From David Ruccio Yesterday, I discussed the mean-spiritedness of the Republican tax cuts—which are being sold as a gift to the middle-class but, in reality, represent a massive transfer to a small group of large corporations and wealthy individuals. But, of course, the real violence associated with the tax-cut gift occurs before federal taxes are even levied, in the pre-tax distribution of income. As is clear from the chart above, since the mid-1970s, the share of income captured by the top 1 percent (the red line, measured on the right-hand side) has almost doubled, rising from 10.6 percent to over 20 percent. Meanwhile, the share of income going to the middle 40 percent (the blue line, on the left) has eroded, falling from 45.2 percent to 40.4 percent. But that’s not enough for

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

Yesterday, I discussed the mean-spiritedness of the Republican tax cuts—which are being sold as a gift to the middle-class but, in reality, represent a massive transfer to a small group of large corporations and wealthy individuals.

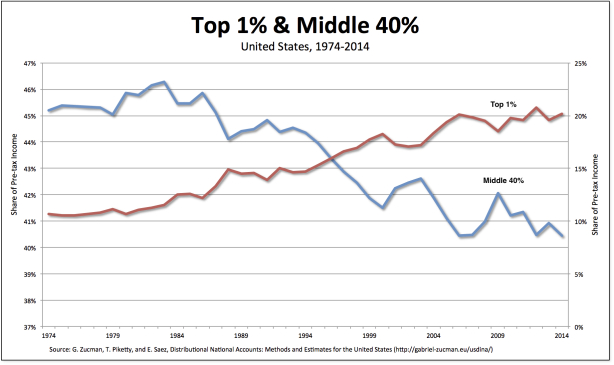

But, of course, the real violence associated with the tax-cut gift occurs before federal taxes are even levied, in the pre-tax distribution of income.

As is clear from the chart above, since the mid-1970s, the share of income captured by the top 1 percent (the red line, measured on the right-hand side) has almost doubled, rising from 10.6 percent to over 20 percent. Meanwhile, the share of income going to the middle 40 percent (the blue line, on the left) has eroded, falling from 45.2 percent to 40.4 percent.

But that’s not enough for those at the top. They want even more—and their growing share of the surplus has given them more power to elect the candidates and write the rules to obtain even more income, both before and after taxes.

Meanwhile, many in the languishing middle-class, having given up hope for any improvement in their pre-tax income share, threw in their lot with the Republicans and their promise of tax relief.

They now know that that’s a dead end, too.

The American middle-class continues to lose out, both when they exchange their ability to work for an income in markets and afterwards, when they pay their taxes to the government.

Meanwhile, the tiny group at the top has been able to rig both mechanisms, exchange and taxes, to capture and keep more of the surplus.

Something clearly has to give.