Britain is in the grip of a worrying trend. Our own Prime Minister compared migrants in Calais to insects when he called them a “swarm”. Meanwhile, internet comment sections relating to the refugees are filled with hatred and venom. Asylum seekers are referred to as “invaders”, and the trolls encourage the British authorities to shoot them, to machine gun them, and hang them on meat hooks. This dehumanization of immigrants frightens me. Not simply because dehumanization of large groups of...

Read More »Don’t Mention The War

It is wrong to suggest that people should be held accountable for the actions of their ancestors. Blaming each other for the deeds of our ancestors is the cause of vast tracts of human suffering and conflict. Tribes and nations have fought each others for centuries — and, in some places, continue to do so — based on the actions of that tribe or nation’s forefathers. This is irrational. We cannot change the actions of our ancestors. That is perhaps one reason why John Cleese’s portrayal of...

Read More »Deflation is Here — And The Government is Poised to Make it Worse

Consumer prices may not be deflating as quickly as Labour’s electoral chances did earlier this month, but — even after £300 billion of quantitative easing — price deflation for the first time in more than half a century is finally here. The Bank of England continues to throw everything at keeping prices rising at close to their 2 percent target. Yet it’s not working. And this is not just about cheaper oil. Core inflation has also been dropping like a rock. I argued that “deflation was...

Read More »Confessions of a 21st Century Lionel Robbins

Marx said that history does not repeat itself. But sometimes, history does. This may be particularly true in the domain of economics and economic knowledge. Economics is a complex subject. It is the study of a series of abstractions (markets, firms, governments) built upon abstractions (money) built upon abstractions (value), a great metaphysical muddle stacked up to the sky like a wobbly Jenga tower. At a simpler level, economics is the study of human behaviour, or as von Mises put it,...

Read More »Tesla & The New Economics Of The Coming Renewable Energy Boom

I don’t need to tell anyone of the importance of Tesla’s expansion into home battery technology. A home battery lets you store solar energy to use when the sun isn’t shining, which is a really, really major thing in terms of power distribution. As I’ve been pointing out for years, this is the crucial missing link between photovoltaic cells being a rapidly, rapidly cheapening technology with a lot of rollout potential, and photovoltaic cells being the major source for the world’s power. As I...

Read More »I Don’t Understand the Apple Watch

In 2006, I was telling anyone who would listen — which, given that I was a nerdy 19-year old, wasn’t many people — to buy Apple stock. Back then Apple seemed to be on the verge of something amazing. I had had an iPod since 2003, and had just bought a Macbook Pro, and was blown away by OS X. The operating system and interface had a crispness and an attention to detail that made Windows PCs seem like a muddled mess. Turns out I was right about Apple. The past decade has seen Apple blow up...

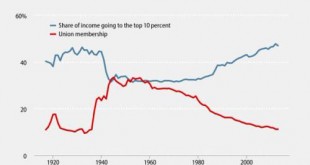

Read More »On Trade Unions & Inequality

This chart is pretty wow: Florence Jaumotte and Carolina Osorio Buitron of the International Monetary Fund have some ideas about how the correlation may have been caused: The main channels through which labor market institutions affect income inequality are the following: Wage dispersion: Unionization and minimum wages are usually thought to reduce inequality by helping equalize the distribution of wages, and economic research confirms this. Unemployment: Some economists argue that while...

Read More »How To Euthanize Rentiers (Wonkish)

In my last post, I established that the “rentier’s share” of interest — resulting from as Keynes put it the “power of the capitalist to exploit the scarcity-value of capital” — can be calculated as the real-interest rate on lending to the monetary sovereign, typically known as the real risk free interest rate. That is because it is the rate that is left over after deducting for credit risk and inflation risk. However, I have been convinced that my conclusion — that euthanizing rentiers...

Read More »The Subtle Tyranny of Interest Rates

Interest rates are the price of credit. They are the price of access to capital. Now, it is obvious that pricing credit is not tyrannical in and of itself. Interest compensates a lender for default risk and the risk of inflation eroding the purchasing power of the money that they lend. The tyranny I am getting at is subtle. It is the tyranny that Keynes pointed to when he proposed a euthanasia of the rentier. Keynes proposed that low interest rates would: mean the euthanasia of the rentier,...

Read More »What The UK’s Low Productivity Is Really Telling Us

This, I would argue, is one of the scariest charts in the world today. The green line is output per hour worked, and the dotted green line is the pre-crisis trend: It’s what the Bank of England calls the “UK productivity puzzle.” As the BBC’s Linda Yueh notes: “output per hour is around 16 percentage points lower than it should be if productivity had grown at its pre-crisis pace.” I don’t think it should be called a “productivity puzzle”. That would imply that we don’t really understand the...

Read More » John Aziz: Azizonomics

John Aziz: Azizonomics