William K. Black February 3, 2016 Bloomington, MN This is the third column in my series about the Wall Street Journal report that “big money managers” want to bring back “liar’s loans.” Here are the article’s first two sentences. Wall Street wants to bring back the “low-doc” loan. These mortgages, which are given to borrowers that can’t fully document their income, helped fuel a tidal wave of defaults during the housing crisis and subsequently fell out of favor. The second sentence...

Read More »Explaining Why Federal Deficits Are Needed

By Thornton (Tip) Parker Most MMT advocates probably took months to get comfortable with it. But like a personal computer, one need not understand its innards to use its power. The great power of MMT is its lesson that the federal government can create new dollars by running deficits to do things that should be done. But the lesson is counterintuitive and will be rejected by voters unless it can be explained convincingly in a few minutes. This paper offers five nuggets for explaining it...

Read More »Real Fiscal Responsibility, Vol. II: The Peterson Network, Inequality, and the Failure of Neoliberalism

This is how the mission of the President’s National Commission on Fiscal Responsibility and Reform was defined by the White House on February 18, 2010: The Commission is charged with identifying policies to improve the fiscal situation in the medium term and to achieve fiscal sustainability over the long run. Specifically, the Commission shall propose recommendations designed to balance the budget, excluding interest payments on the debt, by 2015. This result is projected to stabilize the...

Read More »How Many Lies Can the WSJ Pack into a Chart on Liar’s Loans?

William K. Black February 3, 2016 Bloomington, MN This is the second article in my series prompted by the Wall Street Journal report that “big money managers” want to bring back “liar’s loans.” Given that the best study of liar’s loans during the crisis found a fraud incidence of 90% — this is a startling proof of how openly addicted to fraud the “big money managers” remain. It demonstrates some of the terrible costs of the Department of Justice’s refusal to prosecute the fraudulent...

Read More »For US Democracy: There Is Only One Choice

We need big, big changes in the United States. Many of them will require the Federal Government to spend unprecedented amounts, including deficit spending to enable us to solve problems that have languished, creating needs, for many, many years. How can we get these changes legislated through a political system that has been increasingly less responsive to most people over the past four decades. There’s only one way that will work without revolution. We need a movement for change powerful...

Read More »Lenders’ Lies about Liar’s Loans and “Rigorous Underwriting”

William K. Black February 2, 2016 Bloomington, MN It is time to break out one of our two family rules again – it is impossible to compete with unintentional self-parody. How fraudulent is finance even now? The Wall Street Journal reports that “big money managers” want to bring back “liar’s loans.” I am trying to write much shorter columns, so there will be many columns in this series because the WSJ article so beautifully exemplifies the lies that the industry and the media told...

Read More »The Bank Whistleblowers United – Who are We, and Why are We Trying to Help Implement Real Banking Reform?

At this time (January 29, 2016), we consist of four founding members: Gary Aguirre William Black Richard Bowen Michael Winston Our bios are listed at the end of this post. We share a number of common experiences. They explain why we came together to try to implement real reform. We are whistleblowers We proved correct in our warnings when we blew the whistle Our warnings were not heeded We persevered when our warnings were ignored, knowing that retaliation was likely The failure to heed...

Read More »The Bank Whistleblowers United Campaign Funding Plan: Say “No” to Contributions from Financial Felons

In order to restore the rule of law, we ask every candidate for the nomination of their party for the presidency to pledge that they will not take contributions from any financial firm (or contributions above $250 from their officers) that the United States or its agencies have, after investigation, charged with committing the legal elements of fraud. That list includes virtually all of the largest banks in the U.S. and Europe and Freddie and Fannie. Indeed, most of these financial giants...

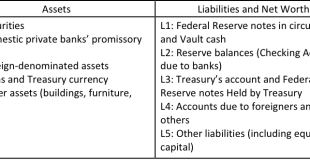

Read More »Money and Banking Blog – Part 4

By Eric Tymoigne For convenience, I have put the balance sheet of the Fed below. A previous post examined the balance sheet and another one provided important information about the meaning of reserves and other basic concepts and their relation to the balance sheet of the Fed. Now let’s look at monetary-policy implementation. What does the Fed do in terms of monetary policy and why? While details in operating procedures have changed through time, the Federal Funds rate (FFR) has...

Read More »An Explanation of the Bank Whistleblowers United 60-Day Plan

On Day One, the President directs each relevant federal financial agency to restore a superb criminal referral process, the criminal referral mandate, and criminal referral coordinators, at every federal financial agency. Local and state police forces rarely investigate sophisticated financial frauds. That work is done overwhelmingly by roughly 2,000 FBI agents in the white-collar section. That means that we have roughly two FBI agents per industry. Those numbers mean that FBI agents...

Read More » New Economic Perspectives

New Economic Perspectives