I was just done with updating student loan data information and checked in at the Student Loan Justice Org site on Facebook to catch up on issues. One new development being Lisa Ansdell. Associate Director @ Casden Institute, USC has joined with Alan at Student Loan Justice Org. promoting Student Loan Debt Relief. Lisa Ansell is working with Alan Collinge and the Student Loan Debt Org. assisting Alan and the members of the organization in their attempts to secure student loan debt relief from usurious loans. As Lisa points out these loans in many cases, the present principal is now larger than the original loan principal. This comes after rolling into the principal interest, consolidation fees, interest on interest, and accumulated penalties. As

Topics:

run75441 considers the following as important: Alan Collinge, Education, Lisa Ansell, politics, Student Loan Justice Org, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I was just done with updating student loan data information and checked in at the Student Loan Justice Org site on Facebook to catch up on issues. One new development being Lisa Ansdell. Associate Director @ Casden Institute, USC has joined with Alan at Student Loan Justice Org. promoting Student Loan Debt Relief.

Lisa Ansell is working with Alan Collinge and the Student Loan Debt Org. assisting Alan and the members of the organization in their attempts to secure student loan debt relief from usurious loans. As Lisa points out these loans in many cases, the present principal is now larger than the original loan principal. This comes after rolling into the principal interest, consolidation fees, interest on interest, and accumulated penalties. As some might call it, it becomes the “gift that keeps on giving” for financial interests.

There are no, (none) no other legitimate loans (if we consider student loans to be legitimate) in the US having such stringent payback requirements.

Also, if you are not aware of it. USC admitted it was part of the issue involving students high debt loans.

Besides writing articles on Student Loans, Ms. Ansdell joined Tim and Johnny on “Busted Pencils” radio to discuss the amount of debt being held. Minus commercials, the talk in this episode is about 40-minutes long (excluding commercials). There is a link to the talk show below. It is worth a listen.

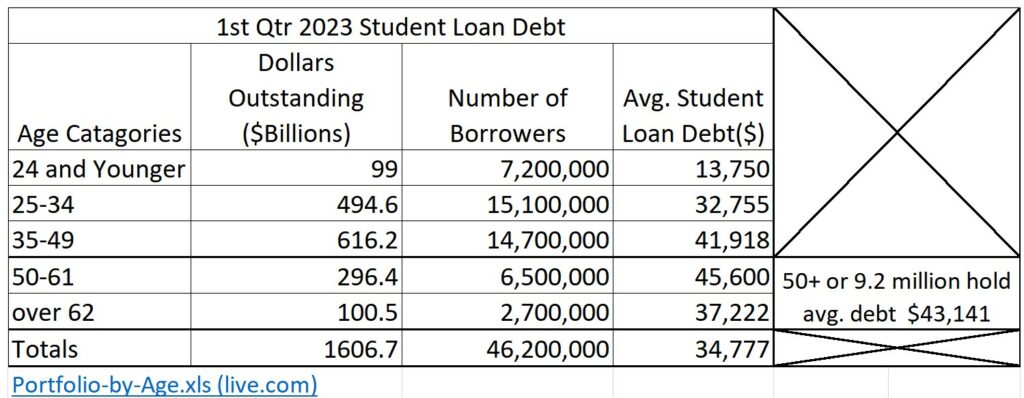

The title of the show on WMDX broadcasting out of MadCity WI says 45 million strong. The number was from last year’s Federal Student Loan portfolio report which reports on “Federal Student” loans. The first quarter of 2023 reflects 46 million students with student loan debt. There is another numeric detailing private loans which I have yet to find. In any case the numbers of people and the dollars represent 92-96% of the total. Taken from the Portfolio-by-Age.xls (live.com).

Here is the site for Lisa Ansell’ talk with Tim and Johnny. I would urge you to listen to it. 45 million strong – Civic Media.

45 million strong – Civic Media

Below is the latest detail of sponsored Federal student loans. The 1.606 trillion dollars in outstanding student loans are the government’s numeric. I have yet to find something which supports a $1.75-$2.0 trillion dollars in student loans. At best and using a 92% percentage being Federal loans, we are at ~$1.75 trillion. I read about the number but nothing is offered up to support it.

The chart below details the numbers of people by age grouping holding student loan debt by average. As you can see the 25-34 year- olds hold the largest total and the second smallest average per person. The 35-49 year olds hold the second largest total and the second largest average per person.

What I would expect to happen are increases in the total for each and also the averages for those less than 50 years old before they hit 50+ years old. Unless of course, there is a change in how these loans are administered, interest decreases, and there is forgiveness of some sort. Debt increases for each category are going to “occur.”

Some look at the totals held, numbers of people holding these loans, and make decisions based on these numerics alone. There is more to this than just the total debt and the numbers of holders.

Age is a factor and those in the 50+ grouping have the greatest overall average debt. If one could even snare a 5% interest loan on an average $45,000 debt, it would take a 50+year old 13 years to pay the loan off at $400 per month. At 62 years old and snaring a 5% interest loan and paying $400 per month, a person would need 10 years and would be 72 years old. This calculated at 50 and 62 years old. Think older and is it possible to do? Not likely.

Student Loans are not that friendly. They are meant to hold student captive. Unless there is some type of relief, many will be captive for a lifetime. Could they pay it back? Four hundred dollars a month is a considerate chunk of money coming out of a budget.

A while back, Senator Elizabeth Warren suggested .75 of 1% interest on these loans. This made sense “for all” students. But the dynamic dual of Chingos and Akers tossed a hissy as it might benefit the higher income brackets who may(?) be taking out student loans. Who might that be and how many were doing it? No one asked the question and Warren’s program fell by the wayside in 2014 based upon flawed information. The following data establishes a foundation for Warren’s proposition.

“All in all, the majority of American households (77%) fall into the 15% tax bracket or below.”

It is strange, we can figure out an income level for small Pell Grants given out; but. we can not do so for setting student loan interest rates. I hope you listen to the radio commentary on Busted Pencils. Ms. Ansell is going to be a power to reckon with on Student Loan forgiveness.

Door Wide Open for Republicans on Student Loans, Angry Bear, Angry Bear Blog.

CRL_NCLC_OnePager, (responsiblelending.org).

Why You’re Paying Back More Than You Borrowed, (Within Reach (salliemae.com).

The Aging Student Debtors of America, The New Yorker.

Student Loan Debt by Age, (investopedia.com).