And the news Media is waking up to this? In December 2022, NPR wrote, “Medicare Advantage plans overcharged Medicare by millions,” Health News : NPR Citing an April 26, 2016 example of US government auditors asked a Blue Cross Medicare Advantage health plan in Minnesota to turn over medical records of patients treated by a podiatry practice whose owner had been indicted for fraud. Medicare had paid the Blue Cross plan more than ,000 to cover the care of 11 patients seen by Aggeus Healthcare, a chain of podiatry clinics, in 2011. Blue Cross said it could not locate any records to justify the payments because Aggeus shut down in the wake of the indictment. This included charges of falsifying patient medical files. Blue Cross asked the

Topics:

run75441 considers the following as important: FFS Medicare, Healthcare, law, Medicare Advantage, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

And the news Media is waking up to this? In December 2022, NPR wrote,

“Medicare Advantage plans overcharged Medicare by millions,” Health News : NPR

Citing an April 26, 2016 example of US government auditors asked a Blue Cross Medicare Advantage health plan in Minnesota to turn over medical records of patients treated by a podiatry practice whose owner had been indicted for fraud.

Medicare had paid the Blue Cross plan more than $20,000 to cover the care of 11 patients seen by Aggeus Healthcare, a chain of podiatry clinics, in 2011.

Blue Cross said it could not locate any records to justify the payments because Aggeus shut down in the wake of the indictment. This included charges of falsifying patient medical files. Blue Cross asked the Centers for Medicare & Medicaid Services for a “hardship” exemption to a strict requirement that health plans retain these files in the event of an audit.

CMS granted the request and auditors removed the 11 patients from a random sample of 201 Blue Cross plan members whose records were reviewed.

A review of 90 government audits, released exclusively to KHN in response to a Freedom of Information Act lawsuit, reveals that Blue Cross and a number of other health insurers issuing Medicare Advantage plans have tried to sidestep regulations requiring them to document medical conditions the government paid them to treat.

The audits, the most recent ones the agency has completed, sought to validate payments to Medicare Advantage health plans for 2011 through 2013.

This is not some new occurrence as it appears to be implied in the NPR article and as KHN reports. This has been going on for years. It has been reported by Kip Sullivan over a long period of time. I have reported on this issue also at Angry Bear. Commercial Medicare Advantage Plans have been side stepping the issue of overcharges for years.

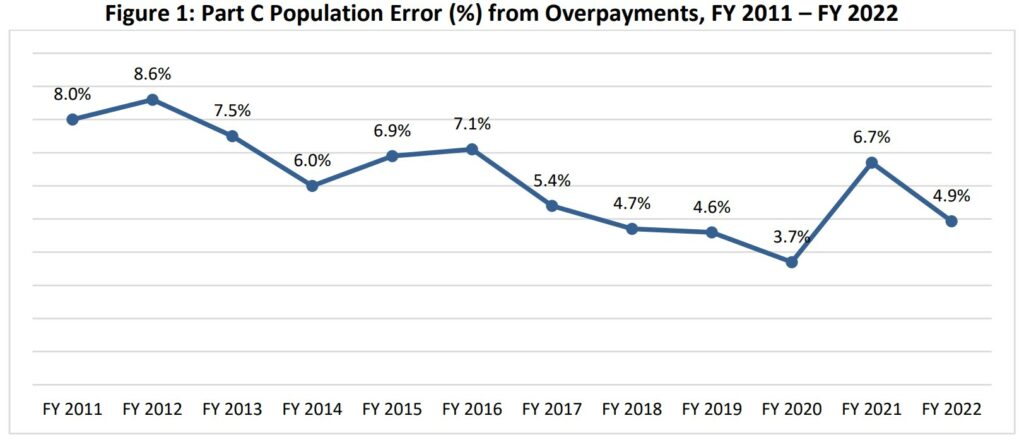

Overpayments for 2020 were in excess of $12 billion as shown in Table 1 below. CMS has not been able to recoup the money. And the government is pushing more people into Medicare Advantage plans out of FFS Medicare. I have been careful not to get caught up in the trap.

First some explanation, then some numbers, and finally how CMS is reporting the issues. Still no recouping of overpayments . . .

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private “commercial” companies approved by Medicare.

Medicare Advantage Plans provides all of Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most plans also include Medicare prescription drug coverage (Part D).

Medicare pays a fixed amount for your care every month to commercial companies offering Medicare Advantage Plans. These companies follow the rules set by Medicare. Each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services. You may need a referral to see a specialist. Or set rules to go to only doctors, facilities, or suppliers belonging to the plan for non‑emergency or non-urgent care). The rules can change each year.

AB: As far as following rules set by CMS Medicare, the following of the rules has been problematic.

~~~~~~~~

“Part C Improper Payment Measure (Part C IPM) Fiscal Year 2022 (FY 2022) Payment Error Rate Results,” CMS

For fiscal year 2022, CMS reported an Improper Payment Measurement (IPM) for the Part C program based on calendar year 2020 (CY 2020) payments. The CY 2020 Part C IPM payment error rate of 5.42% is not comparable to prior years because of refined policy and methodology enhancements that CMS implemented, as described below.

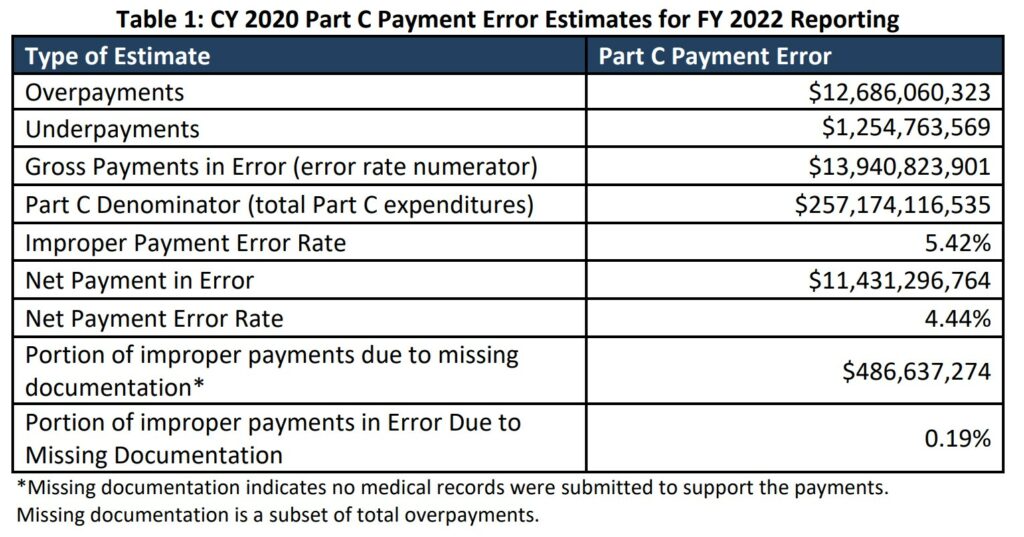

The CY 2020 estimated gross payment error for Part C is approximately $13.94 billion and the estimated net payment error is approximately $11.43 billion. Table 1 presents the CY 2020 Part C Payment Error Estimate results.

Based on each calendar year, CMS reports payments to Part C in the Improper Payment Measurement (IPM) Part C program. Table 1 reflects all payments for year 2020 as reported in 2022.

Total payments in error of ~$13. 9 billion of which ~$12.7 billion are overpayments.

CMS finalized its policy (2022) regarding treatment of spontaneous “additionals” in the improper payment rate calculation. Diagnoses that were not submitted to the United States (U.S.) Department of Health and Human Services (HHS) for payment have been excluded from the payment error calculation to get a true measure of payment error. In previous years, these potential payments were reflected in the under-payment rate and overall payment error calculation; however, including the spontaneous “additionals” in the gross underpayment portion resulted in an overstatement of the overall improper payment rate. The implemented policy for FY 2022 contributed to a decrease in the projected Part C improper payment rate, representing a new baseline improper payment rate for Part C and is not directly comparable with prior reporting years. Moreover, FY 2021 also represented a baseline due to various methodology changes, most significantly, a refined denominator calculation.

Findings on Overpayments

When Medicare Advantage (MA) Organizations report diagnoses to the CMS Encounter Data System (EDS) or the Risk Adjustment Processing System (RAPS) for payment, CMS uses the CMS Hierarchical Condition Category (CMS-HCC) Risk Adjustment model to assign CMS-HCCs and calculate a risk score for each enrollee.

Overpayments occur when CMS-HCCs originally reported to EDS or the RAPS for payment are not supported by the medical record or are identified during medical record review as lower manifestations within the disease hierarchies of the CMS-HCC risk adjustment model. Overpayments also reflect instances when missing or insufficient documentation was provided to validate the CMS-HCC.

The primary overpayment category of FY 2022 Medicare Part C IPM consists of medical record

discrepancies (4.74 percent) and a smaller portion of unknown payments resulting from missing or insufficient documentation to determine whether payment was proper or improper (0.19 percent).

Findings on Underpayments

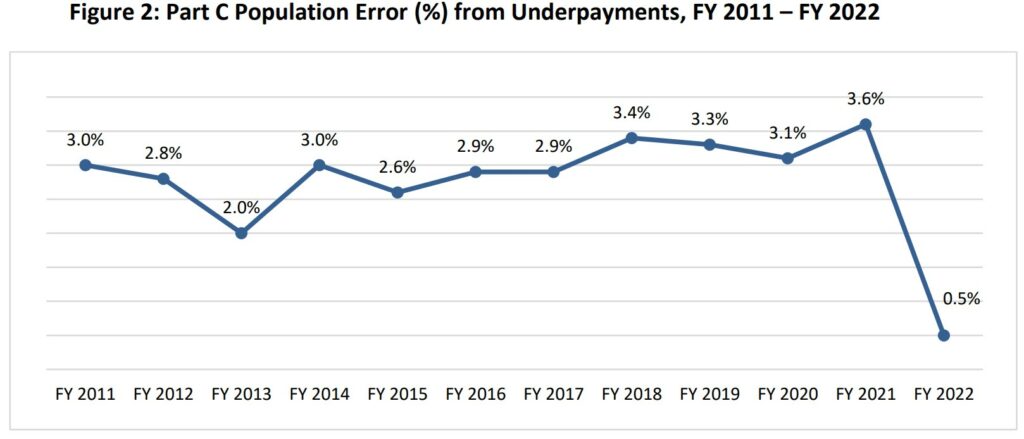

Underpayments occur when CMS-HCCs of higher manifestations of the audited CMS-HCCs, in the same disease hierarchies of the CMS-HCC risk adjustment model, are identified during medical record review. The underpayments category of FY 2022 Medicare Part C IPM consists of medical record discrepancies (0.49 percent in underpayments).

Figure 2 presents the percentage of the payment error attributed to underpayment for FY 2011 through FY 2022

I am not sure what will come out of this report by NPR and KHN. Overcharges by MA plans have been going on for years. Little as been done by Congress.

Biden’s MA plans have been to force more people into Medicare Advantage plans without a choice. This is reminiscent of student loans and subsequent relief. Joe Biden blocked relief deliberately since 1990, And his attempts to grant relief are half-hearted which leads me to believe none will come.

Resources and Information

“Medicare Advantage plans overcharged Medicare by millions,” Health News : NPR

“Medicare Part C Improper Payment Measurement Program,” (cms.gov), Findings and results

“Chapter 12 MedPAC March 2022,” Report to the Congress

“What is Medicare Part C?” HHS.gov