From David Ruccio Back in June, Kim Hemphill, in her letter to the editor of the Washington Post, challenged pharmaceutical industry claims that it must charge high prices on lifesaving drugs to recover research and development costs. The case detailed in the June 11 Business article “Max’s best hope costs 0,000” was yet another example of how the pharmaceutical industry continues to put profits above morals and humanity. . . Research and development costs are a part of the business pharmaceutical companies are in and should have little, if any, bearing on the ultimate price of a drug. What they charge for these specialty drugs is profit-motivated price gouging, plain and simple. The fact is, as is clear from the chart above, pharmaceutical prices (at the wholesale level) have

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Back in June, Kim Hemphill, in her letter to the editor of the Washington Post, challenged pharmaceutical industry claims that it must charge high prices on lifesaving drugs to recover research and development costs.

The case detailed in the June 11 Business article “Max’s best hope costs $750,000” was yet another example of how the pharmaceutical industry continues to put profits above morals and humanity. . .

Research and development costs are a part of the business pharmaceutical companies are in and should have little, if any, bearing on the ultimate price of a drug. What they charge for these specialty drugs is profit-motivated price gouging, plain and simple.

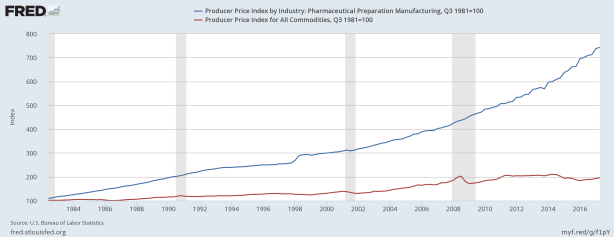

The fact is, as is clear from the chart above, pharmaceutical prices (at the wholesale level) have risen since 1981 at a much faster rate than for all commodities—more than 7 times compared to just two.

Most people, like Ms. Hemphill, think this is a case of “profit-motivated price gouging” on the part of drug companies. But it’s a difficult charge to prove.

Until now.

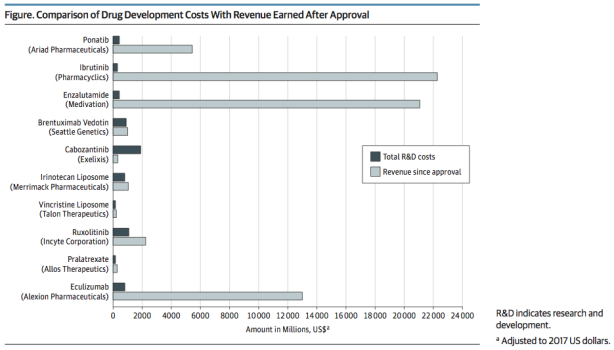

A new study published in the JAMA Internal Medicine journal directly challenges the industry’s argument that the reason for high drug prices is the sizable research and development outlay necessary to bring a drug to the U.S. market.

What the authors of the study show is that, in the case of 10 cancer drugs, the median revenue after approval of the drugs was $1658.4 million while the median cost of developing a single cancer drug was only $648.0 million.

Moreover, given that total spending (including a 7 percent cost of capital) to develop these drugs was $9 billion and total revenue to date was $67 billion, the postapproval revenue was more than 7-fold higher than the R&D spending.

Thus, as is clear in the figure from the study, development costs are more than recouped in a short period—and some companies boast more than a 10-fold higher revenue than research and development spending.

So, Ms. Hemphill was right: the pharmaceutical industry continues to put profits above morals and humanity.