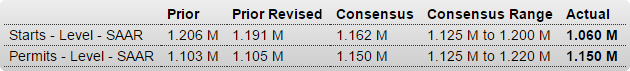

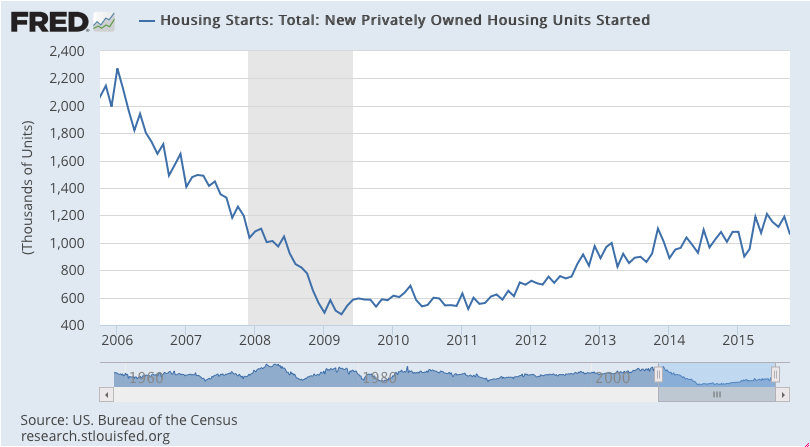

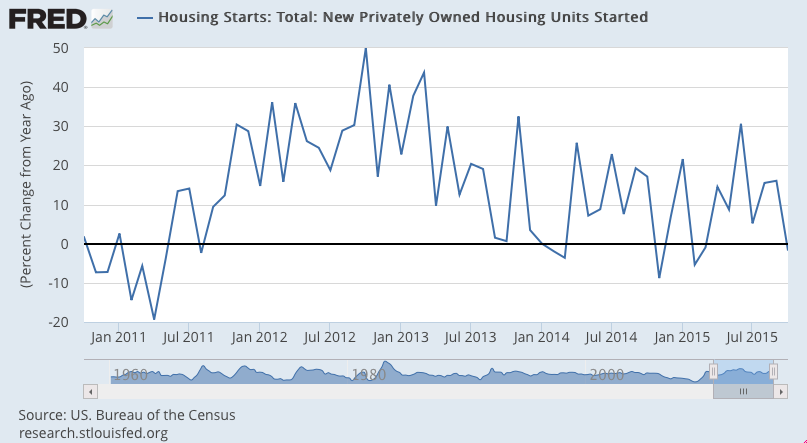

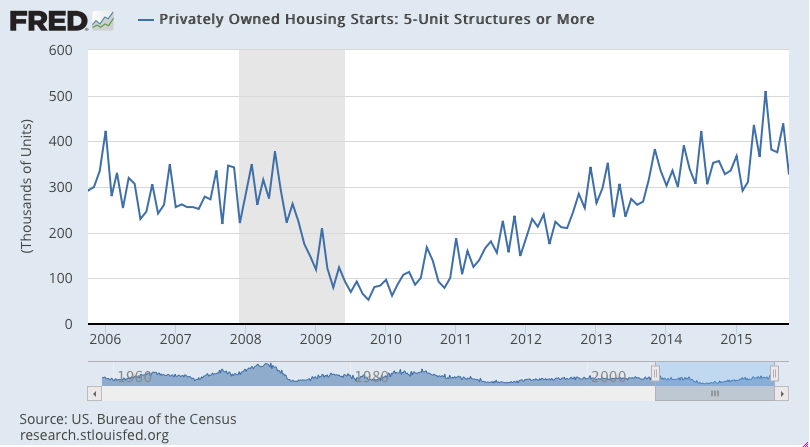

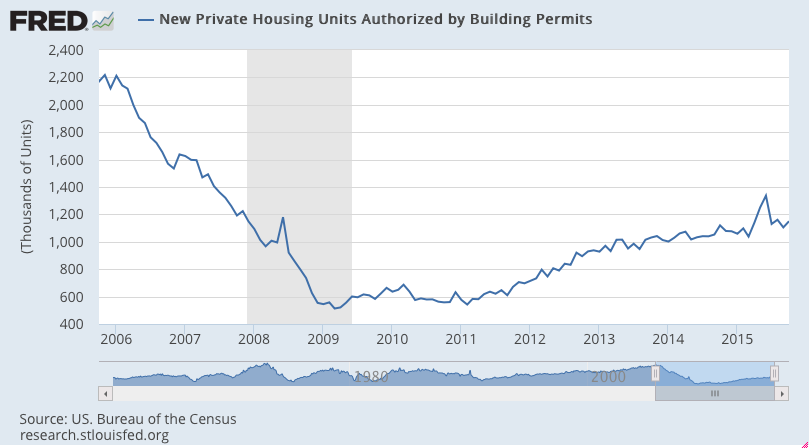

Falling off, as previously discussed, particularly multi family, which had been the driver: Housing StartsHighlightsPulled down by a big drop in multi-family homes, housing starts fell a steep 11.0 percent in October to a 1.060 million annualized rate that is far below Econoday’s low estimate. Starts for multi-family homes, which spiked in September following a springtime jump in permits for this component, fell back 25 percent in the month to a 338,000 annualized rate. Single-family starts fell a much less severe 2.4 percent to 722,000.And there is important good news in this report. Permits are up, rising 4.1 percent to a 1.150 million rate that hits the Econoday consensus. Single-family permits are up 2.4 percent to a 711,000 rate with multi-family up 6.8 percent to 439,000.Housing completions fell back in October, down 6 percent to a 965,000 rate that reflects lower work in the Northeast and Midwest. Homes under construction rose 0.9 percent to a recovery best 938,000 rate and are up a very strong 16.4 percent year-on-year, pointing, despite the slip in starts, to ongoing strength for construction spending, at least for October.But the big drop in starts is definitely a negative for the near-term construction outlook, though the rise in permits points to subsequent strength.

Topics:

WARREN MOSLER considers the following as important: housing

This could be interesting, too:

Nick Falvo writes Subsidized housing for francophone seniors in minority situations

NewDealdemocrat writes Declining Housing Construction

Nick Falvo writes Homelessness among older persons

Bill Haskell writes Q3 Update: Housing Delinquencies, Foreclosures and REO

Falling off, as previously discussed, particularly multi family, which had been the driver:

Housing Starts

Highlights

Pulled down by a big drop in multi-family homes, housing starts fell a steep 11.0 percent in October to a 1.060 million annualized rate that is far below Econoday’s low estimate. Starts for multi-family homes, which spiked in September following a springtime jump in permits for this component, fell back 25 percent in the month to a 338,000 annualized rate. Single-family starts fell a much less severe 2.4 percent to 722,000.And there is important good news in this report. Permits are up, rising 4.1 percent to a 1.150 million rate that hits the Econoday consensus. Single-family permits are up 2.4 percent to a 711,000 rate with multi-family up 6.8 percent to 439,000.

Housing completions fell back in October, down 6 percent to a 965,000 rate that reflects lower work in the Northeast and Midwest. Homes under construction rose 0.9 percent to a recovery best 938,000 rate and are up a very strong 16.4 percent year-on-year, pointing, despite the slip in starts, to ongoing strength for construction spending, at least for October.

But the big drop in starts is definitely a negative for the near-term construction outlook, though the rise in permits points to subsequent strength.

Sotheby’s Offers Employees Voluntary Buyouts to Cut Costs

Nov 13 (Bloomberg) — Sotheby’s is offering employees voluntary buyouts to cut costs after a drop in third-quarter revenue grabbed more attention from the company’s investors than its largest ever semiannual auction season.

San Francisco in housing ‘correction’

Nov 5 (CNBC) — San Francisco homes are still some of the priciest in the nation, but sales of those houses are showing significant weakness. September sales were down 19.5 percent in the city from a year ago, according to the California Association of Realtors.

“We’re going through a kind of correction, as we have a lot of new developments being built right now. The supply is definitely on the rise,” said Justin Fichelson, an agent at Climb Real Estate Group in San Francisco. “The market is not going to continue going up like we’ve seen in the past two years, because prices are already high.”

London Mansion Prices Fall 11.5% as Home `Bubble’ May Have Burst

Nov 12 (Bloomberg) — Prices of homes valued at 5 million pounds ($7.6 million) or more fell 11.5 percent on a per square foot basis in the third quarter from a year earlier, according to Richard Barber, a director at broker W.A. Ellis LLP, a unit of Jones Lang LaSalle Inc. Sales volumes across all homes in the best parts of central London dropped 14 percent in the period, the realtor said on Thursday.

“The bubble may already have burst” for the most expensive homes, Barber said. Now, “36 percent of all properties currently on the market across prime central London are being marketed at a lower price than they were originally listed at, with the average reduction in price being 8.5 percent.”

Luxury-Jet Market Value Seen Slipping for First Time Since 2009

Nov 15 (Bloomberg) — Global long-term spending on private jets is starting to slow for the first time since 2009 as slumping commodity prices sap demand in emerging markets, according to an industry forecast.

Deliveries for the 11 years ending in 2025 will be valued at $270 billion, Honeywell International Inc. said Sunday in its annual survey of the luxury-aircraft market. That’s down 3.6 percent from last year’s comparable projection, and snapped a streak of gains since the last U.S. recession ended.

The decline reflects weakness in Brazil, Russia, India and China, the group known as the BRIC countries, and the impact of political conflicts in the Middle East and Africa, according to Brian Sill, chief of Honeywell’s business and general aviation unit. Delays in some new plane models are also pushing back demand, he said.

Jet shipments will drop 2.6 percent to 9,200 planes, according to Honeywell, whose forecast had predicted fluctuations in deliveries but no drop in the planes’ list value in the post-recession years. Large planes that had spearheaded the recovery are now seeing slower growth.