It is easy to represent the ‘income-expenditure model’ in a graph. Some people find this helpful as a visual aid to understanding; others, not so much. For those who find graphs confusing, this post can safely be ignored. In terms of economic meaning, it does not add much to what has already been explained. But for those who are comfortable with graphs, they can be a handy tool for illustrating or thinking through the logic of a model. We have seen that, by accounting identity, actual...

Read More »Short & Simple 19 – Sectoral Balances in a Closed, Demand-Determined Economy

We have seen that the ‘income-expenditure model’ combines key macro identities (introduced in parts 7 and 15) with particular behavioral assumptions to provide a theory of income determination (considered in parts 16 and 18). The behavioral assumptions relate to causation. The causation envisaged in the income-expenditure model has implications for the sectoral balances, some of which are the focus of the present post. Recall that total leakages must equal total injections: S + T = G + I...

Read More »Short & Simple 18 – Income Determination in a Closed Economy

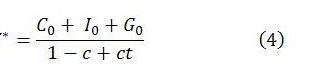

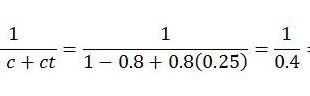

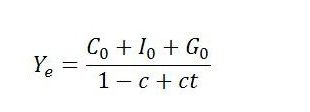

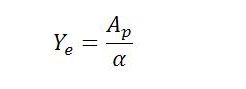

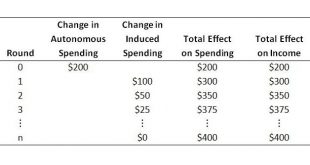

In this and upcoming parts of the series, we will look in a little more detail at the ‘income-expenditure model’. The foundations of the model have been introduced in the previous two parts (here and here). We have seen that, within the model, equilibrium output is determined by two main factors: the level of autonomous expenditure (denoted A); the marginal propensity to leak (denoted α). The expenditure multiplier k is 1/α. Equilibrium output is a multiple of autonomous spending, kA. By...

Read More »Short & Simple 17 – A Notion of Macroeconomic Equilibrium

At the macro level, equilibrium requires that total demand in product markets equals total supply. This could occur at high or low levels of output and employment. For this reason, equality of supply and demand in product markets does not imply full employment. Within a given period, firms set production levels in accordance with what they expect can profitably be sold. If firms sell more or less than expected, they are likely to change their behavior in the next period. Specifically,...

Read More »Short & Simple 16 – The Expenditure Multiplier and Income Determination

We have seen that total spending equals total income (part 4). It has been argued that it is spending that creates (or determines) income (part 9). This can be inferred from the observation that some spending can occur independently of income (part 10). Spending that occurs independently of income is called autonomous spending. Equivalently, it is known as ‘exogenous’ spending. It is called autonomous because it is spending that is not financed out of current income. It is autonomous of...

Read More »Short & Simple 15 – The Sectoral Balances Identity

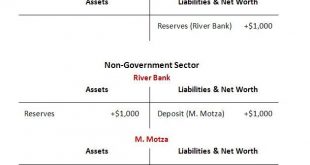

We saw, in part 14, that government spending increases the net financial assets of non-government, whereas taxes do the reverse. The level of net financial assets at a point in time is a stock. The change in net financial assets over the period is the result of flows. In the case of a government deficit, in which government spends more into the economy over the period than it taxes out, non-government will spend less than its income, with the flow of saving adding to its stock of net...

Read More »Short & Simple 14 – Direct Impacts of Fiscal Policy on Net Financial Assets

Now that we have introduced ‘government money‘ and ‘commercial bank money‘, we are in a position to understand in basic terms how fiscal policy (government spending and taxing) is conducted and its direct financial effects. At this stage, the treatment is still cursory. There are more details that can be added in at a later time. In the initial instance, acts of government spending are authorized at the legislative level. For example, in the US, government spending is authorized by...

Read More »Short & Simple 13 – Private Credit Creation

We have seen that a national currency enters the economy when government spends, and that the recipients of the government spending can use the currency for various purposes, including to purchase goods and services. Government is therefore an original source of funds. There is another original source of funds that gives people the ability to make purchases. This other source is private credit creation. Put simply, a household or firm can borrow from a bank or other financial institution...

Read More »Short & Simple 12 – Government Money

We saw in part 2 that to establish a currency, government needs to do three things: 1. Define a unit of account (e.g. dollar).2. Impose taxes that can only be paid in that unit of account.3. Spend or lend the currency into existence. The most basic purpose of taxation (introduced in step 2 of the sequence) is to create a demand for the currency. Provided taxes are effectively enforced, we in the non-government will have a need to obtain the currency, because it is the only means of paying...

Read More »Short & Simple 11 – Money as an IOU

Money can be thought of as an IOU (“I owe you”). The issuer of an IOU can buy goods or services from anybody who is willing to accept the IOU as payment. In return, the issuer of the IOU promises to accept it back again in the future as payment for goods or services the issuer provides. Anybody can attempt to issue an IOU. The difficulty, as the economist Hyman Minsky emphasized, is in getting it accepted. For example, perhaps your neighbor offers to tend to your garden while you are away...

Read More » Heterodox

Heterodox