What Every Conservative Needs to Know about Student Loans, Alan Collinge, Medium. Conservatives have been tricked into defending the worst big-government loan scam in U.S. History; a slight majority of the borrowers identify as either republican, or independent. The 2020 election was a huge loss for the republicans. Even so, Conservatives buoyed by recent election wins, and the current unpopularity of the President. There is one issue that made many of those statewide elections even close in the first place. It is growing quickly and will easily be the largest untethered voting block in the country this November: Student loans. There are 60 million voters in the country- including millions of veterans– who hold either federal or private

Topics:

run75441 considers the following as important: Alan Collinge, Education, Journalism, law, politics, Student Loan Justice Org, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

What Every Conservative Needs to Know about Student Loans, Alan Collinge, Medium.

Conservatives have been tricked into defending the worst big-government loan scam in U.S. History; a slight majority of the borrowers identify as either republican, or independent.

The 2020 election was a huge loss for the republicans. Even so, Conservatives buoyed by recent election wins, and the current unpopularity of the President. There is one issue that made many of those statewide elections even close in the first place. It is growing quickly and will easily be the largest untethered voting block in the country this November: Student loans.

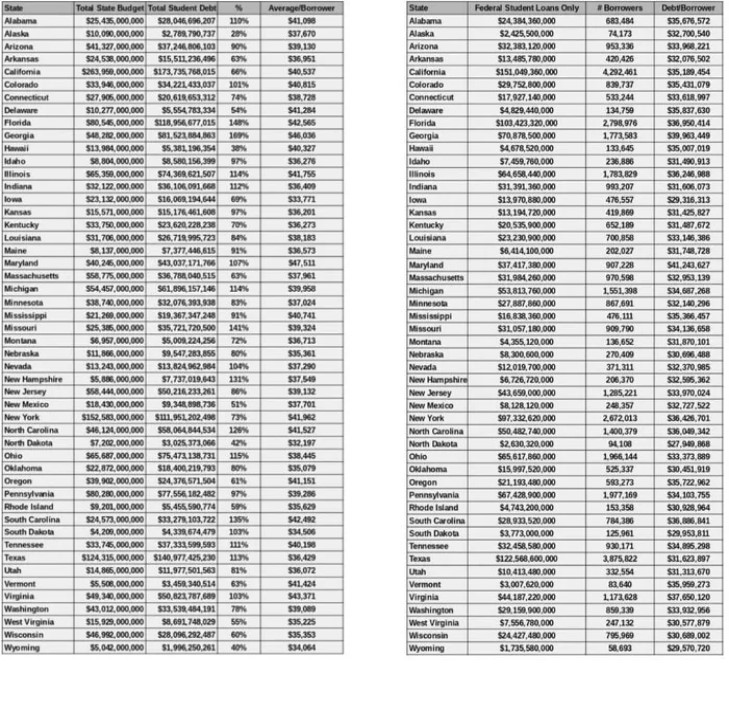

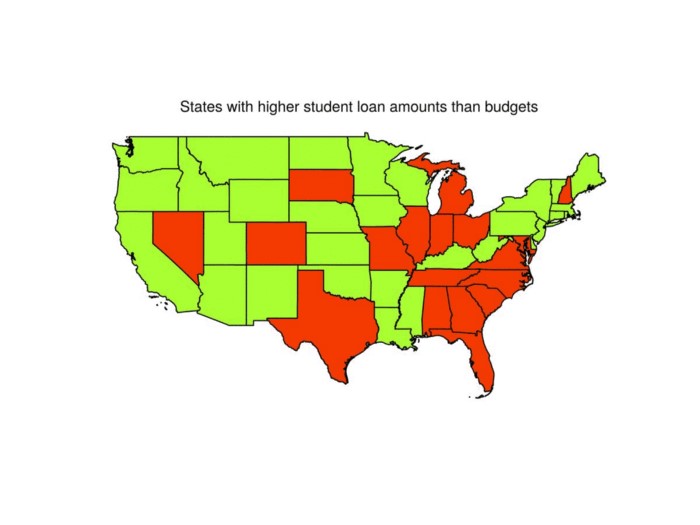

There are 60 million voters in the country- including millions of veterans– who hold either federal or private student loans, They are saddled with nearly $2 Trillion in debt. It was recently shown in over a third of U.S. states, student loan debt now exceeds the state budgets. Of which most of these are “red states”, and 90% of this debt is owed directly to the federal government. And despite the popular belief that these are largely liberal voters, in fact, most of them are republican or independent. Finally, the worst ten, and 17 of the 20 worst states, as measured by average student loan debt vs. average earnings, are red states.

According to Wayne Johnson, who ran the federal lending system under President Trump, 80% of the 45 million federal borrowers were either unable to make payments on their loans, or were paying, but their balances were increasing (interestingly, Johnson now argues for widespread loan cancellation and also for the return of bankruptcy protections to the loans).

The default rate for 2004 students is 40% (double the default rate for subprime home mortgages). Student borrowers were borrowing less than a third of what is occurring by today’s standards. Given this, it is no stretch to say that before the pandemic, the default rate for everyone with federal student loans was going to be something like 60 –70%, if not significantly higher. One can only imagine how much worse this will be post-Covid. The sub-prime home mortgage default rate, by comparison, was a mere 20%.

Most borrowers were not making payments before Covid and were heading to default. Almost no one is paying currently. Very few will resume when the current payment suspension expires. By all reasonable metrics, most should agree this is now a catastrophically failing lending system. The likes of which we have never before seen in the U.S.

Let’s look at Georgia during the election. On November 3rd, there were 1.8 million “student loan voters” in the state. More than 1.4 million of whom were “underwater” on their student loans (ie not paying, or paying with increasing loan balances). Interestingly. Georgia is the worst state in the nation in terms of student debt vs. the state budget ($81.5 Billion in student loan debt vs. a $48 Billion state budget).

Trump and the republicans offered these voters nothing. Biden and the democrats called for both widespread loan cancellation and the return of bankruptcy protections to the loans, even if insincerely. The student loan issue provided the democrats with a margin necessary to win the Georgia elections. It is likely why the races in the state were even close to begin with.

The federal student loan system has become something no conservative should support. It exists in of constitutional bankruptcy protections, statutes of limitations, and other fundamental consumer protections. The entire lending industry and especially the Department of Education has a license to steal from the citizens.

The Department has been booking upwards of $50 Billion per year in profits annually from the lending system. Interestingly, some of these profits are earmarked to pay for Obamacare. What is disturbing: White House Budget data going back decades show that the government has managed to make a profit A profit even, on defaulted loans – a claim that no other lender can make, and a defining characteristic of a predatory lending system.

Demographics and Misconceptions

With 45 million federal borrowers, and an approximate 10 –15 million private loan borrowers and cosigners, by far this is the largest emerging voting bloc in American politics today. Apparently, it is also the least well understood.

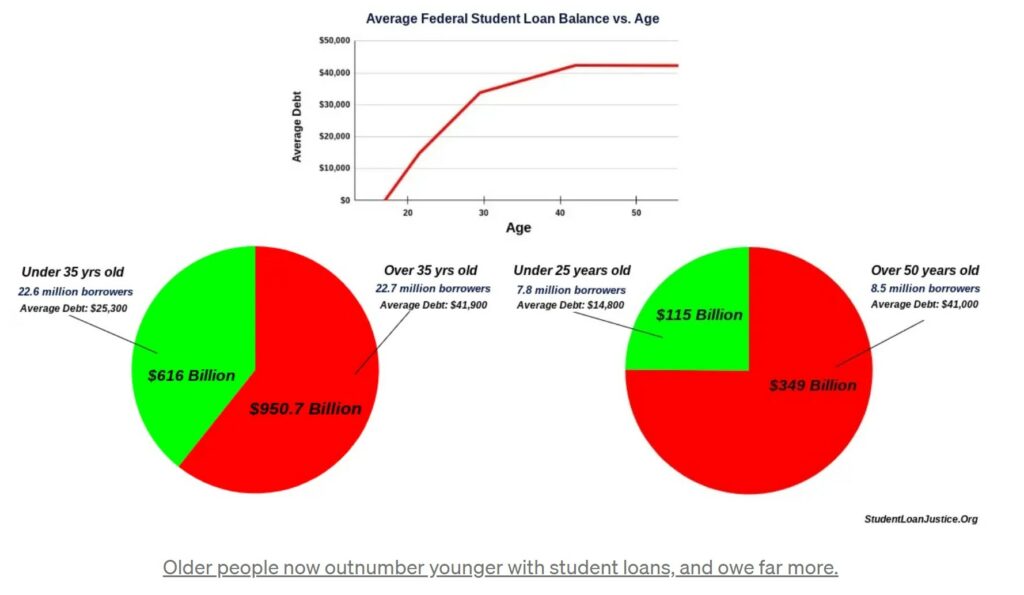

More than 40% of these people never graduated. Most are republicans or independents. All of which were financially needy as a precondition for getting the loans. Many attended community colleges and vocational schools to learn a trade. Despite popular misconceptions, people over 35 years old with student loans outnumber people under the age of 35. Similarly, people over 50 outnumber those under 25 with student loans. They owe triple what the under-25’s owe. Despite having borrowed far, far less, and many years or decades ago. This is a more a senior’s issue than a younger person’s issue!

The popular meme about student loan borrowers being younger, successful, liberal professionals is simply wrong. The “highest earning” student loan borrowers tend to be older people. Today they owe triple what the younger groups owe, despite having borrowed far less, and many years or decades ago.

Furthermore, the “liberal elitists” so often associated with student loans by the media don’t even exist. By definition, liberal elites don’t get student loans. Finally, the most successful federal student loan borrowers tend to refinance their loans at lower interest rates outside of the federal program, so they will not benefit from federal loan cancellation.

The democrats got this. Candidates like Bernie Sanders, Elizabeth Warren, and others included the return of bankruptcy protections in their presidential platforms. They went a step further and called for broad student loan cancellation. Biden endorsed Elizabeth Warren’s bankruptcy agenda. By the time the election happened, he was pledging to “eliminate” student loans for public college students who earn less than $125,000.

Trump and the republicans, meanwhile, had nothing. The republican response to all of this was essentially to wag their fingers at the borrowers, declaring loan cancellation to be unfair to those who had paid off their student loans. They included those who had also paid for college without loans. Republicans demonizing 45 million people captive to these loans, in place of the big-government lending beast and the colleges who are benefiting from them. They sealed their fate in Georgia, and nationally.

President Trump could have stood up to big-government and the colleges, cancelled all federally owned student loans, and called on Congress to return bankruptcy protections to the loans he couldn’t cancel. Unlike the trillions in PPP loans not needing repayment and other stimulus measures. This could have been done without congressional approval, appropriation, and without adding a penny to the national debt. He could have taken the lending system “to the bath and drowned it in the tub” (Grover Norquist’s words), not mine.

Trump and the republicans didn’t get it. They lost. Because in part they chose to defend a lending system vanishing into a mist of illegitimacy. While they may be buoyed by recent gains, and hearten by Biden’s post-election betrayal of these voters and current unpopularity, much could change between now and the mid-terms. If they continue to ignore these people- or worse – disparage them, the democrats will probably and successfully recapture them between now and November.

The republicans should not want to make this mistake again.

At a minimum, republicans should fight for the return of standard bankruptcy protections to all student loans, and immediately pass S.2598. A bipartisan bill (Durbin, Cornyn, Hawley are sponsors) returning bankruptcy rights to federal student loans, and clawing back money from the colleges upon discharge..

If they want to really pull the rug out from under the democrats, they will fight to cancel the loans (call it stimulus), end the lending system, and defund the colleges (or at least put them on a major diet), and come up with a cheaper, more state-friendly way to fund higher education in this country.

Some Conversation About Student Loans, Angry Bear, Alan Collinge