We have seen that a national currency enters the economy when government spends, and that the recipients of the government spending can use the currency for various purposes, including to purchase goods and services. Government is therefore an original source of funds. There is another original source of funds that gives people the ability to make purchases. This other source is private credit creation. Put simply, a household or firm can borrow from a bank or other financial institution and use the funds to spend. A bank lends by creating two things at once. It creates a loan, which is a financial asset for the bank and a financial liability of the borrower. At the same time, it creates a new deposit. The deposit is a financial liability of the bank and a financial asset for the

Topics:

peterc considers the following as important: Short & Simple

This could be interesting, too:

peterc writes Short & Simple 20 – Graphing the Income-Expenditure Model

peterc writes Short & Simple 19 – Sectoral Balances in a Closed, Demand-Determined Economy

peterc writes Short & Simple 18 – Income Determination in a Closed Economy

peterc writes Short & Simple 17 – A Notion of Macroeconomic Equilibrium

We have seen that a national currency enters the economy when government spends, and that the recipients of the government spending can use the currency for various purposes, including to purchase goods and services. Government is therefore an original source of funds.

There is another original source of funds that gives people the ability to make purchases. This other source is private credit creation. Put simply, a household or firm can borrow from a bank or other financial institution and use the funds to spend.

A bank lends by creating two things at once.

It creates a loan, which is a financial asset for the bank and a financial liability of the borrower.

At the same time, it creates a new deposit. The deposit is a financial liability of the bank and a financial asset for the borrower.

A financial asset is a contractual claim on another person or organization.

A financial liability is a contractual obligation to another person or organization.

The bank’s claim on the borrower is the amount owed on the new loan, including any interest that is charged. This is why the loan is an asset for the bank. For the borrower, the loan is a liability. The borrower has an obligation to repay the loan plus interest.

Conversely, the new deposit is an obligation of the bank to provide currency to the deposit holder either on demand or after some specified period of time. More specifically, the bank’s undertaking is to obtain government money (cash plus reserves) sufficient to meet cash demands of the deposit holder and conduct final settlement of transactions in reserves. This makes the deposit a liability of the bank. To the borrower, the deposit is an asset. As deposit holder, the borrower has this claim over the bank.

The bank creates the loan and deposit by putting entries into a balance sheet.

A balance sheet is a statement outlining assets, liabilities and net worth (sometimes called equity). Net worth is the difference between the assets and liabilities of a person or organization. This makes it a balancing item. It ensures that total assets always equal the sum of total liabilities and net worth.

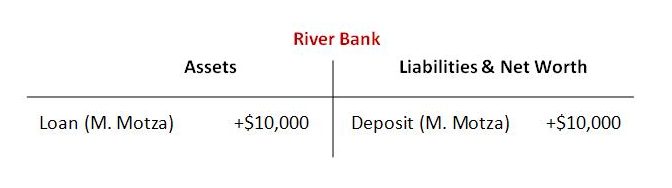

Let’s say that River Bank lends $10,000 to Minnie Motza. For simplicity, assume that the bank charges no interest. The bank creates the new loan and deposit by making accounting entries that have the impacts shown in the following ‘T-Account’:

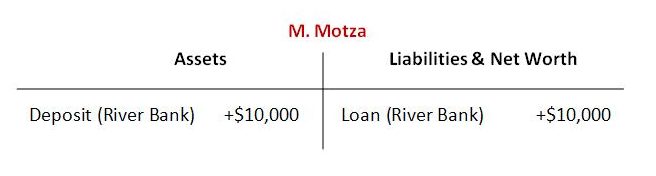

Minnie Motza’s situation will be the mirror image of this:

This is the situation immediately after the loan and deposit are created.

The borrower can now use the funds for making purchases, by drawing down the account.

The reason that banks can commit to providing government money to deposit holders is that they are in a special relationship with government (this is discussed in part 3 of the series). In particular, the government’s bank, often referred to as the central bank, also acts as the banker for all other banks. Among the functions of the central bank is its commitment to act as lender of last resort.

This ensures that if a bank lacks sufficient reserves and finds that it cannot borrow them from other banks, it can always obtain them from the central bank, though there are conditions attached. We will leave such details for another time.

The key for now is just to understand that our capacity to make purchases comes from two original sources – government spending and private credit creation.