Otmar Issing can look back on a long and consequential central banking career. Even in his retirement he is still living the part, evaluating whether his successors at the European Central Bank are pursuing stability-oriented monetary policies to his liking. His most recent critique (“‘Living in a fantasy’: euro’s founding father rebukes ECB over inflation response” https://www.ft.com/content/145b6795-2d21-48c6-984b-4b05d121ba16) shows him on the wrong side of events and debates about sound monetary policy, again.

Mr. Issing spent an eight-year stint at the Bundesbank as chief economist of Germany’s legendary central bank and retired guardian of European monetary affairs. Misled by M3 overshots that were the result of the Buba’s own rate hikes inverting the yield curve, Buba kept on

Articles by Jörg Bibow

Otmar Issing Is Still Living in His Monetary Fantasy World

April 22, 2022Otmar Issing can look back on a long and consequential central banking career. Even in his retirement he is still living the part, evaluating whether his successors at the European Central Bank are pursuing stability-oriented monetary policies to his liking. His most recent critique (“‘Living in a fantasy’: euro’s founding father rebukes ECB over inflation response” https://www.ft.com/content/145b6795-2d21-48c6-984b-4b05d121ba16) shows him on the wrong side of events and debates about sound monetary policy, again.

Mr. Issing spent an eight-year stint at the Bundesbank as chief economist of Germany’s legendary central bank and retired guardian of European monetary affairs. Misled by M3 overshots that were the result of the Buba’s own rate hikes inverting the yield curve, Buba kept on

Amerikas Brechstange droht zu brechen

September 7, 2020Der Abschwung Amerikas Wirtschaft beschleunigte sich im zweiten Quartal 2020 auf eine Jahresrate von knapp 32 Prozent. Der längste Aufschwung der US-Geschichte ist damit abrupt beendet.

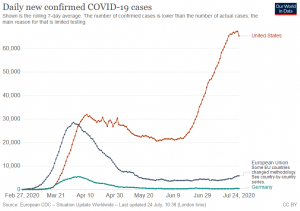

Der Wirtschaftseinbruch war schnell und tief. Erst hatte die US-Regierung die Verbreitung des Coronavirus verschlafen, dann zog sie Ende März die ››Lockdown‹‹ Notbremse. Seit der Wiedereröffnung im Mai ist die Wirtschaft wieder auf Erholungskurs. Zunächst erschien diese auch ähnlich rasant wie der Absturz zu sein, Erholung nach dem ››V-Muster‹‹ (››V-shaped‹‹) war in aller Munde. Doch jetzt ist der Aufschwung ins Stocken geraten, – während die Arbeitslosigkeit auf historisch hohem Niveau verharrt und eine politische Einigung auf neue fiskalische Unterstützung weiter auf sich warten

Es droht der Abstieg in die Armut

July 27, 2020Die Hoffnung auf eine schnelle Erholung der US-Wirtschaft hat sich erledigt. Die Beschäftigung sinkt wieder, die Zahl der Arbeitslosengeldneuanträge steigt. Und die Hilfsprogramme für die Haushalte laufen jetzt aus. Amerika droht ein „Fiskal Cliff“.

Es war absehbar gewesen. Amerikas politische Führung, allen voran Präsident Donald Trump höchstpersönlich, hatte Entwarnung gegeben als die Pandemie in weiten Teilen des Landes noch überhaupt nicht unter Kontrolle gewesen war. Bundesstaaten, die daraufhin ihre Wirtschaft auf Teufel komm raus in Gang bringen wollten, erlebten seither einen rasanten Anstieg der Neuinfektionen. In akuten Krisenregionen sind heute die Grenzen der Krankenhauskapazitäten erreicht oder überschritten.

Mit entsprechender Verzögerung ist auch die

Trump setzt alles auf eine Karte

June 4, 2020In der Covid-19-Krise hat sich der Krisenmanager Donald Trump als Totalversager mit massenhafter Todesfolge bewiesen. Nun soll eine Strategie helfen, die in der Spieltheorie „Glückspiel für die Auferstehung“ genannt wird. Auf Deutsch – er setzt alles auf eine Karte.

Führungsqualitäten – oder die Ermangelung ihrer – offenbaren sich in der Krise wohl am deutlichsten. Und in nur wenigen Ländern hat das Krisenmanagement der Covid 19 Pandemie ähnlich krass versagt wie in Amerika. Kaum ein Land der Welt hat die Krise fehlerlos gemeistert. Amerika hat es fertiggebracht, kaum einen Fehler auszulassen.

Dabei hatte Amerika im Vergleich zu anderen Ländern sogar den Vorzug der Zeitverzögerung. Man konnte das Grauen zunächst in Wuhan und dann in Nord-Italien aus der Ferne

Was kann die Geldpolitik?

May 19, 2020Eine Zentralbank, heißt es, solle „unabhängig“ sein – eine „Vierte Gewalt“ im Staat. Doch Unabhängigkeit ist weder Garant für Kompetenz noch für politische Neutralität. Mangelnde demokratische Kontrolle erhöht sogar das Risiko geldpolitischer Verfehlungen. Der Artikel Was kann die Geldpolitik? erschien zuerst auf MAKROSKOP.

Read More »Amerika probt schon mal die Wiedereröffnung der Wirtschaft

April 30, 2020Charakter und Ausmaß der Krise werden von vielen noch immer nicht gewürdigt. dDoch schon macht sich Ungeduld breit. Als sei staatliche Willkür und nicht die tobende Pandemie an der Krise schuld, mehren sich im Namen der Freiheit Proteste gegen die Ausgangssperre. Der Artikel Amerika probt schon mal die Wiedereröffnung der Wirtschaft erschien zuerst auf MAKROSKOP.

Read More »US-Konjunktur und Amerika im Zeichen der Corona-Krise – 2

April 13, 2020Inzwischen ist klar, dass Amerika – mit New York City in der Startposition – sowohl eine verheerende Krankenhauskrise mit vielen Opfern als auch ein weitreichender Stillstand der Wirtschaft bevorstehen. Der Artikel US-Konjunktur und Amerika im Zeichen der Corona-Krise – 2 erschien zuerst auf MAKROSKOP.

Read More »US-Konjunktur und Amerika im Zeichen der Corona-Krise – 1

April 6, 2020Bis in den Februar hinein gestaltete sich die Arbeitsmarktverfassung der USA sehr positiv. Doch was dabei verborgen bleibt, ist die immer krassere Ungleichheit in der amerikanischen Gesellschaft. Der Artikel US-Konjunktur und Amerika im Zeichen der Corona-Krise – 1 erschien zuerst auf MAKROSKOP.

Read More »Big Guns Shooting Holes in the Sky

March 12, 2019The New Keynesian monetary mainstream has brought out the big guns. Paul Krugman, Kenneth Rogoff, and Larry Summers have come out to shoot down the rising star known as “MMT,” which stands for Modern Monetary Theory. For a while, it was academically convenient to withhold paying any public attention that could foster competition in the field. Like other non-mainstream ideas in economics, MMT was simply ignored by our star mainstream economists, who are always ready and keen to lend their wisdom and advice for public action. Now that MMT has reached the public debate through arousing interest among powerful public voices, fostering political debate about available policy options, protecting the mainstream monopoly of opinion has prompted them to take aim at MMT.

The key issues in the

On Modern Monetary Theory and Some Odd Twists and Turns in the Evolution of Macroeconomics

October 16, 2018Mainstream neoclassical economics is hooked on the idea of individual worker-savers as prime movers in capitalist market economies. As workers, individuals choose how much to work, determining the economy’s output; as savers, they determine how much of that output takes the shape of the economy’s capital investment. With banks as conduits channeling saving flows into investment, firms churn inputs into outputs that match worker-savers’ tastes. In this way, the neoclassical world gets shaped by what rational intertemporal utility-maximizing worker-savers wish it to be.

In its most fanciful version – erected on supposedly sound micro foundations and known as “real business cycle theory” (RBC) – the neoclassical fantasy world of intertemporally optimizing worker-savers is subject to

IMF Provides Cover for Europe’s Dysfunctional Currency Union

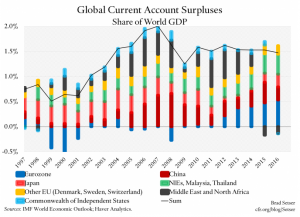

September 20, 2017The Council on Foreign Relations’ Brad W. Setser has produced a couple of interesting blogposts on Germany’s fiscal policies of late. The first one, titled “Germany Cannot Quit Fiscal Consolidation,” was published at the end of August. On September 18th, the second one appeared, titled “The Global Cost of the Eurozone’s 2012 Fiscal Coordination Failure.”

The latter is more limited in scope and draws heavily on a recent report by the Banque de France. Setser elaborates on the rather obvious point that the eurozone’s attempt at fiscal austerity in the years 2011–13, when the currency union experienced the second leg of its double-dip recession, was counterproductively harsh:

The consolidation observed between 2011 and 2013, based on the overall change in the primary structural balance

The “German Problem” Is Not a Problem for Anyone to Worry About. Or Is It?

July 19, 2017It took a very long time. Too long. But just in time for the recent G20 meeting in Hamburg on July 7-8, The Economist’s cover page story featured Germany’s persistent current account surpluses as the world community’ new “German problem”; supposedly an issue of foremost interest to the G20. In fact, Germany has run up current account surpluses exceeding 4 percent of GDP in each and every year since 2004. For the last couple of years Germany’s surpluses even exceeded 8 percent of GDP. Running at over 250 billion euros annually, Germany is the world champion in what is often portrayed as a global competition by the German media and body politic, and not without pride. At close to 300 billion US dollars last year, China’s surplus of 200 billion dollars only came in as a distant second.

Read More »Why Macron Should Not (and Cannot) Follow the German Model

June 2, 2017Jörg Bibow | June 2, 2017

The Economist‘s analysis of Germany’s job market miracle of the past ten years offered in “What the German economic model can teach Emmanuel Macron” is more balanced than the usual accounts one hears in Germany itself. Germans are in love with the idea that structural reform of their labor market and persistent budgetary austerity were solely responsible for the German economy’s superior performance in recent years. The Economist highlights that Germany was fortunate enough to embark on its route for national salvation – the decisive lowering of its labor costs relative to its European partners – at a time when the world economy and global trade were booming, when China was craving German capital

Read More »