We have seen that total spending equals total income (part 4). It has been argued that it is spending that creates (or determines) income (part 9). This can be inferred from the observation that some spending can occur independently of income (part 10). Spending that occurs independently of income is called autonomous spending. Equivalently, it is known as ‘exogenous’ spending. It is called autonomous because it is spending that is not financed out of current income. It is autonomous of income. Examples of autonomous spending are: government spending; autonomous private consumption; private investment; exports. A currency-issuing government spends through the creation of ‘government money‘ in the form of reserves (discussed in part 14). Autonomous private consumption and private

Topics:

peterc considers the following as important: Short & Simple

This could be interesting, too:

peterc writes Short & Simple 20 – Graphing the Income-Expenditure Model

peterc writes Short & Simple 19 – Sectoral Balances in a Closed, Demand-Determined Economy

peterc writes Short & Simple 18 – Income Determination in a Closed Economy

peterc writes Short & Simple 17 – A Notion of Macroeconomic Equilibrium

We have seen that total spending equals total income (part 4). It has been argued that it is spending that creates (or determines) income (part 9). This can be inferred from the observation that some spending can occur independently of income (part 10).

Spending that occurs independently of income is called autonomous spending. Equivalently, it is known as ‘exogenous’ spending.

It is called autonomous because it is spending that is not financed out of current income. It is autonomous of income.

Examples of autonomous spending are:

- government spending;

- autonomous private consumption;

- private investment;

- exports.

A currency-issuing government spends through the creation of ‘government money‘ in the form of reserves (discussed in part 14).

Autonomous private consumption and private investment are financed out of past savings or through private credit creation.

Exports are included in the case of individual trading nations. This is because foreigners finance their purchases of domestically produced goods and services independently of domestic income. Their spending may or may not be financed out of foreign income, but either way, their spending is autonomous of the domestic income of the exporting nation.

Although some spending is best treated as autonomous, it is appropriate to consider most private consumption spending as financed out of current income.

Spending out of income is called induced spending. Equivalently, it is known as ‘endogenous’ spending.

This kind of spending rises and falls roughly in line with income. When income rises, households consume more. When income falls, they consume less.

Because some spending is induced, an initial act of autonomous spending will cause a multiplied increase in new spending and new income. This is known as the expenditure-multiplier effect.

An initial act of autonomous spending immediately creates new income of the same amount. This new income will induce additional private consumption expenditure, which in turn will create new income equal to the amount of the induced consumption. And this new income will induce still further consumption, and so on.

In this way, the initial autonomous expenditure sets off a multiplier process in which consumption is induced in successive rounds.

If all income were consumed, this process would continue at full strength forever. But, of course, we have seen in part 5 that whenever income is created, the recipients get to choose what to do with the income.

When a household receives income, some of it will be used to pay taxes. Some will be used to save. And some will be spent on imports.

Tax payments, saving and imports are all known as leakages. They are referred to in this way because, when they occur, they cause leakage from the income-generating process.

Only spending on domestic output creates income within the domestic economy. Since leakages are not spending on domestic output, they are a drain on the domestic economy.

Leakages mean that the multiplier process whittles away to nothing after numerous rounds.

This is best explained with an example. Let’s say that half of any income leaks out to taxes, saving and imports. That means the other half goes to induced consumption.

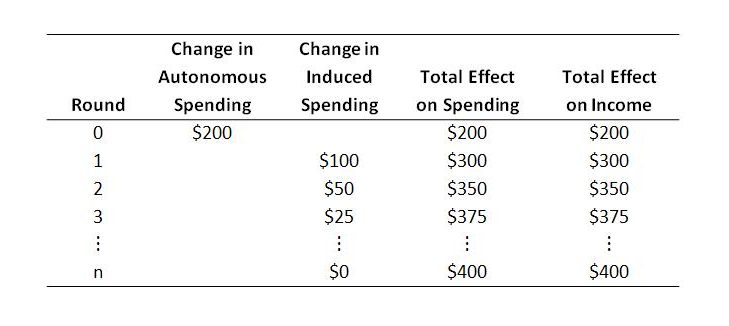

Suppose autonomous spending increases by $200. Initially, $200 of extra income is created. In the next round of the multiplier process, half of this will be consumed, creating another $100 of new income. Half of this smaller amount will be consumed in the subsequent round of the multiplier process, resulting in a further $50 of new income. And so on. In this example, the initial increase in autonomous spending will cause income ultimately to rise by $400. The effect is shown in the table.

There is a simple formula to determine the total change in income caused by an initial change in autonomous spending. Recall that income is usually represented by the letter Y. We can represent autonomous spending by the letter A.

To calculate the effect on income of a change in autonomous spending, we need to know two things:

- The initial change in autonomous spending. Call this ΔA. The Greek letter ‘delta’ here indicates that we are looking at the change in A.

- The ‘marginal propensity to leak’. This is the fraction of any additional income that leaks out to taxes, saving and imports. Call this α (‘alpha’). This fraction must be between 0 and 1.

The formula for the total change in income is then:

In our example above, ΔA = $200 and α = 0.5. Plugging these numbers into the formula gives a total change in income of $400. This matches our answer in the preceding table.

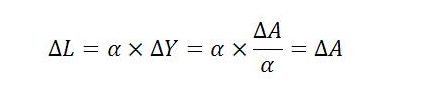

We can also calculate how much additional leakage occurs as a result of the extra income. Call the amount of leakage L. The change in leakages is then:

In the current example, the leakage will be $200, which is half the total change in income.

Notice that the change in leakages equals the change in autonomous spending. This is always the case. We can see this by substituting the expression for ΔY in equation (1) into equation (2):

Formulas very similar to (1) and (2) also work for the economy as a whole. In this context, A will represent net autonomous spending and α will represent, as before, the fraction of extra income that leaks out to taxes, saving and imports. Net autonomous spending is all the autonomous spending that occurs in the period minus any leakages that occur autonomously of income. (Most leakage is induced out of income in accordance with the marginal propensity to leak, but some leakage can occur for reasons not directly related to income, such as when currency depreciation affects imports.)

Here, our interest is in the total income generated within the domestic economy over the period. So Y refers to Gross Domestic Product (GDP). The formulas become:

As an example, perhaps we know that the sum of government spending, private investment, autonomous consumption expenditure and exports comes to 1 trillion dollars. And perhaps, for simplicity, all leakage is induced, with two-thirds of extra income leaking out to taxes, saving and imports.

In that case, A = 1 trillion dollars, α = 0.666… and Y = 1.5 trillion dollars.

Economists would say that the multiplier in this example is 1.5. This is because total income is one-and-a-half times the net autonomous expenditure.

In the earlier example, the multiplier was 2, because the change in income was twice the change in autonomous spending.

The multiplier k can be calculated as:

Further Reading

The present post has introduced the ‘income-expenditure model’ in a highly simplified form. It is possible to go into much more detail on the expenditure multiplier and the income-determination process. For a more in-depth introduction, see:

Bill Mitchell — Spending Multipliers

A treatment of the income-expenditure model at roughly the first-year university level is provided in:

Planned Investment/Saving and Keynesian Causation

There is a close relationship between the income-expenditure model and the ‘sectoral financial balances model’: