Have Medicare Advantage plans been over coding? According the MedPac 2022 report for year 2020 they have been. The funds of which come out of Medicare funding. The amount of which was an ~ billion for 2020 alone. But it is not just 2020, “Medicare Advantage has Overcharged FFS Medicare by Billions for Years,” Angry Bear. “Aggregate Medicare payments to Medicare Advantage plans” have never been lower than FFS Medicare spending. MedPac 2022 Chapter 12, Page 439 “Coding differences increased payments to MA plans by billion in 2020.” “Medicare Advantage Overpayments, An unsustainable future, Kip Sullivan. If Congress is finally going to do something, it is late to the issue and it is about time. Biden Plan to Cut Billions in Medicare Fraud

Topics:

run75441 considers the following as important: Healthcare, law, Medicare Fraud by Advantage Plans, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Have Medicare Advantage plans been over coding? According the MedPac 2022 report for year 2020 they have been. The funds of which come out of Medicare funding. The amount of which was an ~$12 billion for 2020 alone. But it is not just 2020, “Medicare Advantage has Overcharged FFS Medicare by Billions for Years,” Angry Bear. “Aggregate Medicare payments to Medicare Advantage plans” have never been lower than FFS Medicare spending. MedPac 2022 Chapter 12, Page 439 “Coding differences increased payments to MA plans by $12 billion in 2020.” “Medicare Advantage Overpayments, An unsustainable future, Kip Sullivan.

If Congress is finally going to do something, it is late to the issue and it is about time.

Biden Plan to Cut Billions in Medicare Fraud Ignites Lobbying Frenzy, The New York Times, (nytimes.com). Reed Abelson and Margot Sanger-Katz. Aatish Bhatia contributed reporting.

An NYT article makes some points which Kip Sullivan and others have been discussing for years.

Super Bowl ad. In a conversation, one bowler asked another across the lanes.

“How’s the knee?”

The conversation focused on a Biden administration proposal that one bowler warned another would “cut Medicare Advantage.”

“Somebody in Washington is smarter than that.”

The friend responded, before a narrator urged viewers to call the White House to voice their displeasure.

The multimillion dollar ad buy is part of an aggressive campaign by the commercial health insurance industry and its allies to stop the Biden proposal. It would significantly lower payments by billions of dollars a year to Medicare Advantage. The private commercial healthcare plans covering about half of the government’s health program for older Americans.

The change in payment formulas is an effort, Biden administration officials say, to tackle widespread abuses and fraud in the increasingly popular private programs. In the last decade, reams of evidence uncovered in lawsuits and audits revealed systematic overbilling of the government. A final decision on the payments is expected shortly. It is one of a series of tough new rules aimed at reining in the industry. The changes fit into a broader effort by the White House to shore up the Medicare trust fund.

Without reforms, taxpayers will spend about $25 billion more next year in “excess” payments to the private plans, according to the nonpartisan research group Medicare Payment Advisory Commission adviseimg Congress.

The proposed changes unleashed an extensive and noisy opposition front, with lobbyists and insurance executives flooding Capitol Hill to engage in their fiercest fight in years. The largest insurers, including UnitedHealth Group and Humana, are among the most vocal according to congressional staff. UnitedHealth’s chief executive is pressing his company’s case in person. Doctors’ groups, including the American Medical Association, have also voiced their opposition.

“They are pouring buckets of money into this,” said Mark Miller, the former executive director of MedPAC, who is now the executive vice president of health care at Arnold Ventures, a research and advocacy group. Supporters of the restrictions have begun spending money to counter the objections.

The insurers say the new rule would harm the medical care of millions, particularly in vulnerable communities.

The change would force the companies to reduce benefits or increase premiums for Medicare beneficiaries, they say, with less money available for doctors to treat conditions like diabetes and depression.

Former Medicare official now an executive with Optum, a subsidiary of UnitedHealth owning one of the nation’s largest physician groups. Dr. Patrick Conway . . .

The changes are “stripping funding from prevention and early disease,. As you lower payments for those conditions, you are going to have direct impact on patients.”

Since the proposal was tucked deep in a routine document and published with little fanfare in early February, Medicare officials have been inundated with more than 15,000 comment letters for and against the policies, and roughly two-thirds included identical phrases from form letters. Insurers used television commercials and other strategies to urge Medicare Advantage customers to contact their lawmakers. The effort generated about 142,000 calls or letters to protest the changes, according to the Better Medicare Alliance, one of the lobbying groups involved and the one behind the bowling commercial.

The showdown underscores how important and lucrative Medicare Advantage has become to insurers and doctors’ groups that are paid by the federal government to care for older Americans. Roughly $400 billion in taxpayer money went to these private plans last year. Profits on Medicare Advantage plans are at least double what insurers earn from other kinds of policies, according to a recent analysis by the Kaiser Family Foundation.

To the surprise of many in the industry, leaders in Congress have not stepped forward to vigorously defend the private plans.

In interviews this month, top administration health officials said they would not be swayed by the loud outcry from the industry.

Dr. Meena Seshamani, Medicare’s top official . . .

“We need strong oversight of this program,” adding the agency was committed to “holding the industry accountable for gaming the system.”

Stacy Sanders, an adviser to Xavier Becerra, the Health and Human Services secretary, said:

“We will not be deterred by industry hacks and deep-pocketed disinformation campaigns.”

Growing evidence of abuse

Older Americans flocking to Medicare Advantage plans are finding many policies offer lower premiums and more benefits than the traditional government program.

The insurers receive a flat rate for every person they sign up and get bonuses for those with serious health conditions, because their medical care typically costs more.

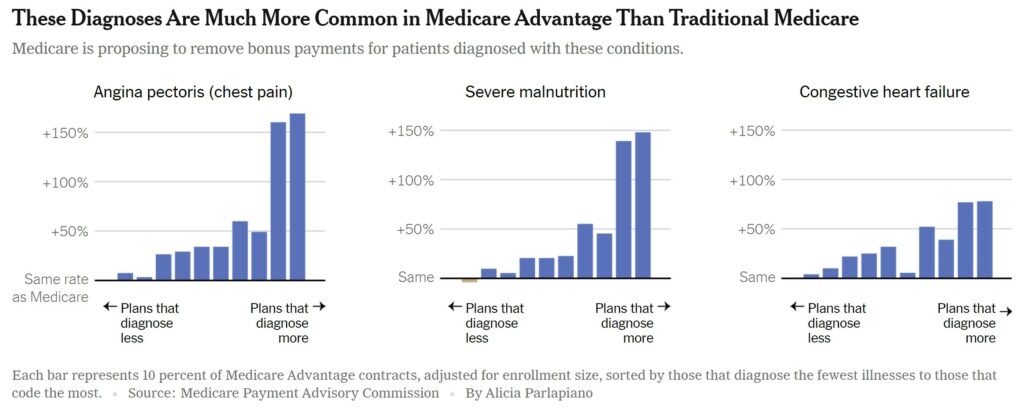

But numerous studies from academic researchers, government watchdog agencies and federal fraud prosecutions underscore how the insurers are manipulating the system by attaching as many diagnosis codes as possible to their patients’ records to harvest these bonus payments.

Four of the largest five insurers have either settled or are currently facing lawsuits claiming fraudulent coding. Similar lawsuits have also been brought against an array of smaller health plans.

Medicare officials propose eliminating more than 2,000 specific diagnosis codes or about one-fifth of all codes from the payment formula for these private plans. Regulators homed in on diagnoses not associated with more medical care. A handful of diagnoses were removed because they were prone to abuse by the private plans.

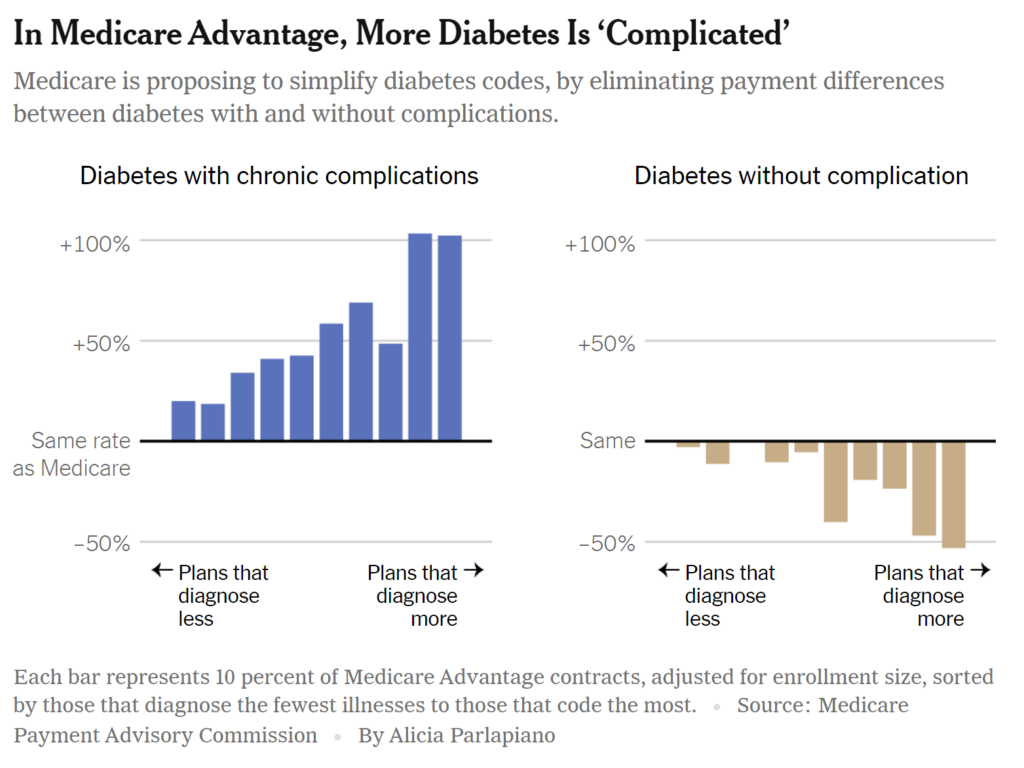

Insurers have focused their objections on three common illnesses for which codes would be removed: mild depression; vascular disease; and “diabetes with complications.”

A group of 19 policy experts who support the changes, led by two former Medicare officials, compared the private plans’ “diagnoses” of these particular illnesses against those in traditional Medicare. For example, some Medicare Advantage plans from UnitedHealth reported that half of their patients had vascular disease, in contrast with just 14 percent in the basic government program. UnitedHealth said the study highlighted how its plans provided better care.

Fraud lawsuits brought against the companies also suggest that the plans were deliberately inflating the codes under review by Medicare officials.

In its lawsuit against Cigna last October, for example, the Justice Department described an insurance executive’s email that referred to diabetes with complications; depression; and vascular disease as

“the golden nuggets we are looking for.”

In Medicare Advantage, More Diabetes Is ‘Complicated’

Medicare is proposing to simplify diabetes codes, by eliminating payment differences between diabetes with and without complications.

The insurers are contesting the allegations in court.

Not all of the plans oppose Medicare’s overhaul of the payment regimen. The Alliance of Community Health Plans, which represents nonprofit insurers, supports the Biden administration’s move on this issue, said Ceci Connolly, the group’s chief executive. In its comment letter, the group asked for a one-year delay.

And at least one corporate chief executive, Bruce Broussard of Humana, recently told investors that Medicare’s proposal might not have much impact. At a conference, he said the company usually performs well in years when Medicare is less generous, according to Modern Healthcare.

“I feel that 2024 will be that way.”

Weakening support in Congress

Medicare Advantage plans are so popular that these changes could affect many people. The widely publicized lawsuits, audits and reviews have influenced the views of past supporters in Congress. Last year, nearly 80 percent of the members of the House of Representatives signed a letter to Medicare urging its officials to “provide a stable rate and policy environment for Medicare Advantage.”

But this year, support among lawmakers appears to have weakened, despite the avalanche of constituent calls. So many legislators would have dropped from the House letter that the insurance industry has declined to circulate one, several congressional aides said. That shift came in part from increasing awareness of overbilling, but also because of concerns about deceptive marketing and denials of care, they said

Representative Pramila Jayapal, Democrat of Washington, organized a letter this year requesting tougher regulation. It was endorsed by some of the very same House Democrats who had supported last year’s industry letter. “So many people just signed on because they thought, ‘Oh, my constituents are all on Medicare Advantage,’” Ms. Jayapal said. “Members are hearing from constituents because they are not happy, and on the inside we did all this deep education to counter all the lobbyists.”

A few Republican lawmakers have raised the proposal to accuse the president of cutting Medicare. The overall Republican response to the rule has been muted, however, with several requests for more information but few attacks on the approach.

Mary Beth Donahue, the chief executive of the Better Medicare Alliance, said the group had been very active in its efforts to educate lawmakers on the complex change, given the compressed time frame. She added . . .

“The changes are dense.”

‘A hammer to a snail’

Critics of the new Medicare approach argue that the complex change would have unintended consequences counter to other Biden administration priorities. They warn it would disproportionately reduce funding for coverage that serves minority communities and the poorest Medicare patients.

A recent analysis from the actuarial firm Milliman, commissioned by UnitedHealth, showed that the change was likely to have a larger effect on plans that served patients in those circumstances.

In comment letters, several insurance and physician groups argued that the reduced payments would make it harder to provide preventive care for sicker patients.

The chief medical officer at VillageMD, and a developer of primary care clinics, Dr. Clive Fields . . .

“It feels like this is a little bit of a hammer to a snail.”

He said he was aware that some plans were engaged in fraudulent overcoding, but said the changes to the formula would mean fewer resources to care for patients with the diagnoses that were removed from the formula.

A growing number of doctors’ practices, including those with VillageMD, have developed relationships with insurers in which they are paid a percentage of premiums, and several doctors’ groups oppose the Medicare proposal.

The former administrator of the Centers for Medicare and Medicaid Services, Dr. Donald Berwick said allowing private plans to overbill for extra diagnoses was not an appropriate way to finance health services for needy populations. Adding . . .

“It’s paying a very high toll in a very opaque way to get some funds to some people who need more support. It’s the wrong tool to solve that problem.”

Dr. Seshamani went further, noting that because Medicare found that the diagnoses were not associated with additional treatment, she did not think the change would have any disproportionate effect on sicker patients:

“We are not proposing any policies that would harm vulnerable beneficiaries.”