On 6 April, Mario Draghi made a speech titled ‘Monetary policy and the economic recovery in the Euro Area’. I would have emphasized the existing disequilibria a little more: unemployment in Germany is not far away from ‘low’ but this comes at the cost of an 8% of GDP surplus of the current account. German domestic demand (investments, public and private consumption) is i.e. about 10% too low to guarantee low unemployment. See also this recent Eurostat press release, which shows that, though some areas are by now characterized by low unemployment (

Topics:

Merijn T. Knibbe considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

On 6 April, Mario Draghi made a speech titled ‘Monetary policy and the economic recovery in the Euro Area’. I would have emphasized the existing disequilibria a little more: unemployment in Germany is not far away from ‘low’ but this comes at the cost of an 8% of GDP surplus of the current account. German domestic demand (investments, public and private consumption) is i.e. about 10% too low to guarantee low unemployment. See also this recent Eurostat press release, which shows that, though some areas are by now characterized by low unemployment (<3,5%) others now levels of over 31% (not even counting ‘broad’ unemployment). But I agree: there is a recovery.

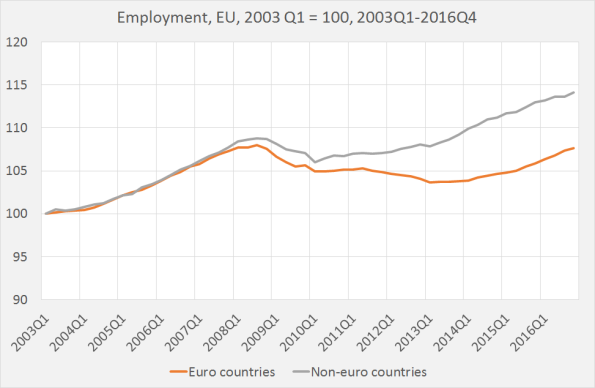

Technical addendum: ‘Euro countries’ are the 19 members of the present Eurozone, the Non-Euro countries are Sweden, Denmark, Poland, Hungary, the UK, Bulgaria, Romania, Iceland, Norway and the Czech Republic.

This is positive view is corroborated by recent Eurostat data on employment (not available at the time of the Draghi speech): employment keeps growing. Based on the underlying data I’ve however made the next graph, which shows that employment outside the Eurozone started to grow again four years earlier than in the Eurozone. The press release also shows that the employment rate of women in (tiny) Iceland is higher than the employment rate of men in every EU country. This suggests that the longer term output gap is still large as many men and women not counted as unemployed and not even covered by the broad unemployment data still might want a (good) job. Aside – the birth rate in Iceland is among the highest of Europe.

Edward Harrison however warns that the deflatory tendencies of the Eurozone institutions are still alive and kicking. As soon as something bad (including a slight increase of interest rates) happens to Italy, the Eurozone will be in the doldrums again.

Employment is increasing and has been increasing for quite some time now. Which is an unmitigated AAA event. This is the time to change the institutional setup of the Eurozone: another mandate of the ECB, Eurobonds, A European base pension of 500,– a month for every Eurozone 70+ citizen (and for people who worked for more than 45 years) and effective policies to resolve the bad bank problem. Believe me: such changes will happen. And we need them, to keep the recovery going.