I had written on the high cost of pharmaceuticals late 2019, “Another Look at Drug Pricing, Costs, and Why” citing from the World Health Organization, the ICER, JAMA Network, Health Affairs, and my own posts (links below and in text). You will find the some of the same articles cited in new commentary of increased drug costs in the Washington Post, Kaiser Health News, and Medpage Today. It appears the three of them have caught up with Angry Bear’s coverage on the rising costs of pharmaceuticals except we go deeper into this issue. A footnote would have been nice as my information has been out for ~ 1 year now. The Cost Table (below) lists the most common prescriptions from 2012 through 2017 as detailed in the May 2019 JAMA Network Open’s article “Trends in

Topics:

run75441 considers the following as important: Health Affairs, Healthcare, ICER, JAMA, Medicare for All, Pharmaceuticals, politics, US EConomics, WHO

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I had written on the high cost of pharmaceuticals late 2019, “Another Look at Drug Pricing, Costs, and Why” citing from the World Health Organization, the ICER, JAMA Network, Health Affairs, and my own posts (links below and in text). You will find the some of the same articles cited in new commentary of increased drug costs in the Washington Post, Kaiser Health News, and Medpage Today. It appears the three of them have caught up with Angry Bear’s coverage on the rising costs of pharmaceuticals except we go deeper into this issue. A footnote would have been nice as my information has been out for ~ 1 year now.

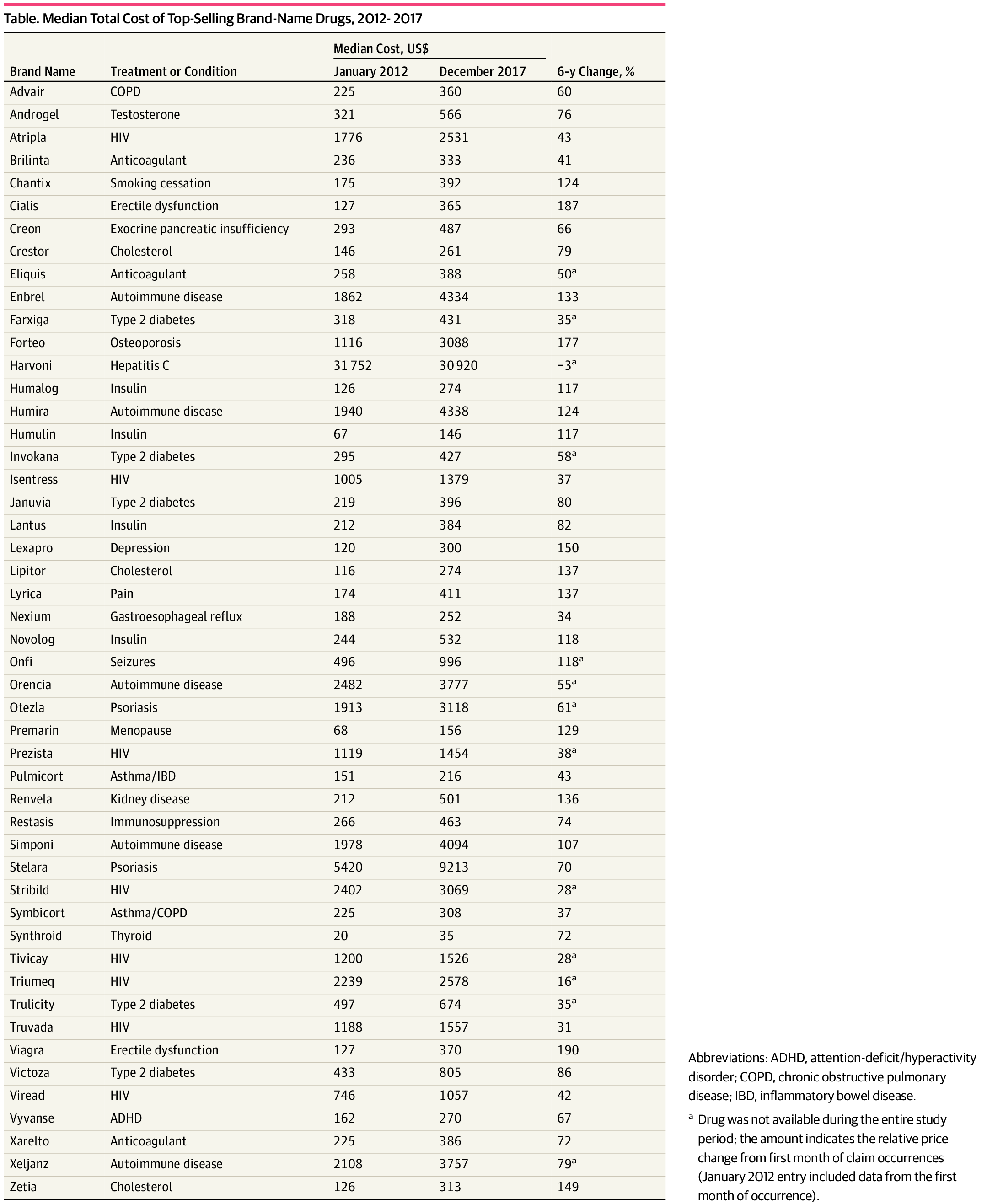

The Cost Table (below) lists the most common prescriptions from 2012 through 2017 as detailed in the May 2019 JAMA Network Open’s article “Trends in Prices of Popular Brand-Name Prescription Drugs in the United States” shows median total costs and percent change in price for 49 high volume brand name drugs over six years. If you care to read it, this JAMA Network Open article is open to anyone.

A Bit of A Summary

This particular table can also be found in another post I wrote; Does Trump Read JAMA Network Open? which reviewed the latest JAMA findings (Trends in Prices of Popular Brand-Name Prescription Drugs in the United States) on pharmaceutical price increases from 2012 to 2017. It is another in a series of articles (by me) which has looked at the rising prices of pharmaceuticals. The World Health Organization (2018) findings cited here reflect on R & D costs for cancer drugs and the amount of time needed to recoup those costs (median of 3 years for $750 million) with an average return of $14. 50 for every $1 invested in R & D for cancer drugs. For the maximum estimated risk-adjusted cost of R&D (US$2.827 BN), the time to cost recovery was 5 years (range: 2 years; 10 years, n=56).

Click on the JAMA Table: Median Total Cost of Top-Selling Brand-Name Drugs 2012 – 2917 to enlarge and again to magnify if needed.

JAMA Details: Taken “From the Trends in Prices of Popular Brand-Name Prescription Drugs in the United States” findings, substantial cost increases among these drugs was near universal, with a 76% median cost increase from January 2012 through December 2017, and almost all drugs (48 [98%]) displaying regular annual or biannual price increases. Of the 36 drugs available since 2012, 28 (78%) have seen an increase in insurer and out-of-pocket costs by more than 50%, and 16 (44%) have more than doubled in price. Insulins (ie, Novolog, Humalog, and Lantus) and tumor necrosis factor inhibitors (ie, Humira and Enbrel) demonstrated highly correlated price increases, coinciding with some of the largest increase in drug costs. Relative price changes did not differ between drugs that entered the market in the past 3 to 6 years (2012 – 2017) and those having been on the market longer (number of drugs, 13 vs 36; median, 29% increase from January 2015 through December 2017; P = .81) nor between drugs with or without a Food and Drug Administration – approved therapeutic equivalent (number of drugs, 17 vs 32; median, 79% vs 73%; P = .21). Changes in prices paid were highly correlated with third-party estimates of changes in drug net prices (ρ = 0.55; P = 3.8 × 10−5), suggesting that the current rebate system, which incentivizes high list prices and greater reliance on rebates, increases overall costs.

JAMA Details: Taken “From the Trends in Prices of Popular Brand-Name Prescription Drugs in the United States” findings, substantial cost increases among these drugs was near universal, with a 76% median cost increase from January 2012 through December 2017, and almost all drugs (48 [98%]) displaying regular annual or biannual price increases. Of the 36 drugs available since 2012, 28 (78%) have seen an increase in insurer and out-of-pocket costs by more than 50%, and 16 (44%) have more than doubled in price. Insulins (ie, Novolog, Humalog, and Lantus) and tumor necrosis factor inhibitors (ie, Humira and Enbrel) demonstrated highly correlated price increases, coinciding with some of the largest increase in drug costs. Relative price changes did not differ between drugs that entered the market in the past 3 to 6 years (2012 – 2017) and those having been on the market longer (number of drugs, 13 vs 36; median, 29% increase from January 2015 through December 2017; P = .81) nor between drugs with or without a Food and Drug Administration – approved therapeutic equivalent (number of drugs, 17 vs 32; median, 79% vs 73%; P = .21). Changes in prices paid were highly correlated with third-party estimates of changes in drug net prices (ρ = 0.55; P = 3.8 × 10−5), suggesting that the current rebate system, which incentivizes high list prices and greater reliance on rebates, increases overall costs.

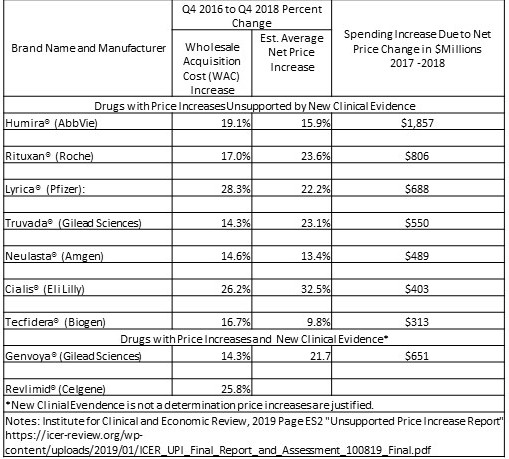

The ICER Unsupported Price Increase Report compares the percentage increases in the Wholesale Acquisition Cost (WAC – second Column) to the increase in the Medical Care Consumer Price Index (CPI) over the same period and excluded those drugs with a WAC increase less than 7.32% or two times the increase in Medical Care CPI over the same period. The medical care CPI is one of eight major components of the CPI recorded and reported by the US Bureau of Labor Statistics .

Findings: In a two year period 4th quarter 2016 through 4th quarter 2018, the drug Rituxan which WaPo discusses in its article whole sale price increased 17% and its retail price increased 25% as determined in the ICER chart. If you go to Page 26 (Cumulative sales incomes of cancer medicines in 2017 US dollars, by molecule) of the WHO report, you can see Rituxan (Rituximab) costs about $93 a molecule and the drug itself has probably recouped its costs within the first 5 years. The need for a price increase is not needed and is rent taking as pointed out by the ICER because Roche can do it. Rituxan worked for me this time around. The complaint by Colorado farmer Michael Costanzo is legitimate. People are being priced out of the market and some are dying.

Medical CPI consists of medical care services (professional services, hospital and related services, and health insurance) and medical care commodities (medical drugs, equipment, and supplies). ICER using overall Medical CPI and not a lone services or commodity related one or subcomponent(s) of either or each was to reflect increases in drug prices relative to inflation in the overall price of medical care. The 77 drugs shown in the ICER Table 2.2 had an increase in Wholesale Acquisition Cost (WAC) greater than 7.32% over the two-year period (4th quarter 2016 – 4th quarter 2018). The remaining 23 drugs were excluded from further analysis as they were less than twice CPI.

The ICER Table 2.3 (above) depicting 9 drugs of the 77 shows the percentage change in net price (Column 3) over the two-year period from the fourth quarter of 2016 to the fourth quarter of 2018, and the increase in drug spending during calendar years 2017 and 2018 and the 4th column depicts net revenue after discounts, rebates, concessions to wholesalers and distributors, and patient assistance programs same as Table 2.2 in the report. Only the ICER Table 2.3 is shown here (JAMA chart above).

Determination: The first seven drugs under assessment did not display evidence meeting the criteria of the accepted evidence grading system called GRADE. As a result, the seven are reported as having price increases “unsupported by new clinical evidence.” GRADE is a method used by systematic reviewers and guideline developers to assess the quality of evidence and decide whether to recommend and intervention. GRADE differs from other appraisal tools for three reasons: (i) because it separates quality of evidence and strength of recommendation, (ii) the quality of evidence assessed for each outcome, and (iii) observational studies can be ‘upgraded’ if they meet certain criteria.

So What Does All of This Mean?

Other reports recognize similar determinations. Healthcare costs are increasing at a much higher rate than inflation. For example, JAMA is reporting patented pharmaceutical price increases to be 50% to 100% between 2007 and 2014, as are the generic versions, and those introduced during 2007 and 2014 have seen similar sizeable increase. The exhibited JAMA table and report details the increases.

The ICER report goes a bit further in criteria and establishes a benchmark of increase at twice Medical CPI and whether a price increase greater than the benchmark can be justified by the result of significant value brought to the market to account for the increase. At greater than a generous twice Medical CPI, the top nine drugs exceeded this benchmark and after investigation, did not bring significant value to the market place following the 4 significant values claimed by pharmaceutical companies. This analysis was completed on 9 of 77 drugs having price increases greater than twice Medical CPI. Seven of the nine drugs were shown to have price increases for which additional value could not be substantiated. The remaining two had evidence of clinical value which could not be examined at this time. Then there is the balance of the 77 drugs which have had price increases greater also. Legit or not?

Remember, the ICER is the organization which justifies pricing for many of the new drugs coming to the market place.

Another Finding: The World Health Organization Report reviews the costs of R & D for Cancer Drugs which pharmaceutical companies blame as a the major factor for higher prices over the life of their patents. The WHO document reports the R & D costs are recouped in a median 3 to 5 years for R & D investments of $750 million to $2.8 Bn. Drug patents are significantly long than the recovery. Rent taking . . .

Other Cost Impacts: This is just pharma alone and I did not look at hospitals, clinics or hospital supplies. Briefly, “Health Affairs – Hospital Prices Grew Substantially Faster Than Physician Prices For Hospital-Based Care In 2007–14″ reports inpatient care at hospital prices grew 42 percent, while physician prices grew 18 percent. Similarly, for hospital-based outpatient care, hospital prices grew 25 percent while physician prices grew 6 percent. Both this report and Kocher and Berwick’s “While Considering Medicare For All: Policies For Making Health Care In The United States Better: Health Affairs” point to increases in hospital care as the leading cause of increased healthcare insurance premiums.

Some Assumptions: The emphasis by politicians has been on the pricing of drugs without looking at the supply chain and the PBM’s influence on it; without looking at the costs of R & D, the return from sales revenue and how quickly those costs are recovered; and without looking at the exclusivity granted drugs through patents that allow the ability to increase pricing without a returning benefit clinically, socially, to the system, and most of all to the patient. The emphasis by government should be a review of drug costs to establish a fair market value/price. I do not see a foundation being established for the setting of pricing.

Trends in Prices of Popular Brand-Name Prescription Drugs in the United States, JAMA Network Open, Nathan E. Wineinger; Yunyue Zhang; Eric J. Topol, May 2019

Unsupported Price Increase Report, Institute for Clinical and Economic Review; David M. Rind, Foluso Agboola, Varun M. Kumar, Eric Borrelli, Steven D. Pearson; October 2019

Technical Report, Pricing of cancer medicines and its impacts; World Health Organization; 2019

While Considering Medicare For All: Policies For Making Health Care In The United States Better; Health Affairs; Kocher and Berwick; 2019

“Health Affairs – Hospital Prices Grew Substantially Faster Than Physician Prices For Hospital-Based Care In 2007–14;” Health Affairs; Zack Cooper, Stuart Craig, Martin Gaynor, Nir J. Harish, Harlan M. Krumholz, and John Van Reenen; 2019

Run75441 (Bill H)