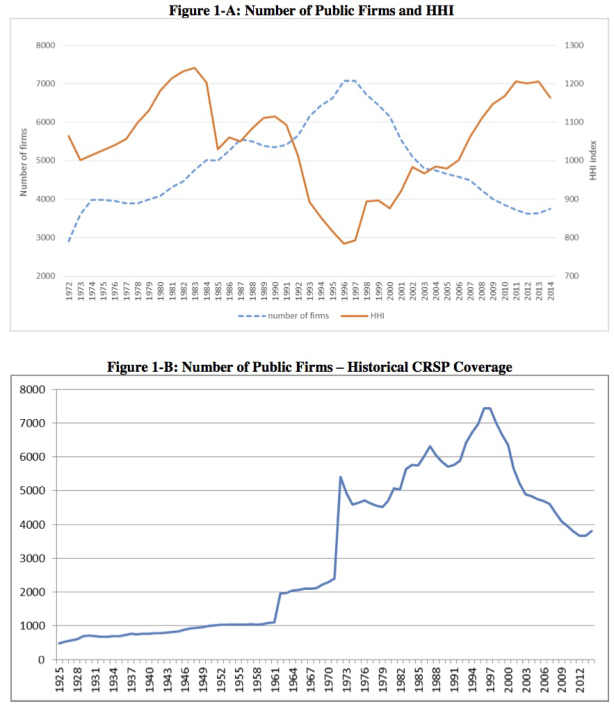

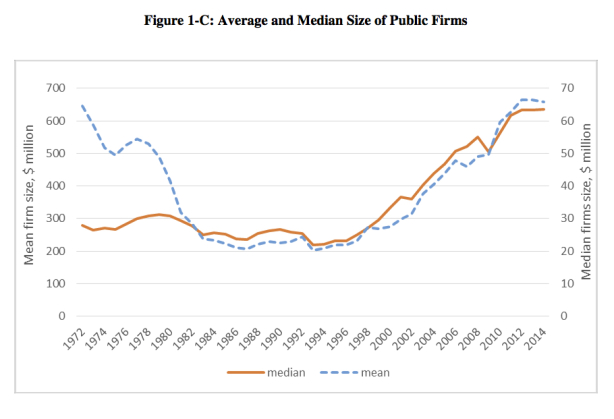

From David Ruccio It comes as no surprise, at least to most of us, that corporations are getting larger and increasing their share in many different industries. We see it everyday—when we buy plane tickets or try to take out a loan or just make a purchase at a retail store. We know it. And now, it seems, economists and the business press have finally taken notice. According to recent research by Gustavo Grullon, Yelena Larkin, and Roni Michaely, More than 75% of US industries have experienced an increase in concentration levels over the last two decades. Firms in industries with the largest increases in product market concentration have enjoyed higher profit margins, positive abnormal stock returns, and more profitable M&A deals, which suggests that market power is becoming an important source of value. In real terms, the average publicly-traded firm is three times larger today than it was twenty years ago. That’s right. As Figures 1-A and 1-B above show, the level of concentration (measured by the Herfindahl-Hirschman Index) has been steadily increasing over the course of the past twenty years, together with a decrease in the number of public firms. And the average size of firms, as shown in Figure 1-C, has also been growing.

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

It comes as no surprise, at least to most of us, that corporations are getting larger and increasing their share in many different industries. We see it everyday—when we buy plane tickets or try to take out a loan or just make a purchase at a retail store.

We know it. And now, it seems, economists and the business press have finally taken notice.

According to recent research by Gustavo Grullon, Yelena Larkin, and Roni Michaely,

More than 75% of US industries have experienced an increase in concentration levels over the last two decades. Firms in industries with the largest increases in product market concentration have enjoyed higher profit margins, positive abnormal stock returns, and more profitable M&A deals, which suggests that market power is becoming an important source of value. In real terms, the average publicly-traded firm is three times larger today than it was twenty years ago.

That’s right. As Figures 1-A and 1-B above show, the level of concentration (measured by the Herfindahl-Hirschman Index) has been steadily increasing over the course of the past twenty years, together with a decrease in the number of public firms.

And the average size of firms, as shown in Figure 1-C, has also been growing.

The business press may have changed the language—they like to refer to such corporations as “superstar firms”—but the problem remains the same: corporations are growing larger, both absolutely and relative to the industries in which they operate.

What mainstream economists and the business press won’t acknowledge is those tendencies have existed since capitalism began. The neoclassical fantasy of perfect competition was only ever that, a fantasy.

Certainly one mid-nineteenth-century critic of both mainstream economic theory and capitalism understood that:

Every individual capital is a larger or smaller concentration of means of production, with a corresponding command over a larger or smaller labour-army. Every accumulation becomes the means of new accumulation. With the increasing mass of wealth which functions as capital, accumulation increases the concentration of that wealth in the hands of individual capitalists, and thereby widens the basis of production on a large scale and of the specific methods of capitalist production. The growth of social capital is effected by the growth of many individual capitals. All other circumstances remaining the same, individual capitals, and with them the concentration of the means of production, increase in such proportion as they form aliquot parts of the total social capital. At the same time portions of the original capitals disengage themselves and function as new independent capitals. Besides other causes, the division of property, within capitalist families, plays a great part in this. With the accumulation of capital, therefore, the number of capitalists grows to a greater or less extent. Two points characterise this kind of concentration which grows directly out of, or rather is identical with, accumulation. First: The increasing concentration of the social means of production in the hands of individual capitalists is, other things remaining equal, limited by the degree of increase of social wealth. Second: The part of social capital domiciled in each particular sphere of production is divided among many capitalists who face one another as independent commodity-producers competing with each other. Accumulation and the concentration accompanying it are, therefore, not only scattered over many points, but the increase of each functioning capital is thwarted by the formation of new and the sub-division of old capitals. Accumulation, therefore, presents itself on the one hand as increasing concentration of the means of production, and of the command over labour; on the other, as repulsion of many individual capitals one from another.

This splitting-up of the total social capital into many individual capitals or the repulsion of its fractions one from another, is counteracted by their attraction. This last does not mean that simple concentration of the means of production and of the command over labour, which is identical with accumulation. It is concentration of capitals already formed, destruction of their individual independence, expropriation of capitalist by capitalist, transformation of many small into few large capitals. This process differs from the former in this, that it only presupposes a change in the distribution of capital already to hand, and functioning; its field of action is therefore not limited by the absolute growth of social wealth, by the absolute limits of accumulation. Capital grows in one place to a huge mass in a single hand, because it has in another place been lost by many. This is centralisation proper, as distinct from accumulation and concentration.

Those of us who have actually read that text are not at all surprised by the contemporary reemergence of the concentration and centralization of capital. We have long understood that the forces of competition within capitalism create both the incentive and the means for individual firms to grow in size and to drive out other firms, thus leading to the concentration of capital. The availability of large amounts of credit and finance only makes those tendencies stronger.

And the limit?

In a given society the limit would be reached only when the entire social capital was united in the hands of either a single capitalist or a single capitalist company.