Part A | Part B | Part C Erratum on Post 18: Figure 18.10 has reversed proportions: about 30 percent are issued by nonfinancial corporations. Note: As I was afraid it would happen, someone emailed me to take issue with the way I use the term promissory note. “Promissory note” has a specific meaning in the law—it is a specific type of financial instruments—but Post 18 uses the term conceptually to mean any formal promise made by someone—a synonymous to financial instrument—, which may...

Read More »Money and Banking – Part 19 (B): Financial institutions: An overview

Part A | Part B | Part C Regulated Portfolio Management Companies: Mutual Funds and Others Portfolio management companies provide a wide variety of placement opportunities to economic units with spare funds who do not want to, or cannot, directly buy securities or other assets. There are three broad types of portfolio management companies: mutual funds, closed-end funds, and unit investment trusts (UITs). One of the main differences between them is the characteristics of the shares...

Read More »Money and Banking – Part 19 (C): Financial institutions: An overview

Part A | Part B | Part C Farmer Mac, Fannie Mae, Freddie Mac, and Sallie Mae This section closes the presentation of government-sponsored enterprise with a quick look at other GSEs. They work in a similar fashion to the FCS, by issuing securities and using the proceeds to buy or to back illiquid financial instruments held by financial institutions. The goal is once again to lower the level and volatility of interest rates on specific financial instruments and to encourage credit for...

Read More »Trump vs. Sessions: A One-Sided Twitter War

“All of this is particularly bizarre because the Trump administration is having enormous difficulty getting any of its supposed agenda done, and the only person who is actively implementing the Trump agenda is Jeff Sessions,” says NEP’s Bill Black. You can view here with a transcript. [embedded content] [Translate]

Read More »Bank fraud shows failure of controls, says fraud expert

NEP’s Bill Black appears on ABS-CBN news discussing bank fraud and specifically Metrobank loan fraud involving one of its executives. [embedded content] [Translate]

Read More »Dear Professors Uribe-Teran and Vega-Garcia…

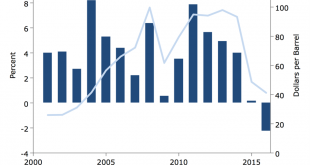

More than fifty economists signed onto an open letter, written by professors Ha-Joon Chang of the University of Cambridge and James K. Galbraith of the University of Texas at Austin, ahead of this year’s presidential elections in Ecuador. The letter noted: Over the past ten years, Ecuador has achieved major economic and social advances. We are concerned that many of these important gains in poverty reduction, wage growth, reduced inequality, and greater social inclusion could be eroded...

Read More »Jamie Dimon: You Make Us Embarrassed to be Americans

By William K. Black July 24, 2017 Kansas City, MO Jamie Dimon talked about his personal pain recently using the exact phrase that many of us have used to explain his personal anguish that “It’s almost an embarrassment to be an American citizen traveling around the world and listening to the stupid sh—t we have to deal with in this country.” The Wall Street Journal’s “Market Watch” described Dimon’s fervor. “J.P. Morgan Chase & Co.’s outspoken CEO on Friday broke into an...

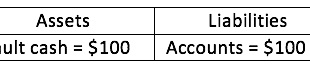

Read More »A Memo From MMT’s Legal Department

Orthodox economists are often inclined to think of law as an external force that ‘intervenes’ to regulate otherwise naturally occurring economic phenomena. In contrast, Modern Monetary Theory and its antecedent intellectual traditions have long recognized that law in fact constitutes and shapes modern economies and the monetary regimes that underpin them. For example, Knapp argued explicitly that money was a “creature of law.” Similarly, Keynes, in A Treatise on Money, stated: “The...

Read More »Monetary Sovereigns, Monetary Subjects: Modern Money & The Criminal Legal System

By Raúl Carrillo I delivered the talk published below as part of a panel at Yale’s annual Rebellious Lawyering Conference, on February 17th, 2017. The panel, entitled “Financing Criminal Justice”, co-hosted by The Modern Money Network, focused on the connections between fiscal austerity and the horrors of the U.S. criminal legal system. I was joined on the panel by Thomas Harvey, Co-Founder and Executive Director of ArchCityDefenders, Judge Jaribu Hill, Director of the Mississippi...

Read More »The CFPB Arbitration Rule is Pro (Honest) Businesses

By William K. BlackJuly 11, 2017 Bloomington, MN Politico has just published a column with a title and analytics that drive white-collar criminologists nuts: “In a major setback for businesses, CFPB opens door to consumer class actions.” Logically, the title should have read: “In an important step forward for consumers, investors, and honest bankers and lenders, CFPB begins to restore the rule of law to banking.” The CFPB is the acronym for the Consumer Financial Protection...

Read More » New Economic Perspectives

New Economic Perspectives