From Shimshon Bichler and Jonathan Nitzan There is a lot of buzz about Trump’s recently launched trade wars, but much of this buzz misses the point. The key issue here is not foreign trade, but foreign investment. Foreign trade contributes relatively little to US corporate profit. The disaggregate data here are patchy, but if we can assume that profit rates on exports and domestic sales are roughly the same, we can use the share of exports in GDP as a proxy for the share of export profit in overall profit. Based on this proxy, exports currently account for only 12% of the US corporate bottom line. And as the figure shows, this contribution changed only gradually over the years, rising at a trend growth rate of 1.7% per annum. The story with foreign investment is very different. Back

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from Shimshon Bichler and Jonathan Nitzan

There is a lot of buzz about Trump’s recently launched trade wars, but much of this buzz misses the point. The key issue here is not foreign trade, but foreign investment.

Foreign trade contributes relatively little to US corporate profit. The disaggregate data here are patchy, but if we can assume that profit rates on exports and domestic sales are roughly the same, we can use the share of exports in GDP as a proxy for the share of export profit in overall profit.

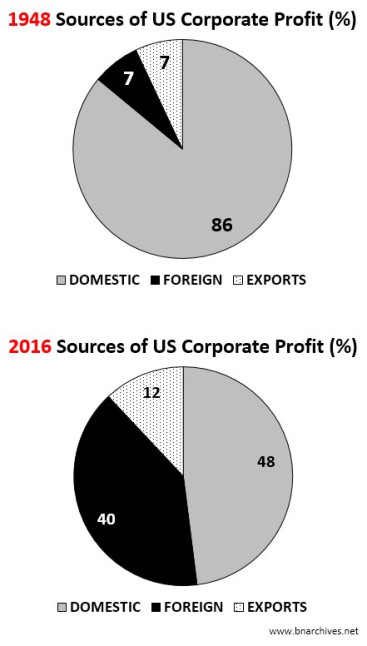

Based on this proxy, exports currently account for only 12% of the US corporate bottom line. And as the figure shows, this contribution changed only gradually over the years, rising at a trend growth rate of 1.7% per annum.

The story with foreign investment is very different. Back in the 1940s, foreign subsidiaries of and minority investments by US-based corporations accounted for 7% of all US profit – the same proportion as exports. But with a much steeper growth trend – rising at a rate of 2.6% annually – by the 2010s foreign operations accounted for nearly half of all US corporate profit.

The two pie charts depict a dramatic shift in the sources of US corporate profit. In 1948, the United States was practically a ‘closed market’. The bulk of its profit – some 86% of it – came from domestic sources, with the remaining 14% split evenly between foreign operations and exports. By 2016, though, the picture was radically different: the share of domestic profit has shrunk to 48% of the total, while the shares of foreign operations and exports have grown to 40% and 12%, respectively.

On the face of it, then, US capitalists have little reason to fret about a Trump-led trade war. First, at 12%, their export-to-GDP ratio is not only small, but also lower than their rivals’ in the European Union (43%) and East Asia and the Pacific (28%). Second, although a trade war is bound to undermine their profit from exports, this drop is likely to be offset, at least in part, by tariff-boosted, domestic profit margins.

These calculations, though, ignore a far bigger issue: the impact of trade wars on foreign investment and foreign profit.

Foreign trade is the ideological, political and commercial bedrock of global ownership. Without a steadfast belief in the ‘free movement of commodities’, global ownership comes under assault, the cross-border movement of capital declines, and the flow of foreign profit dries up.

During the postwar period, the growth of foreign trade allowed and invited a much bigger expansion of foreign investment and profit. But, as the interwar period painfully demonstrated, this amplification also works on the way down. The trade wars of the 1920s and 1930s triggered ‘investment wars’, with collapsing exports and imports sparking even bigger declines in foreign investment and foreign profit (see, for example, Bichler and Nitzan, ‘Imperialism and Financialism: A Story of a Nexus, Journal of Critical Globalization Studies, 2012: Figure 1, p. 53).

Of course, a downward spiral of the interwar type is not (yet) in the cards. However, given the crucial and increasing importance of foreign profit for US firms, even a modest movement in that direction will be highly disconcerting for the country’s dominant capitalists.

Although Trump’s jittery behaviour makes him hard to predict and difficult to trust, so far most capitalist heavyweights have supported him, and for good reason: he has served them by assaulting socialized medicine and environmental planning, by cutting corporate and personal income taxes, and by promising a privatized infrastructure boom. His trade-war initiative, though, goes in the opposite direction. It threatens the very structure of US corporate power, and if Trump allows it to degenerate into open investment wars, the heavy capitalist guns are sure to turn against him.