This popped up on “Letters from an American” just last night. I was too tired to read Prof. Heather Cox-Richardson’s article. So, I missed out on a good message about the income of America’s population. This is a recent commentary by the not-so nonpartisan Congressional Budget Office in September 2022. The thrust of the article? “Trends in the Distribution of Family Wealth, 1989 to 2019.” Prof. Heather Cox-Richardson’s Introduction; Since the 1980s, the argument for dismantling the government has been that federal regulations hamper the operation of the free market, thus slowing economic growth, while the taxes required to maintain a bureaucratic system take money away from those who otherwise would invest in businesses. The avowed theory is

Topics:

run75441 considers the following as important: CBO, Family Weath, politics, Taxes/regulation, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

This popped up on “Letters from an American” just last night. I was too tired to read Prof. Heather Cox-Richardson’s article. So, I missed out on a good message about the income of America’s population. This is a recent commentary by the not-so nonpartisan Congressional Budget Office in September 2022. The thrust of the article? “Trends in the Distribution of Family Wealth, 1989 to 2019.”

Prof. Heather Cox-Richardson’s Introduction;

Since the 1980s, the argument for dismantling the government has been that federal regulations hamper the operation of the free market, thus slowing economic growth, while the taxes required to maintain a bureaucratic system take money away from those who otherwise would invest in businesses. The avowed theory is that a freely operating market will free up money on the “supply side” of the economy. Flush with cash, investors will theoretically pump that money into new enterprises that will hire workers, and everyone will prosper together.

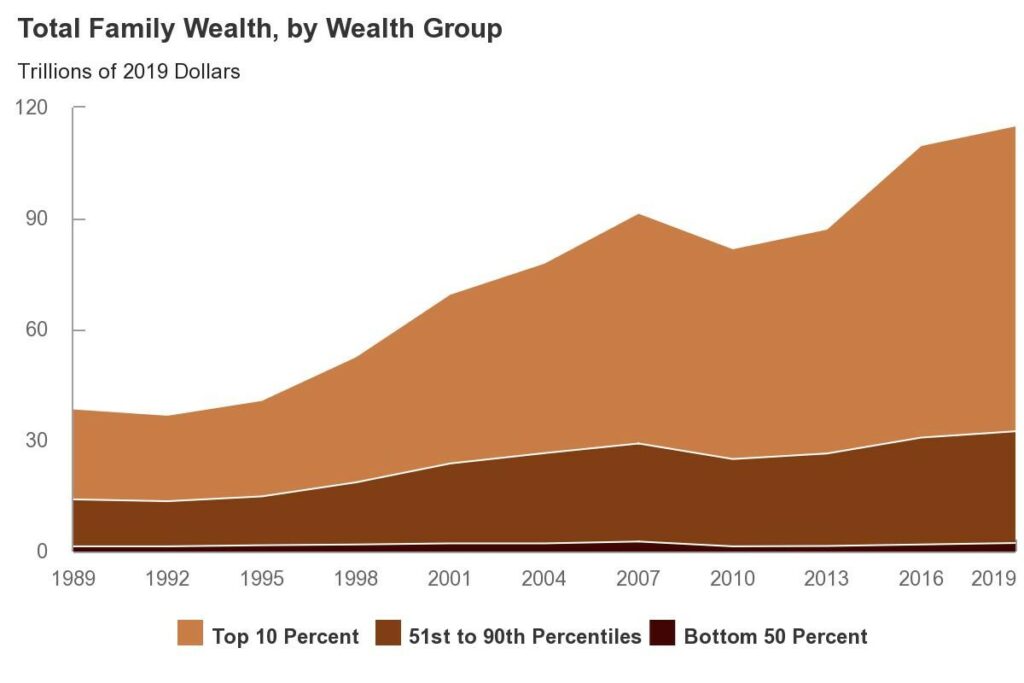

Yesterday the Congressional Budget Office released a study of trends in the distribution of family wealth between 1989—immediately after President Ronald Reagan began the antiregulation and antitax push—and 2019. In those thirty years, total real wealth held by families tripled from $38 trillion to $115 trillion. But the distribution of that growth was not even.

Money moved toward the families in the top 10%, and especially in the top 1%, shifting from families with less income and education toward those with more wealth and education. In the 30 years examined, the share of wealth belonging to families in the top 10% increased from 63% in 1989 to 72% in 2019, from $24.3 trillion to $82.4 trillion (an increase of 240%). The share of total wealth held by families in the top 1% increased from 27% to 34% in the same period. In 2019, families in the bottom half of the economy held only 2% of the national wealth, and those in the bottom quarter owed about $11,000 more than they owned.

The relative invisibility of these statistics after forty years under Republican ideology has enabled today’s Republicans to insist the Democrats are “socialists” who are trying to redistribute wealth downward even as our laws are clearly redistributing it upward.

A Little More Detail

• Total Wealth. Total real wealth (adjusted to remove the effects of inflation) held by families in the United States tripled from 1989 to 2019. It increased from $38 trillion in 2019 dollars (roughly four times the nation’s gross domestic product, or GDP) to $115 trillion (about five times GDP).

• Concentration of Wealth. The growth of real wealth over the past three decades was not uniform: Family wealth increased more in the top half of the distribution than in the bottom half. Families in the top 10 percent and in the top 1 percent of the distribution saw their share of total wealth rise over the period. In 2019, families in the top 10 percent of the distribution held 72 percent of total wealth. Families in the top 1 percent of the distribution held more than one-third; families in the bottom half of the distribution held only 2 percent of total wealth.

• Trends by Family Characteristics. Over the 30-year period, the median wealth of families in higher-income groups rose. Families with more education and older families rose faster than that of families with less income, families with less education, and younger families. The median wealth of White families exceeded that of families in other racial and ethnic groups by considerable amounts throughout the period. The median wealth of every cohort born since 1950 was less than the preceding cohort’s median wealth when that cohort was the same age.

• Trends Since 2019. In the first quarter of 2020, total family wealth declined as a result of the disruption in economic activities caused by the coronavirus pandemic. By the end of the second quarter of 2020, total family wealth had recovered; it continued to increase through the fourth quarter of 2021 but declined slightly in the first quarter of 2022

Distibution of Family Wealth

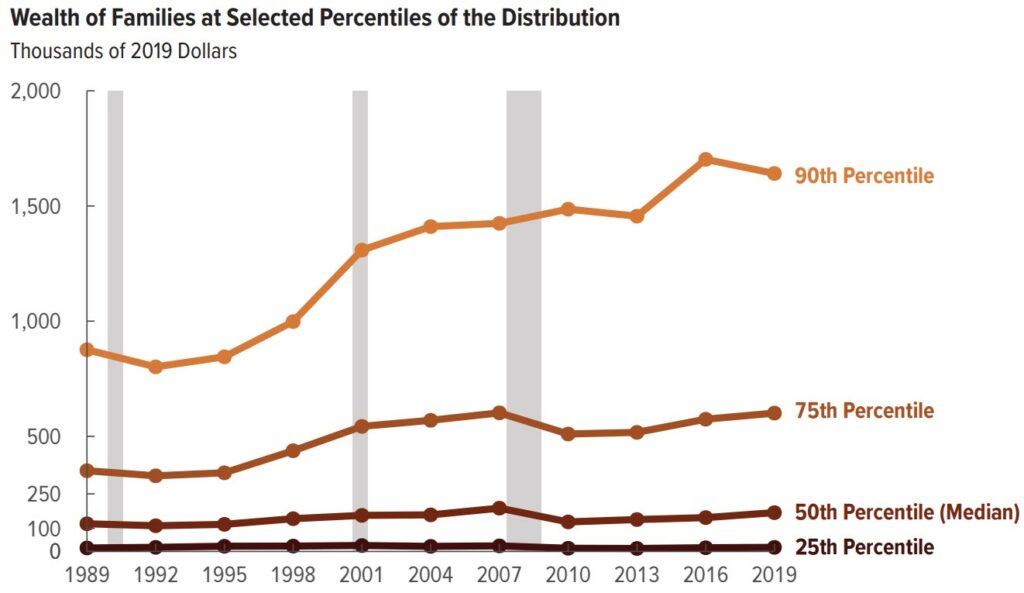

Over the 1989–2019 period, family wealth increased more rapidly at the 90th and 75th percentiles of the wealth

distribution than it did at the 50th and 25th percentiles. Measured in 2019 dollars, family wealth rose by 87 percent at

the 90th percentile, by 71 percent at the 75th percentile, by 40 percent at the 50th percentile, and by 17 percent at the

25th percentile of the distribution.

The differential growth of family wealth at the selected percentiles of the distribution is partly attributable to differences in growth rates after the 2007–2009 recession. From 2007 to 2010, wealth declined the most at the 25th and 50th percentiles—by 42 percent and 32 percent, respectively. Wealth also fell at the 75th percentile—by 15 percent—but at the 90th percentile, wealth increased by 4 percent. The recovery followed a similar pattern. Family wealth at the 25th and 50th percentiles still had not fully recovered in 2019: It was 26 percent and 10 percent less, respectively, than it had been in 2007. By contrast, family wealth at the 75th percentile was the same in 2019 as it had been in 2007, and wealth at the 90th percentile was 15 percent greater than it had been before the recession.

There is more data in this CBO report. What I pulled out and what Prof. Heather revealed is a great deal of difference in who the economy favored based upon political policy.

“Trends in the Distribution of Family Wealth, 1989 to 2019″ (cbo.gov)

“September 28, 2022,” Letters from an American, Prof. Heather Cox Richardson, (substack.com)