From David Ruccio There’s no real mystery behind the spectacular gains in the stock market over the course of 2017. Much of it can be explained by the rise in U.S. corporate profits. But, as is clear from the chart above, the relationship between corporate profits (after tax, in red, measured on the right-hand side) and the stock market (the Dow Jones Industrial Index, in blue on the left) actually goes back almost a decade. Corporate profits have increased, from their low in the fourth quarter of 2008, some 176 percent. Meanwhile, the stock market has risen 182 percent from its own low in the first quarter of 2009. Corporate profits are, of course, a signal to investors that their stocks will likely rise in value. Moreover, increased profits allow corporations themselves to buy back

Topics:

David F. Ruccio considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from David Ruccio

There’s no real mystery behind the spectacular gains in the stock market over the course of 2017. Much of it can be explained by the rise in U.S. corporate profits.

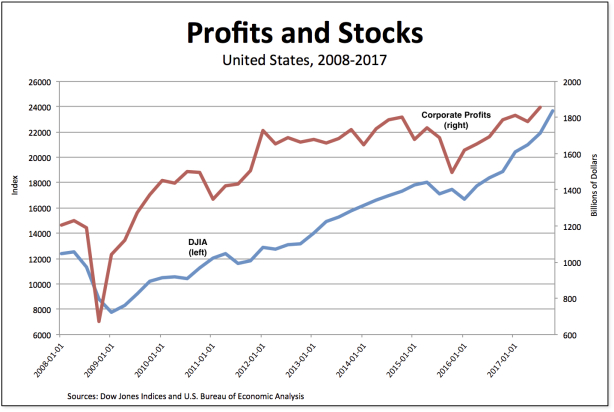

But, as is clear from the chart above, the relationship between corporate profits (after tax, in red, measured on the right-hand side) and the stock market (the Dow Jones Industrial Index, in blue on the left) actually goes back almost a decade. Corporate profits have increased, from their low in the fourth quarter of 2008, some 176 percent. Meanwhile, the stock market has risen 182 percent from its own low in the first quarter of 2009.

Corporate profits are, of course, a signal to investors that their stocks will likely rise in value. Moreover, increased profits allow corporations themselves to buy back a portion of their stocks. Finally, wealthy individuals, who manage to capture a large share of the growing surplus appropriated by corporations, have had a larger and larger mountain cash to speculate on stocks.

Clearly, the United States has had a profit-led recovery since the crash of 2007-08, which is both a cause and consequence of the stock-market bubble.

However, that recovery has left most other Americans behind. First, corporate profits have increased in large part because workers’ wages have largely stagnated. Second, most American workers don’t own any stocks, either directly or indirectly. Stock ownership itself is highly concentrated, as the top 10 percent of households own well over 80 percent of the U.S. stock market.

And looking forward? I don’t make predictions but it’s obvious that the Republican administration is determined to do all it can to keep corporate profits growing and to make sure wealthy individuals keep a larger share of the surplus they receive. As long as that happens, we’ll continue to see the kind of lopsided recovery—including banner gains in the stock market—that has characterized the U.S. economy for the better part of the past decade.