Medicare Advantage (Part C) plans were to be the private plans able to deliver more and better healthcare than FFS Medicare. MA plans does offer more services than FFS Medicare. It offers similar services at a higher cost than ordinary Medicare costs. This is accomplished by over coding healthcare issues of participants which in turn increases prices to FFS Medicare. Random surveys over the years have revealed excessive charges by Medicare Advantage. Detail we have presented can be found here, here, here, here, and here. As the article title states aggregate Medicare payments to Medicare Advantage plans have never been lower than FFS Medicare spending. Risk adjustment through coding intensity (coding increases) by MA plans year to year

Topics:

run75441 considers the following as important: Healthcare, politics, social security

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Medicare Advantage (Part C) plans were to be the private plans able to deliver more and better healthcare than FFS Medicare. MA plans does offer more services than FFS Medicare. It offers similar services at a higher cost than ordinary Medicare costs. This is accomplished by over coding healthcare issues of participants which in turn increases prices to FFS Medicare.

Random surveys over the years have revealed excessive charges by Medicare Advantage. Detail we have presented can be found here, here, here, here, and here.

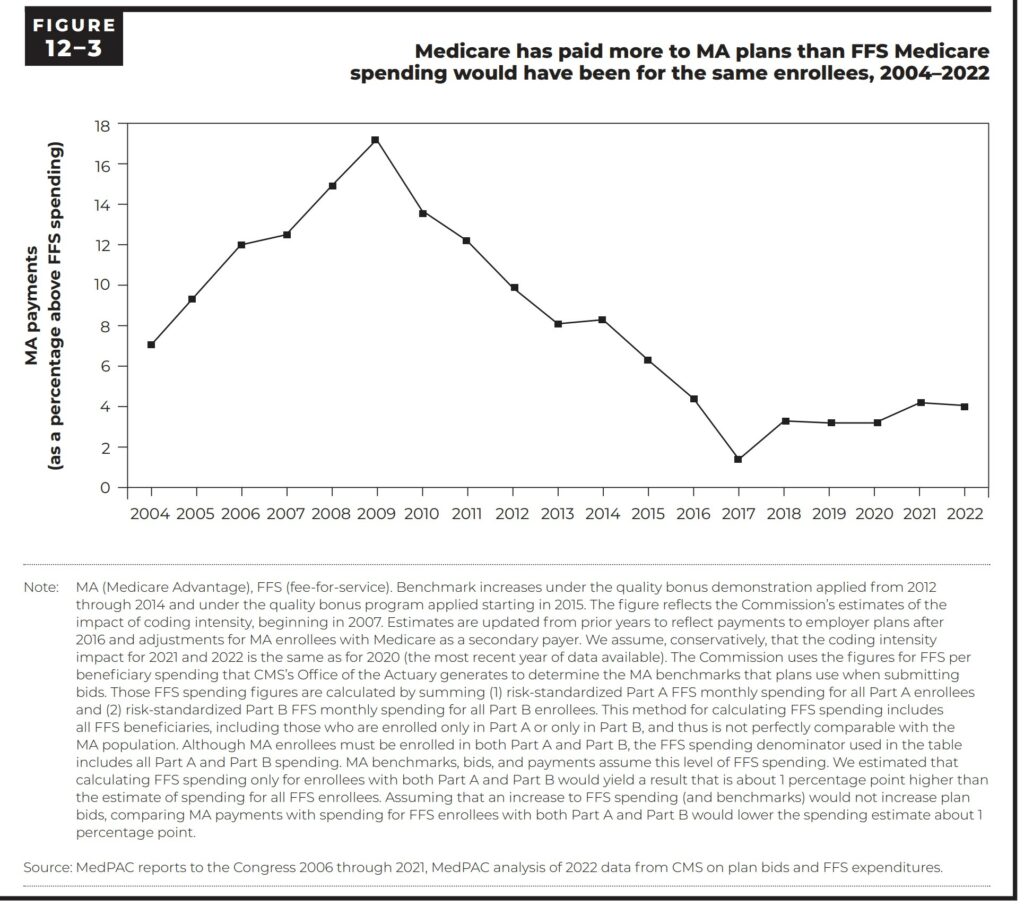

As the article title states aggregate Medicare payments to Medicare Advantage plans have never been lower than FFS Medicare spending. Risk adjustment through coding intensity (coding increases) by MA plans year to year inflates pricing to FFS Medicare. The quality of MA treatments by MA is difficult to evaluate due to a lack of information. Yearly reports developed from surveys have found overcharges of $billions.

Both Kip Sullivan and I have had a random conversation going over the most recent MedPac Report. What I have written is not a complete report of the 50 pages or so. Just some highlighted parts I believe will explain some of the issues.

“Aggregate Medicare payments to Medicare Advantage plans” have never been lower than FFS Medicare spending.

Over a 37-year history, a review of private plan payments was made. It suggests, the many iterations of full-risk contracting with private plans never yielded aggregate savings for the Medicare program. To which, the plans were expected to do.

Throughout the history of Medicare managed care, the program has paid more, sometimes much more than it would have paid. That is if beneficiaries were to remain in fee-for service (FFS) Medicare. Conversations about Medicare running out of funds have been had. Billions of dollars can be laid at the feet of MA plans over coding patients, etc. Page 432 of the MedPac report;

“In 2020, differences in diagnostic coding caused Medicare to pay MA plans $12 billion more than it would have spent if the same beneficiaries had been enrolled in FFS Medicare.” Page 432 of the MedPac Report.

Evaluations of private plan payment rates under Medicare demonstrations occurring before 1985 found that payment rates were 15 percent to 33 percent higher than FFS Medicare spending (Langwell and Hadley 1990).

Between 1985 and 2004, risk adjustment was inadequate and led to private plan payments that were, in the late 1980s and through the mid-1990s, 5 percent to 7 percent higher than FFS Medicare spending (Brown et al. 1993, Medicare Payment Advisory Commission 1998, Newhouse 2002, Riley et al. 1996).

Figure 12-3 shows, since 2004, payments to MA plans continue to be above the amount FFS Medicare would have spent for the same beneficiaries.

The CMS Commission has found;

(1) coding intensity inflates payments to MA plans and undermines the goal of plans competing to improve quality and reduce healthcare costs;

(2) the quality bonus program boosts plan payments for nearly all enrollees but does not provide beneficiaries with the necessary information to evaluate local quality; and

(3) plan benchmarks are set high and the Medicare program (rather than plans) subsidizes extra benefits for MA enrollees.

Apart from payment policies, the Commission finds that plan-submitted data about beneficiaries’ health care encounters are incomplete. If these data were complete and accurate, they could be used to understand MA plan efficiencies, improve quality measurement, and provide oversight of the MA program. These policy flaws diminish the integrity of the program and generate waste from beneficiary

premiums and taxpayer funds. The rapid growth of MA enrollment and spending elevates the urgency and need for a major overhaul of MA policies.

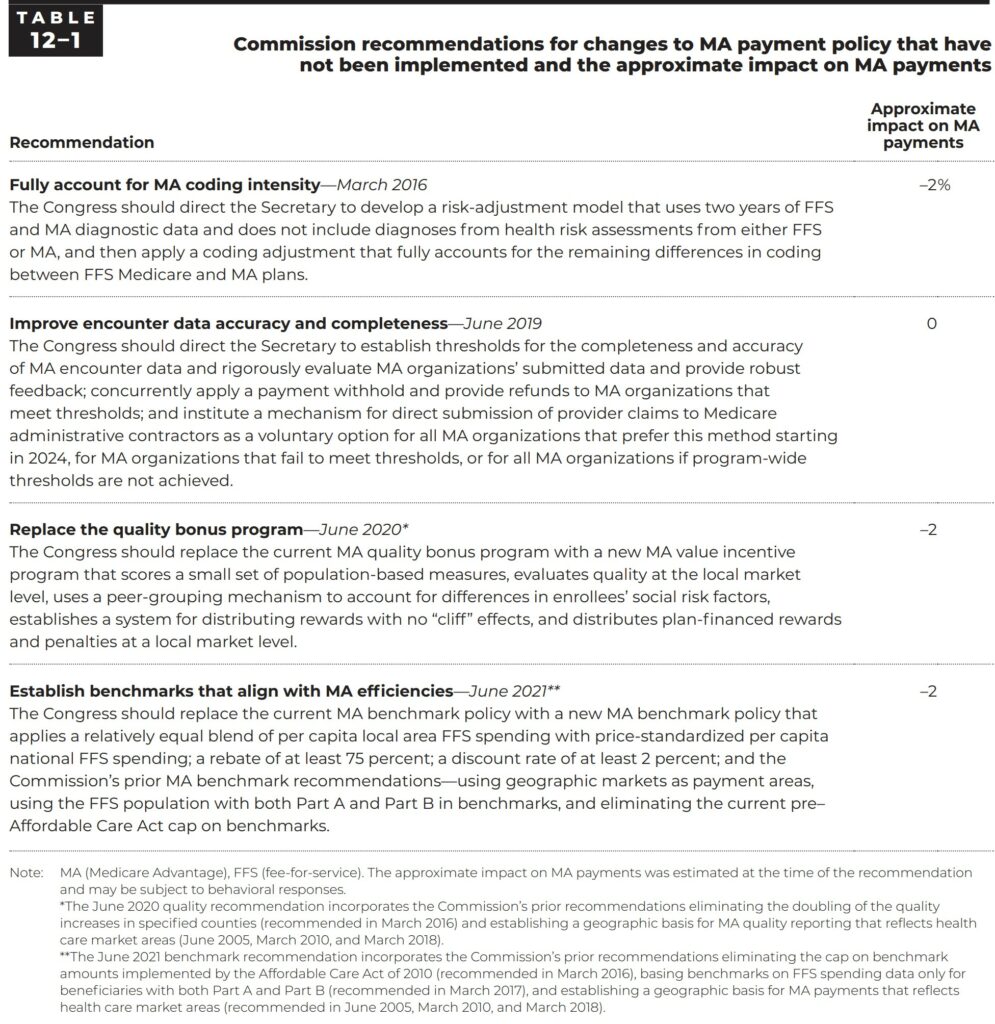

Over the past few years, four recommendations have been developed by the Commission to improve the interaction between FFS and the MA program. Each new recommendation incorporates and updates prior recommendations. Each also eliminate or reduces the effects of the most significant current policy flaws in the MA program. Table 12-1(p. 418) summarizes the Commission’s recommendations.

(1) Account for continued coding differences between MA and FFS and address those differences in a complete and equitable way (Medicare Payment Advisory Commission 2016);

(2) ensure the completeness and accuracy of encounter data to improve the MA payment system, serve as a source of quality data, and facilitate comparisons with FFS Medicare (Medicare Payment Advisory Commission 2019a);

(3) replace the quality bonus program with a market-based, plan-financed reward program (Medicare Payment Advisory Commission 2020a); and

(4) establish more equitable MA benchmarks for the Medicare program (Medicare Payment Advisory

Commission 2021b)

Through reforms to the MA payment system, the Commission aims to better focus the program on the beneficiaries it serves and to harness plan efficiency to improve Medicare’s long term financial sustainability.

Here comes the clincher.

The Commission is committed to including private plans in the Medicare program and allowing beneficiaries to choose among Medicare coverage options. This includes the alternative delivery systems private plans can provide. Beneficiaries find MA an attractive option through which to receive their Medicare benefits. Tis is evidenced by the year-over-year trends in enrollment growth. The appeal of MA does not mean Medicare should continue to overpay MA plans as MA enrollment continues to grow, it will further worsen Medicare’s fiscal sustainability. This is due to over coding and the excess and unfunded additional amenities.

Continuing the Conversation concerning Medicare and Medicare Advantage – Angry Bear (angrybearblog.com)

“Continuing the Conversation on Medicare and Medicare Advantage – 2″ – Angry Bear (angrybearblog.com)