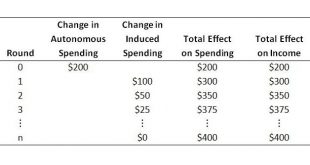

We have seen that total spending equals total income (part 4). It has been argued that it is spending that creates (or determines) income (part 9). This can be inferred from the observation that some spending can occur independently of income (part 10). Spending that occurs independently of income is called autonomous spending. Equivalently, it is known as ‘exogenous’ spending. It is called autonomous because it is spending that is not financed out of current income. It is autonomous of...

Read More »Short & Simple 15 – The Sectoral Balances Identity

We saw, in part 14, that government spending increases the net financial assets of non-government, whereas taxes do the reverse. The level of net financial assets at a point in time is a stock. The change in net financial assets over the period is the result of flows. In the case of a government deficit, in which government spends more into the economy over the period than it taxes out, non-government will spend less than its income, with the flow of saving adding to its stock of net...

Read More »Short & Simple 14 – Direct Impacts of Fiscal Policy on Net Financial Assets

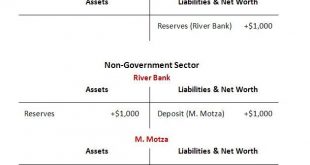

Now that we have introduced ‘government money‘ and ‘commercial bank money‘, we are in a position to understand in basic terms how fiscal policy (government spending and taxing) is conducted and its direct financial effects. At this stage, the treatment is still cursory. There are more details that can be added in at a later time. In the initial instance, acts of government spending are authorized at the legislative level. For example, in the US, government spending is authorized by...

Read More »Short & Simple 13 – Private Credit Creation

We have seen that a national currency enters the economy when government spends, and that the recipients of the government spending can use the currency for various purposes, including to purchase goods and services. Government is therefore an original source of funds. There is another original source of funds that gives people the ability to make purchases. This other source is private credit creation. Put simply, a household or firm can borrow from a bank or other financial institution...

Read More »Short & Simple 12 – Government Money

We saw in part 2 that to establish a currency, government needs to do three things: 1. Define a unit of account (e.g. dollar).2. Impose taxes that can only be paid in that unit of account.3. Spend or lend the currency into existence. The most basic purpose of taxation (introduced in step 2 of the sequence) is to create a demand for the currency. Provided taxes are effectively enforced, we in the non-government will have a need to obtain the currency, because it is the only means of paying...

Read More »Professor Bill Mitchell in New Zealand Discussing MMT

This is a presentation by Professor Bill Mitchell at the University of Victoria, Wellington, New Zealand on July 28, 2017. It addresses framing of the macroeconomic policy debate and touches on the most fundamental insights of Modern Monetary Theory. Most here will be avid readers of the professor’s blog, but this talk is too good not to post. While in New Zealand, Professor Mitchell also did an interview for the public broadcaster. A link can be found in the billy blog post of July 31,...

Read More »Self-Imposed Constraints as an Obfuscating Factor

From inception of a monetary economy with a government-issued currency, it is clear that government spending must come before tax payments or purchases of government debt. The order of requirements is basically: (i) government defines its monetary unit of account; (ii) government imposes taxes and other obligations that can only finally be settled in that currency; (iii) government spends (or lends) its currency into existence; (iv) non-government can now obtain the currency and, among...

Read More »Excellent Video Explaining MMT Basics

This is an excellent introductory video, scripted and narrated by Geoff Coventry. It is mentioned in the YouTube comments that Stephanie Kelton and others advised on the work. No doubt the video has already appeared on other blogs. The link was provided by acorn in the comments. [embedded content]

Read More »Short & Simple 11 – Money as an IOU

Money can be thought of as an IOU (“I owe you”). The issuer of an IOU can buy goods or services from anybody who is willing to accept the IOU as payment. In return, the issuer of the IOU promises to accept it back again in the future as payment for goods or services the issuer provides. Anybody can attempt to issue an IOU. The difficulty, as the economist Hyman Minsky emphasized, is in getting it accepted. For example, perhaps your neighbor offers to tend to your garden while you are away...

Read More »Short & Simple 10 – Spending Independently of Income

It was mentioned (in part 2) that a currency-issuing government issues its currency in the act of spending. An implication of this is that a currency-issuing government does not need income in order to spend. We have also noted (in parts 5 and 9) that a household or business can spend independently of current income. They can do this either by drawing down past savings or through borrowing. Now, if we think about past savings, these are the result of saving in an earlier period. This...

Read More » Peter Cooper: Heteconomist

Peter Cooper: Heteconomist