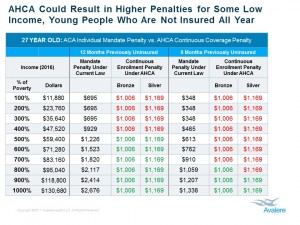

Caroline Pearson at Avalere has a piece on how the House of Representatives AHAC healthcare program penalizes older and lower income people more so than higher incomes and younger people. Just to refresh your memory, the ACA penalizes people who do not have insurance based upon income. The penalties under the AHAC are based upon premiums and the penalties under the ACA are based upon income. Older people under the AHAC have higher premiums up to 5:1 rather than 3:1. Many Millenials have lower incomes and can have issues paying the penalty under the AHAC and they are the healthiest. Another interesting facet is the penalties under the AHAC are paid to a private company and not the government. This one will probably go to court also Younger Adults Older Adults If young adults are discouraged by the penalty and cannot afford to enroll,it could hurt the risk pool. While a recent RAND analysis showed that young people as a whole moving in or out of coverage may not have a large impact on the risk pool, the healthiest and least expensive young adults not enrolling could result in a significant negative impact on the pool.

Topics:

run75441 considers the following as important: Healthcare, politics, Taxes/regulation

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Caroline Pearson at Avalere has a piece on how the House of Representatives AHAC healthcare program penalizes older and lower income people more so than higher incomes and younger people. Just to refresh your memory, the ACA penalizes people who do not have insurance based upon income.

The penalties under the AHAC are based upon premiums and the penalties under the ACA are based upon income. Older people under the AHAC have higher premiums up to 5:1 rather than 3:1. Many Millenials have lower incomes and can have issues paying the penalty under the AHAC and they are the healthiest. Another interesting facet is the penalties under the AHAC are paid to a private company and not the government. This one will probably go to court also

If young adults are discouraged by the penalty and cannot afford to enroll,it could hurt the risk pool. While a recent RAND analysis showed that young people as a whole moving in or out of coverage may not have a large impact on the risk pool, the healthiest and least expensive young adults not enrolling could result in a significant negative impact on the pool. A recent CBO report confirms a similar projection of those deterred from enrolling due to the continuous coverage provision will tend to be healthier and a penalty could have a significant negative impact on the risk pool and result in higher premiums.