House Bill Markup Details Updated Democrats are updating the ACA and detailing the .9 Tn bill to meet the Covid Pandemic and the resulting unemployment. The aid goes well beyond the direct payment of an additional 00/person. The assumption is the released House COVID Relief Bill ends up passing as part of the final American Rescue Plan as currently written. It would include major expansion and enhancements to ACA subsidies. The subsidy improvements would be retroactive to the beginning of this year. Additional direct assistance: – Give working families an additional direct payment of ,400 per person and bringing their total relief to ,000 per person. Support for unemployed workers: – Extend temporary federal

Topics:

run75441 considers the following as important: Healthcare, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

House Bill Markup Details Updated

Democrats are updating the ACA and detailing the $1.9 Tn bill to meet the Covid Pandemic and the resulting unemployment. The aid goes well beyond the direct payment of an additional $1400/person.

The assumption is the released House COVID Relief Bill ends up passing as part of the final American Rescue Plan as currently written. It would include major expansion and enhancements to ACA subsidies. The subsidy improvements would be retroactive to the beginning of this year.

Additional direct assistance:

– Give working families an additional direct payment of $1,400 per person and bringing their total relief to $2,000 per person.

Support for unemployed workers:

– Extend temporary federal unemployment and benefits through August 29, 2021.

– Increase the weekly benefit from $300 to $400.

Enhance the tax code for families and workers:

– Enhance the Earned Income Tax Credit for workers without children by increasing (~ tripling) the maximum credit and extending eligibility.

– Expand the Child Tax Credit to $3,000 per child and $3,600 for children under 6. Make it fully refundable and advanceable.

– Expand the Child and Dependent Tax Credit (CDCTC). Allow families to claim up to half of their child care expenses (day care).

Support health coverage and improve affordability:

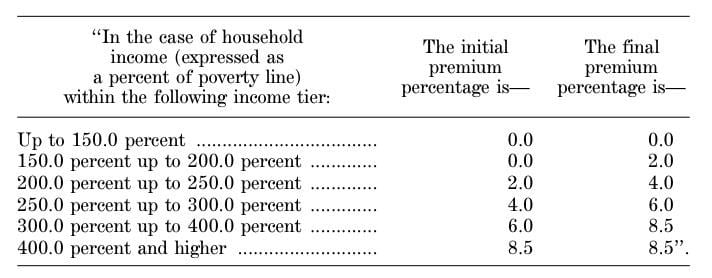

– Reduce health care premiums for low and middle-income families by increasing the ACA premium tax credits for 2021 and 2022. Provide subsidies for those making greater than 400% FPL. Make both retroactive to January 21, 2021 (see chart).

– Continuation of employer-based health coverage by subsidizing COBRA coverage through the end of the fiscal year. Provide COBRA premium assistance (85%) for eligible individuals and families from the first of the month after enactment through Sept. 31, 2021.

– Creates health care subsidies for unemployed workers who are ineligible for COBRA.

Protect the elderly by eliminating COVID in nursing homes:

– Provide skilled nursing facilities (SNFs) the tools and on – site support to contain COVID-19 outbreaks.

– Create, support, and fund state – strike teams to manage SNF outbreaks when they do occur.

– Increase public health and social services to eliminate abuse, neglect, and exploitation of the elderly exacerbated by the COVID-19 pandemic.

Assistance for children, families, and workers:

– Use existing pathways to supply aide to people quickly targeting those not receiving assistance during the pandemic. Target pregnant women, children, and struggling families and improve access to housing, diapers, internet service, soap, food, etc..

Strengthen retirement security:

– Stabilize pensions stabilization for 1 million Americans, frontline workers, and those who participate in multi-employer plans. Such plans are rapidly approaching insolvency.

– Prevent multi-employer pension system from collapsing and leaving retirees in poverty, businesses in bankruptcy, and communities in crisis.

The bill passed by the Democrats would have a major impact on citizens.

Additional ACA – COVID Signup Period

– Passed by an Executive Order in January, the HHS will open the HealthCare Exchange for a “Special Enrollment Period” from February 15 through May 15, 2021. Americans not having health care coverage can enroll then.