First acquaintance with MMT can bring clarity on key aspects of the monetary system that may previously have seemed unclear, yet likely also calls other questions to mind. For instance, if taxes do not finance a currency issuer, why are they necessary? And if banks create deposits ex nihilo (“out of nothing”), how is it that (other than the central bank) they are financially constrained and subject to risk? Or, considering that issuance of the currency is essentially costless to the...

Read More »A Brief Q&A on Three Aspects of MMT

First acquaintance with MMT can bring clarity on key aspects of the monetary system that may previously have seemed unclear, yet likely also calls other questions to mind. For instance, if taxes do not finance a currency issuer, why are they necessary? And if banks create deposits ex nihilo (“out of nothing”), how is it that (other than the central bank) they are financially constrained and subject to risk? Or, considering that issuance of the currency is essentially costless to the...

Read More »Markets are Creatures of Government

This is not just a matter of markets requiring a system of enforced property rights, which presupposes government, at least in rudimentary form. In monetary economies, functioning markets also require a viable currency, one that is generally accepted in exchange. Government ensures a currency’s acceptance when it imposes and effectively enforces taxes that are payable only in that particular currency. This is true not only of exogenous taxes but of taxes on consumption, income and wealth...

Read More »Persistent Demand-Pull Inflation is Unlikely in Demand-Led Economies

Capitalist economies are demand led in the sense that both output and growth tend to reflect the behavior of autonomous demand, especially in the long run. Prices, in contrast, tend to be supply determined, reflecting cost. Supply shocks can temporarily dominate demand effects on output (for instance, as the result of war, a pandemic, or an oil shock), just as variations in demand, especially if supply is constricted, can temporarily dominate cost effects on prices. But the normal...

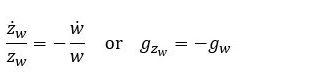

Read More »Currency Value, Productivity, and a Currency’s Command over Use-Values

In general terms, Modern Monetary Theory (MMT) defines the value of the currency as “what must be done to obtain it”. As MMT authors have noted, this general definition can be interpreted in terms of labor time. A Marxist interpretation, consistent with MMT’s general definition, is to define currency value in terms of socially necessary labor time. Two interpretations seem particularly suitable. A first approach is to define currency value as the reciprocal of the average money wage....

Read More »MARX & MMT – Currency Value and its Relationship to Price Stability

The marxian labor-time values of individual commodities fall as productivity improves. This means that if a currency unit is to command a stable quantity of use-values (i.e. physical goods and services) over time, the value of the currency must likewise fall as productivity improves. For a given distribution between wage and profit income, and a given share of value added in total value, a currency unit’s command over use-values will remain stable when money wages rise in line with...

Read More »Cost-Push Inflation

Inflationary pressures can originate from the demand side or the supply side of the economy. Demand-side inflation, known as demand-pull inflation, becomes increasingly likely as the economy nears full capacity. Inflation driven from the supply side, referred to as cost-push inflation, is possible in the absence of any excess demand for goods and services. A supply shock can cause one-off price hikes, independently of demand conditions, but for the one-off effect to act as a catalyst...

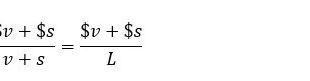

Read More »Currency Value Interpreted as the Reciprocal of the MELT

In an earlier post it is suggested that when value is conceived as socially necessary labor time, it makes sense to define currency value in one of two ways, either as the reciprocal of the average money wage paid for an hour of simple labor or, alternatively, as the reciprocal of the ‘monetary expression of labor time’ (MELT). Under the first definition, currency value is the amount of simple labor-power commanded by a unit of the currency and, on average, the amount of simple labor...

Read More »The Core Significance of Taxation and Currency Sovereignty in a Nutshell

A government with the authority to tax can ensure acceptance of a particular currency. By nominating a currency in which income and wealth are to be assessed, and imposing taxes that can only be paid in the nominated currency, the government establishes a demand for the currency. This is true whether the government issues its own currency or instead adopts a currency issued by some other entity. But a government that adopts somebody else’s currency is reduced to the status of mere...

Read More »Government Spending Comes First in a Sovereign Currency System

Modern Monetary Theory (MMT) makes clear that the spending of a currency-issuing government necessarily precedes tax payments and bond sales to non-government. This has important implications. It means that a currency-issuing government does not – and cannot – require revenue prior to spending. It means that it is government spending that makes possible the payment of taxes and non-government purchase of bonds, not the other way round. And it means that when a government requires...

Read More » Peter Cooper: Heteconomist

Peter Cooper: Heteconomist