From Lars Syll So in what sense is this “dynamic stochastic general equilibrium” model firmly grounded in the principles of economic theory? I do not want to be misunderstood. Friends have reminded me that much of the effort of “modern macro” goes into the incorporation of important deviations from the Panglossian assumptions that underlie the simplistic application of the Ramsey model to positive macroeconomics. Research focuses on the implications of wage and price stickiness, gaps and asymmetries of information, long-term contracts, imperfect competition, search, bargaining and other forms of strategic behavior, and so on. That is indeed so, and it is how progress is made. But this diversity only intensifies my uncomfortable feeling that something is being put over on us, by

Topics:

Lars Pålsson Syll considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Lars Syll

So in what sense is this “dynamic stochastic general equilibrium” model firmly grounded in the principles of economic theory? I do not want to be misunderstood. Friends have reminded me that much of the effort of “modern macro” goes into the incorporation of important deviations from the Panglossian assumptions that underlie the simplistic application of the Ramsey model to positive macroeconomics. Research focuses on the implications of wage and price stickiness, gaps and asymmetries of information, long-term contracts, imperfect competition, search, bargaining and other forms of strategic behavior, and so on. That is indeed so, and it is how progress is made.

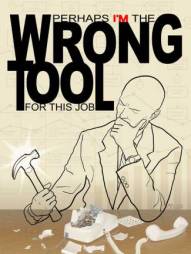

But this diversity only intensifies my uncomfortable feeling that something is being put over on us, by ourselves. Why do so many of those research papers begin with a bow to the Ramsey model and cling to the basic outline? Every one of the deviations that I just mentioned was being studied by macroeconomists before the “modern” approach took over. That research was dismissed as “lacking microfoundations.” My point is precisely that attaching a realistic or behavioral deviation to the Ramsey model does not confer microfoundational legitimacy on the combination. Quite the contrary: a story loses legitimacy and credibility when it is spliced to a simple, extreme, and on the face of it, irrelevant special case. This is the core of my objection: adding some realistic frictions does not make it any more plausible that an observed economy is acting out the desires of a single, consistent, forward-looking intelligence …

For completeness, I suppose it could also be true that the bow to the Ramsey model is like wearing the school colors or singing the Notre Dame fight song: a harmless way of providing some apparent intellectual unity, and maybe even a minimal commonality of approach. That seems hardly worthy of grown-ups, especially because there is always a danger that some of the in-group come to believe the slogans, and it distorts their work …

There has always been a purist streak in economics that wants everything to follow neatly from greed, rationality, and equilibrium, with no ifs, ands, or buts. Most of us have felt that tug. Here is a theory that gives you just that, and this

time “everything” means everything: macro, not micro. The theory is neat, learnable, not terribly difficult, but just technical enough to feel like “science.”

Yes, indeed, there certainly is a “purist streak in economics that wants everything to follow neatly from greed, rationality, and equilibrium, with no ifs, ands, or buts.” That purist streak has given birth to a kind ‘deductivist blindness’ of mainstream economics, something that also to a larger extent explains why it contributes to causing economic crises rather than to solving them. But where does this ‘deductivist blindness’ of mainstream economics come from? To answer that question we have to examine the methodology of mainstream economics.

The insistence on constructing models showing the certainty of logical entailment has been central in the development of mainstream economics. Insisting on formalistic (mathematical) modeling has more or less forced the economist to give upon on realism and substitute axiomatics for real world relevance. The price paid for the illusory rigour and precision has been monumentally high

This deductivist orientation is the main reason behind the difficulty that mainstream economics has in terms of understanding, explaining and predicting what takes place in our societies. But it has also given mainstream economics much of its discursive power – at least as long as no one starts asking tough questions on the veracity of – and justification for – the assumptions on which the deductivist foundation is erected. Asking these questions is an important ingredient in a sustained critical effort at showing how nonsensical is the embellishing of a smorgasbord of models founded on wanting (often hidden) methodological foundations.

This deductivist orientation is the main reason behind the difficulty that mainstream economics has in terms of understanding, explaining and predicting what takes place in our societies. But it has also given mainstream economics much of its discursive power – at least as long as no one starts asking tough questions on the veracity of – and justification for – the assumptions on which the deductivist foundation is erected. Asking these questions is an important ingredient in a sustained critical effort at showing how nonsensical is the embellishing of a smorgasbord of models founded on wanting (often hidden) methodological foundations.

The mathematical-deductivist straitjacket used in mainstream economics presupposes atomistic closed-systems — i.e., something that we find very little of in the real world, a world significantly at odds with an (implicitly) assumed logic world where deductive entailment rules the roost. Ultimately then, the failings of modern mainstream economics has its root in a deficient ontology. The kind of formal-analytical and axiomatic-deductive mathematical modeling that makes up the core of mainstream economics is hard to make compatible with a real-world ontology. It is also the reason why so many critics find mainstream economic analysis patently and utterly unrealistic and irrelevant. The empty formalism that Solow points at in his critique of ‘modern’ macroeconomics is still one of the main reasons behind the monumental failure of ‘modern’ macroeconomics.