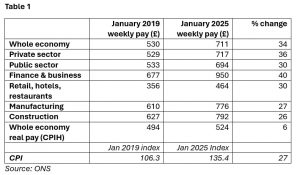

Today (Thursday), the Office for National Statistics published its monthly set of employment stats. While its Labour Force Survey has been under the cosh for some time for unreliability, the ONS’s data on average wage rates and changes retain their importance. The data – this time for January 2025 – covers average total pay, regular pay and bonus pay for the whole workforce. It also provides average wage data by broad sector.The ONS also publishes its estimate of ‘real pay’ after taking account of inflation – for this it uses its CPIH index (which by including some housing elements differs slightly from the more generally used Consumer Price Index, CPI).The Bank of England’s Monetary Policy Committee also announced, today, its decision to hold its Bank Rate unchanged at 4.5%. The MPC

Read More »Articles by Jeremy Smith

Feeling the pay pain

July 13, 2023May 2023. The UK economy struggles along, shedding another 0.1% of GDP. The ‘size’ of the economy, measured as GDP, is a fraction (0.7% to be precise) greater than in May 2019, 4 long years ago. It’s still smaller than in the second half of 2019. Even worse, average real pay (i.e. after allowing for CPI inflation) is a fraction lower than it was in 2019 – in May 209, £499, in May 2023, £497. But that average masks a great deal of variety, between those whose pay has kept up with inflation (and in some cases moved ahead of it), and those whose real pay has fallen sharply and dangerously. To be precise, it is those working in manufacturing and in the public sector whose average real pay has drastically fallen.In a couple of tables and charts, you can get a clear picture in the changes in the

Read More »Feeling the pay pain

July 13, 2023May 2023. The UK economy struggles along, shedding another 0.1% of GDP. The ‘size’ of the economy, measured as GDP, is a fraction (0.7% to be precise) greater than in May 2019, 4 long years ago. It’s still smaller than in the second half of 2019. Even worse, average real pay (i.e. after allowing for CPI inflation) is a fraction lower than it was in 2019 – in May 209, £499, in May 2023, £497. But that average masks a great deal of variety, between those whose pay has kept up with inflation (and in some cases moved ahead of it), and those whose real pay has fallen sharply and dangerously. To be precise, it is those working in manufacturing and in the public sector whose average real pay has drastically fallen.In a couple of tables and charts, you can get a clear picture in the changes in the

Read More »Feeling the pay pain

July 13, 2023May 2023. The UK economy struggles along, shedding another 0.1% of GDP. The ‘size’ of the economy, measured as GDP, is a fraction (0.7% to be precise) greater than in May 2019, 4 long years ago. It’s still smaller than in the second half of 2019. Even worse, average real pay (i.e. after allowing for CPI inflation) is a fraction lower than it was in 2019 – in May 209, £499, in May 2023, £497. But that average masks a great deal of variety, between those whose pay has kept up with inflation (and in some cases moved ahead of it), and those whose real pay has fallen sharply and dangerously. To be precise, it is those working in manufacturing and in the public sector whose average real pay has drastically fallen.

In a couple of tables and charts, you can get a clear picture in the changes in

The UK economy – stalled and unhealthy

May 16, 2023Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean.

[The Rime of the Ancient Mariner, Samuel Taylor Coleridge]

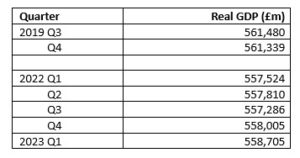

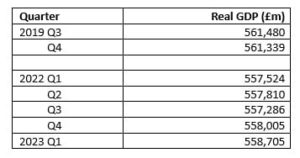

The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than in the same quarter a year ago.

The table below (which excludes the pandemic-affected years 2020 and 2021) gives the quarterly GDP figures (in £ millions, base year 2019) for Qs 3 and 4 of 2019, and all four quarters of 2022, as follows (source ONS):

Beneath the painted ocean, however, there are some

The UK economy – stalled and unhealthy

May 16, 2023Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean.[The Rime of the Ancient Mariner, Samuel Taylor Coleridge]The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than in the same quarter a year ago.The table below (which excludes the pandemic-affected years 2020 and 2021) gives the quarterly GDP figures (in £ millions, base year 2019) for Qs 3 and 4 of 2019, and all four quarters of 2022, as follows (source ONS):Beneath the painted ocean, however, there are some

Read More »The UK economy – stalled and unhealthy

May 16, 2023Day after day, day after day,We stuck, nor breath nor motion;As idle as a painted shipUpon a painted ocean.[The Rime of the Ancient Mariner, Samuel Taylor Coleridge]The UK economy remains stuck. Last Friday, the latest GDP numbers for the UK (first estimate for Q1 2023) from the Office for National Statistics (ONS) indicate that the UK economy is still a little shy of where it was back in late 2019, still down by 0.5% on Qs 3 and 4 of that year. The economy in Q1 was just 0.2% larger than in the same quarter a year ago.The table below (which excludes the pandemic-affected years 2020 and 2021) gives the quarterly GDP figures (in £ millions, base year 2019) for Qs 3 and 4 of 2019, and all four quarters of 2022, as follows (source ONS):Beneath the painted ocean, however, there are some

Read More »UK – bottom of the international economic league table

April 17, 2023Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »UK – bottom of the international economic league table

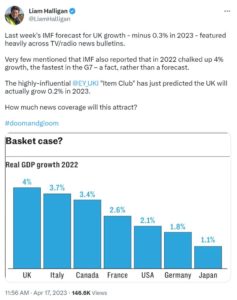

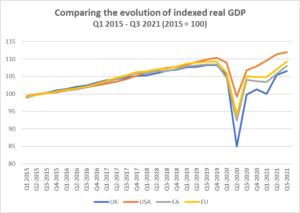

April 17, 2023There are still a lot of arguments on Twitter as to whether the UK is doing ‘better’ or ‘worse’ in terms of GDP than, in particular, our EU neighbours, and the G7 in general. (Yes we know GDP is a wholly inadequate measure, but it’s still the common currency in our political debate, and we don’t want to leave the field to the false claims of others).

Today, dear old Liam Halligan, now to be found wandering the arid deserts of GB News and the Daily Torygraph, has valiantly tried to lift Brexiter morale with a statistically misleading tweet and chart:

Many are those who replied to Liam pointing out that the UK’s ‘chalked up’ performance in 2022 was wholly due to having fallen further GDP-wise than other countries in 2020 – something that Halligan knew very well already. Though

Read More »UK – bottom of the international economic league table

April 17, 2023Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »Settling the public sector pay disputes now – modest cost, big benefits

February 6, 2023Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached?Just before Christmas, Prime Minister Sunak told us“I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..”On 1st February, Mr Sunak’s Official Spokesman said“We want to have further talks with the unions. Some of these discussions have been constructive. We have to balance that against the need to be fair to all taxpayers, the majority of whom don’t work for the public sector.”So two distinct arguments from government – to settle the current year public sector pay disputes would (1)

Read More »Settling the public sector pay disputes now – modest cost, big benefits

February 6, 2023Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached?

Just before Christmas, Prime Minister Sunak told us

“I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..”

On 1st February, Mr Sunak’s Official Spokesman said

“We want to have further talks with the unions. Some of these discussions have been constructive. We have to balance that against the need to be fair to all taxpayers, the majority of whom don’t work for the public sector.”

So two distinct arguments from government – to settle the current year public sector pay disputes

Read More »Settling the public sector pay disputes now – modest cost, big benefits

February 6, 2023Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached?Just before Christmas, Prime Minister Sunak told us“I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..”On 1st February, Mr Sunak’s Official Spokesman said“We want to have further talks with the unions. Some of these discussions have been constructive. We have to balance that against the need to be fair to all taxpayers, the majority of whom don’t work for the public sector.”So two distinct arguments from government – to settle the current year public sector pay disputes would (1)

Read More »Changes in the UK labour market from 2019 to 2022 – our new report

August 3, 2022Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »Changes in the UK labour market from 2019 to 2022 – our new report

August 3, 2022Our new research report, published today, looks at the state of the UK’s labour market, based on the most recent data from the Office for National Statistics. It compares these recent data with those from 2019, and sometimes with earlier data. You can download the report here.

The report looks at a wide range of issues, including size of the workforce, the economically active and inactive, employees and self-employed, full and part-time workers. It also examines data on developments in nominal and ‘real’ (after allowing for inflation) pay. It shows that over a long period, the sector of the workforce whose pay has increased by far the most is the Finance & Business sector. The sectors that have relatively declined in pay are manufacturing, the public sector, and those in the ‘wholesale /

Changes in the UK labour market from 2019 to 2022 – our new report

August 3, 2022Policy Research in Macroeconomics (PRIME’s official name) is a company limited by guarantee, incorporated in England and Wales. It is company no. 07438334 and its registered office is at 11a Hatch Road, Pilgrims Hatch, Brentwood, Essex, CM15 9PU.We collect cookies on this website through web analytics. For more information, please read our Privacy Policy.

Read More »The UK’s public spending led recovery – before the cost-of-living deluge strikes

May 18, 2022In this article I look mainly at the UK’s GDP position. While the ONS first estimate for Q1 2022 shows that it is now 0.6% higher than the pre-pandemic peak in Q3 of 2019, this is entirely down to increased government consumption and investment, mainly health-related. But for this real-terms increase, the economy (measured in GDP) would be some 2% smaller now, even before the cost-of-living crisis hits us fully, and before government and Bank of England tighten fiscal and monetary policy simultaneously. In a second article, I will seek to analyse this week’s labour market statistics and their significance for policy.We’ve now had the UK’s GDP and labour market estimates from the Office for National Statistics for the first quarter (Q1) of 2022, plus the April stats for inflation, so we

Read More »The UK’s public spending led recovery – before the cost-of-living deluge strikes

May 18, 2022In this article I look mainly at the UK’s GDP position. While the ONS first estimate for Q1 2022 shows that it is now 0.6% higher than the pre-pandemic peak in Q3 of 2019, this is entirely down to increased government consumption and investment, mainly health-related. But for this real-terms increase, the economy (measured in GDP) would be some 2% smaller now, even before the cost-of-living crisis hits us fully, and before government and Bank of England tighten fiscal and monetary policy simultaneously. In a second article, I will seek to analyse this week’s labour market statistics and their significance for policy.We’ve now had the UK’s GDP and labour market estimates from the Office for National Statistics for the first quarter (Q1) of 2022, plus the April stats for inflation, so we

Read More »The UK’s public spending led recovery – before the cost-of-living deluge strikes

May 18, 2022In this article I look mainly at the UK’s GDP position. While the ONS first estimate for Q1 2022 shows that it is now 0.6% higher than the pre-pandemic peak in Q3 of 2019, this is entirely down to increased government consumption and investment, mainly health-related. But for this real-terms increase, the economy (measured in GDP) would be some 2% smaller now, even before the cost-of-living crisis hits us fully, and before government and Bank of England tighten fiscal and monetary policy simultaneously. In a second article, I will seek to analyse this week’s labour market statistics and their significance for policy.

We’ve now had the UK’s GDP and labour market estimates from the Office for National Statistics for the first quarter (Q1) of 2022, plus the April stats for inflation, so we

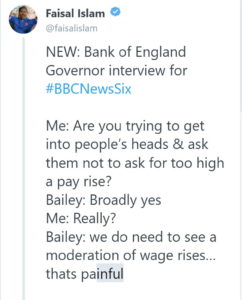

Inflation and pay – Doing the wrong Something

February 6, 2022Many years ago, on family holiday in Wales, a problem arose when my father tried to turn our car and caravan around in an urban street. A man noted generally for his calmness, Dad had got out and started looking at whatever the problem was. My brother and I (ages 14 and 12) stayed in the back seat chatting away inconsequentially but, it seems, annoyingly. Suddenly, Dad’s patience broke – “GET OUT AND DO SOMETHING!” he boomed. Unaccustomed to such temper-induced imperatives, we leapt out into the street, examined the situation without having a clue what to do, and tried to look as though we were doing something helpful. Dad soon calmed down, and somehow the problem was resolved.Last Wednesday’s Bank of England Monetary Policy report and MP Committee decisions brought this old memory

Read More »Inflation and pay – Doing the wrong Something

February 6, 2022Many years ago, on family holiday in Wales, a problem arose when my father tried to turn our car and caravan around in an urban street. A man noted generally for his calmness, Dad had got out and started looking at whatever the problem was. My brother and I (ages 14 and 12) stayed in the back seat chatting away inconsequentially but, it seems, annoyingly.

Suddenly, Dad’s patience broke – “GET OUT AND DO SOMETHING!” he boomed. Unaccustomed to such temper-induced imperatives, we leapt out into the street, examined the situation without having a clue what to do, and tried to look as though we were doing something helpful. Dad soon calmed down, and somehow the problem was resolved.

Last Wednesday’s Bank of England Monetary Policy report and MP Committee decisions brought this old memory

Inflation and pay – Doing the wrong Something

February 6, 2022Many years ago, on family holiday in Wales, a problem arose when my father tried to turn our car and caravan around in an urban street. A man noted generally for his calmness, Dad had got out and started looking at whatever the problem was. My brother and I (ages 14 and 12) stayed in the back seat chatting away inconsequentially but, it seems, annoyingly. Suddenly, Dad’s patience broke – “GET OUT AND DO SOMETHING!” he boomed. Unaccustomed to such temper-induced imperatives, we leapt out into the street, examined the situation without having a clue what to do, and tried to look as though we were doing something helpful. Dad soon calmed down, and somehow the problem was resolved.Last Wednesday’s Bank of England Monetary Policy report and MP Committee decisions brought this old memory

Read More »(How far) has Brexit affected UK GDP?

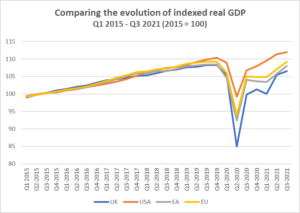

January 18, 2022It looks as if the UK’s GDP will have risen by a little over 7% in 2021, after a fall now estimated at 9.4% in 2020. (We await the Q4 data). It seems that – despite stronger November data – GDP in 2021 will come in below that of 2019, and maybe a tad less than 2018. Clearly COVID has played a major part, but is there also evidence of Brexit-induced slowdown in the mix?The “Conservative Home” website (among so many other right-wing propaganda outlets) tries hard to keep spirits up and the – ever-receding – vision of post-Brexit economic success alive. Here’s Harry Phibbs (3rd January):“The UK’s economy continued to grow – by 2.3 per cent in 2016, 2.1 per cent in 2017, 1.7 per cent in 2018, and 1.7 per cent in 2019. True, it fell in 2020, by 9.7 per cent – but that was due to the

Read More »(How far) has Brexit affected UK GDP?

January 18, 2022It looks as if the UK’s GDP will have risen by a little over 7% in 2021, after a fall now estimated at 9.4% in 2020. (We await the Q4 data). It seems that – despite stronger November data – GDP in 2021 will come in below that of 2019, and maybe a tad less than 2018. Clearly COVID has played a major part, but is there also evidence of Brexit-induced slowdown in the mix?

The “Conservative Home” website (among so many other right-wing propaganda outlets) tries hard to keep spirits up and the – ever-receding – vision of post-Brexit economic success alive. Here’s Harry Phibbs (3rd January):

“The UK’s economy continued to grow – by 2.3 per cent in 2016, 2.1 per cent in 2017, 1.7 per cent in 2018, and 1.7 per cent in 2019. True, it fell in 2020, by 9.7 per cent – but that was due to the

(How far) has Brexit affected UK GDP?

January 18, 2022It looks as if the UK’s GDP will have risen by a little over 7% in 2021, after a fall now estimated at 9.4% in 2020. (We await the Q4 data). It seems that – despite stronger November data – GDP in 2021 will come in below that of 2019, and maybe a tad less than 2018. Clearly COVID has played a major part, but is there also evidence of Brexit-induced slowdown in the mix?The “Conservative Home” website (among so many other right-wing propaganda outlets) tries hard to keep spirits up and the – ever-receding – vision of post-Brexit economic success alive. Here’s Harry Phibbs (3rd January):“The UK’s economy continued to grow – by 2.3 per cent in 2016, 2.1 per cent in 2017, 1.7 per cent in 2018, and 1.7 per cent in 2019. True, it fell in 2020, by 9.7 per cent – but that was due to the

Read More »Spend for recovery & green future, raising corporation tax is ok, & there are no bond vigilantes

March 3, 2021A couple of weeks ago, my old shower broke down, needing replacement. Chatting to bathroom-kitchen store manager, I learnt that business was brisk for them, especially the demand for new bathrooms. In fact, very brisk. Lots of people wanting new bathrooms for their holiday to-be-let homes, with higher rents in mind, as well as for actually lived-in homes. His order book is far stronger than in ‘normal’ times.For those who ‘have’, the times are not – financially speaking – bad at all.All this is mainly planned substitute spending; instead of overseas holidays, frequent eating out or public entertainment, many are choosing new home improvement projects.Finding the money is unlikely to be a problem for this segment of the population. In a recent speech, Bank of England Chief Economist Andy

Read More »Spend for recovery & green future, raising corporation tax is ok, & there are no bond vigilantes

March 3, 2021A couple of weeks ago, my old shower broke down, needing replacement. Chatting to bathroom-kitchen store manager, I learnt that business was brisk for them, especially the demand for new bathrooms. In fact, very brisk. Lots of people wanting new bathrooms for their holiday to-be-let homes, with higher rents in mind, as well as for actually lived-in homes. His order book is far stronger than in ‘normal’ times.For those who ‘have’, the times are not – financially speaking – bad at all.All this is mainly planned substitute spending; instead of overseas holidays, frequent eating out or public entertainment, many are choosing new home improvement projects.Finding the money is unlikely to be a problem for this segment of the population. In a recent speech, Bank of England Chief Economist Andy

Read More »Spend for recovery & green future, raising corporation tax is ok, & there are no bond vigilantes

March 3, 2021A couple of weeks ago, my old shower broke down, needing replacement. Chatting to bathroom-kitchen store manager, I learnt that business was brisk for them, especially the demand for new bathrooms. In fact, very brisk. Lots of people wanting new bathrooms for their holiday to-be-let homes, with higher rents in mind, as well as for actually lived-in homes. His order book is far stronger than in ‘normal’ times.

For those who ‘have’, the times are not – financially speaking – bad at all.

All this is mainly planned substitute spending; instead of overseas holidays, frequent eating out or public entertainment, many are choosing new home improvement projects.

Finding the money is unlikely to be a problem for this segment of the population. In a recent speech, Bank of England Chief Economist

Spend for recovery & green future, raising corporation tax is ok, & there are no bond vigilantes

March 3, 2021A couple of weeks ago, my old shower broke down, needing replacement. Chatting to bathroom-kitchen store manager, I learnt that business was brisk for them, especially the demand for new bathrooms. In fact, very brisk. Lots of people wanting new bathrooms for their holiday to-be-let homes, with higher rents in mind, as well as for actually lived-in homes. His order book is far stronger than in ‘normal’ times.

For those who ‘have’, the times are not – financially speaking – bad at all.

All this is mainly planned substitute spending; instead of overseas holidays, frequent eating out or public entertainment, many are choosing new home improvement projects.

Finding the money is unlikely to be a problem for this segment of the population. In a recent speech, Bank of England Chief Economist

GDP, Brexit & the trade winds of change

February 15, 2021In 2020, GDP per head of population fell, year on year, by a massive 10.5%. For me, that’s the take-away statistic from last Friday’s GDP-related ‘data dump’ by ONS. The level of GCDP per head (in real, inflation-adjusted terms) was £29,124. This was almost identical to the level in 2009 (£29,098), at the peak of the global financial crisis, and otherwise the lowest on record since 2003. Of course, the extent of the decline is heavily down to the government’s first lockdown restrictions, which fell mainly in Q2. But even the Q4 estimate of £7,456 per head (8.3% below Q4 2019) is still the lowest for that quarter since 2011 – and indeed lower than the Q4 figures for 2005-2007.‘Real’ GDP is estimated to have fallen 9.9% for the year 2020, which may have caused relief for government

Read More »