I am winding down Azizonomics, though, as I am sure you are already aware it has already existed in a winded down state for many years, particularly since I left The Week in 2014. I mostly started this blog in 2011 because I was concerned about the economy, and the future, and was reading a lot, and jotting down my thoughts.

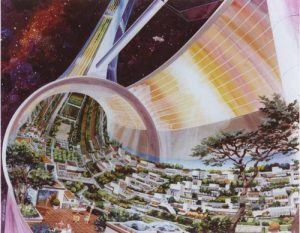

From today, I will be focusing on my new podcast: Cybernetics Chat. The focus of that is much more a mixture of techno-utopianism, ecology, science fiction, and futurism, blended with economics discussion, as well as music that I enjoy.

Here are some links to the first three episodes:

https://tunein.com/podcasts/Music-Podcasts/Gadget-G-Radio-p1287151/?topicId=156512704

Read More »