniversary Editor’s Choice Collection”. Until 10 march: ungated. Quite a bit about the nature and structure of markets. According to the ECB their QE policy was an astounding success. It got Southern European company and household interest rates down. In my view: this kept the Euro afloat. In the meanwhile government interest rates also declined: win-win. M2 is a metric of the amount of money in circulation (the ECB uses M3, a slightly less restrictive metric). Does an increase in M2 money cause inflation? Richard Vague made even my jaw drop: “Cases 5 and 6 underscore the lack of a causal relationship between rapid M2 growth and high inflation, because when we increase the threshold of nominal M2 growth to from 60 percent in five years to 200 percent in five years, it is followed by high inflation even less frequently than in Cases 3 and 4. This is, of course, the opposite of what one would expect if high M2 growth causes high inflation”. Especially surprising: many bouts of high consumer price inflation took place without any kind of fast increase of the amount of money in circulation.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

Lina Kahn wrote an excellent totally Veblenian analysis of Amazone and anti-trust policies. Or: why Chicago style price based anti-trust analysis does not work and we have to look at the nature and structure of the brave new internet markets. “Journal of Economic Issues: 50th Anniversary Editor’s Choice Collection”. Until 10 march: ungated. Quite a bit about the nature and structure of markets. According to the ECB their QE policy was an astounding success. It got Southern European company and household interest rates down. In my view: this kept the Euro afloat. In the meanwhile government interest rates also declined: win-win. M2 is a metric of the amount of money in circulation (the ECB uses M3, a slightly less restrictive metric). Does an increase in M2 money cause inflation? Richard Vague made even my jaw drop: “Cases 5 and 6 underscore the lack of a causal relationship between rapid M2 growth and high inflation, because when we increase the threshold of nominal M2 growth to from 60 percent in five years to 200 percent in five years, it is followed by high inflation even less frequently than in Cases 3 and 4. This is, of course, the opposite of what one would expect if high M2 growth causes high inflation”. Especially surprising: many bouts of high consumer price inflation took place without any kind of fast increase of the amount of money in circulation.

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

- Lina Kahn wrote an excellent totally Veblenian analysis of Amazone and anti-trust policies. Or: why Chicago style price based anti-trust analysis does not work and we have to look at the nature and structure of the brave new internet markets.

- “Journal of Economic Issues: 50th Anniversary Editor’s Choice Collection”. Until 10 march: ungated. Quite a bit about the nature and structure of markets.

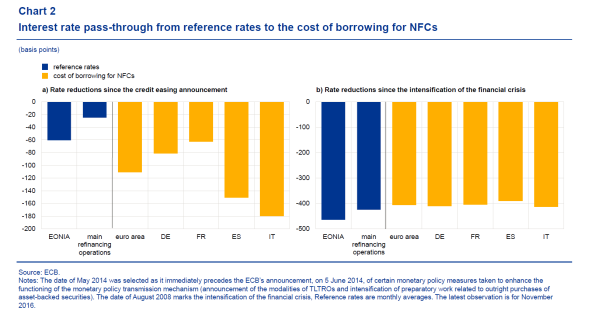

- According to the ECB their QE policy was an astounding success. It got Southern European company and household interest rates down. In my view: this kept the Euro afloat. In the meanwhile government interest rates also declined: win-win.

- M2 is a metric of the amount of money in circulation (the ECB uses M3, a slightly less restrictive metric). Does an increase in M2 money cause inflation? Richard Vague made even my jaw drop: “Cases 5 and 6 underscore the lack of a causal relationship between rapid M2 growth and high inflation, because when we increase the threshold of nominal M2 growth to from 60 percent in five years to 200 percent in five years, it is followed by high inflation even less frequently than in Cases 3 and 4. This is, of course, the opposite of what one would expect if high M2 growth causes high inflation”. Especially surprising: many bouts of high consumer price inflation took place without any kind of fast increase of the amount of money in circulation.

- For the nerds: how did Keynes cope with data about real and nominal wages which did not fit his prediction. At the end of the linked article one can find the original, pretty good, articles from the thirties which presented the results of an investigation of the relation between real wages and money wages suggested by Keynes.