This is a brief and targeted commentary by EPI’s Josh Bivens to which I have added input. The Fed has been flailing away at the economy in the belief Labor is the issue. Josh contends, product or profit markups have been a major issue. He does provide a foundation for his posit. I look to the supply chain issue(s) as the basis for the higher profits. I experienced similar in getting componentry in 2008-2010. With less supply and a lengthen (and silly lead times) lead time, companies increased prices not due to cost but because they could on items like semiconductors. I was the guy on th other end of the phone listening to the excuse for a higher price. They raised prices because they could and this component was specified by automotive. The

Topics:

run75441 considers the following as important: corporate profits, Economic Policy Institute, EPI, Inflation growth, Josh Bivens, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

This is a brief and targeted commentary by EPI’s Josh Bivens to which I have added input. The Fed has been flailing away at the economy in the belief Labor is the issue. Josh contends, product or profit markups have been a major issue. He does provide a foundation for his posit.

I look to the supply chain issue(s) as the basis for the higher profits. I experienced similar in getting componentry in 2008-2010. With less supply and a lengthen (and silly lead times) lead time, companies increased prices not due to cost but because they could on items like semiconductors. I was the guy on th other end of the phone listening to the excuse for a higher price. They raised prices because they could and this component was specified by automotive. The manufacturer knew it and we knew it.

It took a while for the market to normalize. I believe we will see similar shortages before a return to normalcy in today’s environment.

I do not make a major case for supply chain here. Instead I concentrate on Josh’s points.

Even with today’s slowdown, profit growth remains a big driver of inflation in recent years, Economic Policy Institute, Josh Bivens.

The opening comment by Josh . . . “Corporate profits have contributed to more than a third of price growth.”

He continues by stating the actual economic cost of inflation is often hard to identify. One might think that it’s obvious that if inflation rises from 0% to 5% then the purchasing power of “real” incomes (nominal incomes adjusted for inflation) throughout the economy has fallen by 5%.

It is not right, or at the least it is not right without some further thought of whose income has fallen. The “circular flow” diagram in chapter one of most macroeconomic textbooks highlights profoundly:

One person’s cost is another person’s income.

So, when egg prices rise by 30%, the additional money spent by shoppers does not disappear into thin air. Instead, it lands someplace. With eggs, the someone could be in a chicken farmers’ income, or the middle-men brokers profits, or grocery stores profits.

Inflation can be driven mostly by incomes in society. It rises at approximately the same pace for all. In such a case, inflation is distributionally neutral and there is also no “real” cost. If inflation accelerates from 0% to 4%, and nominal wage growth accelerates from 2% to 6%; real wages have not been harmed. The inflation since 2021 has had profound distributional consequences. Prices and incomes for low-wage workers, middle-wage workers, high-wage workers, and profits have not moved in lockstep but have seen very different rates of growth.

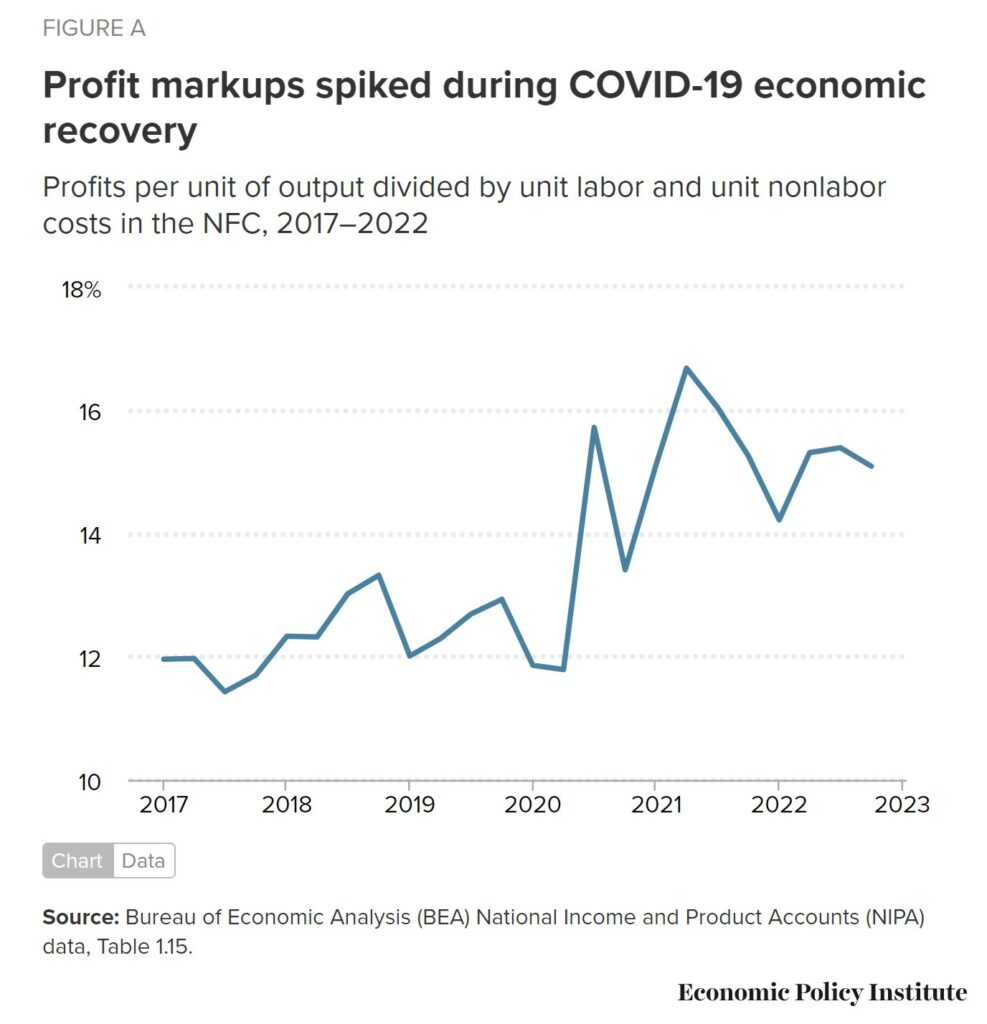

Since 2021 profits have started and sustained inflation. Figure A below shows one measure of profit “mark-ups” in the non-financial corporate (NFC) sector of the U.S. economy. We look at this sector because it has rich and timely data coverage. As I know them, mark-ups are essentially profits per unit of output divided by labor and non-labor costs.

When profit markups rise, the result is increasing prices for consumers (inflation). The very large spike in the beginning quarters of the COVID-19 recovery is clear. Since then, mark-ups have decreases little, but remain elevated relative to historic norms. There was hope by many the high mark-ups would come down providing more relief from too-high inflation. It has yet to have an impact.

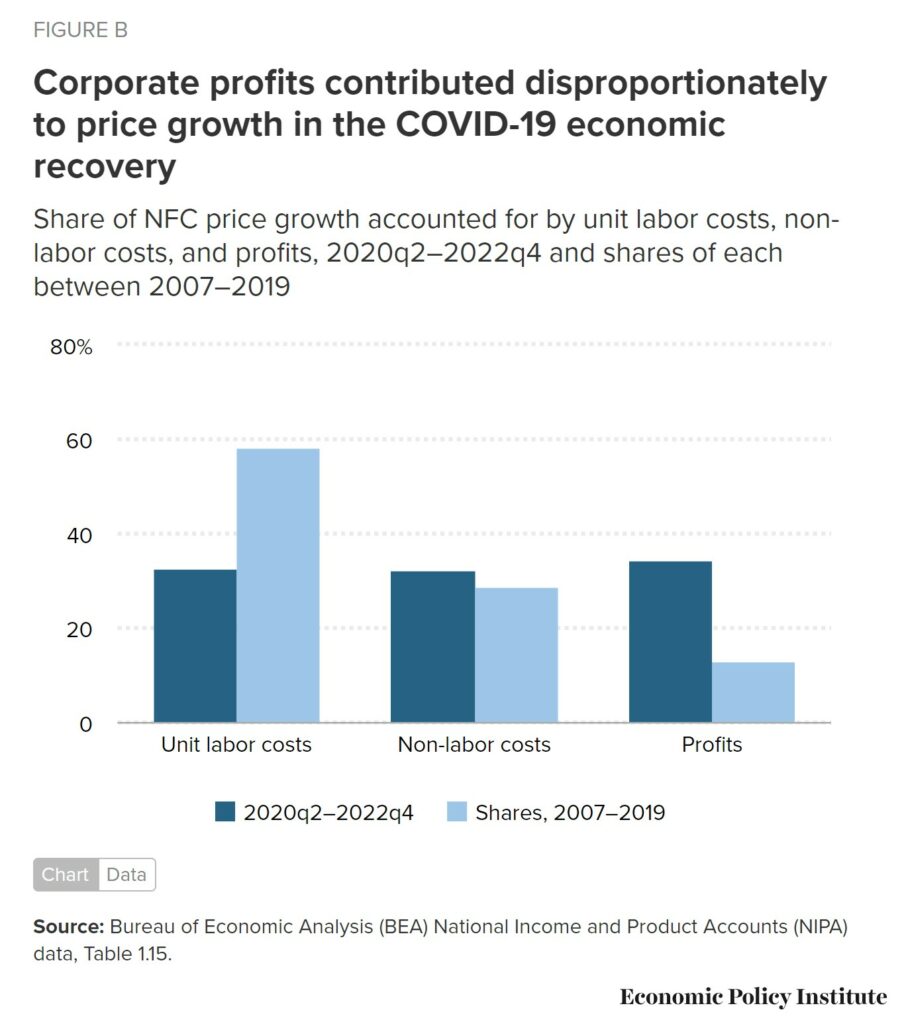

Figure B shows the contribution of profits, labor costs, and nonlabor costs to growth in non-financial corporate (NFC) prices since the COVID-19 recovery began (second quarter of 2020). Measuring since the last business cycle peak (the fourth quarter of 2019) does not change this story radically.

Normally, corporate profits contribute ~13% to prices. Since the second quarter of 2020, they have contributed more than a third of price growth. This is more than twice as much as they normally do. The contribution was larger in previous quarters. The slight decline in mark-ups shown in Figure A has put slight downward pressure on inflation in recent quarters. There is a long way to go before profits are back to normal.

What extreme profit bias of recent inflation means for economic policymakers is relatively complex. The Economic Policy Institute does provide some overview of these issues here. The most important takeaway being the measures aimed at dousing any presumed inflationary overheating in the labor market are absolutely not addressing the key drivers of inflation. Corporate profits being one and supply chain issues still being another belief.