Now that we have introduced ‘government money‘ and ‘commercial bank money‘, we are in a position to understand in basic terms how fiscal policy (government spending and taxing) is conducted and its direct financial effects. At this stage, the treatment is still cursory. There are more details that can be added in at a later time. In the initial instance, acts of government spending are authorized at the legislative level. For example, in the US, government spending is authorized by Congress. The Treasury then has the go-ahead to initiate spending operations. To spend, the fiscal authority (e.g. the Treasury) informs the monetary authority (e.g. the central bank) of the spending measures. The monetary authority: Credits the reserve accounts of banks at which spending recipients have

Topics:

peterc considers the following as important: Short & Simple

This could be interesting, too:

peterc writes Short & Simple 20 – Graphing the Income-Expenditure Model

peterc writes Short & Simple 19 – Sectoral Balances in a Closed, Demand-Determined Economy

peterc writes Short & Simple 18 – Income Determination in a Closed Economy

peterc writes Short & Simple 17 – A Notion of Macroeconomic Equilibrium

Now that we have introduced ‘government money‘ and ‘commercial bank money‘, we are in a position to understand in basic terms how fiscal policy (government spending and taxing) is conducted and its direct financial effects. At this stage, the treatment is still cursory. There are more details that can be added in at a later time.

In the initial instance, acts of government spending are authorized at the legislative level. For example, in the US, government spending is authorized by Congress. The Treasury then has the go-ahead to initiate spending operations.

To spend, the fiscal authority (e.g. the Treasury) informs the monetary authority (e.g. the central bank) of the spending measures. The monetary authority:

- Credits the reserve accounts of banks at which spending recipients have accounts;

- Instructs banks to credit the accounts of spending recipients.

The government spending, in addition to creating income for the spending recipients (see part 9), causes an increase in the net financial assets (financial assets minus financial liabilities) of non-government.

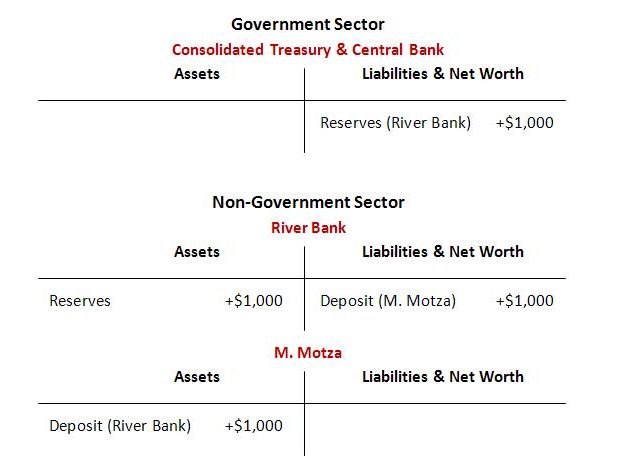

To see this, consider the key changes to financial assets and liabilities that occur if the government pays wages of $1,000 into Minnie Motza’s account at River Bank. (Other balance-sheet changes are left out to highlight the points presently under discussion.)

In the above figure, the actions of the Treasury and central bank are combined into a single consolidated T-Account. Any intragovernment transactions between the Treasury and central bank net to zero, and so are left out. Only transactions between government and non-government show up in the consolidated government’s T-Account.

We can determine the overall financial impact of the government spending by considering its effects on each non-government entity.

On the one hand, River Bank’s net position is unchanged. The bank has extra reserves, which is its asset, but this is exactly offset by the new deposit, which is its liability.

Minnie, on the other hand, has a new asset (her deposit) with no offsetting liability.

So, for non-government as a whole, there has been an increase in financial assets relative to financial liabilities. In other words, there has been an increase in net financial assets.

This is possible, even though financial assets and liabilities for the system as a whole must sum to zero, because the extra financial asset held by non-government is matched by an extra financial liability for government. Namely, the extra reserves, which are an asset of River Bank, are a liability of the consolidated government sector.

The change in net financial assets, as presented so far, equals the change in reserves of $1,000.

Taxes have a financial impact opposite to that of government spending. If Minnie Motza pays $300 in taxes, this amount will be debited from her account at River Bank, and $300 of reserves will be debited from River Bank’s account with the central bank. The net effect will be a reduction in non-government net financial assets. For River Bank, the impact is neutral. Its liability (Minnie’s deposit) is reduced by $300, but its asset (reserves at the central bank) is reduced by the same amount. Minnie, however, has less financial assets than before, since her account now has a smaller balance. Offsetting this is a reduction in the government’s liabilities (since there are less reserves in River Bank’s account with the central bank).

Once again, the change in net financial assets, as presented so far, equals the change in reserves.

In most countries, governments neutralize the fiscal impacts on reserves by buying or selling treasuries (or government bonds). This can involve the fiscal authority issuing new treasuries. Or it can involve the monetary authority buying or selling previously-issued treasuries. In either case, these actions relate to monetary policy. They enable the central bank to target a short-term interest rate. We will get to this in a later post.

For now, we just need to note that when government spending exceeds tax payments (a fiscal deficit), the government will sell treasuries to non-government. Non-government payments for the treasuries cause bank accounts and reserve accounts to be debited. In this way, a government sale of treasuries eliminates excess reserves. Conversely, when tax payments exceed government spending (a fiscal surplus), the central bank will buy treasuries. The central bank pays for the treasuries by crediting reserve accounts and instructing banks to credit appropriate accounts. This prevents a shortage of reserves.

These actions alter the composition of net financial assets but have no direct impact on the level of net financial assets.

In the case of a fiscal deficit, the government’s sale of treasuries means that non-government will hold its extra financial assets in the form of treasuries rather than reserves. This is akin to an individual switching funds from a checking account (or current account), which attracts little or no interest, to a savings account (or term deposit) that pays interest.

In the case of a fiscal surplus, the central bank’s purchase of previously-issued treasuries means that non-government will possess less treasuries rather than less reserves.

The key takeaway is that government spending adds net financial assets, whereas taxes subtract them.

In aggregate:

Net Financial Assets = Cash on issue + Reserves + outstanding Treasuries

The reason for this is that all other assets have an offsetting liability within the non-government sector.

For example, Minnie’s deposit, which is her asset, is a liability of River Bank. For the non-government as a whole, this non-government-issued liability has its accounting offset in the non-government sector, and so nets to zero.

The only way non-government can acquire net financial assets is for government to issue more cash, reserves and treasuries than it imposes in taxes. This occurs when government spends more than it taxes.