A new article at consumerreports.org suggests that the Patient Protection and Affordable Care Act* (PPACA) played a substantial role in the decline of annual personal bankruptcies that we have seen since the high of 1.5 million in 2010. As I showed several years ago, international bankruptcy data support the oft-heard claim that medical bills make up one of the biggest, if not the biggest, causes of personal bankruptcy. That is, if the United States has a bunch of medical bankruptcies and other countries don’t, all other things equal you would expect the U.S. to have a higher overall bankruptcy rate than other countries. And the only article I was able to find on this showed that it was true: In 2006, the U.S. had a rate (6000 per million population) that was

Topics:

Kenneth Thomas considers the following as important: Healthcare

This could be interesting, too:

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes RFK Jr. blames the victims

Joel Eissenberg writes The branding of Medicaid

Bill Haskell writes Why Healthcare Costs So Much . . .

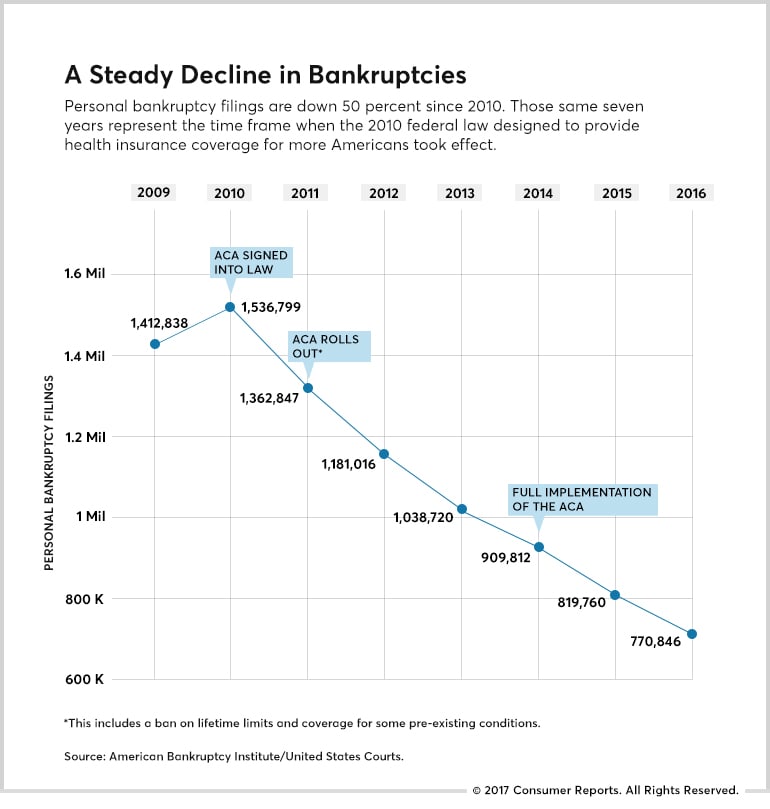

A new article at consumerreports.org suggests that the Patient Protection and Affordable Care Act* (PPACA) played a substantial role in the decline of annual personal bankruptcies that we have seen since the high of 1.5 million in 2010.

As I showed several years ago, international bankruptcy data support the oft-heard claim that medical bills make up one of the biggest, if not the biggest, causes of personal bankruptcy. That is, if the United States has a bunch of medical bankruptcies and other countries don’t, all other things equal you would expect the U.S. to have a higher overall bankruptcy rate than other countries. And the only article I was able to find on this showed that it was true: In 2006, the U.S. had a rate (6000 per million population) that was twice Canada’s (3000 per million), which in turn far outstripped #3 Germany (1200 per million). The U.S. and Canadian rates have long been the highest because they had the most debtor-friendly bankruptcy systems, so debtors took advantage of it when they could.

Canada and the U.S. had similar rates in 1982, but thereafter the U.S. rate increased substantially more rapidly than Canada’s did. As this period was also marked by U.S. health care costs outstripping those of other OECD countries, this is definitely evidence that medical bills were contributing to the higher U.S. bankruptcy rate.

Now, as suggested by Consumer Reports, the increase in insurance coverage rates and the many consumer protections due to the Affordable Care Act are contributing to a falling bankruptcy rate. Certainly, part of the fall is due to the passing of the worst part of the Great Recession, but the numbers are still striking.

As the article points out and the chart above emphasizes, protections that surely reduced bankruptcy rates were contained in even the initial phase of the ACA. In 2011, the Obama administration rolled out the ban on yearly and lifetime limits, guaranteed coverage for pre-existing conditions, and implemented the rules allowing adult children to remain on their parents’ policies until they were 26. By the time all ACA provisions were in effect in 2014, there was already a decline of over 600,000 bankruptcies per year. In the next two years, bankruptcies declined by a further 160,000 per year.

With the possibility that the American Health Care Act (AHCA) could reverse many of those protections, the conclusion is inescapable that medical bankruptcies will once again increase. Just how much, of course, depends on the particulars after (and if) the bill goes through the Senate, but this new study shows us just how much we have gained, and how much we have at risk.

* I use the full name of the law because both the patient protection and affordability aspects of the legislation contributed to this outcome.

Consumer Reports has not responded to my request to use the chart. It will be removed if so requested.

Cross-posted from middleclasspoliticaleconomist.com.