From C. P. Chandrasekhar and Jayati Ghosh It is more than a year since China, reportedly in retaliation to US-driven restrictions on exports of advanced semiconductors and related manufacturing equipment, imposed export controls on two crucial materials—germanium and gallium—that enter into the production of semiconductors and military and communications equipment (advanced microprocessors, fibre-optic products and night-vision goggles). Imposed in the name of safeguarding “national security and interests”, the restrictions on the exports of these materials from China were viewed with alarm. China accounts for 98 per cent of global production of gallium and for two thirds of imported supplies of germanium in the US market. If these restrictions, requiring prior permission for export

Topics:

Editor considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

from C. P. Chandrasekhar and Jayati Ghosh

It is more than a year since China, reportedly in retaliation to US-driven restrictions on exports of advanced semiconductors and related manufacturing equipment, imposed export controls on two crucial materials—germanium and gallium—that enter into the production of semiconductors and military and communications equipment (advanced microprocessors, fibre-optic products and night-vision goggles).

Imposed in the name of safeguarding “national security and interests”, the restrictions on the exports of these materials from China were viewed with alarm. China accounts for 98 per cent of global production of gallium and for two thirds of imported supplies of germanium in the US market. If these restrictions, requiring prior permission for export based on reporting of likely end uses, results in a shortage of these materials, it could affect the production of strategically important products. Correcting for a shortfall in supply by diversifying to new sources is difficult and definitely time consuming. Seen in the context of the fact that China dominates production in a host of critical minerals the restrictions appeared to be an ominous development.

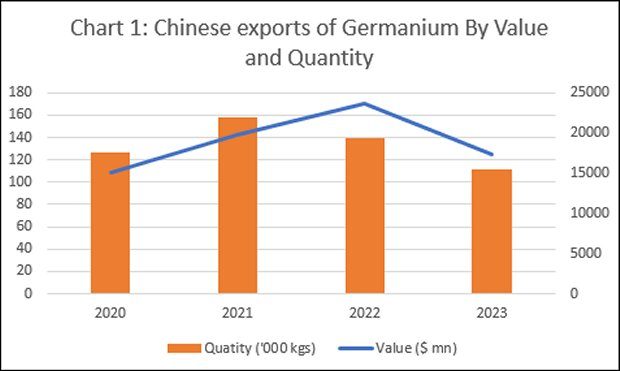

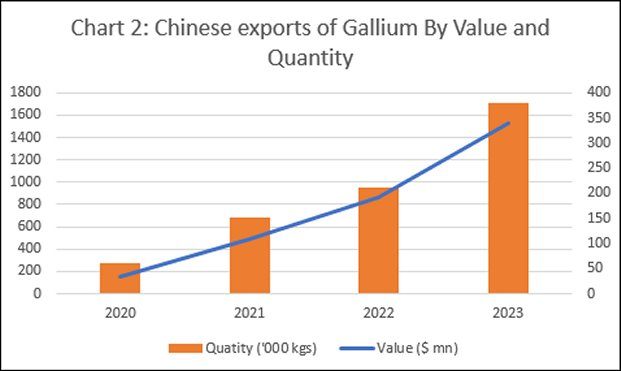

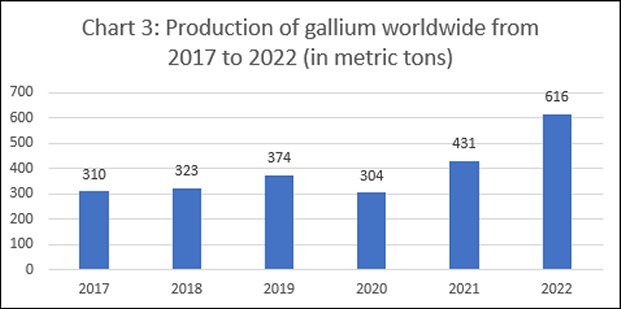

Over the last year, however, the worst fears spread by China baiters have not really materialized. Chinese exports of gallium have risen from 274,000 kgs in 202 to 956,000 kgs in 2022 and further to 1.71 million kgs in 2023, when the restrictions were imposed. The situation with respect to germanium seems less straight forward, with Chinese exports having fallen from 19.4 million kgs in 2022 to 15.4 million kgs in 2023. But the decline in Chinese exports had begun well before sanctions year 2023, having fallen from 219.1 million kgs in 2021. (Charts 1 and 2). The sources of germanium imports are more diversified, and it is possible that some adjustment in supply sources was responsible for the decline of Chinese exports rather than the export restrictions imposed in China. In sum, there is no evidence that China’s action has triggered any major disruption in the global supply chain for these two inputs. In fact, available figures suggest that global production prior to 2023 was rising to accommodate increases in demand (Chart 3).

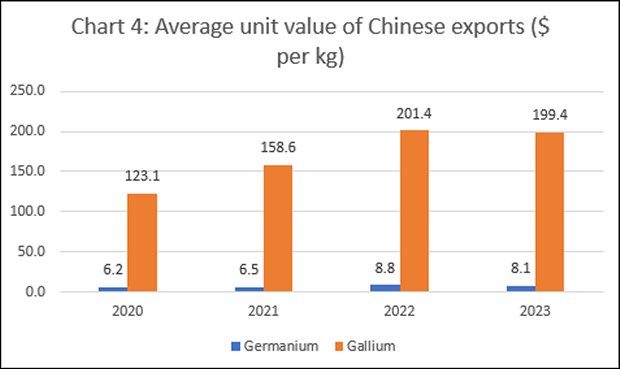

Yet, there seems to have been a revival of concern among global observers that China’s actions have begun to hurt. The principal reason for this is the price of the materials as available in the market. Though the exact source and version of the minerals being referred to are unclear, the Financial Times claims that prices have almost doubled over the past year. However, even in this case, the price on the Chinese side does not seem to be the issue. The average unit value of the broad category of ‘germanium’ exports (HS Code 282560: Germanium oxides and zirconium dioxides) from China which rose from $6.5 a kg in 2021 to $8.8 a kg in 2022, actually came down to $8.1 a kg in 2023. The export unit value for gallium (HS Code 811291: Gallium, hafnium, indium, niobium, rhenium or thall) too recorded a spike in 2022 (before the restrictions) and remained stable in 2023. (Chart 4). The real problem appears to be the price of these materials as delivered in global markets. Figures from Argus reported by the Financial Times point to a sharp divergence in the airport price in Europe and that in China between the last quarter of 2023 (after the restrictions) and the third quarter of 2024. Chinese prices have started to rise only in the third quarter of 2024. Clearly, as of now global trading firms seem to be the beneficiaries of the surge in prices, and it is their speculative activity rather than an actual supply shortfall that seems to explain the spike.

These firms are possibly speculating on the future trade in these commodities given the longer-term implications of any stand-off between the US and China. Those implications in turn are the result of what globalization has done to global production chains. Even before the wave of trade and foreign capital flow liberalization beginning in the 1980s, technological changes had prepared the ground for the emergence of truly international production. Those changes, hinging in particular on the microelectronics revolution, had allowed for the fragmentation of production processes as well created the conditions where much of the operations of an international firm operating worldwide could be supervised and managed centrally. Data transfer was cheap and instantaneous, and communication costs collapsed. Transportation costs had fallen.

However, the emergence of truly international production chains depended on the wave of liberalization which converted any location across the world into a potential site for world market production. Liberalization facilitated the globalization of fragmented production by making the cross-border movements of goods and services and capital easy.

Firms controlling intellectual property rights moved production to the lowest cost and convenient locations or subcontracted production to fabrication or assembly units, while shifting profits to tax havens. In the fashioning of these production chains the dominant international firms stayed out of areas that were messy to handle or yielded low profit shares, leaving it to subordinate firms in the value chain to undertake those activities. Those ‘subordinate firms’ could be of any nationality and could even be involved in segments of the value chain that were crucial for its functioning, so long as that was the best cost option.

Critical minerals were one set of such commodities and Chinese firms turned out to be the ‘subordinate’ ones that came to control these crucial fragments in the production chain. This did not seem to matter as long as production was adequate, supply consistent and prices low, facilitating the centralization of profits in the knowledge centres of the different chains. But if that unequal arrangement in the distribution of production and profits was disrupted, the sanguine satisfaction with the benefits of globalization had to give. Capitalist globalization has within its structure the sources of its own destruction.

What happened when China decided to react to US sanctions with its own export restrictions is that the fragility of those chains and those profits were exposed. The result was fear and alarm. That psychological environment has allowed trading firms to hike prices even if supplies, however uncertain, were available at prices that were normal by historical standards. The consequence has been a return to the fear and alarm that had faded over a year. They may not be warranted by current supply circumstances. But they definitely are warranted by the fragile framework of globalization itself.