Many years ago, on family holiday in Wales, a problem arose when my father tried to turn our car and caravan around in an urban street. A man noted generally for his calmness, Dad had got out and started looking at whatever the problem was. My brother and I (ages 14 and 12) stayed in the back seat chatting away inconsequentially but, it seems, annoyingly. Suddenly, Dad’s patience broke – “GET OUT AND DO SOMETHING!” he boomed. Unaccustomed to such temper-induced imperatives, we leapt out into the street, examined the situation without having a clue what to do, and tried to look as though we were doing something helpful. Dad soon calmed down, and somehow the problem was resolved. Last Wednesday’s Bank of England Monetary Policy report and MP Committee decisions brought this old memory

Topics:

Jeremy Smith considers the following as important: Article, Inflation & Deflation, Monetary Policy, UK

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

T. Sabri Öncü writes Argentina’s Economic Shock Therapy: Assessing the Impact of Milei’s Austerity Policies and the Road Ahead

T. Sabri Öncü writes The Poverty of Neo-liberal Economics: Lessons from Türkiye’s ‘Unorthodox’ Central Banking Experiment

Matias Vernengo writes Very brief note on the Brazilian real and the fiscal package

Many years ago, on family holiday in Wales, a problem arose when my father tried to turn our car and caravan around in an urban street. A man noted generally for his calmness, Dad had got out and started looking at whatever the problem was. My brother and I (ages 14 and 12) stayed in the back seat chatting away inconsequentially but, it seems, annoyingly.

Suddenly, Dad’s patience broke – “GET OUT AND DO SOMETHING!” he boomed. Unaccustomed to such temper-induced imperatives, we leapt out into the street, examined the situation without having a clue what to do, and tried to look as though we were doing something helpful. Dad soon calmed down, and somehow the problem was resolved.

Last Wednesday’s Bank of England Monetary Policy report and MP Committee decisions brought this old memory back… like us 60 years ago, they felt they must respond to criticism by looking as though they were Doing Something, even if that Something made no positive contribution towards a solution.

The diagnosis – it’s global factors causing inflation

The problem for the Committee is that this is very much not a home-grown bout of inflation. Here’s how the February MPC report opens:

“Consumer price inflation has risen markedly in many countries including the UK. This mainly reflects the sharp increases in global energy and tradable goods prices, the latter due to global bottlenecks.” [My emphasis].

The report notes:

“UK CPI inflation rose to 5.4% in December, and in the Monetary Policy Committee’s (MPC’s) central projection peaks at 7¼% in April 2022. Three quarters of that further increase reflects higher contributions from energy and goods prices. UK domestic cost pressures are also rising and firms’ expectations for the increase in their selling prices are robust. Underlying wage growth has picked up and is expected to strengthen over 2022, given the recent tightening in the labour market and some temporary upward pressure from higher price inflation.”

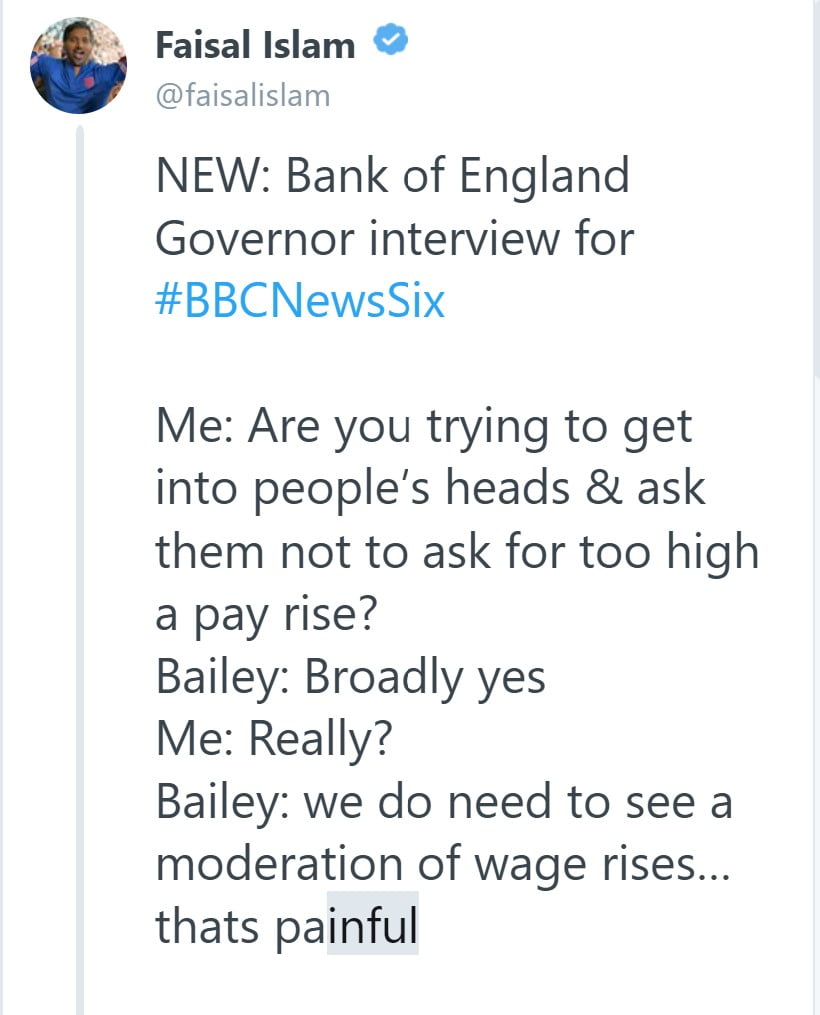

The Governor of the Bank of England, Andrew Bailey, confirmed to BBC journalist Faisal Islam that workers should not ask for “too high a pay rise”, and that “we do need to see a moderation of wage rises”.

There is a lack of any persuasive evidence from the Governor or MPC about the alleged causal contribution of ‘wage growth’ to future inflation. The MPC – as we have seen – acknowledge that three quarters of the coming increase in prices is externally driven. But they say:

“Informed by evidence from the Agents’ pay survey that wage settlements are expected to be much higher in 2022 than in 2021 (Section 3), underlying private sector wage growth is projected to rise somewhat further to around 4¾% over the next year, given the recent tightening in the labour market.”

The Labour Research Department confirms that settlements have risen in the latter part of 2021. They tell us that, from the Payline database of over 2,000 pay and conditions settlements,

“The median standard increase for January – December 2021 was 2.0% (1.0% in the public sector) – the median increase on the lowest pay rate was higher at 2.2%…

The median for the three months from October – December 2021 was 4.8% for both the standard increase and the increase on the lowest pay rate.”

We recall that annualised CPI inflation for December was 5.4%, up from 5.1% in November, so pay settlements, far from pricing in future inflation, are still running well below CPI inflation – let alone RPI (7.5% in December) which is the trade unions’ preferred index, and the one that is used to pay UK government bond-holders on inflation-linked bonds.

The other notable point on wages is that, from ONS data, the annual rates of increase of average (nominal) wages have been falling recently. Taking the “whole economy” average total weekly pay figures, the November 2021 annual increase was 3.5% (single month) compared to October 4.3% and September 4.7%. By comparison, the annual rate of increase in November 2019, before COVID and when inflation was extremely low, was 3.1%.

In their latest publication on average weekly earnings, ONS confirm that real pay is not growing:

“In real terms (adjusted for inflation), total and regular pay have shown minimal growth in September to November 2021, at 0.4% for total pay and 0.0% for regular pay; single-month growth in real average weekly earnings for November 2021 fell on the year for the first time since July 2020, at negative 0.9% for total pay and negative 1.0% for regular pay.”

Real wages and labour productivity

The MPC report also points to “labour shortages” as a factor:

“Labour shortages have also weighed on activity: contacts of the Bank’s Agents have cited these as one of the biggest constraints on growth. Surveys suggest that such shortages, while widespread, have been most acute in the accommodation and food, health, construction and manufacturing sectors. Business surveys suggest that labour shortages in the manufacturing sector were somewhat more acute relative to other countries.”

Now, one might expect that significant labour shortages within these sectors would lead to above-normal pay increases, yet this is not the case, at least on any scale likely to affect inflation or to justify restrictive monetary policy as a result. ONS data show that the sector with the lowest rate of wage increase in the last quarter is manufacturing – with average annual pay in October and November rising by 2.5% and 1.1% respectively. For construction workers, the annual increase in these two months was 3.7% and 3.8%. In retail, accommodation etc., which constitutes the sector with the lowest average pay, the annual rates of increase for October and November were a bit higher, at 3.8% and 4.8%.

In fact, the sector that has shown both the highest average level of pay, and the highest current rate of annual increase, is the finance and business services sector. The annual rates of increase in pay for October and November in this sector were 7.2% and 5.7%. Indeed, looking back over the last 5 years, nominal pay in the finance and business services sector has risen by 30%, far higher than any other sector shown by ONS – manufacturing pay has risen by just 11%, while the average increase over the 5 years is around 16%.

The Monetary Policy Report also correctly points out that increased government “consumption” was a material factor in keeping GDP rising in recent months:

“The output of the government and consumer-facing services sectors were above pre-pandemic levels, while the output of other services and the production sector were below.”

Public sector employees, however, can certainly not be seen as inflation-incubators, since the annual rate of increase of pay for this sector has been 3% or less since May; it was 2.6% in November.

The Tiger by the Tail

When still Chief Economist at the Bank of England, Andy Haldane was the first senior officer to raise the ‘spectre’ of unemployment, in a speech (26 February 2021) which he chose to call “Inflation: a tiger by the tail?”

He explained the problem facing the Bank (and the title to his speech), as he saw it:

“Friedrich von Hayek once referred to inflation control as akin to trying to catch a tiger by its tail. That metaphor seems apt today. For many years, the inflationary tiger slept. The combined effects of unprecedentedly large shocks, and unprecedentedly high degrees of policy support, have stirred it from its slumber. In this environment, the tiger-taming act facing central banks is a difficult and dangerous one.”

Haldane first examined reasons why inflation had, for a long time, been so “tame”, and identified “persisting effects of the global financial crisis”:

“The recovery from this crisis was significantly slower than expected, with the level of activity in the UK consistently undershooting expectations. This resulted in a larger and more persistent output gap, and hence a larger and longer downdraught on inflation, from the demand side of the economy than was anticipated. The same was true internationally… [The] level of activity in the UK lies very significantly below its level at the equivalent stage following the 1930s depression. The UK’s Great Recession was far-worse than the Great Depression.”

Turning to the supply-side of the economy, Haldane referred to “the rise of global trade and value chains which offer access to lower-cost inputs, lowering the price of final imported goods and services”, to demographic trends which have added to the economy’s labour supply and lowered wage costs, and to increased automation and labour flexibility in the jobs market.

Haldane then turned to the possible inflationary pressures that might occur post-COVID. In terms of demand, he noted that households (or rather, some of them) had built up large savings in many countries (including the UK) which if used rapidly by all, would create their own pressures. On the supply side, he surmised that some of the disinflationary “global forces” of recent decades were slowing and might even reverse. He also argued that the UK may be the victim of its own demographic trends, with the (till recently growing) workforce now declining.

He concluded, fairly,

“My judgement is that we might see a sharper and more sustained rise in UK inflation than expected, potentially overshooting its target for a more sustained period, as resurgent demand bumps up against constrained supply.”

But he then added:

“Inflation is the tiger whose tail central banks control”.

This claim – that central banks can always control the tail of the tiger – is highly questionable, in cases such as now, unless central banks, acting together, are willing to ‘do a Volcker’, to raise interest rates so far that a deep recession follows, with mass unemployment, as in the early 1980s. For sure, the Bank of England alone has no chance of halting inflation which, as it points out, is very largely due to forces far beyond its control.

The shadow of Hayek

“We now have a tiger by the tail: how long can this inflation continue? If the tiger (of inflation) is freed he will eat us up; yet if he runs faster and faster while we desperately hold on, we are still finished! I’m glad I won’t be here to see the final outcome.

(Notes of comments by F.A. Hayek on a paper presented to the Mont Pèlerin Conference, Caracas, 1969, cited in ‘Tiger by the Tail’)

My strongest objection to Haldane’s speech at the time – and now – was his choice of title, channelling Friedrich Hayek and his deeply reactionary (and wrong) analysis. In 1972, two right-wing think-tanks, the Institute of Economic Affairs and the Ludwig von Mises Institute, jointly published a book comprising mainly extracts from Hayek’s work entitled “Tiger by the Tail”, and including polemical attacks by Hayek on Keynes. In it Hayek, hostile always to trade unionism (but a friend to the Chilean dictator Pinochet), put all ‘ultimate’ responsibility for inflation upon trade unions and collective bargaining – wholly untrue at the time, and patently not true of our current burst of inflation:

“There seems little immediate prospect that we shall be able directly to eliminate that determination of wages by collective bargaining which is the ultimate cause of the inflationary trend, or that we can reimpose upon trade unions the restraint which in the past stemmed from the fear of causing extensive unemployment.” (p.131)

And a couple of pages later, another Hayekian untruth:

“If we want to preserve the market economy our aim must be to restore the effectiveness of the price mechanism. The chief obstacle to its functioning is trade union monopoly. It does not come from the side of money, and an exaggerated expectation of what can be achieved by monetary policy has diverted our attention from the chief causes.” (p.133-4)

There are those right-wing ideologues like Hayek who have sought to place all responsibility for price inflation on workers and their trade unions, blaming both collective bargaining (almost forgetting that it has at least two sides!) and the use of industrial action.

But there have long been those less overtly polemical than Hayek who, like Governor Bailey, consider that – where significant inflation occurs – workers should be willing to accept real wage reductions even when, as today, there is no evidence, and no claim, that they or their trade unions are responsible for the inflation.

In essence, the case is that even where workers try simply to maintain but not increase real wages, capitalists need to (and will) increase prices by an equivalent amount if they are to maintain profit margins. This may then lead to longer-run inflation, and/or to pressure to introduce price controls, which interfere further with the working of the market economy.

James Meade, made this general argument, in the course of his 1977 lecture marking receipt of ‘The Sveriges Riksbank Prize in Economic Sciences after Alfred Nobel’, in which at one point he paints a scene that we can relate to today (if we read ‘gas’ for ‘oil’):

There is, however, one feature of this connection between the supply-demand criterion for fixing wage rates and the attitude of the wage earner to his real standard of living on which I do wish to comment. Suppose, for example because of a rise in the world price of oil or of other imported foodstuffs or raw materials, that the international terms of trade turn against an industrialised country. This is equivalent to a reduction in the productivity of labour and of other factors employed in the country in question. If money wage rates are pushed up as the prices of imported goods go up in order to preserve the real purchasing power of wage incomes, money wage costs are raised for the domestic producer without any automatic rise in the selling price of the domestic components of their outputs. Profit margins are squeezed. The demand for labour will fall unless and until profit margins are restored by a corresponding rise in the selling prices of domestic products. But such a rise would in turn cause a further rise in the cost of living, followed perhaps by a further offsetting rise in money wage rates, with a further round of pressure on profit margins. In fact workers are attempting to establish a real wage rate which, because of the adverse effect of the terms of international trade, is no longer compatible with full employment.

Meade was no extremist of the Hayek kind; his experience of the 1930s (he had worked quite closely with Keynes in the 30s and 40s) gave him, throughout his life, a sense of the terrible social and human damage that mass unemployment causes. Yet he, like Governor Bailey, seems to have thought that only one party to the social contract must make sacrifices – workers. He does not envisage the possibility that the owners of capital should share or take on the burden. It is true that at the time of Meade’s lecture, the ‘labour share’ of national income was several points higher than today, and the ‘capital share’ less, but this does not explain the one-sided argumentation.

Real pay and labour productivity

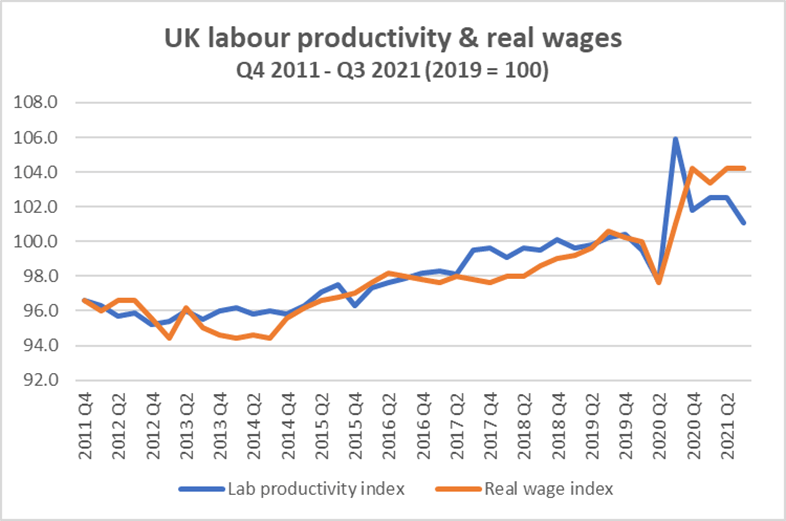

It is worth noting that – though UK productivity has risen at a low annual rate since the 2007-09 global financial crisis – UK real pay has tended to lag behind rather than run ahead of labour productivity (output per hour worked). It is only in the last year or so that – faced with rising energy prices – real pay has run a little ahead, but in 13 of the last 20 years, workers’ real pay did not benefit from increased labour productivity. In most of the other years, the margin of difference was modest.

For the years 2013 to 2020, the real wage index was lower than the labour productivity index in 24 quarters out of a total of 32 (3/4)

Conclusion

The current surge in inflation is very largely due to external, global factors. Everyone seems to agree with this. The issue therefore is whether an increase in interest rates by the Bank of England has any effective or desirable role to play in responding to the type of consumer price inflation we currently face.

My argument is that it has no positive role at present, and that its decisions to raise interest rates is for public show – the sense that the Bank had to be seen to Do Something. This is not to argue that (comparatively) high consumer price inflation is a good thing; it is merely that it is not today an animal whose tail can be seized with any expectation of the animal reacting.

Over recent months, consumers appear to have been spending the surplus cash stockpiled during the pandemic and its lockdowns, so there is an element of extra demand which may be adding to supply bottlenecks and prices. But this will by definition have a strong class-based element to it, with the better-off in a far stronger position to make – and then spend – significant savings. To the limited extent that increased demand via spending of abnormal savings is a cause of consumer price inflation, this ‘excess’ demand will ease as those savings diminish, and all the more so given the coming fiscal tightening through the national insurance increase from April. And given that UK GDP only returned to its 2019 level in Q4 of 2021, we are hardly in big boom territory (compare and contrast with the scale of the Barber boom of the early 1970s, or the Lawson boom of the late 1980s, both of which – occurring under Conservative governments – led to severe ‘busts’). Household expenditure in Q3 2021 had not reached its level of Q3 2019, which indicates that the economy is not over-heated

Interest rate rises generally work through two main routes. First, they affect the finances of debtors/borrowers, i.e. mainly those with a mortgage on their home. As the Monetary Policy report shows, this is not likely to work through rapidly, since 80% of UK mortgagors have mortgages with rate fixed for a period of years. The impact here is only felt on re-mortgaging. The interest rate on business loans is more likely to rise in the short term, however, thus likely to deter new borrowing as well as increasing the pressure on existing business debtors.

The second route is via the exchange rate – with the UK increasing interest rates at a faster pace than other major central banks, this should lead to the pound increasing in value, diminishing the cost of imports and increasing the cost of exports. In the very short term, however, this has not happened on this occasion – the pound has fallen a little against dollar and euro.

In short, the main purpose of raising interest rates is to lower overall demand in the economy. By lowering overall demand, citizens ‘tighten their belt’ and reduce spending; unemployment and under-employment increase. The government receives less tax income, but pays out more in benefits (the ‘automatic stabilisers’).

What is of most concern is that we are seeing an imminent broad-based fiscal tightening on top of the sharp price increases for life-essential ‘products’, such as gas for cooking and heating, and into which the Bank of England’s higher interest rates will feed over a period. All this together is likely to bring about a sharp economic slowdown, and (which seems to be baked in already) a savage decline in the living standards of the poor in particular. It’s a case of un-levelling down.