At the beginning of 2007, net worth of households and non-profit organizations exceeded its 1947-1996 historical average multiple, relative to GDP, by some trillion. It took 24 months to wipe out eighty percent, or trillion, of that colossal but ephemeral slush fund. In mid-2016, net worth stood at a multiple of 4.83 times GDP, compared with the multiple of 4.72 on the eve of the Great Unworthing. Below is a FRED graph of GDP and household income both indexed to 1952: The empty spaces between the red line and the blue line that open up after around 1995 is what John Kenneth Galbraith called “the bezzle” — summarized by John Kay as “that increment to wealth that occurs during the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it.” In Chapter 8 of The Great Crash, 1929, Galbraith wrote: “In many ways the effect of the crash on embezzlement was more significant than on suicide. To the economist embezzlement is the most interesting of crimes. Alone among the various forms of larceny it has a time parameter. Weeks, months or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss.

Topics:

Sandwichman considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

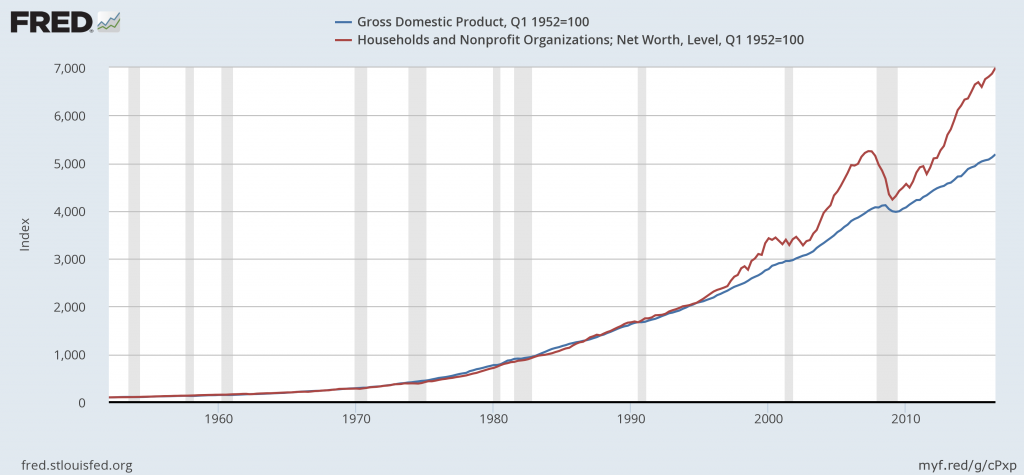

At the beginning of 2007, net worth of households and non-profit organizations exceeded its 1947-1996 historical average multiple, relative to GDP, by some $16 trillion. It took 24 months to wipe out eighty percent, or $13 trillion, of that colossal but ephemeral slush fund.

In mid-2016, net worth stood at a multiple of 4.83 times GDP, compared with the multiple of 4.72 on the eve of the Great Unworthing. Below is a FRED graph of GDP and household income both indexed to 1952:

The empty spaces between the red line and the blue line that open up after around 1995 is what John Kenneth Galbraith called “the bezzle” — summarized by John Kay as “that increment to wealth that occurs during the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it.”

In Chapter 8 of The Great Crash, 1929, Galbraith wrote:

“In many ways the effect of the crash on embezzlement was more significant than on suicide. To the economist embezzlement is the most interesting of crimes. Alone among the various forms of larceny it has a time parameter. Weeks, months or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss. There is a net increase in psychic wealth.) At any given time there exists an inventory of undiscovered embezzlement in – or more precisely not in – the country’s business and banks. This inventory – it should perhaps be called the bezzle – amounts at any moment to many millions of dollars. It also varies in size with the business cycle. In good times people are relaxed, trusting, and money is plentiful. But even though money is plentiful, there are always many people who need more. Under these circumstances the rate of embezzlement grows, the rate of discovery falls off, and the bezzle increases rapidly. In depression all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The bezzle shrinks.”

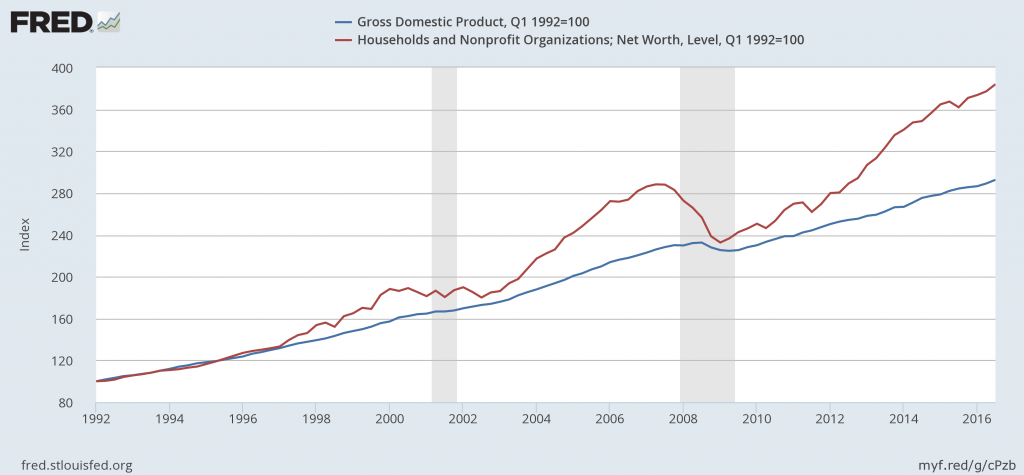

In the present case, the bezzle is an economic policy feature. It is the product of tax cuts, Greenspan puts and banking deregulation. Here is a FRED graph close-up of the post 1995 asset bubbles:

To make a long story short, think of wealth as capital. The value of capital is determined by the present value of an expected future income stream. The value of capital fluctuates with changing expectations but when the nominal value of capital diverges persistently and significantly from net revenues, something’s got to give. Either economic growth is going to suddenly gush forth “like nobody has ever seen before” or net worth is going to have to come back down to earth.

Somewhere between 20 and 30 TRILLION dollars of net worth will evaporate within the span of perhaps two years.

When will that happen? Who knows? There is one notable regularity in the data, though — the one that screams “Ponzi!”

When the net worth bubble stops going up…

…it goes down.